Hendricks County Notice of Intention to Hold Lien Form

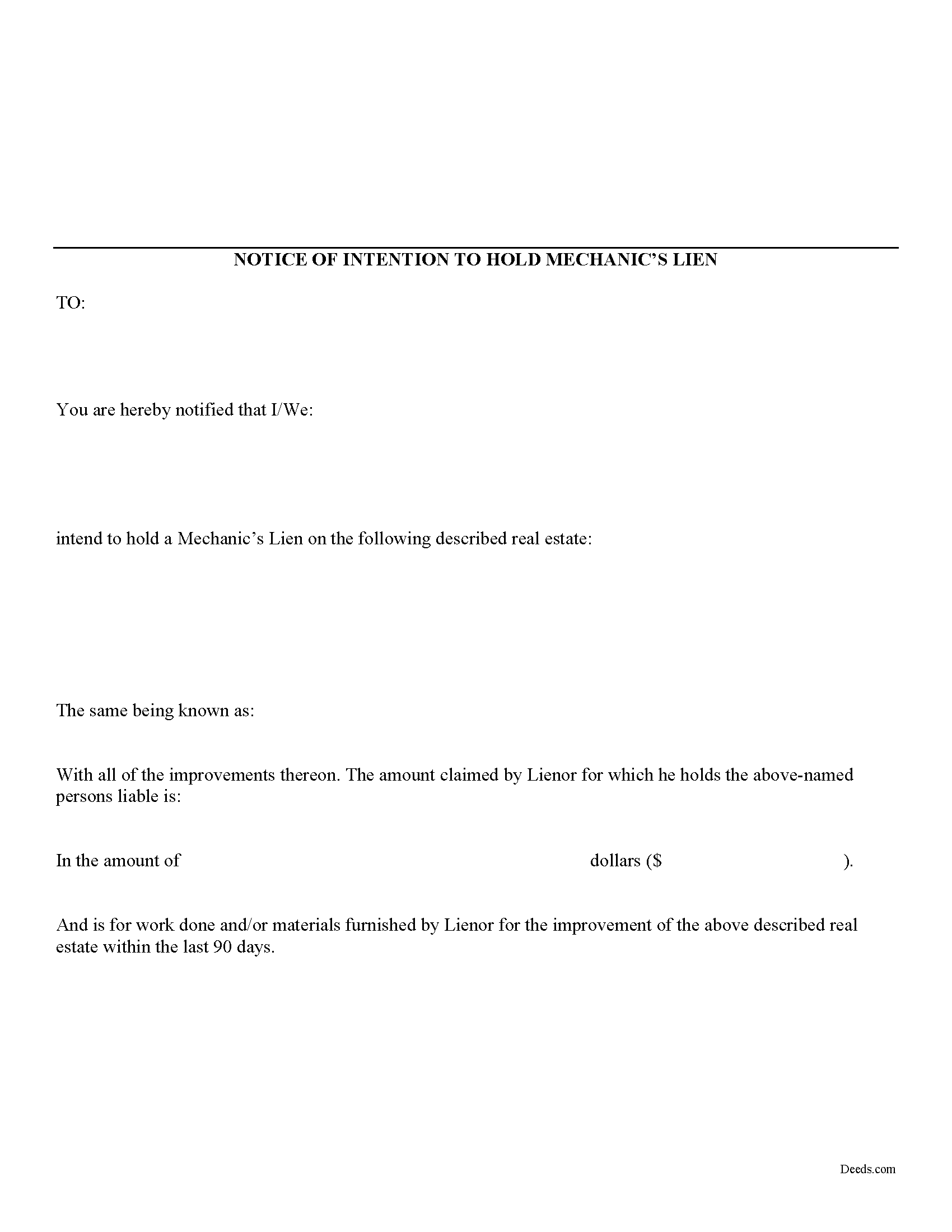

Hendricks County Notice of Intention to Hold Lien Form

Fill in the blank Notice of Intention to Hold Lien form formatted to comply with all Indiana recording and content requirements.

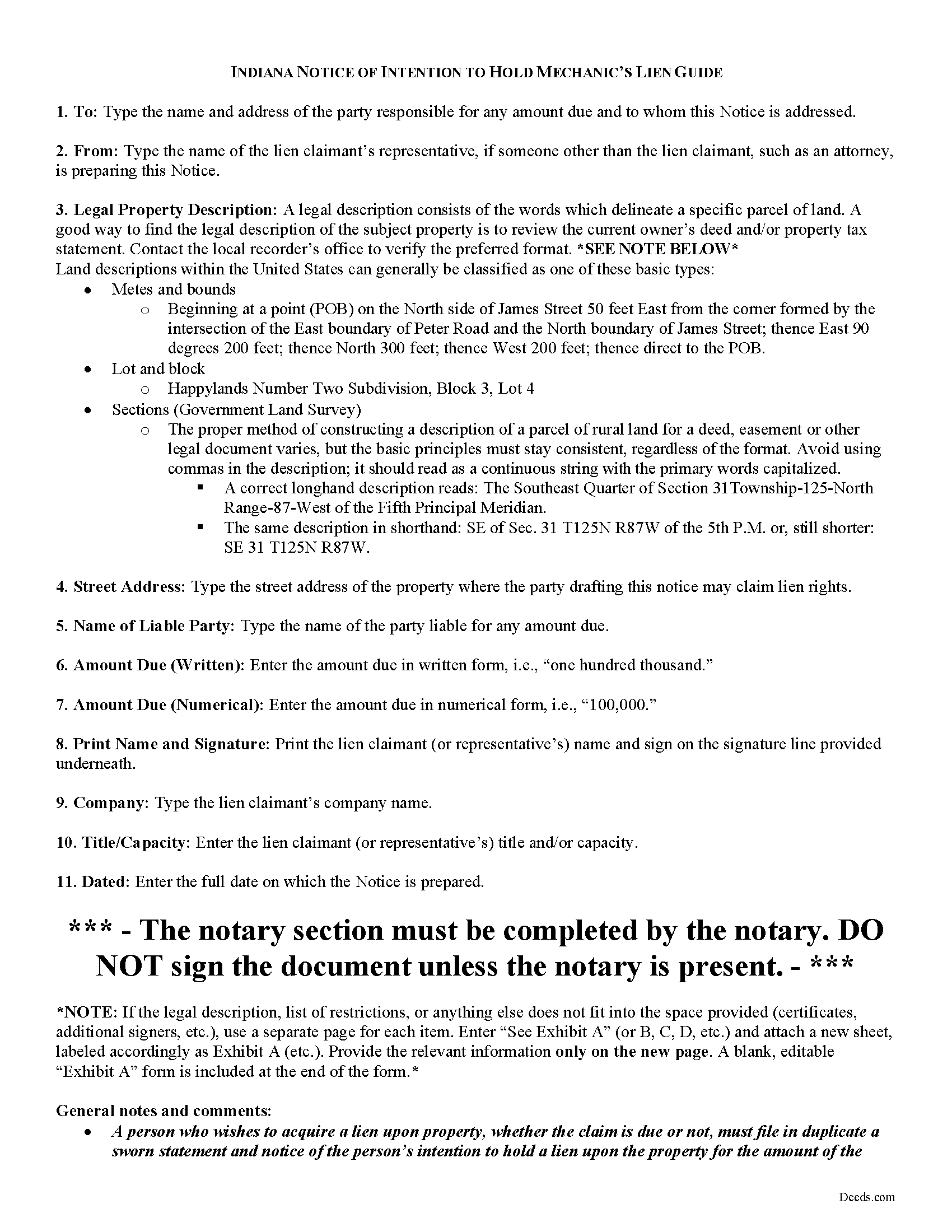

Hendricks County Notice of Intention to Hold Lien Guide

Line by line guide explaining every blank on the form.

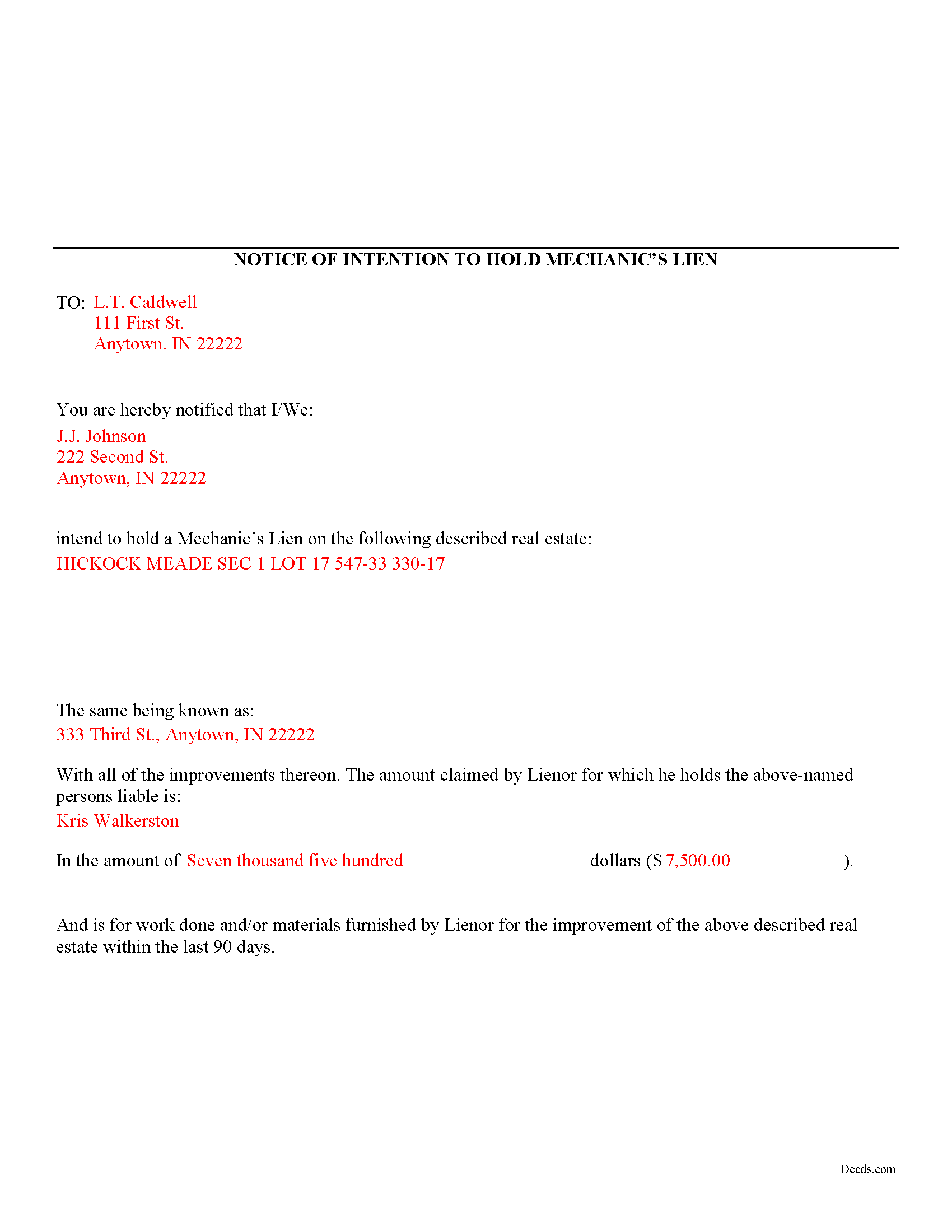

Hendricks County Completed Example of Notice of Intention to Hole Lien Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Indiana and Hendricks County documents included at no extra charge:

Where to Record Your Documents

Hendricks County Recorder

Danville, Indiana 46122

Hours: Monday - Friday 8:00a.m. - 4:00p.m.

Phone: (317) 745-9224

Recording Tips for Hendricks County:

- Ensure all signatures are in blue or black ink

- Bring your driver's license or state-issued photo ID

- White-out or correction fluid may cause rejection

- Make copies of your documents before recording - keep originals safe

Cities and Jurisdictions in Hendricks County

Properties in any of these areas use Hendricks County forms:

- Amo

- Avon

- Brownsburg

- Clayton

- Danville

- Lizton

- North Salem

- Pittsboro

- Plainfield

- Stilesville

Hours, fees, requirements, and more for Hendricks County

How do I get my forms?

Forms are available for immediate download after payment. The Hendricks County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Hendricks County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hendricks County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Hendricks County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Hendricks County?

Recording fees in Hendricks County vary. Contact the recorder's office at (317) 745-9224 for current fees.

Questions answered? Let's get started!

A Notice of Intention to Hold a Mechanic's Lien is a required pre-lien notice used to make property owners aware that there may be lien rights exercised on their property.

Any person who wishes to acquire a lien upon public property or property held by three or more tenants, whether the claim is due or not, must file in duplicate a sworn statement and notice of the person's intention to hold a lien upon the property for the amount of the claim: (1) in the recorder's office of the county; and (2) not later than ninety (90) days after performing labor or furnishing materials or machinery. IC 32-28-3-3(a).

Any person who wishes to acquire a lien upon property held as a dwelling unit, whether the claim is due or not, must file in duplicate a sworn statement and notice of the person's intention to hold a lien upon the property for the amount of the claim: (1) in the recorder's office of the county; and (2) not later than sixty (60) days after performing labor or furnishing materials or machinery. IC 32-28-3-3(b).

The statement and notice of intention to hold a lien may be verified and filed on behalf of a client by an attorney registered with the clerk of the supreme court as an attorney in good standing under the requirements of the supreme court. Id.

A statement and notice of intention to hold a lien filed under this section must specifically set forth: (1) the amount claimed; (2) the name and address of the claimant; (3) the owner's: (A) name; and (B) latest address as shown on the property tax records of the county; and (4) the: (A) legal description; and (B) street and number, if any; of the lot or land on which the house, mill, manufactory or other buildings, bridge, reservoir, system of waterworks, or other structure may stand or be connected with or to which it may be removed. IC 32-28-3-3(c).

This article is provided for informational purposes only and should not be relied upon as a substitute for advice from an attorney. Please consult with an Indiana attorney for any questions regarding mechanic's liens.

Important: Your property must be located in Hendricks County to use these forms. Documents should be recorded at the office below.

This Notice of Intention to Hold Lien meets all recording requirements specific to Hendricks County.

Our Promise

The documents you receive here will meet, or exceed, the Hendricks County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hendricks County Notice of Intention to Hold Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

james h.

June 15th, 2020

Service was quick and easy to use. I got not only the necessary forms, but instructions and sample forms filled out. Highly recommended.

Thank you!

Steven T.

August 1st, 2022

I needed the deed forms for setting up our living trust. It appears this will do the trick! Steve

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sheneda A.

November 23rd, 2022

Great!

Thank you!

Micael J.

August 28th, 2021

Easy to follow and fill out forms online.

Thank you for your feedback. We really appreciate it. Have a great day!

Diana H.

February 10th, 2019

little expensive same document in other county is free. however quite fast in responding. and just what i needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joni S.

February 6th, 2024

Excellent service, no hassle, easy to use, affordable, best service -- hands down. I thought it would be difficult for me to record a deed in Florida while residing in California but you made it so easy. I will tell everyone about your service. Thank you.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Angelique A.

December 27th, 2018

Very helpful and quick customer service. Highly recommended

Thank you for your feedback Angelique, we appreciate you. Have a great day!

Charles C.

December 2nd, 2020

This was my first experience with e-recording. Deeds.com was AWESOME! Within one hour, I signed up with Deeds.com, recorded a deed in a neighboring county and had access to a copy of the recorded deed. I also appreciate the fact that there are no monthly or annual fees. Thanks Deeds.com!

Thank you for your feedback. We really appreciate it. Have a great day!

Jo Ann P.

August 19th, 2025

Was hoping I would be sent copies on paper so I can fill them out without a desk computer

We appreciate your feedback. Our forms are delivered instantly as digital files, so customers can download and print as many copies as they need. This way, you have the flexibility to complete them by hand if you prefer.

Magdy G.

July 13th, 2020

Very fast and efficient service. Everything was done online. Did not need any help.

Thank you!

Shelly S.

January 20th, 2021

Was able to sell a property with the information obtained from your website without using an attorney! Extremely happy.

Thank you!

GARY S.

April 16th, 2021

I thought your forms are great. Easy to use with instructions provided.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Judith A.

January 14th, 2022

Excellent

Thank you!

Mark R.

January 10th, 2019

Easy and simple to understand, had no trouble with the transaction or the forms. Recorded on the first try, not something that happens very often.

Great to hear that Mark. have an awesome day!

Luis C.

May 10th, 2019

Excellent forms but the instructions are not to clear.

Thank you for your feedback. We really appreciate it. Have a great day!