Randolph County Quitclaim Deed Form (Indiana)

All Randolph County specific forms and documents listed below are included in your immediate download package:

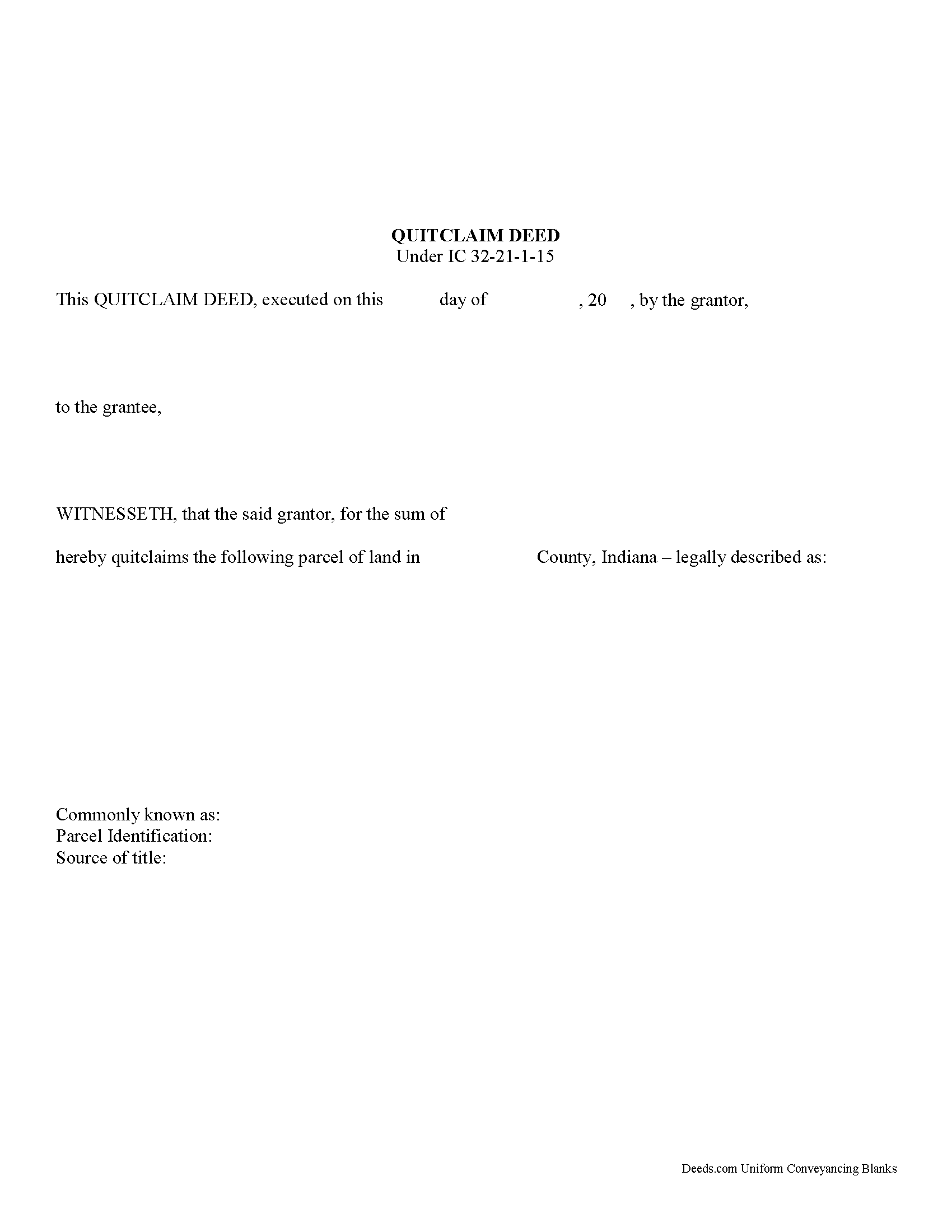

Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all Indiana recording and content requirements.

Included Randolph County compliant document last validated/updated 5/8/2025

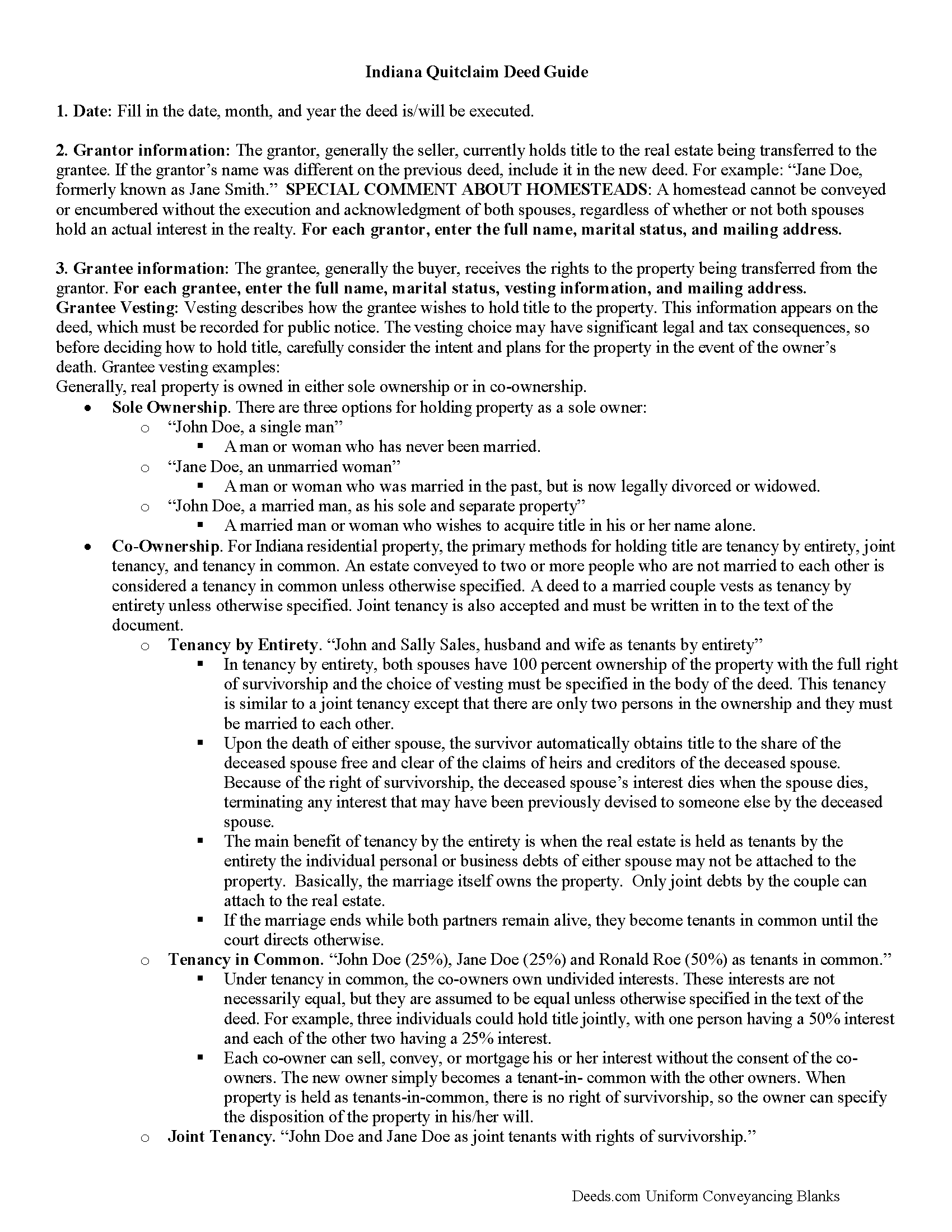

Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

Included Randolph County compliant document last validated/updated 11/22/2024

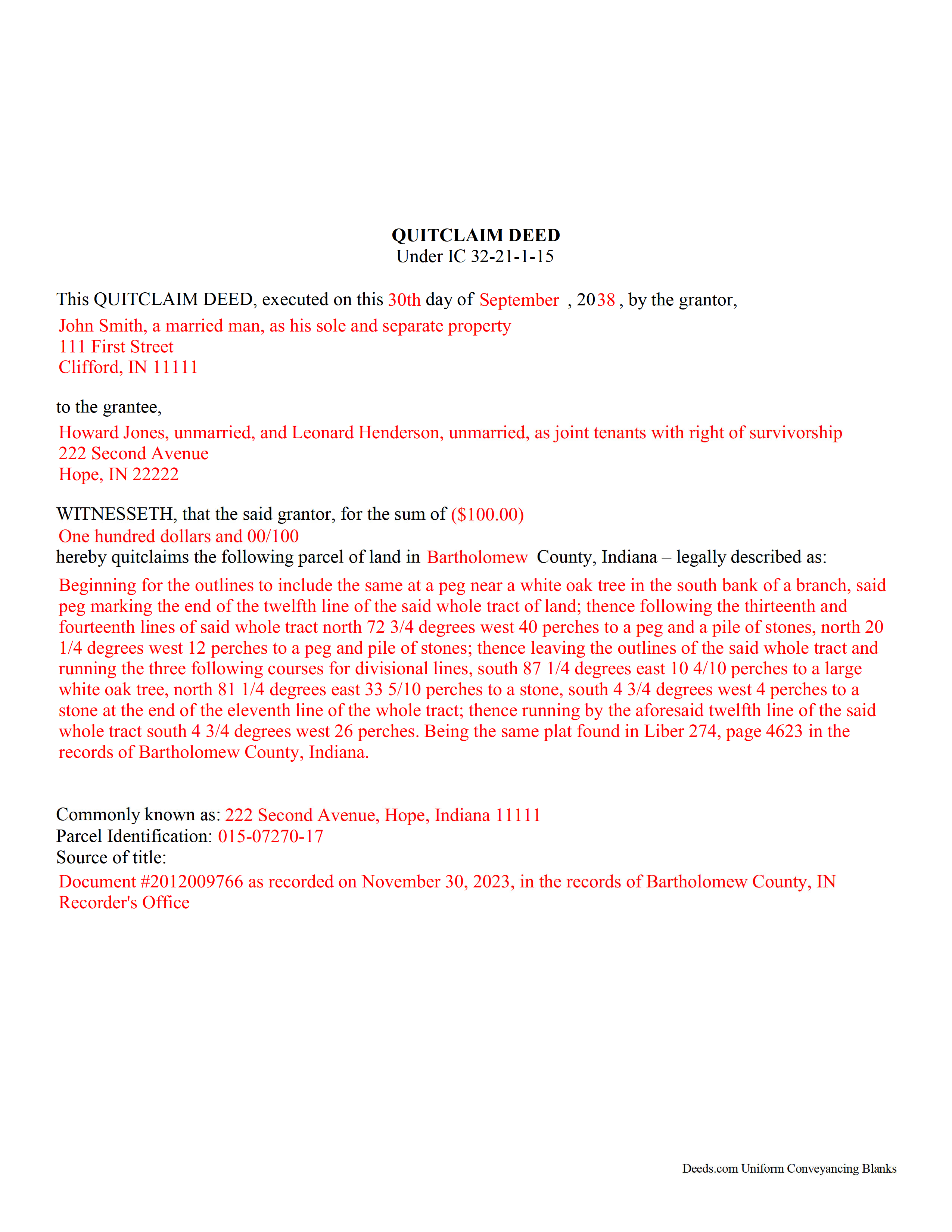

Completed Example of the Quitclaim Deed Document

Example of a properly completed Indiana Quitclaim Deed document for reference.

Included Randolph County compliant document last validated/updated 7/10/2025

The following Indiana and Randolph County supplemental forms are included as a courtesy with your order:

When using these Quitclaim Deed forms, the subject real estate must be physically located in Randolph County. The executed documents should then be recorded in the following office:

Randolph County Recorder

Courthouse - 100 S Main St, Rm 101, Winchester, Indiana 47394

Hours: 8:00 to 4:00 Monday through Friday

Phone: (765) 584-7300

Local jurisdictions located in Randolph County include:

- Farmland

- Losantville

- Lynn

- Modoc

- Parker City

- Ridgeville

- Saratoga

- Union City

- Winchester

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Randolph County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Randolph County using our eRecording service.

Are these forms guaranteed to be recordable in Randolph County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Randolph County including margin requirements, content requirements, font and font size requirements.

Can the Quitclaim Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Randolph County that you need to transfer you would only need to order our forms once for all of your properties in Randolph County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Indiana or Randolph County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Randolph County Quitclaim Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

An Indiana quitclaim deed transfers any interest the grantor may have in a property without guaranteeing clear title. To ensure lawful execution and recording, the deed must meet specific state requirements.

Legal Framework

Under IC 32-17-2-2, a quitclaim deed transfers the grantor's interest in the property. The execution requirements are outlined in:

- IC 32-21-1

- IC 32-21-2-3

- IC 32-21-13

- IC 36-2-11-15

Written Document: The deed must be in writing and signed by the grantor or an authorized agent.

Names and Addresses: Include the names and addresses of all grantors and grantees. Ensure consistency in names throughout the document to avoid rejection by the recorder's office.

Consideration: State the type and amount of consideration (usually money).

Legal Description: Provide a complete legal description of the property.

Signatures: All signatures must be original and notarized, with the signer's name typed or printed below the signature.

Return Address: Include a return address (typically the grantee) for receiving the recorded deed and future tax bills.

Preparer Information: Include the preparer's name and social security number statement.

Formatting Standards

According to IC 36-2-11-14 and IC 36-2-11-16.5, the deed must:

Be endorsed by the county auditor before recordation.

Be printed on white paper (20 lb. minimum weight), no larger than legal size (8" x 14").

Be typed or computer-generated in permanent black ink, minimum 10-point font.

Have margins of at least ½ inch on all sides, except the first and last pages, which require 2-inch top and bottom margins.

Recording Process

Under IC 32-21-4-1, Indiana follows a "race-notice" recording statute. To record a quitclaim deed:

County Recording: The deed must be recorded in the county where the property is located.

Public Record Entry: Upon acceptance, the county recorder stamps the deed with the date and time of filing and enters it into the public record.

Constructive Notice: This public record serves as constructive notice to interested parties and preserves the chain of title.

Priority Ranking: The stamped date and time establish the deed's priority against other claims on the property. Recording promptly is crucial to secure the grantee's interest.

Importance of Timely Recording

Recording the quitclaim deed immediately after execution protects the grantee's interests. In a "race-notice" jurisdiction, the first party to record the deed has priority. For example, if the grantor sells the same property to two different parties, the party who records their deed first generally retains ownership. Therefore, prompt recording is essential to avoid disputes and ensure clear title.

Conclusion

To comply with Indiana law, follow these detailed requirements when preparing and recording a quitclaim deed. Proper execution and timely recording ensure a smooth transfer of property interests and protect all parties involved in the transaction.

Our Promise

The documents you receive here will meet, or exceed, the Randolph County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Randolph County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4563 Reviews )

JAMES D.

July 10th, 2025

Slick as can be and so convenient.rnrnWorked like a charm

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael G M.

October 26th, 2022

The download files should have the name of the form included. The present numeric soup is frustrating to navigate.

Thank you for your feedback. We really appreciate it. Have a great day!

Cynthia (Cindy) R.

August 24th, 2020

This has been the most seamless process I have ever experienced. Thank you for addressing my needs so quickly and professionally.

Thank you!

Robert D.

December 25th, 2020

I was trying to register a financial statement (non real estate document). There was no link or statement on the home page to indicate that this could be done. All I had to do was to create an account, name and then upload the document. It took me over a day and several phone calls to the local deed recording office to try to figure this out. A simple link or statement to this effect would have saved me a lot of time

Thank you for your feedback. We really appreciate it. Have a great day!

Diane C.

April 28th, 2021

This was just the info I needed

Thank you!

Andrew F.

May 25th, 2020

Must admit, I have not really had the chance to search site. Seems to be able to provide good info.

Thank you!

Quinn R.

April 3rd, 2023

DEEDS.COM IS THE BEST WAY TO E-RECORD DEEDS. THEY ARE FAST, POLITE AND A FANTASTIC DEAL FOR THE SERVICE THAT THEY OFFER!!!

Thank you!

Tullea S.

October 15th, 2024

Although I didn't get what I needed, the customer service is outstanding. I got a text asking if I needed any help. He canceled my subscription right away and was very helpful. He responded quickly each time.

We are delighted to have been of service. Thank you for the positive review!

Sylvia H.

December 22nd, 2023

Deeds.com really made the process of completing and submitting the Lien application easy. Thank you, and I will be using you whenever I need a real estate document that you carry.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Thomas M.

September 21st, 2020

EXCELLENT resource for ALL state documents! The forms come with explanations and examples. A real Deal!!!

Thank you!

LANDON C.

March 5th, 2021

Process was simple, with a reasonable fee and within the suggested timetable for recordation. I highly recommend Deeds.com

Thank you!

David M.

May 21st, 2020

Extremely easy to use. The sample completed document was very helpful. I really appreciated not having to spend a few hundred dollars for a lawyer to generate a document that I can produce myself for a small fraction of the cost.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert P.

October 22nd, 2020

Excellent product. Wish I had found this site a week earlier. It would have saved me many hours of struggle and $40.00 in notary fees. Thanks and I will recommend to anyone needing forms.

Thank you for your feedback. We really appreciate it. Have a great day!