Crawford County General Durable Power of Attorney Form

Crawford County General Durable Power of Attorney Form

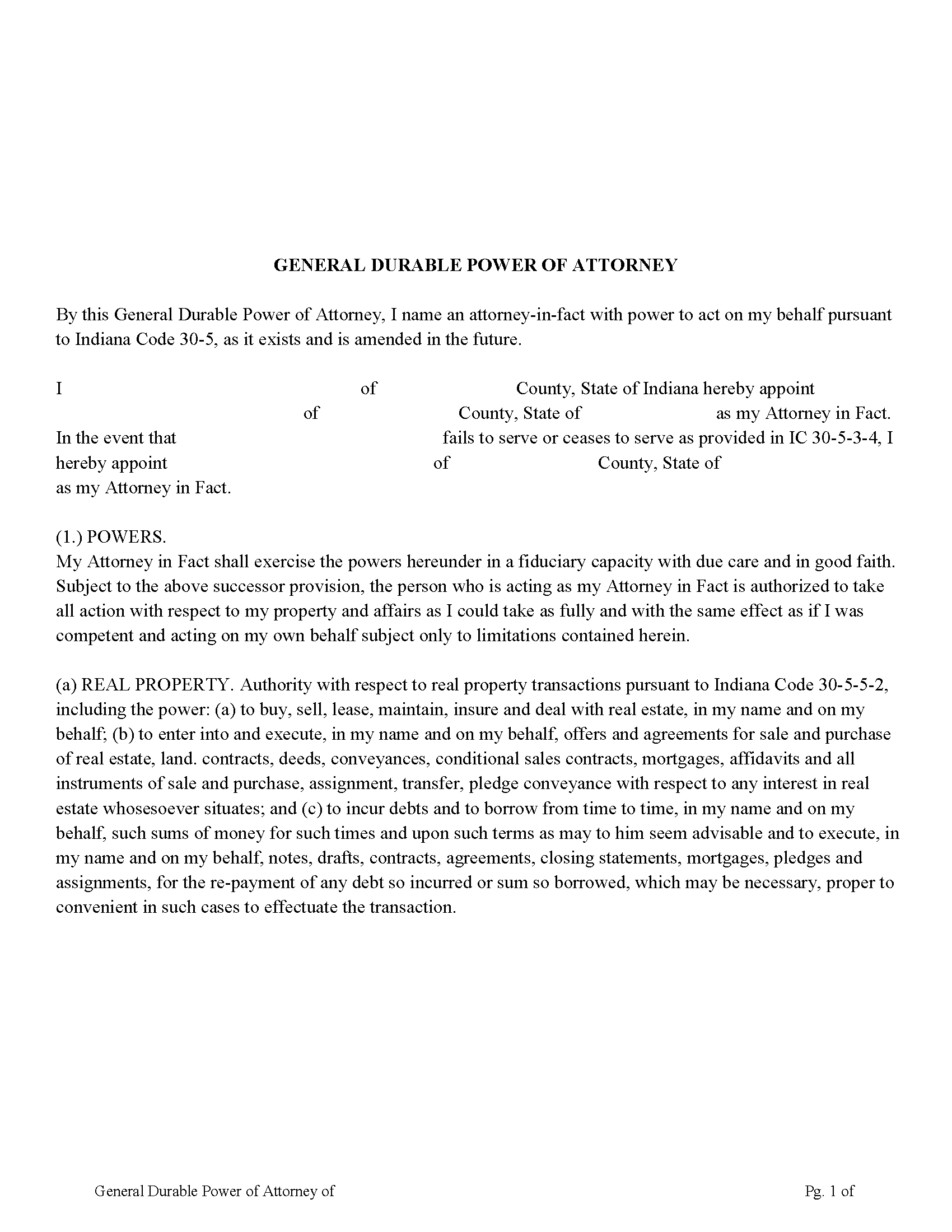

Fill in the blank form formatted to comply with all recording and content requirements.

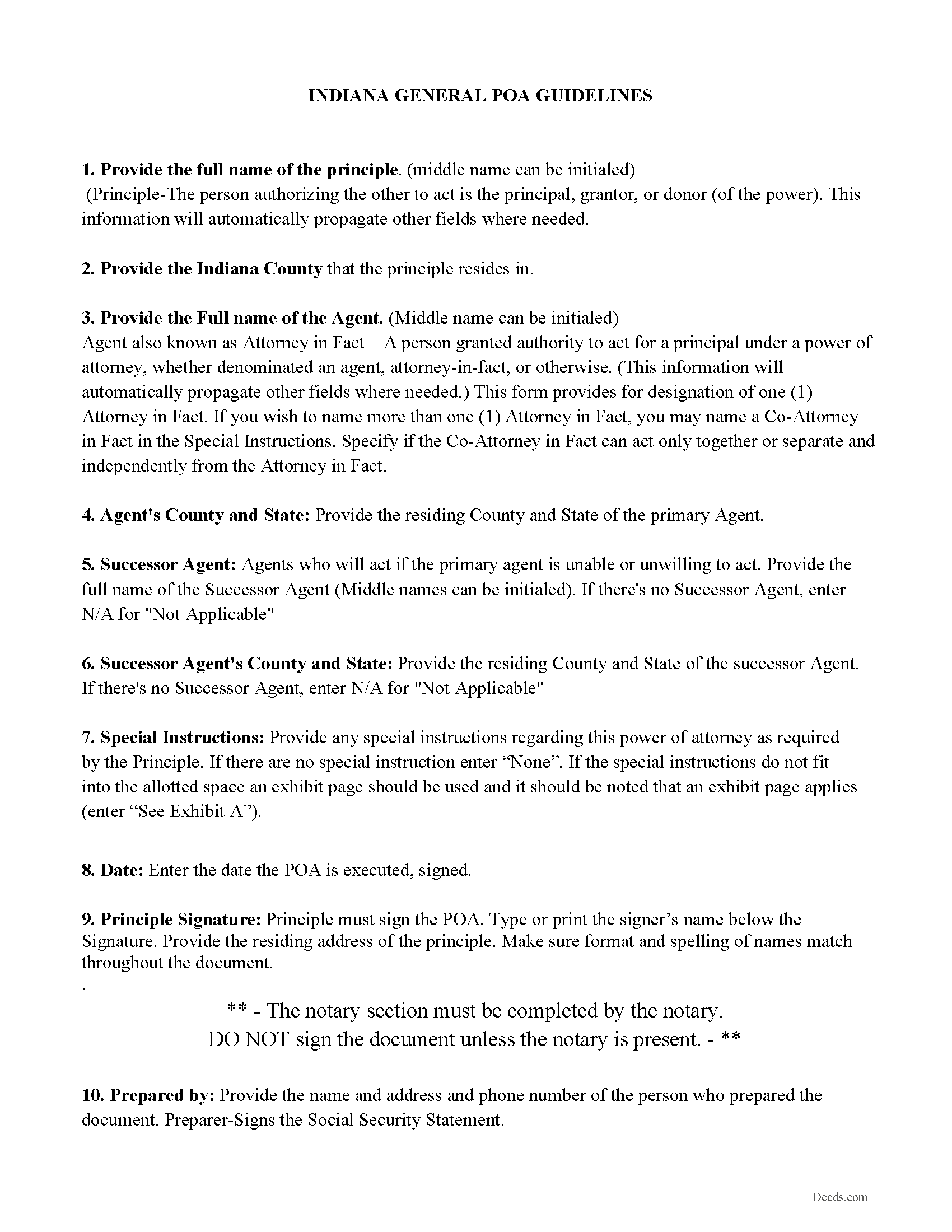

Crawford County Power of Attorney Guidelines

Line by line guide explaining every blank on the form, includes Indiana POA Statutes

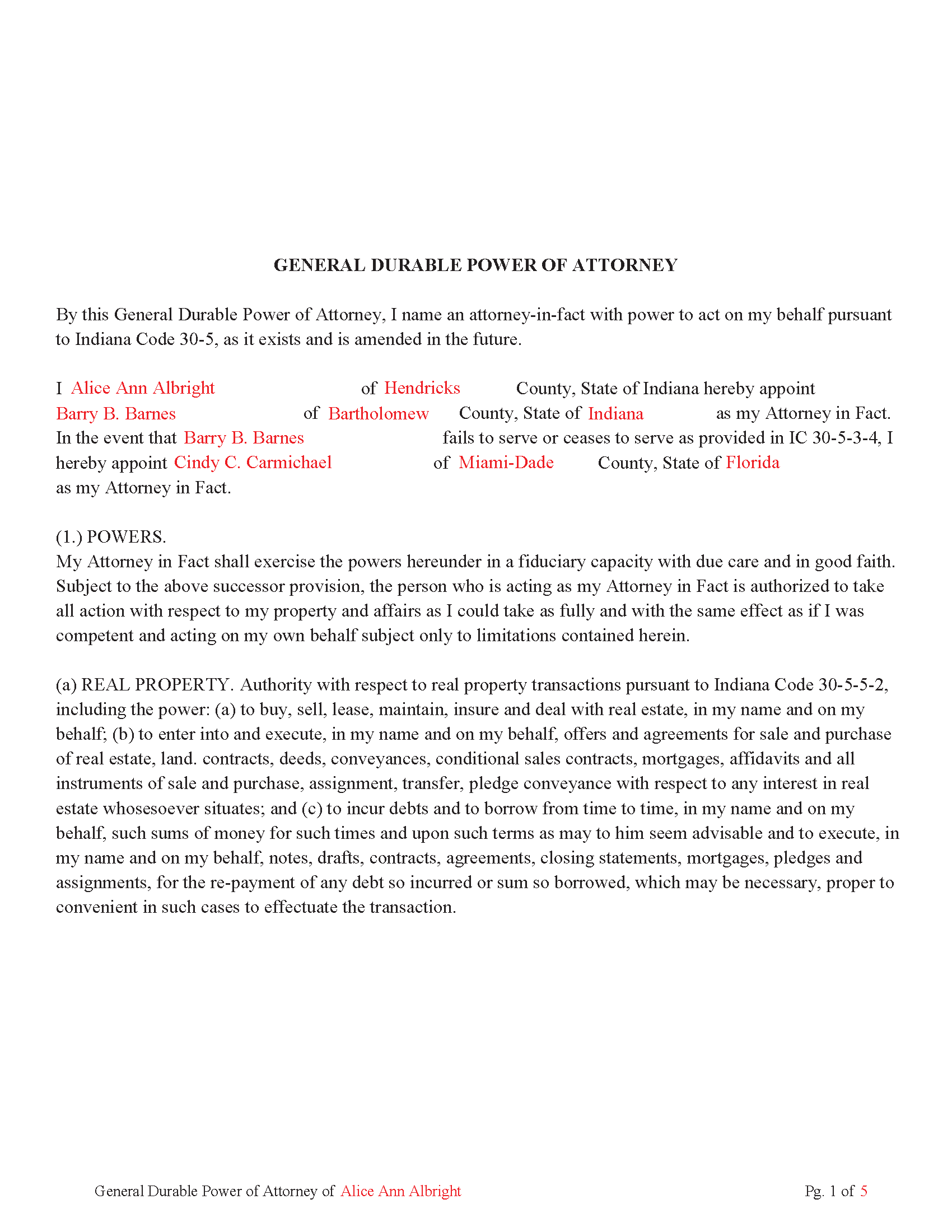

Crawford County Completed Example of the Power of Attorney Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Indiana and Crawford County documents included at no extra charge:

Where to Record Your Documents

Crawford County Recorder

English, Indiana 47118

Hours: Call for hours

Phone: (812) 338-2615

Recording Tips for Crawford County:

- Ensure all signatures are in blue or black ink

- Verify all names are spelled correctly before recording

- Double-check legal descriptions match your existing deed

- Ask about their eRecording option for future transactions

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Crawford County

Properties in any of these areas use Crawford County forms:

- Eckerty

- English

- Grantsburg

- Leavenworth

- Marengo

- Milltown

- Sulphur

- Taswell

Hours, fees, requirements, and more for Crawford County

How do I get my forms?

Forms are available for immediate download after payment. The Crawford County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Crawford County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Crawford County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Crawford County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Crawford County?

Recording fees in Crawford County vary. Contact the recorder's office at (812) 338-2615 for current fees.

Questions answered? Let's get started!

(5) Five Page General Durable Power of Attorney, following Indiana Code and subjects listed below.

By this General Durable Power of Attorney, you name an attorney-in-fact with power to act on your behalf pursuant to Indiana Code 30-5, as it exists and is amended in the future.

(a) REAL PROPERTY. Authority with respect to real property transactions pursuant to Indiana Code 30-5-5-2

(b) TANGIBLE PERSONAL PROPERTY. Authority with respect to tangible personal property transactions pursuant to Indiana Code 30-5-5-3

(c) BOND, SHARE AND COMMODITY. Authority with respect to bond, share. and commodity transactions pursuant to Indiana Code 30-5-5-4,

(d) BANKING. Authority with respect to banking transactions pursuant to Indiana Code 30-5-5-5, including but not limited to the authority:

(e) BUSINESS. Authority with respect to business operating transactions pursuant to Indiana Code 30-5-5-6, including the power:

(f) INSURANCE. Authority with respect to insurance transactions pursuant to

Indiana Code 30-5-5-7.

(g) BENEFICIARY. Authority with respect to beneficiary transactions pursuant to

Indiana Code 30-5-5-8.

(h) GIFTS. In the event I become permanently mentally incapacitated, to make gifts of my property and to have general authority with respect to gift transactions as provided in IC 30-5-5- 9

(i) FIDUCIARY. Authority with respect to fiduciary transactions pursuant to Indiana Code 30-5-5-10

(j) CLAIMS AND LITIGATION. Authority with respect to claims and litigation pursuant to

Indiana Code 30-5-5-11.

(k) FAMILY MAINTENANCE. Authority with respect to family maintenance pursuant to

Indiana Code 30-5-5-12.

(l) MILITARY SERVICE. Authority with respect to benefits from military service pursuant to

Indiana Code 30-5-5-13.

(m) RECORDS, REPORTS AND STATEMENTS. Authority with respect to records, reports and statements pursuant to Indiana Code 30-5-5-14, including, but not limited to, the power to execute on my behalf any

(n) ESTATE TRANSACTIONS. Authority with respect to estate transaction pursuant to

Indiana Code 30-5-5-15.

(o) DELEGATING AUTHORITY. Authority with respect in delegating authority in writing to one (1) or more persons as to any or all powers given to the attorney-in-fact by this General Durable Power of Attorney document, pursuant to Indiana Code 30-5-5-18.

(p) TAX MATTERS. Authority: (a) to prepare, execute and file on your behalf.

(q) SOCIAL SECURITY ADMINISTRATION. Authority to act as your representative and attorney-in-fact for all matters involving the Social Security Administration and benefits from the administration.

(r) ALL OTHER MATTERS. Authority with respect to all other possible matters and affairs affecting property owned by you pursuant to Indiana Code 30-5-5-19.

(Indiana General Durable POA Package includes form, guidelines, and completed example)

Important: Your property must be located in Crawford County to use these forms. Documents should be recorded at the office below.

This General Durable Power of Attorney meets all recording requirements specific to Crawford County.

Our Promise

The documents you receive here will meet, or exceed, the Crawford County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Crawford County General Durable Power of Attorney form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4577 Reviews )

Andrew M.

March 20th, 2021

Very easy to find the Quitclaim Deed form I needed. It was correct format and was accepted by my bank.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Max P.

February 26th, 2021

Excellent. Timely. Efficient. Smooth. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Richard S.

August 13th, 2020

Not user friendly, and not an Adobe fan. The first page of Quitclaim Deed form cuts off the Parcel Identification line on the bottom. Also quite a few forms showed up to be downloaded , after I paid, so I was unsure if all the forms were part of the quitclaim package. I have adobe but was unable to locate the forms in adobe on my computer after I downloaded them. Just wanted to print out one quitclaim deed form, which would have taken less that 3 minutes. instead it took 97 minutes. Thank you, though, for having the form there.

Thank you for your feedback. We really appreciate it. Have a great day!

Kelin F.

April 16th, 2025

Prompt, accurate and professional response. Thank you. Kelin F.

Thank you, Kelin! We appreciate your kind words and are glad we could help. Let us know if you ever need anything else!

CHARLES H.

December 3rd, 2022

Easy to fill-in forms, easy instructions, worth purchasing

Thank you!

Scott A.

July 8th, 2020

Good site. Saved me a trip to one or two courthouses.

Thank you for your feedback. We really appreciate it. Have a great day!

Diane O.

September 1st, 2022

Filling out forms was easy....so far, I am happy !

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Filomena G.

March 8th, 2025

very helpful

Thank you!

Gina M.

August 25th, 2021

Wow, great forms. They do have some protections in place to keep you from doing something stupid but if you use the forms as intended they will work perfectly for you.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael G. S.

January 3rd, 2019

The process was quite easy, following the instructional guide. I have yet to find out if the deed was accepted, but your site was very user friendly.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Martha B.

January 11th, 2019

Not too hard to do, I did get it checked out by an attorney after I completed it just to be safe. He said it was fine, made no changes.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John v.

April 7th, 2020

Process is well laid out, clear and concise. Check out is easy. Recommendations: * Assign names to the downloadable files that are meaningful, such as: WARRANTY DEED instead of the useless and cryptic 1420490866F11417.pdf. * Provide a ONE BUTTON DOWNLOAD for all forms ordered. It's aggravating to have to click on each of the 20 documents and download them individually.

Thank you for your feedback. We really appreciate it. Have a great day!

A. S.

February 27th, 2019

First, I am glad that you gave a blank copy, an example copy, and a 'guide'. It made it much easier to do. Overall I was very happy with your products and organization... however, things got pretty confusing and I have a pretty 'serious' law background in Real Estate and Civil law. With that said, I spent about 10+ hours getting my work done, using the Deed of Trust and Promissory note from you and there were a few problems: First, it would be FANTASTIC if you actually aligned your guide to actually match the Deed or Promissory Note. What I mean is that if the Deed says 'section (E)' then your guide shouldn't be 'randomly' numbered as 1,2,3, for advice/instructions, but should EXACTLY match 'section (E)'. Some places you have to 'hunt' for what you are looking for, and if you did it based on my suggestion, you wouldn't need to 'hunt' and it would avoid confusion. 2nd: This one really 'hurt'... you had something called the 'Deed of Trust Master Form' yet you had basically no information on what it was or how to use it. The only information you had was a small section at the top of the 'Short Form Deed of Trust Guide'. Holy Cow, was that 'section' super confusing. I still don't know if I did it correctly, but your guide says only put a return address on it and leave the rest of the 16 or so page Deed of Trust beneath it blank... and then include your 'Deed of Trust' (I had to assume the short form deed that I had just created) as part of it. I had to assume that I had to print off the entire 17 page or so title page and blank deed. I also had to assume that the promissory note was supposed to be EXHIBIT A or B on the Short Form Deed. It would be great if someone would take a serious look at that short section in your 'Short Form Deed of Trust Guide' and realize that those of us using your products are seriously turning this into a county clerk to file and that most of us, probably already have a property that has an existing Deed... or at least can find one in the county records if necessary... and make sure that you make a distinction between the Deed for the property that already exists, versus the Deed of Trust and Promissory note that we are trying to file. Thanks.

Thank you for your feedback. We'll have staff review the document for clarity. Have a great day!

David G.

February 27th, 2025

Very easy to fill out and understand. Thank You!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Peggy J.

July 26th, 2021

I have been researching for months to figure out how to remove deceased owner of property with right of survivorship in Florida. The County Clerk was not helpful. They refer you to get legal advice which is expensive. So hopefully by completing these forms I can actually complete the task. And would be helpful to be reassured that this is all I need to complete overdue task. I was hesitant to pay, but I believe this is legit. If so- a great Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!