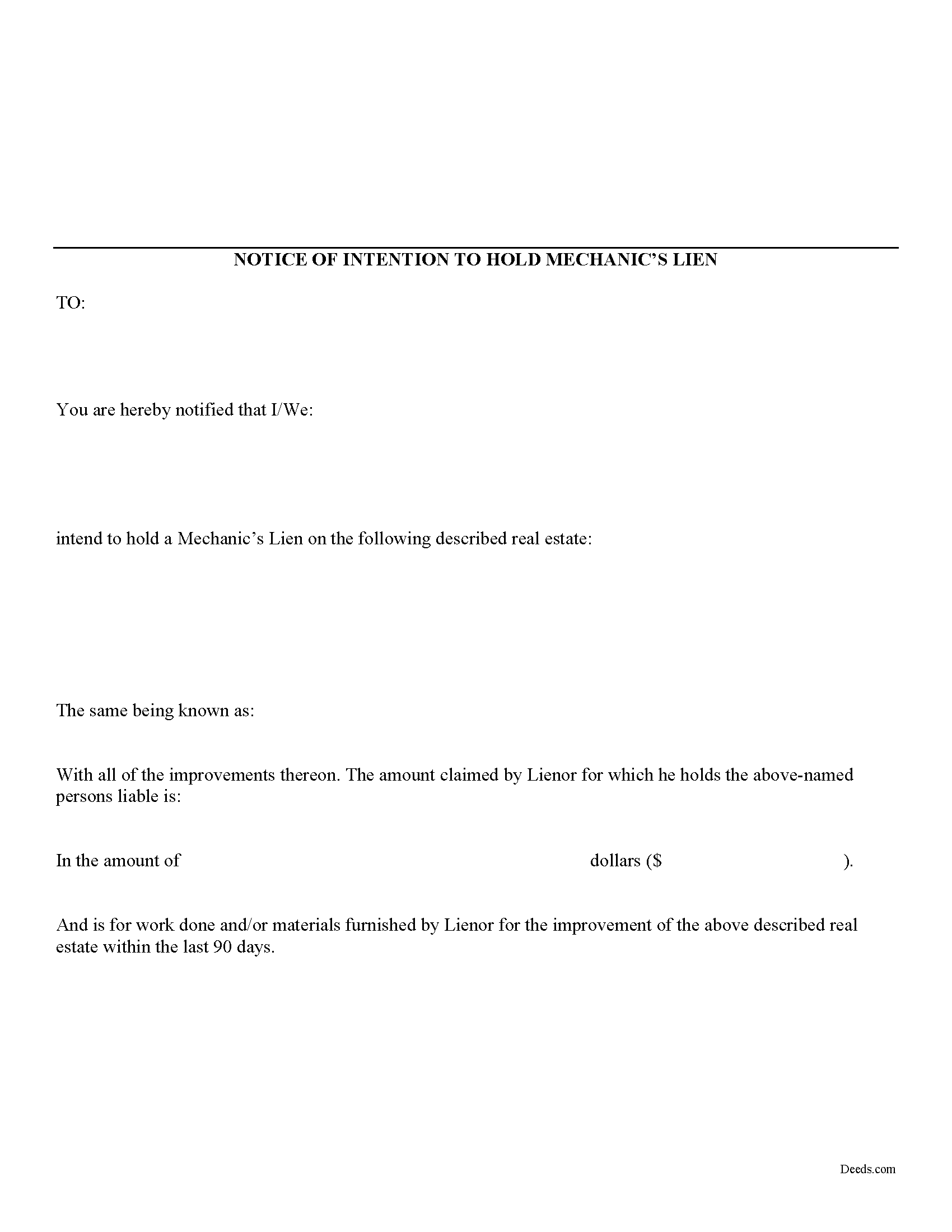

Crawford County Notice of Intention to Hold Lien Form

Crawford County Notice of Intention to Hold Lien Form

Fill in the blank Notice of Intention to Hold Lien form formatted to comply with all Indiana recording and content requirements.

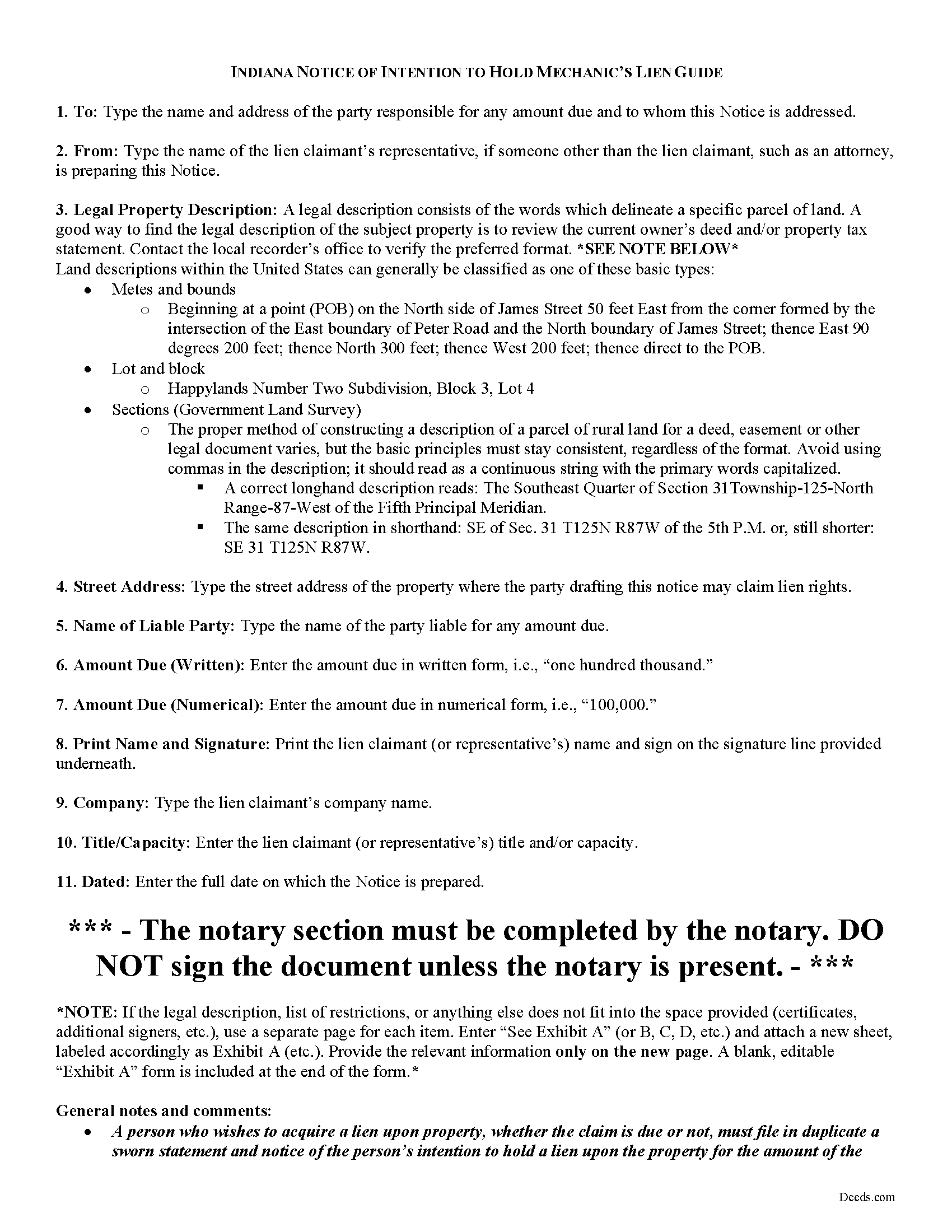

Crawford County Notice of Intention to Hold Lien Guide

Line by line guide explaining every blank on the form.

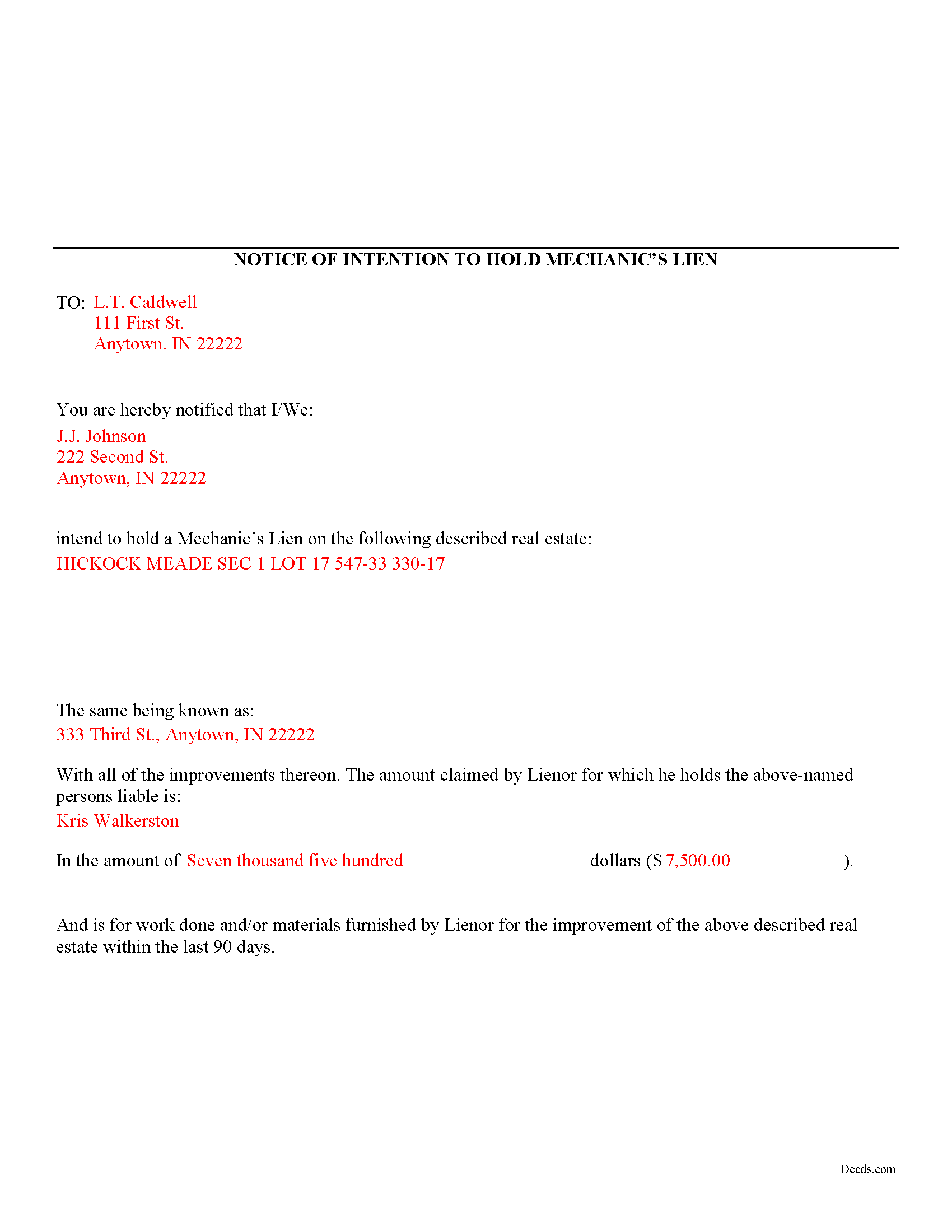

Crawford County Completed Example of Notice of Intention to Hole Lien Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Indiana and Crawford County documents included at no extra charge:

Where to Record Your Documents

Crawford County Recorder

English, Indiana 47118

Hours: Call for hours

Phone: (812) 338-2615

Recording Tips for Crawford County:

- Ask if they accept credit cards - many offices are cash/check only

- Make copies of your documents before recording - keep originals safe

- Bring extra funds - fees can vary by document type and page count

- Bring multiple forms of payment in case one isn't accepted

Cities and Jurisdictions in Crawford County

Properties in any of these areas use Crawford County forms:

- Eckerty

- English

- Grantsburg

- Leavenworth

- Marengo

- Milltown

- Sulphur

- Taswell

Hours, fees, requirements, and more for Crawford County

How do I get my forms?

Forms are available for immediate download after payment. The Crawford County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Crawford County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Crawford County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Crawford County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Crawford County?

Recording fees in Crawford County vary. Contact the recorder's office at (812) 338-2615 for current fees.

Questions answered? Let's get started!

A Notice of Intention to Hold a Mechanic's Lien is a required pre-lien notice used to make property owners aware that there may be lien rights exercised on their property.

Any person who wishes to acquire a lien upon public property or property held by three or more tenants, whether the claim is due or not, must file in duplicate a sworn statement and notice of the person's intention to hold a lien upon the property for the amount of the claim: (1) in the recorder's office of the county; and (2) not later than ninety (90) days after performing labor or furnishing materials or machinery. IC 32-28-3-3(a).

Any person who wishes to acquire a lien upon property held as a dwelling unit, whether the claim is due or not, must file in duplicate a sworn statement and notice of the person's intention to hold a lien upon the property for the amount of the claim: (1) in the recorder's office of the county; and (2) not later than sixty (60) days after performing labor or furnishing materials or machinery. IC 32-28-3-3(b).

The statement and notice of intention to hold a lien may be verified and filed on behalf of a client by an attorney registered with the clerk of the supreme court as an attorney in good standing under the requirements of the supreme court. Id.

A statement and notice of intention to hold a lien filed under this section must specifically set forth: (1) the amount claimed; (2) the name and address of the claimant; (3) the owner's: (A) name; and (B) latest address as shown on the property tax records of the county; and (4) the: (A) legal description; and (B) street and number, if any; of the lot or land on which the house, mill, manufactory or other buildings, bridge, reservoir, system of waterworks, or other structure may stand or be connected with or to which it may be removed. IC 32-28-3-3(c).

This article is provided for informational purposes only and should not be relied upon as a substitute for advice from an attorney. Please consult with an Indiana attorney for any questions regarding mechanic's liens.

Important: Your property must be located in Crawford County to use these forms. Documents should be recorded at the office below.

This Notice of Intention to Hold Lien meets all recording requirements specific to Crawford County.

Our Promise

The documents you receive here will meet, or exceed, the Crawford County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Crawford County Notice of Intention to Hold Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4577 Reviews )

Justine John S.

February 17th, 2022

Splendid! I will definitely and absolutely recommend you guys and this company to my co-investors !

Thank you!

Gisela A.

April 11th, 2019

Great selection of documents. Properly formatted form also included great instructions and the example was very helpful. Filed it myself - no problem!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

SHEDDRICK H.

June 17th, 2023

I got exactly what I paid for. No fraudulent transaction on my card. I like that. This is an excellent service. Straight and to the point help. That e-recording process looks like a winner. When I get my forms filled out I might use that.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joyce S.

September 30th, 2020

So happy, great forms made everything a breeze.

Thank you for your feedback. We really appreciate it. Have a great day!

Nancy A.

April 24th, 2024

This is an excellent resource. I was surprised because the price is so low I thought the products might be inferior. Not only were were the requested documents high quality, additional unrequested documents were added to my order that I didn't realize I would need until I read them. I especially appreciate that all the documents were specific to my county. I highly recommend using deeds.com.

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

James J.

February 26th, 2019

The form itself was very good and easy to use. The only problem I had was the Sample they provided. Using a different name in every spot doesnt help determine what goes where. Using "Theodore Rockafeller" as Lien Claimant in one spot and Jebediah Finklestein in another then Harvey Johnson in the last spot is confusing if you really need a helpful sample.

Thank you for your feedback James. We will have staff review the completed example to see if we can make it more helpful. Have a great day!

Roy C.

January 25th, 2021

Great Product no problems filing

Thank you for your feedback. We really appreciate it. Have a great day!

Steven W.

April 11th, 2021

Seems to be just what I needed and easy to use.

Thank you!

RAMONA F.

July 29th, 2020

Good communication but they were unable to help me

Thank you for your feedback. We really appreciate it. Have a great day!

John K.

December 28th, 2020

The sample completed form was a big help. While not exactly on point with my situation, it was enough to help me complete it on my own

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

MARY LACEY M.

June 25th, 2020

Excellent service! From setting up an account to successfully recording, the instructions were clear and easy to follow. I am very pleased to have this service available, and favorably impressed by our current Maricopa County Recorder for pursuing its availability. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Susan L.

January 4th, 2022

Instructions easy to follow, example form was a big help.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Deborah P.

June 7th, 2021

Very good information. Easy access and easy to download. All the forms needed for TOD to be notarized and recorded with the county office. Much better than working with a Trust and the expense of lawyers, especially when several parties are involved and the owner of said property knows exactly to whom the property should go. Having forms and instructions available for the public to have their wishes recorded and confirmed makes handling final planning much easier and prevents family members from having the unnecessary task of going through court to solve property distribution issues. Thank you for this site and the forms you provide. I will recommend Deeds.com to those I know who are making final plans.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert A.

June 9th, 2021

First timer with Deeds.com - excellent experience. I am a lawyer and do not record often. Did not have to pay membership- fast and easy upload of documents- fast response - fast recording time from county recorder- very legible documents- very reasonable price. I give 6 stars out of 5!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lana B.

February 5th, 2021

Website is easy to use. I ordered the form, filled it out and uploaded it for recording. My only critique is that you can't preview the form before ordering and paying for it. I ordered a Deed of Full Reconveyance form only to find out I needed the Substitution of Trustee and Deedn of Reconveyance form instead. So I wasted $22 on the wrong form.

Thank you for your feedback. Order and payment for the incorrect order has been canceled. Have a wonderful day.