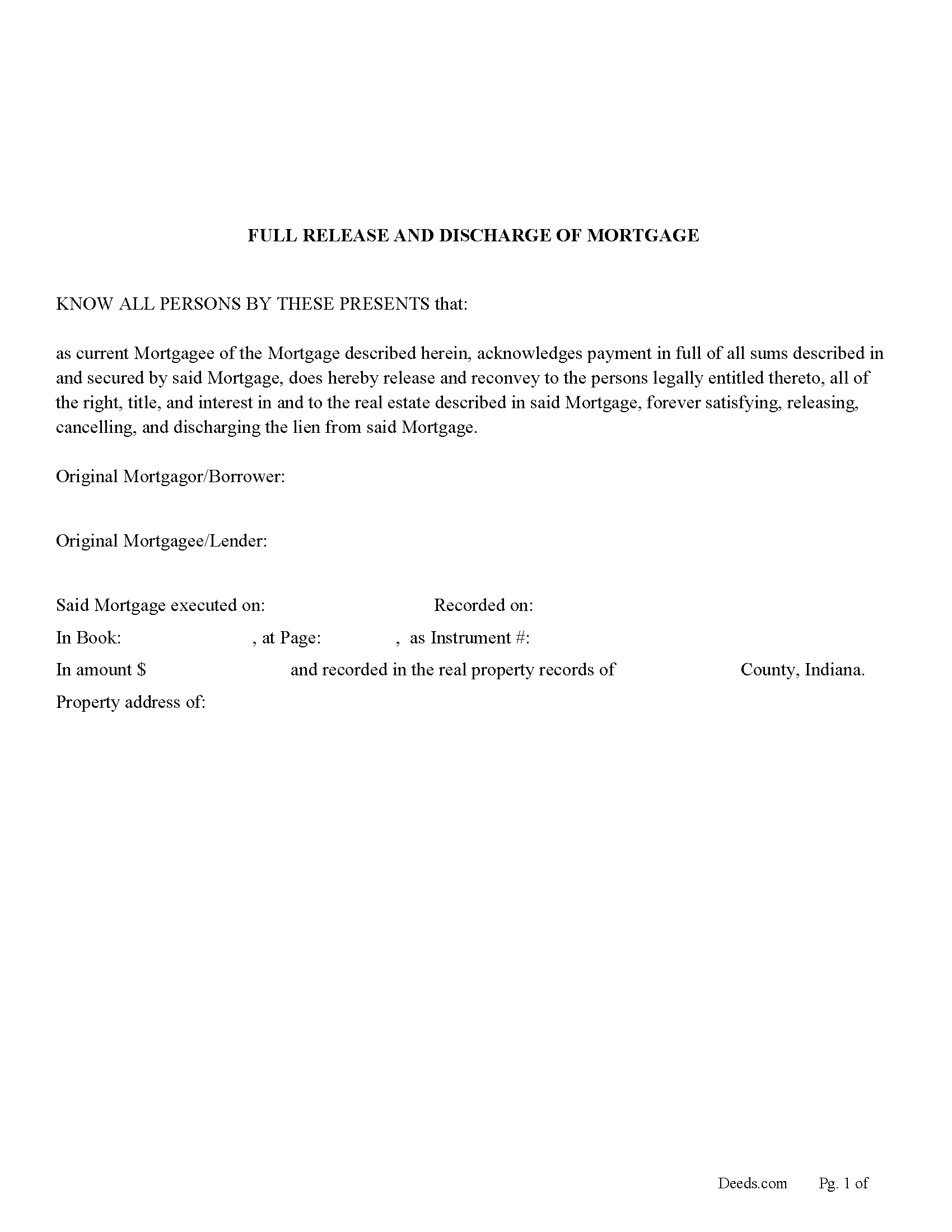

Warrick County Full Release of Mortgage Form

Warrick County Full Release of Mortgage Form

Fill in the blank form formatted to comply with all recording and content requirements.

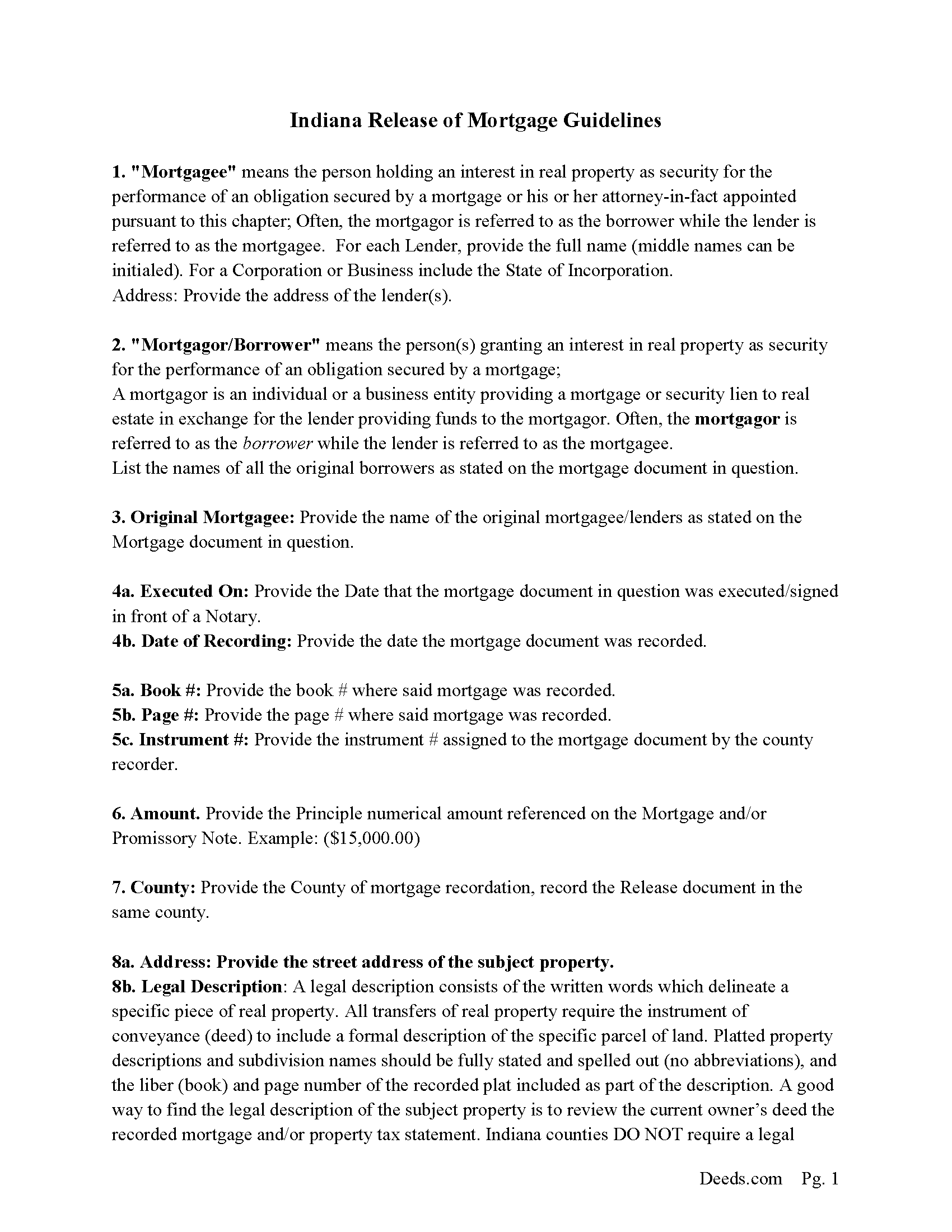

Warrick County Release of Mortgage Guidelines

Line by line guide explaining every blank on the form

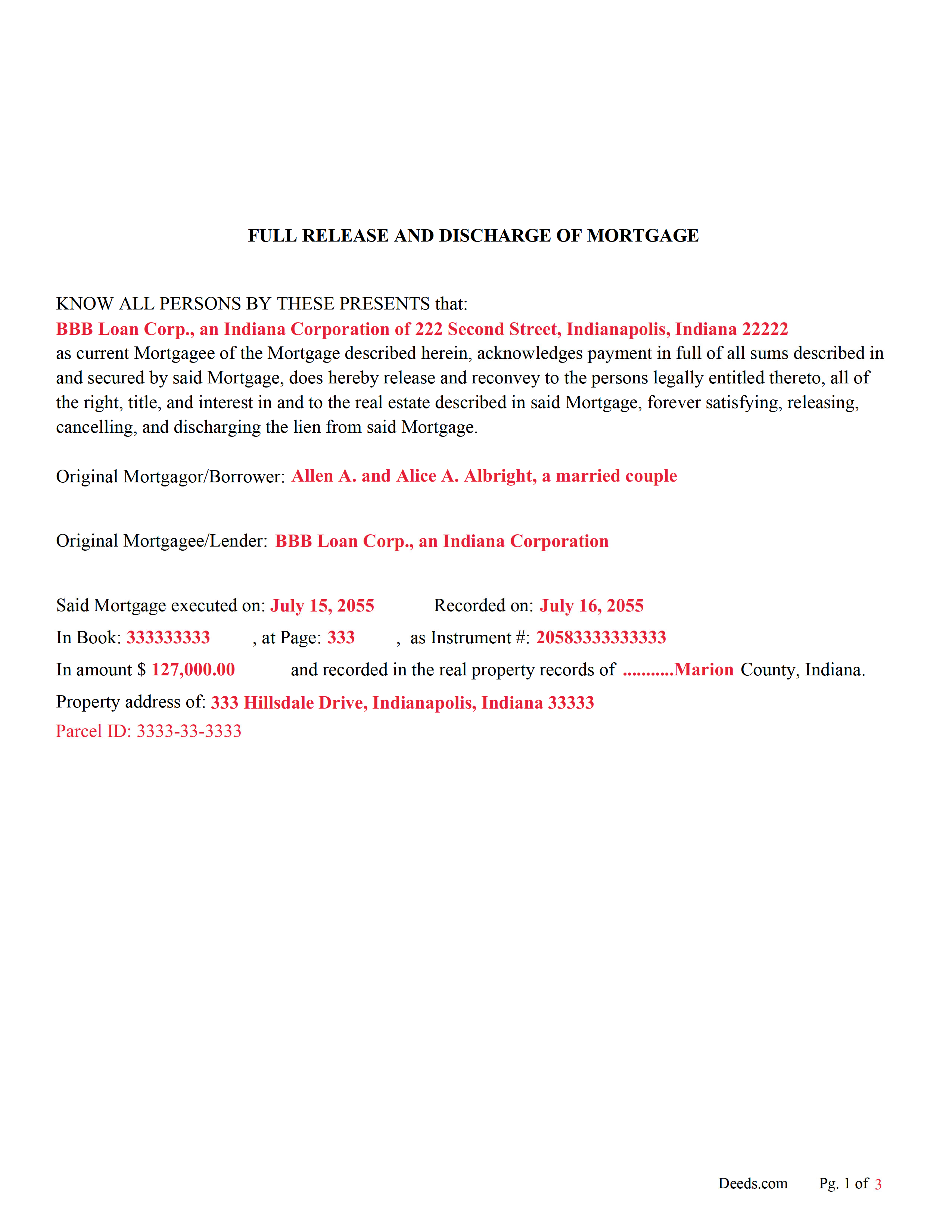

Warrick County Completed Example of the Release of Mortgage Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Indiana and Warrick County documents included at no extra charge:

Where to Record Your Documents

Warrick County Recorder

Boonville, Indiana 47601

Hours: 8:00 to 4:00 Monday through Friday

Phone: (812) 897-6165

Recording Tips for Warrick County:

- Bring your driver's license or state-issued photo ID

- Check that your notary's commission hasn't expired

- Documents must be on 8.5 x 11 inch white paper

- Ask about their eRecording option for future transactions

- If mailing documents, use certified mail with return receipt

Cities and Jurisdictions in Warrick County

Properties in any of these areas use Warrick County forms:

- Boonville

- Chandler

- Elberfeld

- Folsomville

- Lynnville

- Newburgh

- Tennyson

Hours, fees, requirements, and more for Warrick County

How do I get my forms?

Forms are available for immediate download after payment. The Warrick County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Warrick County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Warrick County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Warrick County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Warrick County?

Recording fees in Warrick County vary. Contact the recorder's office at (812) 897-6165 for current fees.

Questions answered? Let's get started!

In general a lender has 15 days once notified to release a mortgage to avoid penalty.

((1) a sum not to exceed five hundred dollars ($500) for the failure, neglect, or refusal of the owner, holder, or custodian to:

(A) release;

(B) discharge; and

(C) satisfy of record the mortgage or lien; and

(2) costs and reasonable attorney's fees incurred in enforcing the release, discharge, or satisfaction of record of the mortgage or lien.

(c) If the court finds in favor of a plaintiff who files an action to recover damages under subsection (b), the court shall award the plaintiff the costs of the action and reasonable attorney's fees as a part of the judgment.

(d) The court may appoint a commissioner and direct the commissioner to release and satisfy the mortgage, mechanic's lien, judgment, or other lien. The costs incurred in connection with releasing and satisfying the mortgage, mechanic's lien, judgment, or other lien shall be taxed as a part of the costs of the action. (e) The owner, holder, or custodian, by virtue of having recorded the mortgage, mechanic's lien, judgment, or other lien in Indiana, submits to the jurisdiction of the courts of Indiana as to any action arising under this section.) (IC 32-28-1-2 (b)(1))

IC 32-29-1-6 Payment in full; release and discharge of mortgage

Sec. 6. After a mortgagee of property whose mortgage has been recorded has received full payment from the mortgagor of the sum specified in the mortgage, the mortgagee shall, at the request of the mortgagor, enter in the record of the mortgage that the mortgage has been satisfied. An entry in the record showing that a mortgage has been satisfied operates as a complete release and discharge of the mortgage.

((a) It is lawful for:

(1) the president, vice president, cashier, secretary, treasurer, attorney in fact, or other authorized representative of a national bank, state bank, trust company, or savings bank; or

(2) the president, vice president, general manager, secretary, treasurer, attorney in fact, or other authorized representative of any other corporation doing business in Indiana;

to release upon the record mortgages, judgments, and other record liens upon the payment of the debts secured by the liens.) (IC 32-29-5-1)

(Indiana Mortgage Release Package includes form, guidelines, and completed example) For use in Indiana only.

Important: Your property must be located in Warrick County to use these forms. Documents should be recorded at the office below.

This Full Release of Mortgage meets all recording requirements specific to Warrick County.

Our Promise

The documents you receive here will meet, or exceed, the Warrick County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Warrick County Full Release of Mortgage form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Kelly S.

May 19th, 2020

Fast, easy, responsive.

Thank you!

Archie POA G.

January 25th, 2020

got what I ordered, as expected, in good time

Thank you!

Scott W.

February 5th, 2024

Quick and simple.

Thank you!

Linda W.

August 3rd, 2020

Received feedback in a timely manner and got a quick reponse.

Thank you!

Steve R.

June 17th, 2023

Hopefully filling out and filing the paperwork is as easy as this was.

Thank you for your feedback. We really appreciate it. Have a great day!

Nancy E.

May 4th, 2025

Took me awhile to figure out and get the information printed so I can use it later. Thank you.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Jeffery H.

October 18th, 2023

Very easy to use. Thanks for your quick response on my document submissions and follow up and guidance on specific questions.

Thank you for your positive words! We’re thrilled to hear about your experience.

Jana H.

December 23rd, 2020

I love this recording service! They are so fast and let me know in advance if they think something is wrong and will be rejected! They are reasonably priced too!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kenneth C.

August 24th, 2020

Great forms, easy to use if you have at least a sixth grade education.

Thank you!

Jean K.

February 25th, 2021

The website worked fine and I would have been happy to pay the extra money except the deed I needed was "not available". Ended up calling the courthouse anyway.

Thank you for your feedback. We really appreciate it. Have a great day!

Frank K.

July 27th, 2023

One thing I suggest is use the nomenclature Borrower / Lender / instead of Mortgatator / Mortgatee… Had to google which is which ? !

Thank you for your feedback. We really appreciate it. Have a great day!

Jeffrey G.

January 10th, 2022

We had a one-time-only recording to make in the District of Columbia. We could not have e-filed the document without the assistance Deeds.com! The service they provided was wonderful.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael M.

April 30th, 2019

Easy to follow directions and instructions to properly and legally fill-in the Deed that I requested. It was also very easy and convenient. If I was going to employ an Attorney or Legal Documents Preparer, they would easily charge me between $150 to $225 a Deed! For the cost of $19.97, anyone would pursue this price! Thank you, Deeds.com for a wonderful and terrific experience! I'm going to need you again to change Titles for my other Investment Properties.

Thank you for your feedback. We really appreciate it. Have a great day!

Preston P.

January 12th, 2023

Filled my need for the documents needed. thank you, I am sure I will return soon.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

CLAUDE G.

September 18th, 2019

just what I needed Thank You

Thank you!