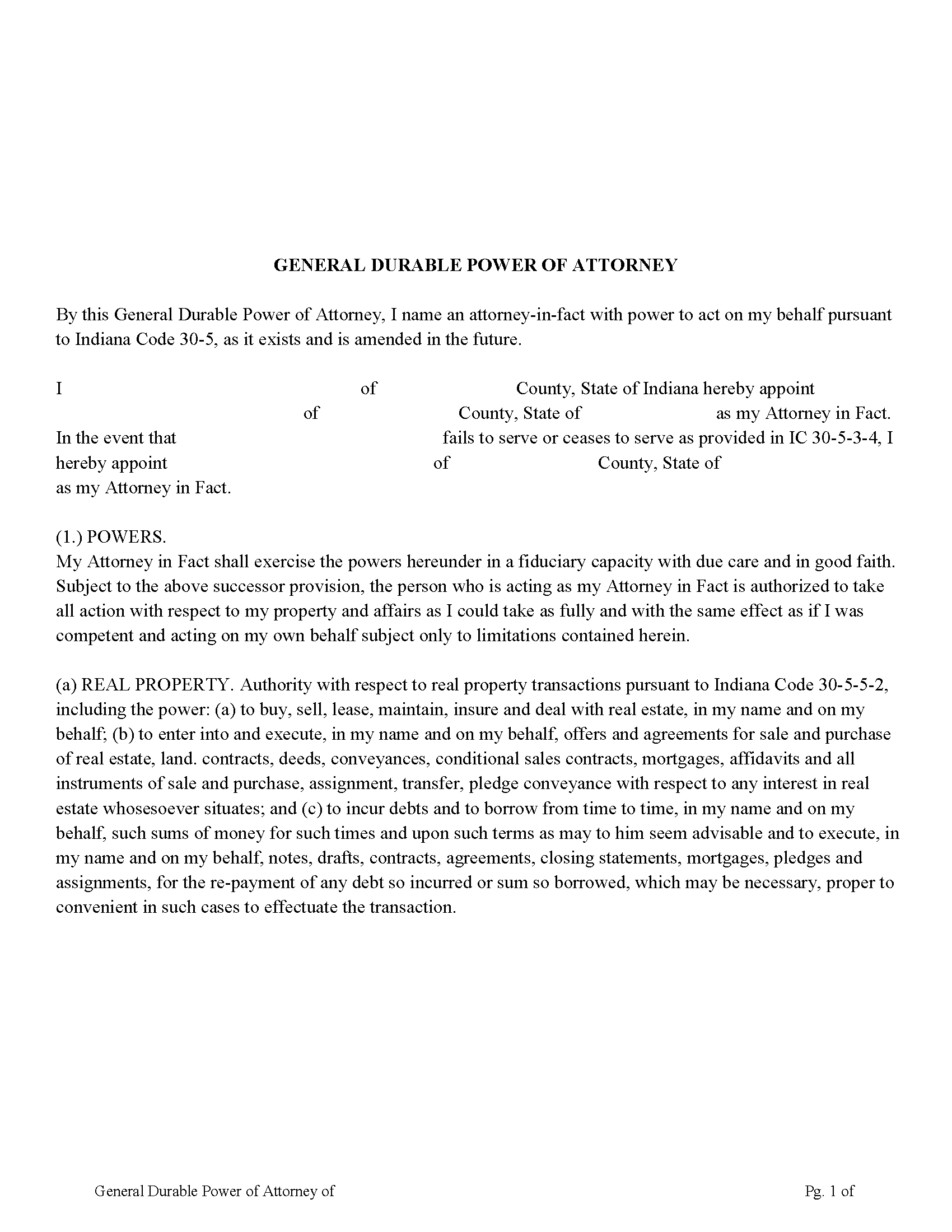

Huntington County General Durable Power of Attorney Form

Huntington County General Durable Power of Attorney Form

Fill in the blank form formatted to comply with all recording and content requirements.

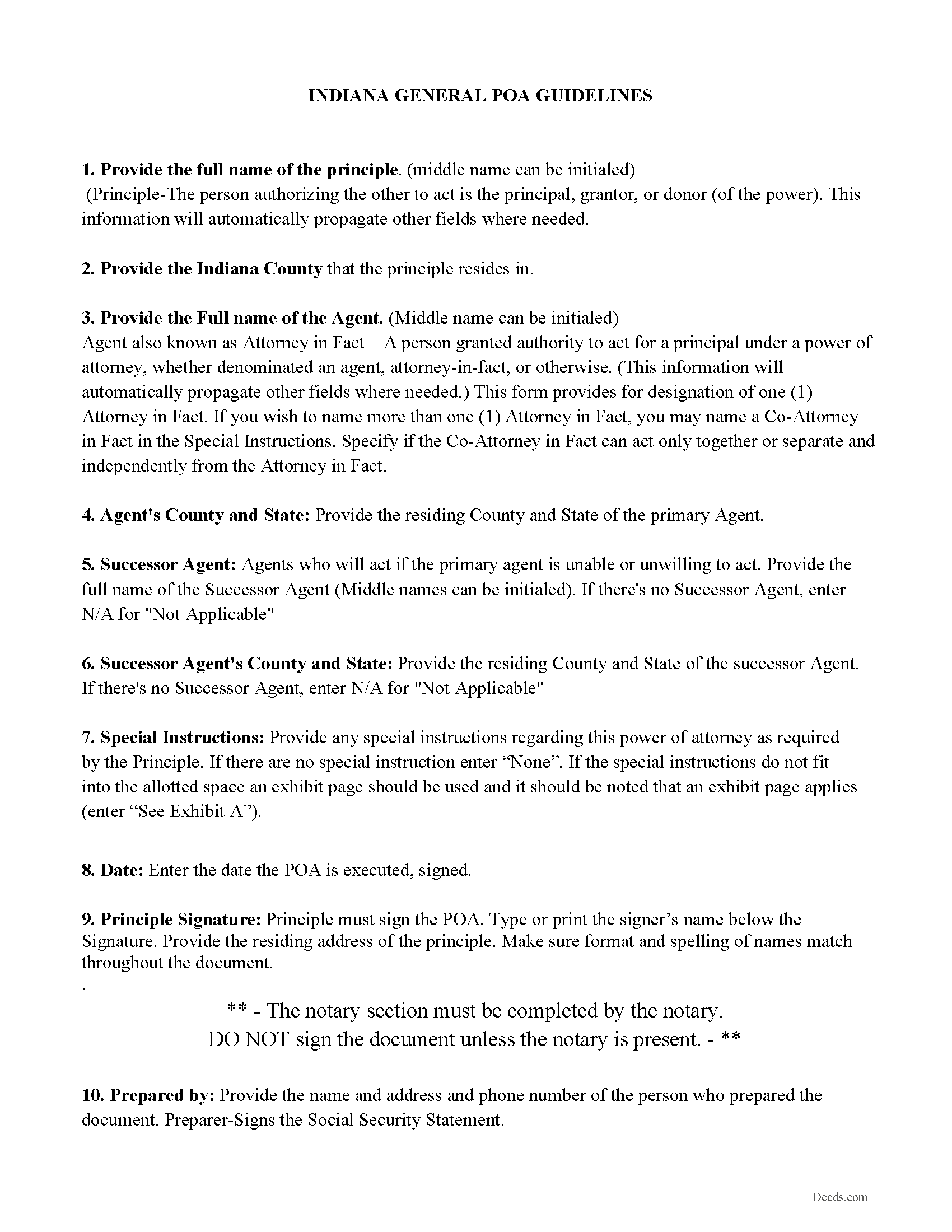

Huntington County Power of Attorney Guidelines

Line by line guide explaining every blank on the form, includes Indiana POA Statutes

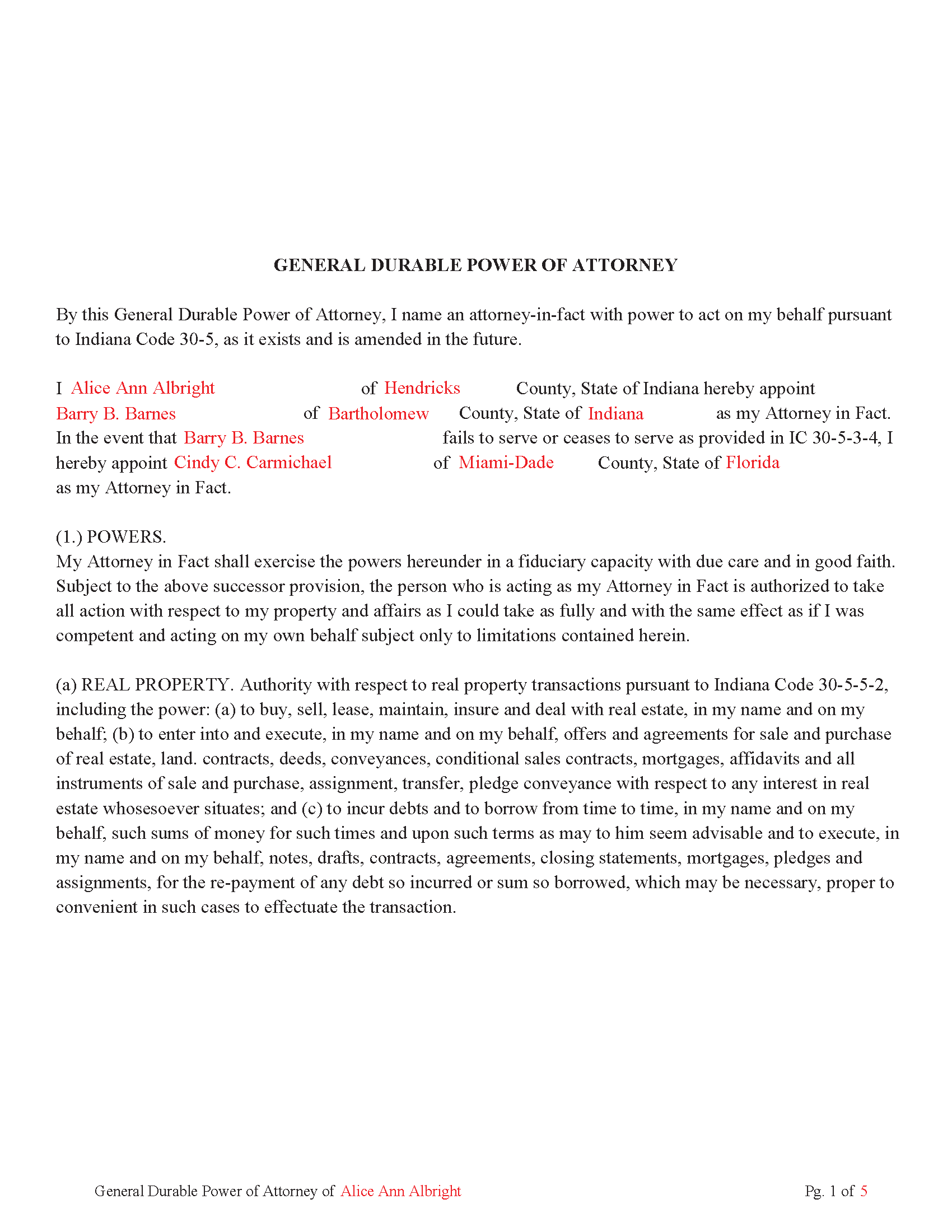

Huntington County Completed Example of the Power of Attorney Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Indiana and Huntington County documents included at no extra charge:

Where to Record Your Documents

Huntington County Recorder

Huntington, Indiana 46750

Hours: 8:00 to 4:30 M-F

Phone: (260) 355-2312

Recording Tips for Huntington County:

- Verify all names are spelled correctly before recording

- Bring extra funds - fees can vary by document type and page count

- Ask about their eRecording option for future transactions

Cities and Jurisdictions in Huntington County

Properties in any of these areas use Huntington County forms:

- Andrews

- Bippus

- Huntington

- Roanoke

- Warren

Hours, fees, requirements, and more for Huntington County

How do I get my forms?

Forms are available for immediate download after payment. The Huntington County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Huntington County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Huntington County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Huntington County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Huntington County?

Recording fees in Huntington County vary. Contact the recorder's office at (260) 355-2312 for current fees.

Questions answered? Let's get started!

(5) Five Page General Durable Power of Attorney, following Indiana Code and subjects listed below.

By this General Durable Power of Attorney, you name an attorney-in-fact with power to act on your behalf pursuant to Indiana Code 30-5, as it exists and is amended in the future.

(a) REAL PROPERTY. Authority with respect to real property transactions pursuant to Indiana Code 30-5-5-2

(b) TANGIBLE PERSONAL PROPERTY. Authority with respect to tangible personal property transactions pursuant to Indiana Code 30-5-5-3

(c) BOND, SHARE AND COMMODITY. Authority with respect to bond, share. and commodity transactions pursuant to Indiana Code 30-5-5-4,

(d) BANKING. Authority with respect to banking transactions pursuant to Indiana Code 30-5-5-5, including but not limited to the authority:

(e) BUSINESS. Authority with respect to business operating transactions pursuant to Indiana Code 30-5-5-6, including the power:

(f) INSURANCE. Authority with respect to insurance transactions pursuant to

Indiana Code 30-5-5-7.

(g) BENEFICIARY. Authority with respect to beneficiary transactions pursuant to

Indiana Code 30-5-5-8.

(h) GIFTS. In the event I become permanently mentally incapacitated, to make gifts of my property and to have general authority with respect to gift transactions as provided in IC 30-5-5- 9

(i) FIDUCIARY. Authority with respect to fiduciary transactions pursuant to Indiana Code 30-5-5-10

(j) CLAIMS AND LITIGATION. Authority with respect to claims and litigation pursuant to

Indiana Code 30-5-5-11.

(k) FAMILY MAINTENANCE. Authority with respect to family maintenance pursuant to

Indiana Code 30-5-5-12.

(l) MILITARY SERVICE. Authority with respect to benefits from military service pursuant to

Indiana Code 30-5-5-13.

(m) RECORDS, REPORTS AND STATEMENTS. Authority with respect to records, reports and statements pursuant to Indiana Code 30-5-5-14, including, but not limited to, the power to execute on my behalf any

(n) ESTATE TRANSACTIONS. Authority with respect to estate transaction pursuant to

Indiana Code 30-5-5-15.

(o) DELEGATING AUTHORITY. Authority with respect in delegating authority in writing to one (1) or more persons as to any or all powers given to the attorney-in-fact by this General Durable Power of Attorney document, pursuant to Indiana Code 30-5-5-18.

(p) TAX MATTERS. Authority: (a) to prepare, execute and file on your behalf.

(q) SOCIAL SECURITY ADMINISTRATION. Authority to act as your representative and attorney-in-fact for all matters involving the Social Security Administration and benefits from the administration.

(r) ALL OTHER MATTERS. Authority with respect to all other possible matters and affairs affecting property owned by you pursuant to Indiana Code 30-5-5-19.

(Indiana General Durable POA Package includes form, guidelines, and completed example)

Important: Your property must be located in Huntington County to use these forms. Documents should be recorded at the office below.

This General Durable Power of Attorney meets all recording requirements specific to Huntington County.

Our Promise

The documents you receive here will meet, or exceed, the Huntington County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Huntington County General Durable Power of Attorney form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4584 Reviews )

Philip F.

August 2nd, 2024

Quick, user-friendly, and complete! Thank you

We are grateful for your feedback and looking forward to serving you again. Thank you!

Gloria B.

September 1st, 2022

Super easy and efficient. One time charge for the form with no commitment to a recurring charge for monthly membership. *****

Thank you for your feedback. We really appreciate it. Have a great day!

Lisa P.

October 23rd, 2020

Your forms are worth the investment. The guide and example were very helpful and thorough.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James U.

June 18th, 2020

Fonts for all fields are not the same. Collin County has a specified size it wants in all fields. Other than that every thing was fine.

Thank you!

Ronald L.

January 21st, 2021

There is not enough room on the form to describe my property which was taken directly from the previous deed. Other than that worked as expected.

Thank you for your feedback. We really appreciate it. Have a great day!

Theresa J.

March 27th, 2023

The beginning of the process was very simple. In the middle now waiting for the invoice to move forward.

Thank you for your feedback. We really appreciate it. Have a great day!

Angelique A.

December 27th, 2018

Very helpful and quick customer service. Highly recommended

Thank you for your feedback Angelique, we appreciate you. Have a great day!

Jim A.

January 26th, 2022

Your website is user friendly and when I brought up issues they were quickly addressed. thank you so much! jim atkinson

Thank you!

Bennie W.

January 9th, 2021

I used the Quitclaim form. The form was easy to complete without using the example or guide. $21 was a fair price compared to paying a lawyer.

Thank you for your feedback. We really appreciate it. Have a great day!

Cecilia G.

July 24th, 2023

This site is so easy to use. It is so convenient to have access to forms for all states. I’d recommend this site to anyone who needs to create any real estate documents.

Thank you for your feedback. We really appreciate it. Have a great day!

SheRon F.

March 21st, 2022

It was a quick and easy process and deeds.com was very helpful and dealt with a very stressful situation, painless.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Josephine H.

April 26th, 2022

This was so helpful! I was able to get the right forms. Presto! Peace of mind.

Thank you for your feedback. We really appreciate it. Have a great day!

Paula M.

October 15th, 2021

So far it seems good. I am still trying to send information to this company so they can help me with the deed.

Thank you for your feedback. We really appreciate it. Have a great day!

Dora O.

August 27th, 2024

Best platform to buy forms. Simple and easy.

It was a pleasure serving you. Thank you for the positive feedback!

Lynnellen S.

May 9th, 2019

My rating is not a 5. Although it had good instructions, it would NOT print the whole document no matter how many times I inputted the names. I ended up writing it in to complete. I also recommend putting it on one page. I had to pay an additional fees per page and if I had to notarize it, why did I have to find 2 witnesses as well. I deserve a discount for the time I spent repeatedly putting the same data. I was trying to save money since Im on social security only. It didnt. Get it to work correctly

Thank you for your feedback Lynnellen. Sorry to hear of your struggle with our document. We've gone ahead and refunded your payment. Hope you have a wonderful day.