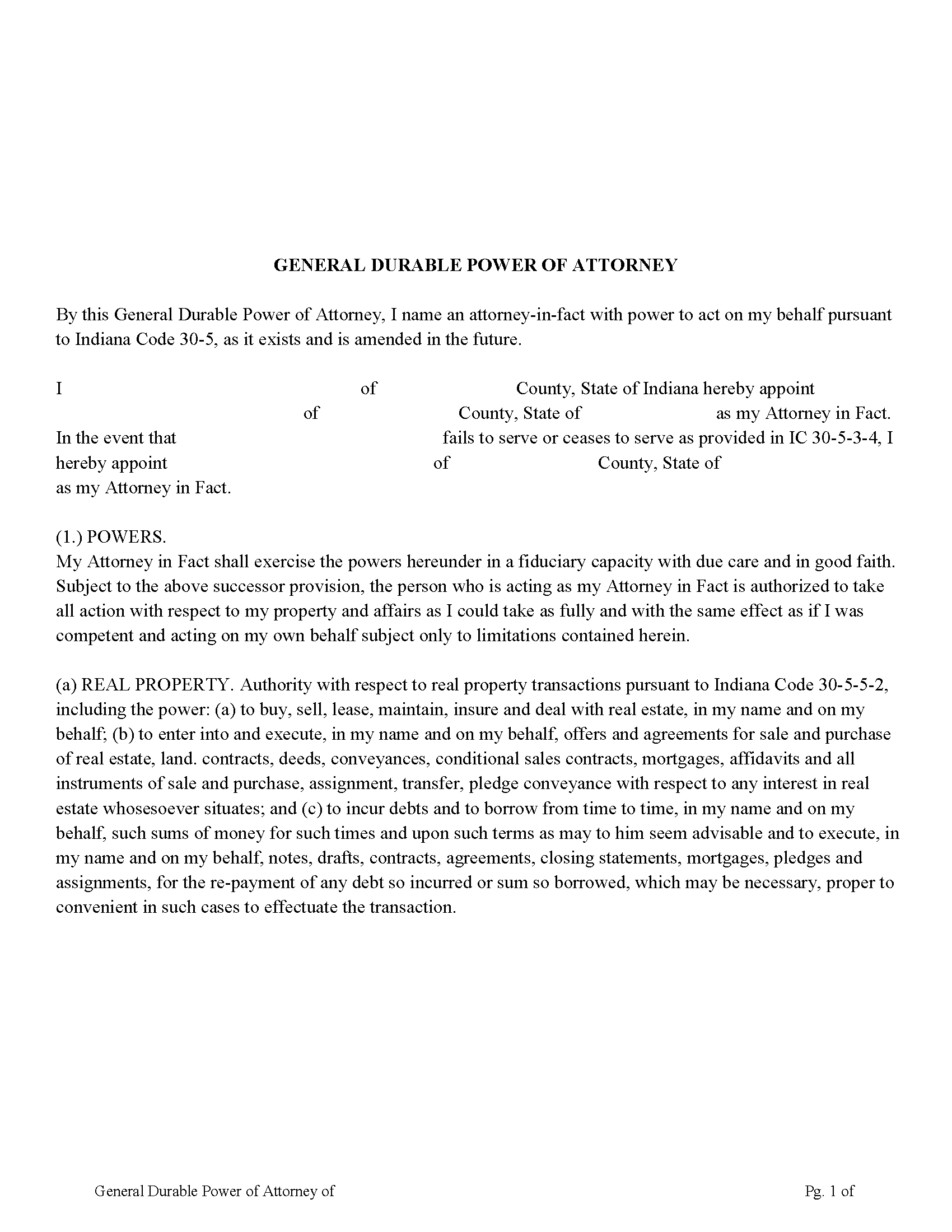

Brown County General Durable Power of Attorney Form

Brown County General Durable Power of Attorney Form

Fill in the blank form formatted to comply with all recording and content requirements.

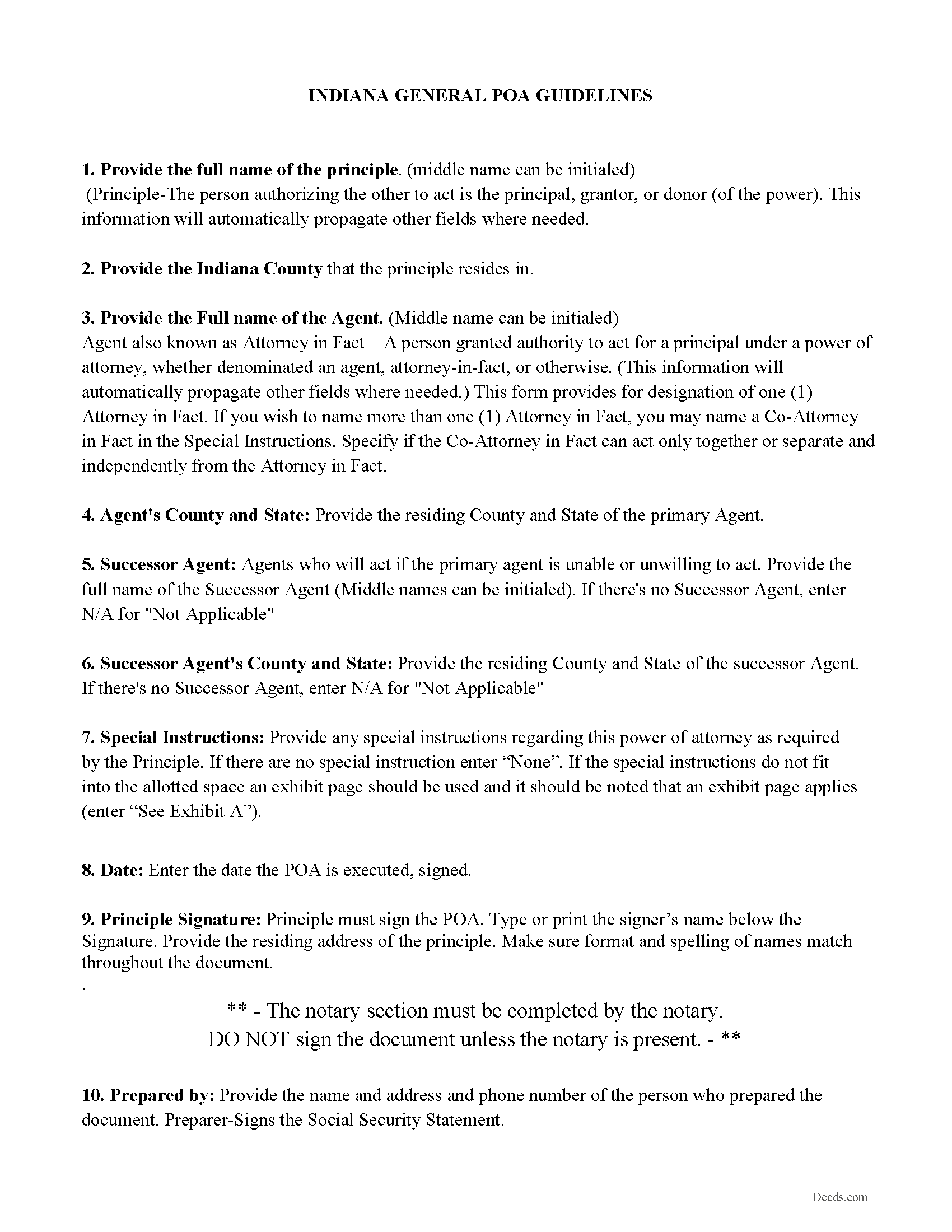

Brown County Power of Attorney Guidelines

Line by line guide explaining every blank on the form, includes Indiana POA Statutes

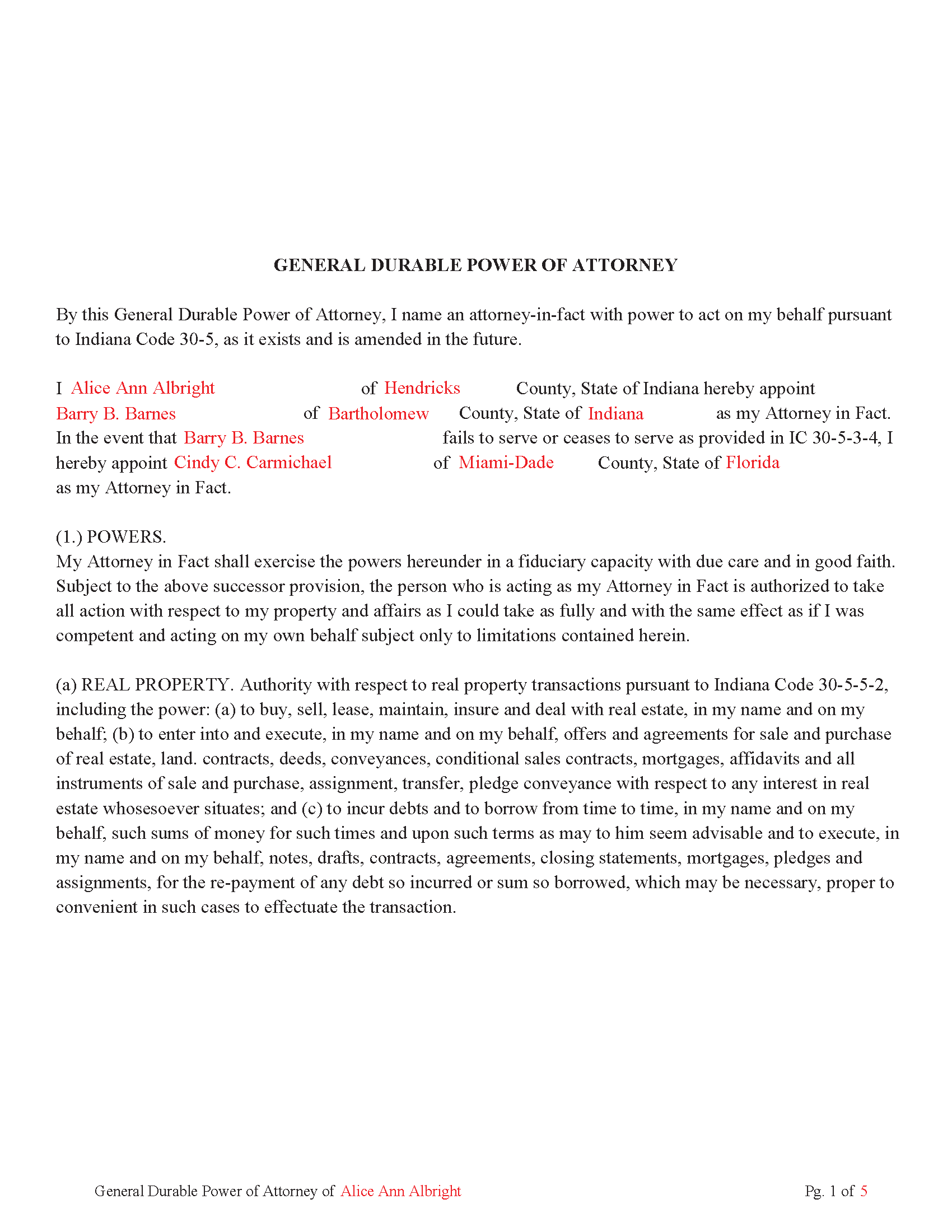

Brown County Completed Example of the Power of Attorney Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Indiana and Brown County documents included at no extra charge:

Where to Record Your Documents

Brown County Recorder

Nashville, Indiana 47448

Hours: 8:00 a.m. - 4:00 p.m. Monday-Friday

Phone: (812) 988-5462

Recording Tips for Brown County:

- Bring your driver's license or state-issued photo ID

- Ensure all signatures are in blue or black ink

- Double-check legal descriptions match your existing deed

- White-out or correction fluid may cause rejection

- Ask about their eRecording option for future transactions

Cities and Jurisdictions in Brown County

Properties in any of these areas use Brown County forms:

- Helmsburg

- Nashville

Hours, fees, requirements, and more for Brown County

How do I get my forms?

Forms are available for immediate download after payment. The Brown County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Brown County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Brown County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Brown County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Brown County?

Recording fees in Brown County vary. Contact the recorder's office at (812) 988-5462 for current fees.

Questions answered? Let's get started!

(5) Five Page General Durable Power of Attorney, following Indiana Code and subjects listed below.

By this General Durable Power of Attorney, you name an attorney-in-fact with power to act on your behalf pursuant to Indiana Code 30-5, as it exists and is amended in the future.

(a) REAL PROPERTY. Authority with respect to real property transactions pursuant to Indiana Code 30-5-5-2

(b) TANGIBLE PERSONAL PROPERTY. Authority with respect to tangible personal property transactions pursuant to Indiana Code 30-5-5-3

(c) BOND, SHARE AND COMMODITY. Authority with respect to bond, share. and commodity transactions pursuant to Indiana Code 30-5-5-4,

(d) BANKING. Authority with respect to banking transactions pursuant to Indiana Code 30-5-5-5, including but not limited to the authority:

(e) BUSINESS. Authority with respect to business operating transactions pursuant to Indiana Code 30-5-5-6, including the power:

(f) INSURANCE. Authority with respect to insurance transactions pursuant to

Indiana Code 30-5-5-7.

(g) BENEFICIARY. Authority with respect to beneficiary transactions pursuant to

Indiana Code 30-5-5-8.

(h) GIFTS. In the event I become permanently mentally incapacitated, to make gifts of my property and to have general authority with respect to gift transactions as provided in IC 30-5-5- 9

(i) FIDUCIARY. Authority with respect to fiduciary transactions pursuant to Indiana Code 30-5-5-10

(j) CLAIMS AND LITIGATION. Authority with respect to claims and litigation pursuant to

Indiana Code 30-5-5-11.

(k) FAMILY MAINTENANCE. Authority with respect to family maintenance pursuant to

Indiana Code 30-5-5-12.

(l) MILITARY SERVICE. Authority with respect to benefits from military service pursuant to

Indiana Code 30-5-5-13.

(m) RECORDS, REPORTS AND STATEMENTS. Authority with respect to records, reports and statements pursuant to Indiana Code 30-5-5-14, including, but not limited to, the power to execute on my behalf any

(n) ESTATE TRANSACTIONS. Authority with respect to estate transaction pursuant to

Indiana Code 30-5-5-15.

(o) DELEGATING AUTHORITY. Authority with respect in delegating authority in writing to one (1) or more persons as to any or all powers given to the attorney-in-fact by this General Durable Power of Attorney document, pursuant to Indiana Code 30-5-5-18.

(p) TAX MATTERS. Authority: (a) to prepare, execute and file on your behalf.

(q) SOCIAL SECURITY ADMINISTRATION. Authority to act as your representative and attorney-in-fact for all matters involving the Social Security Administration and benefits from the administration.

(r) ALL OTHER MATTERS. Authority with respect to all other possible matters and affairs affecting property owned by you pursuant to Indiana Code 30-5-5-19.

(Indiana General Durable POA Package includes form, guidelines, and completed example)

Important: Your property must be located in Brown County to use these forms. Documents should be recorded at the office below.

This General Durable Power of Attorney meets all recording requirements specific to Brown County.

Our Promise

The documents you receive here will meet, or exceed, the Brown County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Brown County General Durable Power of Attorney form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Mark S.

September 30th, 2020

Quick and easy. Had what I was searching for. Simple to pay and download.

Thank you!

Judy F.

December 29th, 2018

I thought your site was focused on my specific county, but it wasn't. Therefore, I did not complete a transaction.

Thank you for your feedback Judy. Our site is national, we focus on all jurisdictions. Have a great day.

Julia C.

May 18th, 2025

Deeds.com was such a blessing in order for me to get something done that my lawyers could not get done. Transferring a mineral right from my deceased parents to me and my husband. The mineral company person I worked with went above and beyond helping me fill the paperwork out perfectly so that it had “right of survivorship” (and other things phrased properly) so that either my husband or I won’t have the issue I have had. Had it not been for deeds.com I don’t think I would have been able to complete this process. I hope anyone that ever needs something such as this learns about I deeds.com.

Thank you, Julia, for your kind and thoughtful review. We're truly honored to have played a role in helping you and your husband secure your mineral rights — especially after such a frustrating experience elsewhere. It’s great to hear that our team and resources were able to guide you through the process with clarity and care. Your words mean a lot to us, and we hope others in similar situations find the support they need through Deeds.com, just like you did. Wishing you continued peace of mind and security with your property.

Erika H.

December 14th, 2018

The service was fast and efficient. So glad I stumbled upon this website!

Thank you for your feedback. We really appreciate it. Have a great day!

Harry S.

March 30th, 2021

This is my first time using the service. Wow! How efficient and effortless! Keep up the good work!

Thank you!

Alexis B.

December 31st, 2018

Highly Pleased- Strongly Recommend Deeds.com Long review... sorry:-) Originally I was very skeptical due to the enormous amount of the scams going on now days and the number of online sources that "claim" to provide you with deed forms for free or for a few. Nothing that you need and want done is free. There is always a cost. So luckily I came across deeds.com. This was the only site that appeared to be simple, to the point, and made no crazy promises. So before selecting this site, I did a little more checking around/price checking to ensure I am getting the best price for the product I needed. I even checked Staples and Amazon to find that they do indeed sell these forms but I do not think the products they provide are specific for my state and county. They claim their forms provided are for all states but my state is specific and I prefer to have forms provided by Deeds.com that is based on Indiana statute that Deed.com clearly identifies on each form. Deeds.com price of $20 seemed a little high at first but when I saw the products provided, the $20 cost is more than reasonable and fair. You not only get the deed form specific for my state and my specific "county" but also the other various/supplemental forms that may be required. Being familiar with my state and knowing how tedious and anal my state is on everything, I was pleasantly please to see the info and extra supplemental forms provided. For example, a person new to the State who recently had property deeded to them, would not necessarily know about the Homestead tax exemption provided if property is your primary residents, over 65 exemption etc. I would highly recommend this site for anyone needing these documents because Deeds.com has you covered on any and all forms/info you could ever need! A bonus is that there is one flat fee and not monthly cost that you have to worry about canceling later unless you superficially select a monthly package. I love the fact that Deeds.com is nothing fancy. There is not a bunch of elaborate graphics etc. They only provide what you need and what they provide is very accurate. Deeds.com has a customer for life.

Thank you so much Alexis. We appreciate you, have a fantastic day.

Anitra C.

July 10th, 2021

This was so easy and the instructions were great.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John G.

July 25th, 2022

I was actually quite pleased with the ease of use of this site. I really, really liked the step by step instructions and examples of the finished product !!

Thank you!

Mary D. B.

May 11th, 2023

BIG THANK YOU EXCELLENT WEBSITE

Thank you!

AKILAH S.

March 14th, 2024

It was a little challenging and I had to call to speak to someone a few time but I got it done and and over with so I'm happy.

It was a pleasure serving you. Thank you for the positive feedback!

Carolyn A.

October 18th, 2019

Easy to use!!

Thank you!

Erika K.

July 3rd, 2020

Very Easy to use, especially since the county recorder's office is closed due to COVID-19

Thank you!

William J. T.

July 9th, 2019

Satisfied with downloaded documents.

Thank you!

Nancy v.

February 3rd, 2022

Amazing! So easy to get all the forms. Very impressive!

Thank you!

Van S.

March 25th, 2022

Easy to use...very informative...ttook care of exactly what I was looking for.

Thank you for your feedback. We really appreciate it. Have a great day!