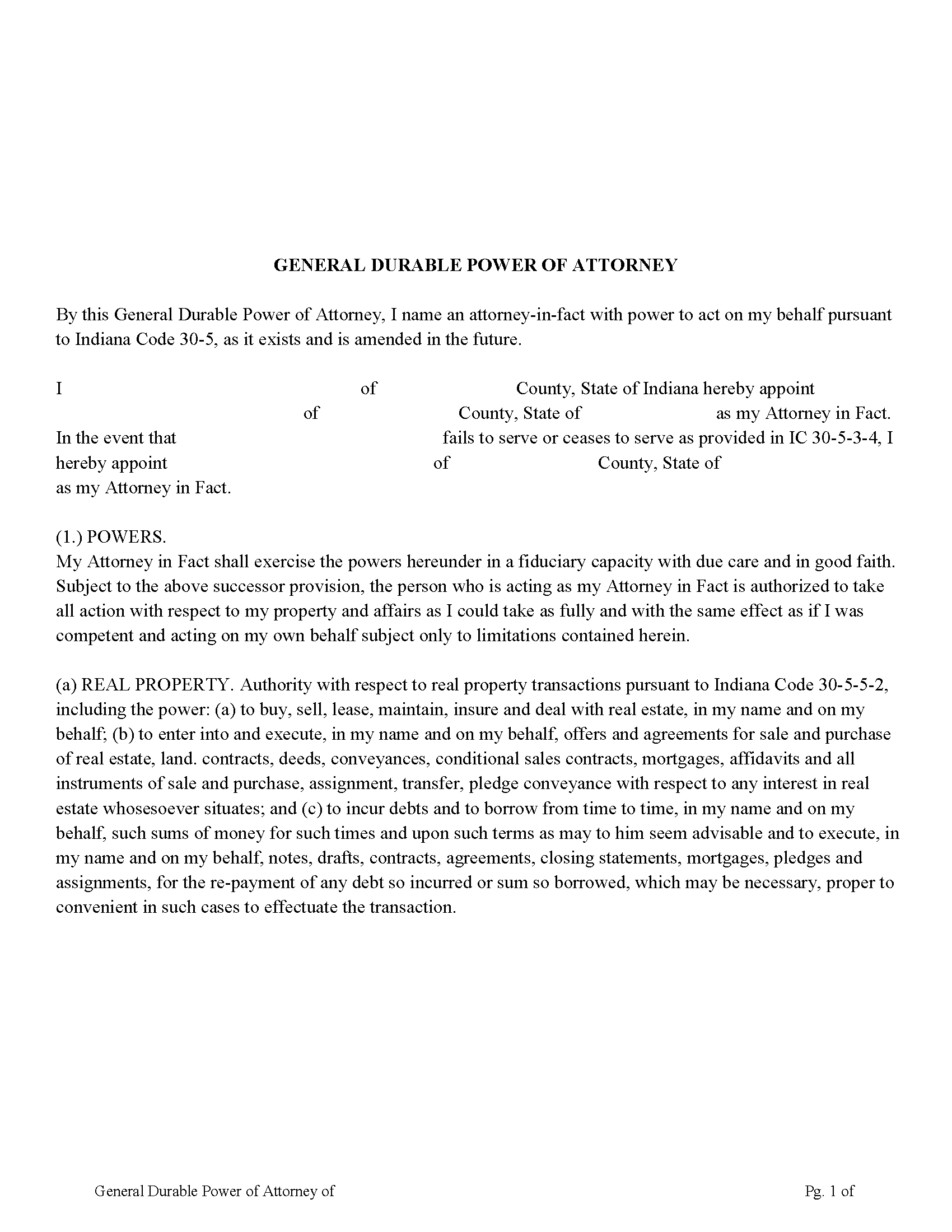

Tippecanoe County General Durable Power of Attorney Form

Tippecanoe County General Durable Power of Attorney Form

Fill in the blank form formatted to comply with all recording and content requirements.

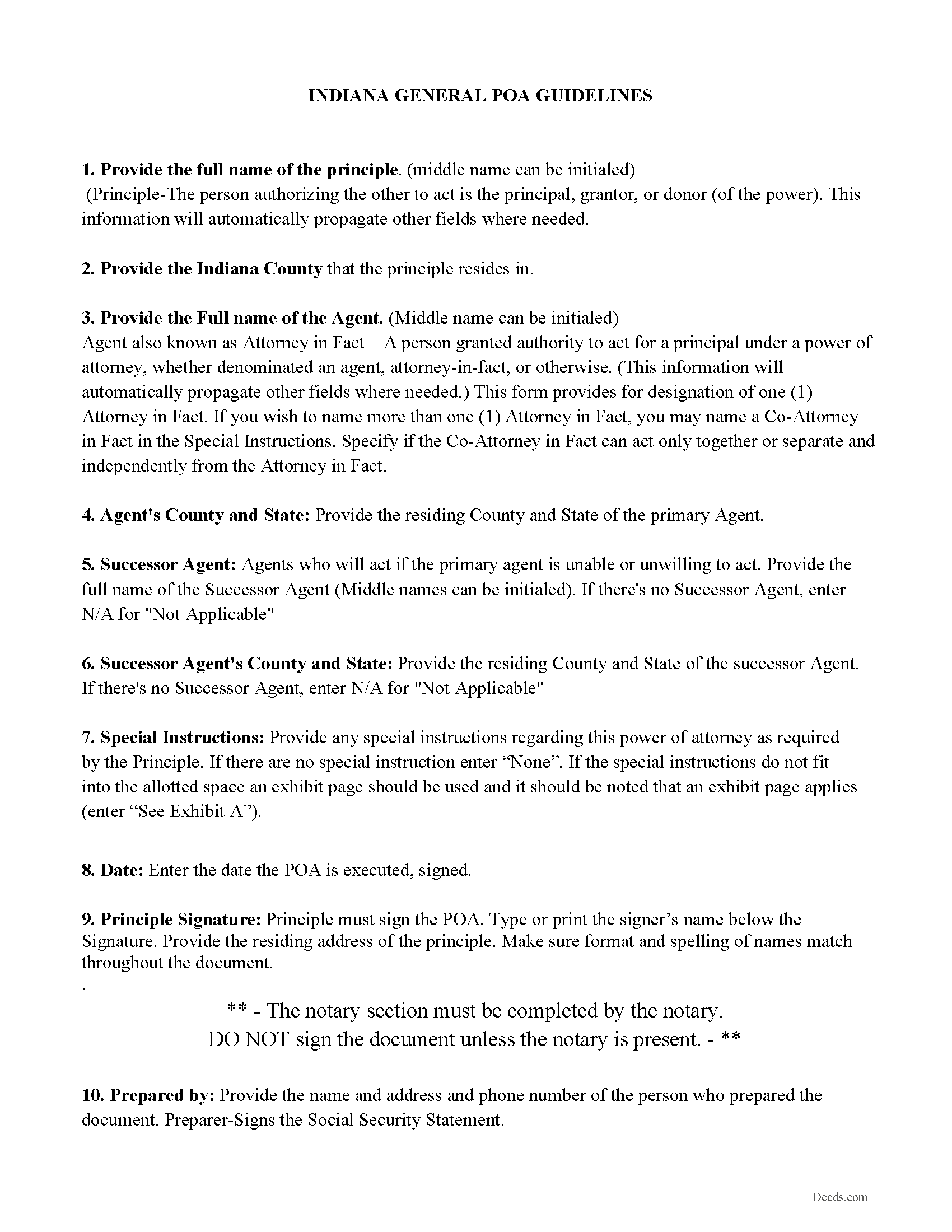

Tippecanoe County Power of Attorney Guidelines

Line by line guide explaining every blank on the form, includes Indiana POA Statutes

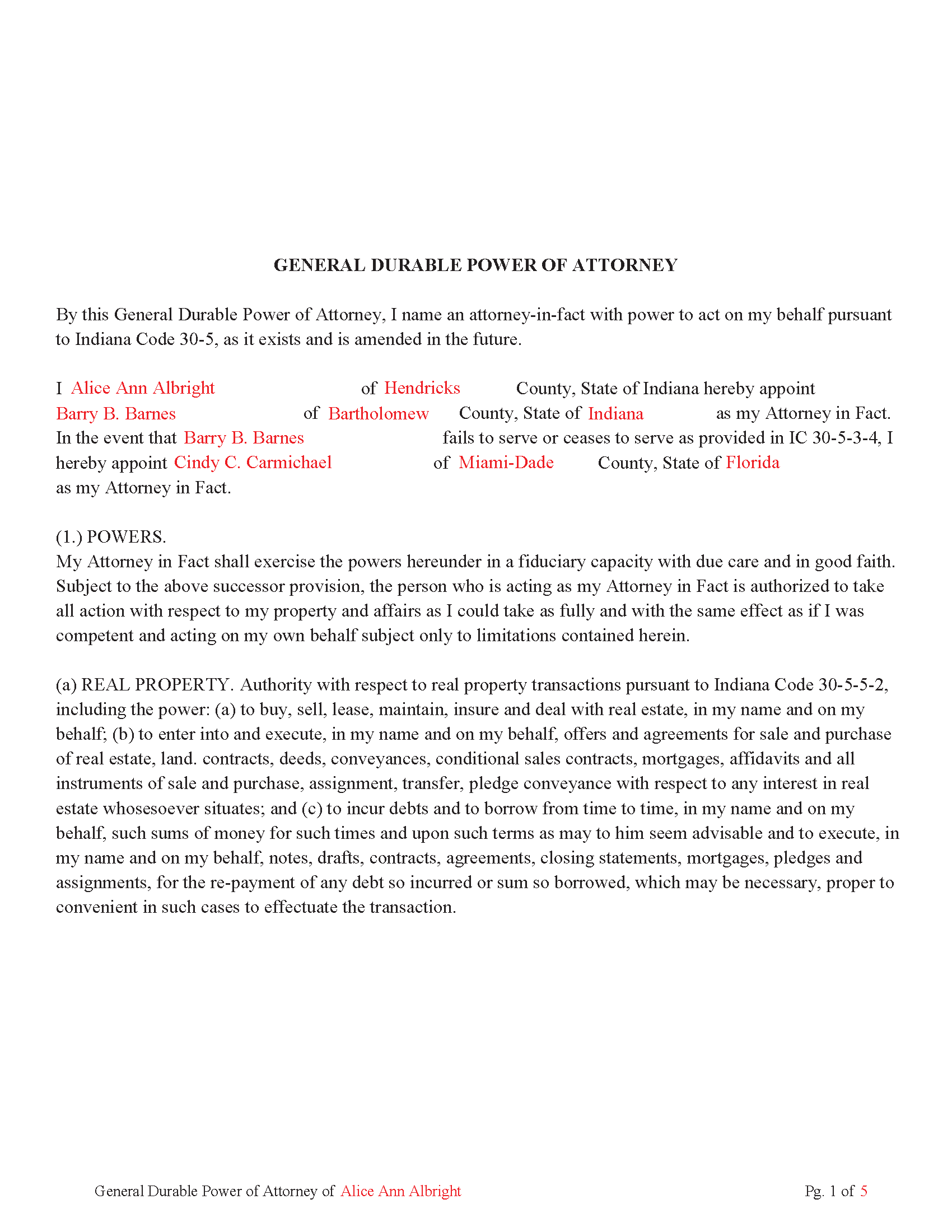

Tippecanoe County Completed Example of the Power of Attorney Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Indiana and Tippecanoe County documents included at no extra charge:

Where to Record Your Documents

Tippecanoe County Recorder

Lafayette, Indiana 47901

Hours: 8:00 to 4:30 Monday through Friday

Phone: (812) 423-9352

Recording Tips for Tippecanoe County:

- Bring your driver's license or state-issued photo ID

- Ask if they accept credit cards - many offices are cash/check only

- Recording fees may differ from what's posted online - verify current rates

- Multi-page documents may require additional fees per page

- Some documents require witnesses in addition to notarization

Cities and Jurisdictions in Tippecanoe County

Properties in any of these areas use Tippecanoe County forms:

- Battle Ground

- Buck Creek

- Clarks Hill

- Dayton

- Lafayette

- Montmorenci

- Romney

- Stockwell

- West Lafayette

- Westpoint

Hours, fees, requirements, and more for Tippecanoe County

How do I get my forms?

Forms are available for immediate download after payment. The Tippecanoe County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Tippecanoe County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Tippecanoe County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Tippecanoe County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Tippecanoe County?

Recording fees in Tippecanoe County vary. Contact the recorder's office at (812) 423-9352 for current fees.

Questions answered? Let's get started!

(5) Five Page General Durable Power of Attorney, following Indiana Code and subjects listed below.

By this General Durable Power of Attorney, you name an attorney-in-fact with power to act on your behalf pursuant to Indiana Code 30-5, as it exists and is amended in the future.

(a) REAL PROPERTY. Authority with respect to real property transactions pursuant to Indiana Code 30-5-5-2

(b) TANGIBLE PERSONAL PROPERTY. Authority with respect to tangible personal property transactions pursuant to Indiana Code 30-5-5-3

(c) BOND, SHARE AND COMMODITY. Authority with respect to bond, share. and commodity transactions pursuant to Indiana Code 30-5-5-4,

(d) BANKING. Authority with respect to banking transactions pursuant to Indiana Code 30-5-5-5, including but not limited to the authority:

(e) BUSINESS. Authority with respect to business operating transactions pursuant to Indiana Code 30-5-5-6, including the power:

(f) INSURANCE. Authority with respect to insurance transactions pursuant to

Indiana Code 30-5-5-7.

(g) BENEFICIARY. Authority with respect to beneficiary transactions pursuant to

Indiana Code 30-5-5-8.

(h) GIFTS. In the event I become permanently mentally incapacitated, to make gifts of my property and to have general authority with respect to gift transactions as provided in IC 30-5-5- 9

(i) FIDUCIARY. Authority with respect to fiduciary transactions pursuant to Indiana Code 30-5-5-10

(j) CLAIMS AND LITIGATION. Authority with respect to claims and litigation pursuant to

Indiana Code 30-5-5-11.

(k) FAMILY MAINTENANCE. Authority with respect to family maintenance pursuant to

Indiana Code 30-5-5-12.

(l) MILITARY SERVICE. Authority with respect to benefits from military service pursuant to

Indiana Code 30-5-5-13.

(m) RECORDS, REPORTS AND STATEMENTS. Authority with respect to records, reports and statements pursuant to Indiana Code 30-5-5-14, including, but not limited to, the power to execute on my behalf any

(n) ESTATE TRANSACTIONS. Authority with respect to estate transaction pursuant to

Indiana Code 30-5-5-15.

(o) DELEGATING AUTHORITY. Authority with respect in delegating authority in writing to one (1) or more persons as to any or all powers given to the attorney-in-fact by this General Durable Power of Attorney document, pursuant to Indiana Code 30-5-5-18.

(p) TAX MATTERS. Authority: (a) to prepare, execute and file on your behalf.

(q) SOCIAL SECURITY ADMINISTRATION. Authority to act as your representative and attorney-in-fact for all matters involving the Social Security Administration and benefits from the administration.

(r) ALL OTHER MATTERS. Authority with respect to all other possible matters and affairs affecting property owned by you pursuant to Indiana Code 30-5-5-19.

(Indiana General Durable POA Package includes form, guidelines, and completed example)

Important: Your property must be located in Tippecanoe County to use these forms. Documents should be recorded at the office below.

This General Durable Power of Attorney meets all recording requirements specific to Tippecanoe County.

Our Promise

The documents you receive here will meet, or exceed, the Tippecanoe County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Tippecanoe County General Durable Power of Attorney form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Maribeth M.

June 25th, 2021

Usually I have trouble registering things online, even though people tell me it's easy. This time, it WAS easy and fast, and I'm grateful I didn't have to drive somewhere and stand in line. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Janna V.

December 2nd, 2020

Very easy process!

Thank you!

Kim H.

October 17th, 2020

Great site. quick turnaround and communication. I needed an exception that they told me I needed and where to get the info within hours. I returned warranty deed with exception and the deed was recorded the same day! Great turnaround!

Thank you for your feedback. We really appreciate it. Have a great day!

ray r.

July 17th, 2020

excellent service

Thank you!

Larry A.

December 17th, 2021

Provided exactly the form I was looking for at a reasonable price. Easy to do as well.

Thank you!

Dennis O.

August 22nd, 2020

Everything I needed plus more. Great service!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Louise J.

September 6th, 2020

I found your service to be very helpful. The documents were correct and comprehensive as well as easy to access. The cost is so reasonable. I think it's a great service and was impressed with it.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rosa Leticia A.

March 1st, 2022

Outstanding service, quick and efficient. Provides promptly updates of the process, highly recommended.

Thank you!

Sam A.

September 26th, 2022

User friendly website and deeds are very easy to maneuver. I'm very happy with everything Deeds.com has to offer. It truly helped me with the business that I had to take care of.

Thank you!

Kevin M.

May 14th, 2019

All I can say is WOW. They were so fast and professional. I received my copy of my deed that same day I requested it. There was some confusion on my part but within minutes it was explained.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Connie H.

January 18th, 2019

I really appreciated the detailed instructions provided with the document. The instructions made it easy to fill it out correctly. Filed the document with the courthouse the next day and have received confirmation that it has been filed.

Thanks Connie! Have a great day!

Gretchen B.

June 22nd, 2021

I wanna give more stars because the required information is there, but the character spacing is disjointed on the first page, rendering a gap-filled, awkward-looking document. Also, the opening parenthesis for the first field on the first page is on the wrong line and is backwards, which sets the wrong tone especially since it's the first thing you have to fill out.

Thank you for your feedback. We really appreciate it. Have a great day!

Richard C.

February 10th, 2025

Fast, effective, and good communication. I have no complaints at all.

Thank you for your positive words! We’re thrilled to hear about your experience.

Tracey M.

August 9th, 2022

Using Deeds.com was unbelievably quick and easy to file a deed restriction with our local county office. From uploading the initial file to deeds.com, to having a fully recorded document was right on one hour - and all from the comfort of my home. I found your service was easy to use and your staff were very quick in responding to my filing. I will definitely use and recommend deeds.com in the future.

Thank you for your feedback. We really appreciate it. Have a great day!

Shannon D.

November 4th, 2020

Extremely easy site to use. We had our document e-recorded the same day and we didn't have to make a trip downtow!

Thank you!