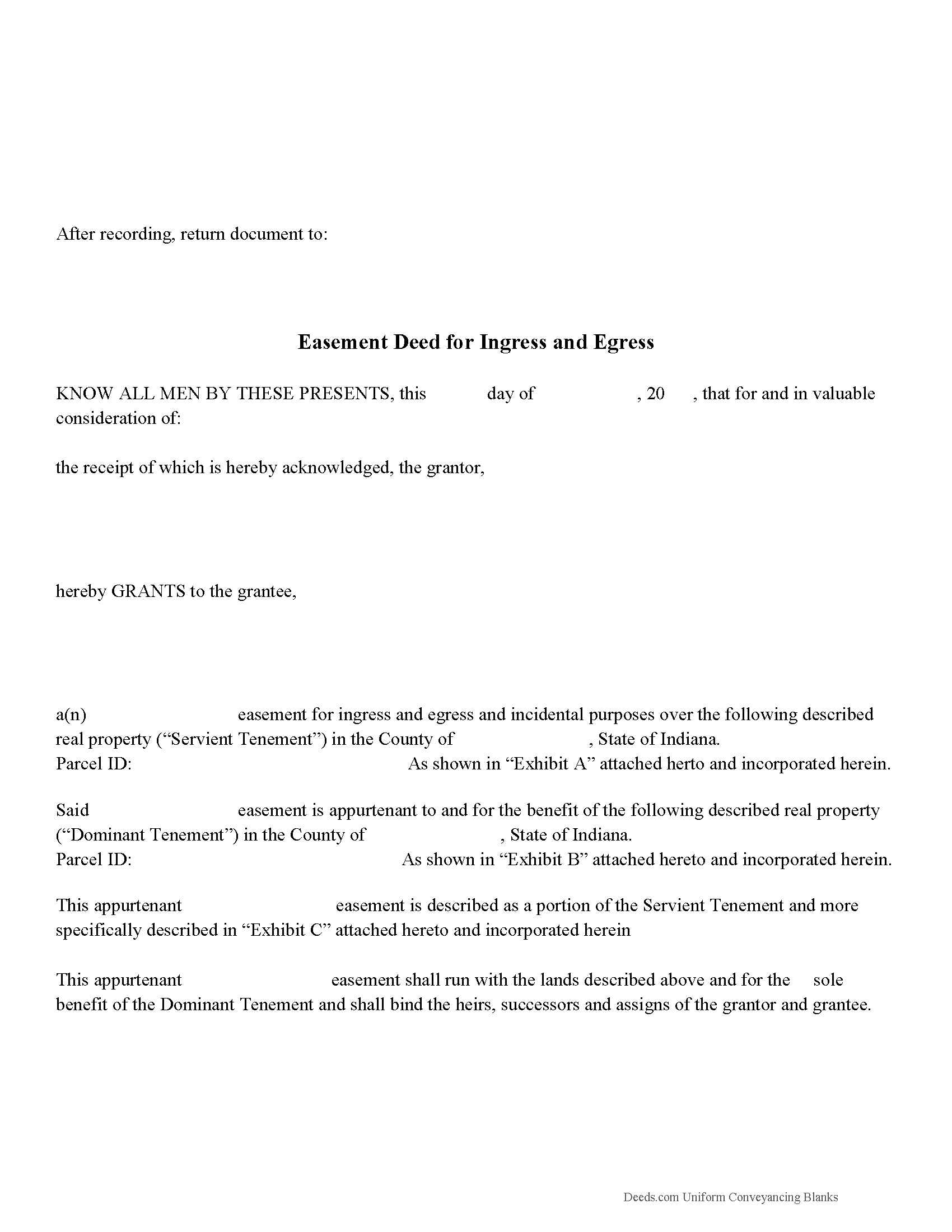

Grant County Easement Deed Form

Grant County Easement Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

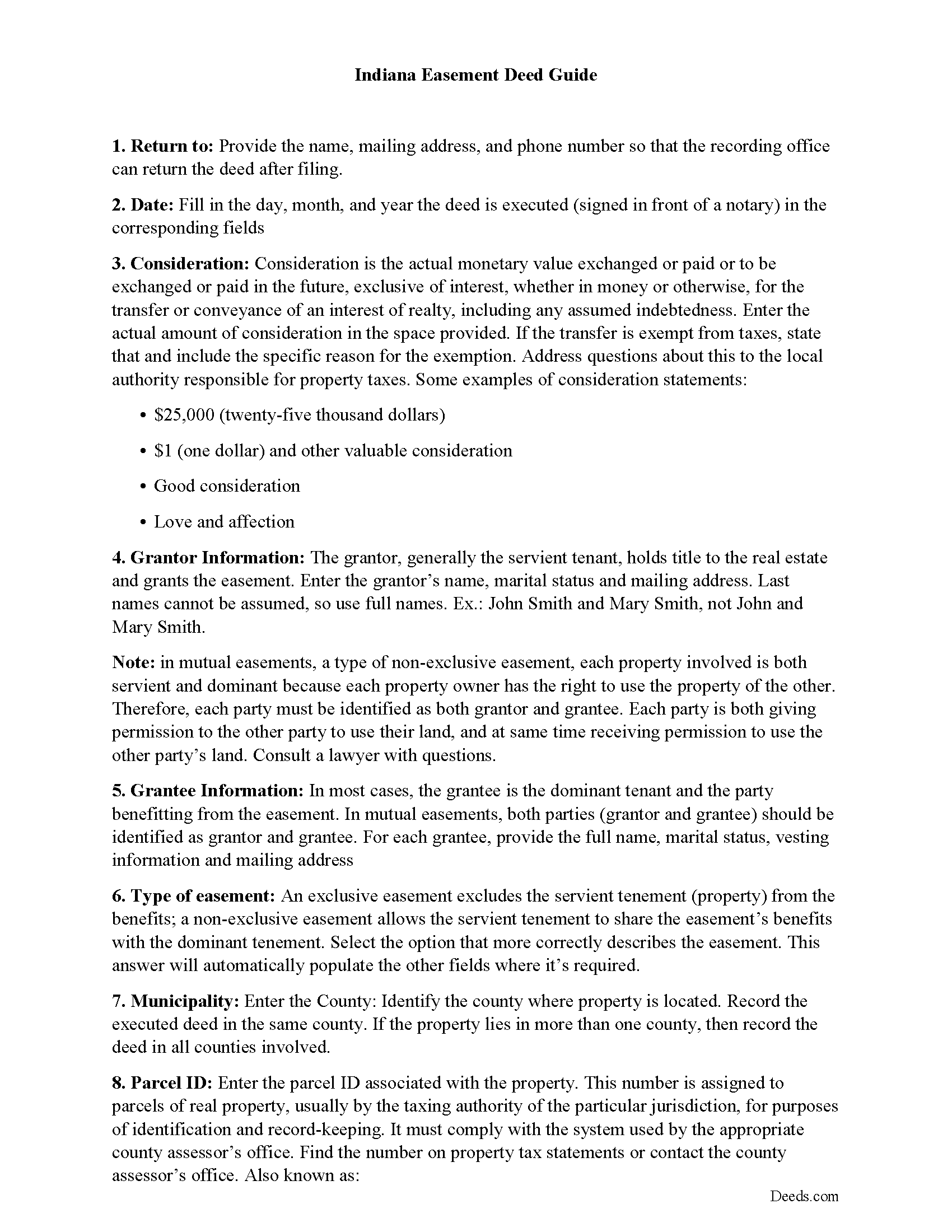

Grant County Easement Deed Guide

Line by line guide explaining every blank on the form.

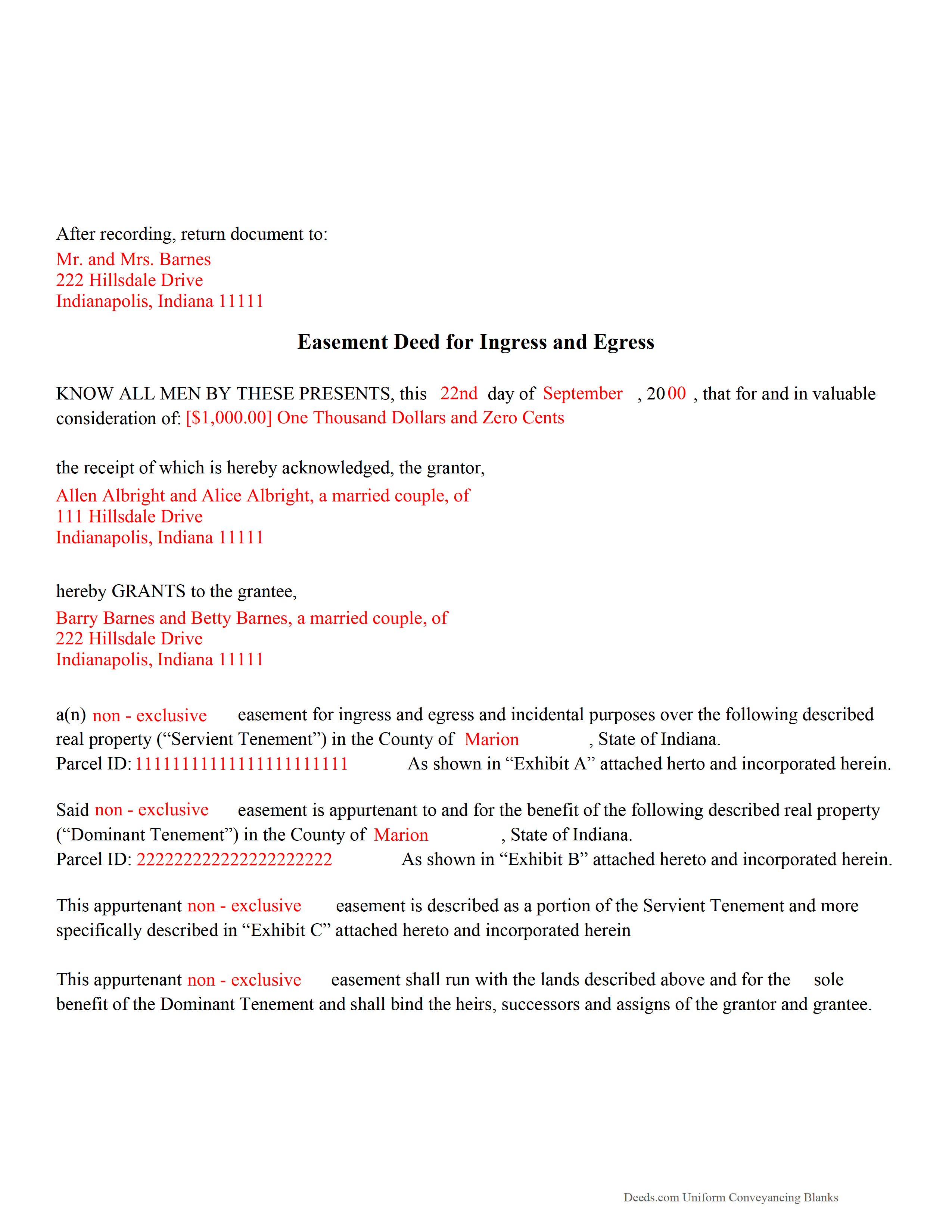

Grant County Completed Example of the Easement Deed Document

Example of a properly completed form for reference.

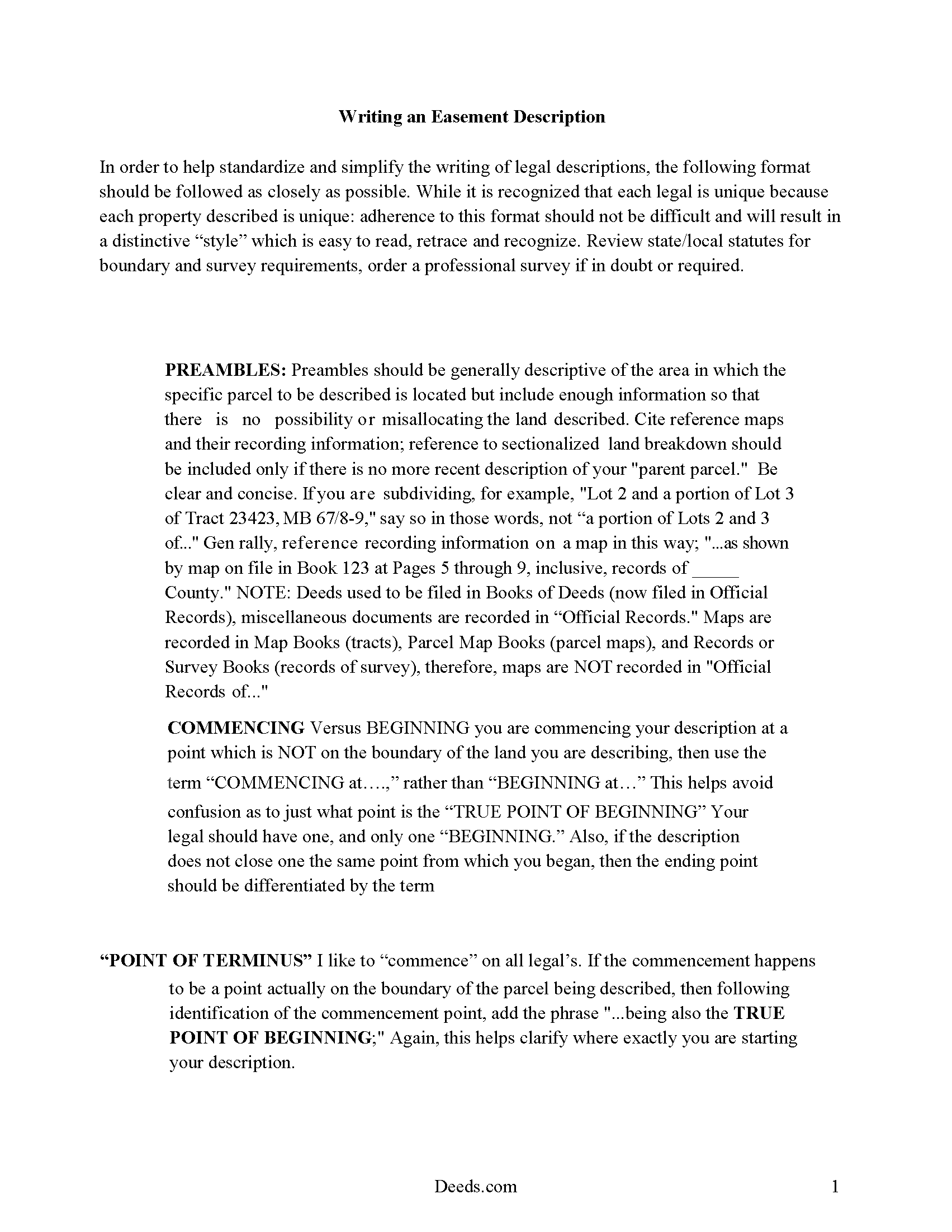

Grant County Easement Deed Description

A Description of the Easement will be required. This will show how to write an acceptable description for a Right of Way Easement, which gives access, to and from - point A to point B.

All 4 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Indiana and Grant County documents included at no extra charge:

Where to Record Your Documents

Grant County Recorder

Marion, Indiana 46953

Hours: 8:00 a.m. - 4:00 p.m. Monday-Friday

Phone: (765) 668-6559

Recording Tips for Grant County:

- White-out or correction fluid may cause rejection

- Documents must be on 8.5 x 11 inch white paper

- Check that your notary's commission hasn't expired

- Double-check legal descriptions match your existing deed

Cities and Jurisdictions in Grant County

Properties in any of these areas use Grant County forms:

- Fairmount

- Fowlerton

- Gas City

- Jonesboro

- Marion

- Matthews

- Swayzee

- Sweetser

- Upland

- Van Buren

Hours, fees, requirements, and more for Grant County

How do I get my forms?

Forms are available for immediate download after payment. The Grant County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Grant County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Grant County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Grant County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Grant County?

Recording fees in Grant County vary. Contact the recorder's office at (765) 668-6559 for current fees.

Questions answered? Let's get started!

Easements in Indiana are commonly created by prescription, in gross, in appurtenant, or by necessity. An easement is a non-possessory and non-ownership right of one person to use the real property of another person for a specific purpose. The easement deed is the instrument in writing that creates the right. Additional easements, such as solar easements and conservation easements, can also be obtained in Indiana. A solar easement can be obtained for the purpose of exposure of a solar energy devise or passive solar energy system to the direct rays of the sun (32-23-4-2). A conservation easement is a non-possessory interest of a holder of real property that imposes limitations or affirmative obligations for purposes as outlined in 32-23-5-2 of the Indiana Revised Code. Conservation and solar easements are subject to the same conveyance and recording requirements as other easements in this state.

An easement created after June 30, 1989 must cross reference the original recorded plat. If the real property from which the easement is being created is not platted, the easement must cross reference the most recent deed of record for that property in the recorder's office (32-23-2-5).

Just as with any other real property instrument in Indiana, an easement deed should be dated and signed, sealed, and acknowledged by the grantor. If an acknowledgement is not present on the deed, it can be proved before one of the officers listed in 32-21-2-3. Easement deeds can be acknowledged in the county where the deed is to be recorded, in another county in Indiana, or in another state, or as according to statute. If acknowledged in another county or state, the easement deed must be certified by the clerk of the circuit court in the county where the officer resides and must also be attested by the seal of that court (32-21-2-4). If acknowledgements are taken before an officer having an official seal and are attested by the officer's official seal, it will be sufficient without a certificate. If the certificate of acknowledgment is required, it should be written on the easement deed or attached to it and recorded with it (32-21-2-29). Unless the certificate of acknowledgement is recorded with the easement deed, the deed may not be received or read in evidence (32-21-2-11).

Easement deeds will not be valid or effectual against any person other than the grantor, the grantor's heirs and devisees, and those with notice of the conveyance unless the easement deed is recorded within the time and manner provided by Indiana Statutes (32-21-3-3). An easement deed will take priority according to the time of its filing. Easement deeds in Indiana should be recorded with the county recorder in the county where the property is located.

(Indiana Easement Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Grant County to use these forms. Documents should be recorded at the office below.

This Easement Deed meets all recording requirements specific to Grant County.

Our Promise

The documents you receive here will meet, or exceed, the Grant County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Grant County Easement Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Kimberaley J.

May 24th, 2021

I had no problem printing out the forms, very easy. Also when I called, customer service was very helpful and very polite. Thank you for that, have a great day.

Thank you!

crystal l.

January 16th, 2019

Another legal professional directed me to this site. The best advice I've received from the legal profession! Forms were instantly available, easily printed & exactly what I needed at a cost that was more than affordable!! I will definitely be back again!!

Thank you Crystal and please thank your associate for us. Have a fantastic day!

Terry S.

February 14th, 2023

I was very happy with the document package that I purchased. It contained all of the necessary documents and a few extras I had not thought about. Perhaps if you provided a link to download all of the documents with one click, it would make it a little easier.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael H.

November 5th, 2019

Site was easy to understand and use. Service was prompt. Good job Montgomery County!

Thank you!

John C.

April 14th, 2019

Excellent find (Deeds.com) from a google search, first hit. This was exactly what we were looking for. It also got me to upgrade Adobe to be able to fill in the forms. Will be back for follow up as needed, but I think I got everything we needed in the first downloads. Appreciate a well done site like yours. Thanks John

Thank you for your feedback. We really appreciate it. Have a great day!

Zina J.

October 30th, 2019

Deeds.com supplied exactly what I needed to complete a quitclaim. Deeds.com saved me $180, supplied the necessary forms, and a sample page to use as a guide. I recommend Deeds.com.

Thank you!

Christine H.

June 23rd, 2020

Easy to use. Customer service is very responsive!

Thank you!

Richard P.

April 18th, 2020

Excellent source and easy to use site.

Thank you!

Michael F.

February 22nd, 2024

This service wasn't helpful at all.

We're sorry the records you were looking for were not available Michael. We understand how frustrating that can be. Thank you for taking the time to share your thoughts. We're continually working to expand our database and hope to better serve your needs in the future.

Margie H.

June 9th, 2021

Great

Thank you!

roger m.

April 2nd, 2019

super clean interface i thank you very much

Thank you!

Douglas N.

September 13th, 2021

Great!

Thank you!

Kathy L.

January 30th, 2022

Review: There are 10 PDFs in this warranty deed package. I don't even know what to do with them all. I don't think the directions are clear enough on how to put it all together. I probably won't use it, and feel I have wasted my money.

Sorry to hear that the volume of documents required to complete your task was more than you anticipated. It is rare that we get complaints about providing everything needed. We certainly don't want you to be overwhelmed or feel like you have wasted your money. Your order and payment has been canceled and we do hope that you find something more suitable to your needs elsewhere. Have a wonderful day.

Dhanminder D.

July 30th, 2020

The service was great. Thank you.

Thank you!

Robert G.

July 2nd, 2020

Excellent. I needed a NOC recorded immediately and you guys made it happen when all other avenues looked like they were not going to be possible. Thank you very much.

Thank you for your feedback. We really appreciate it. Have a great day!