Perry County Special Warranty Deed Form

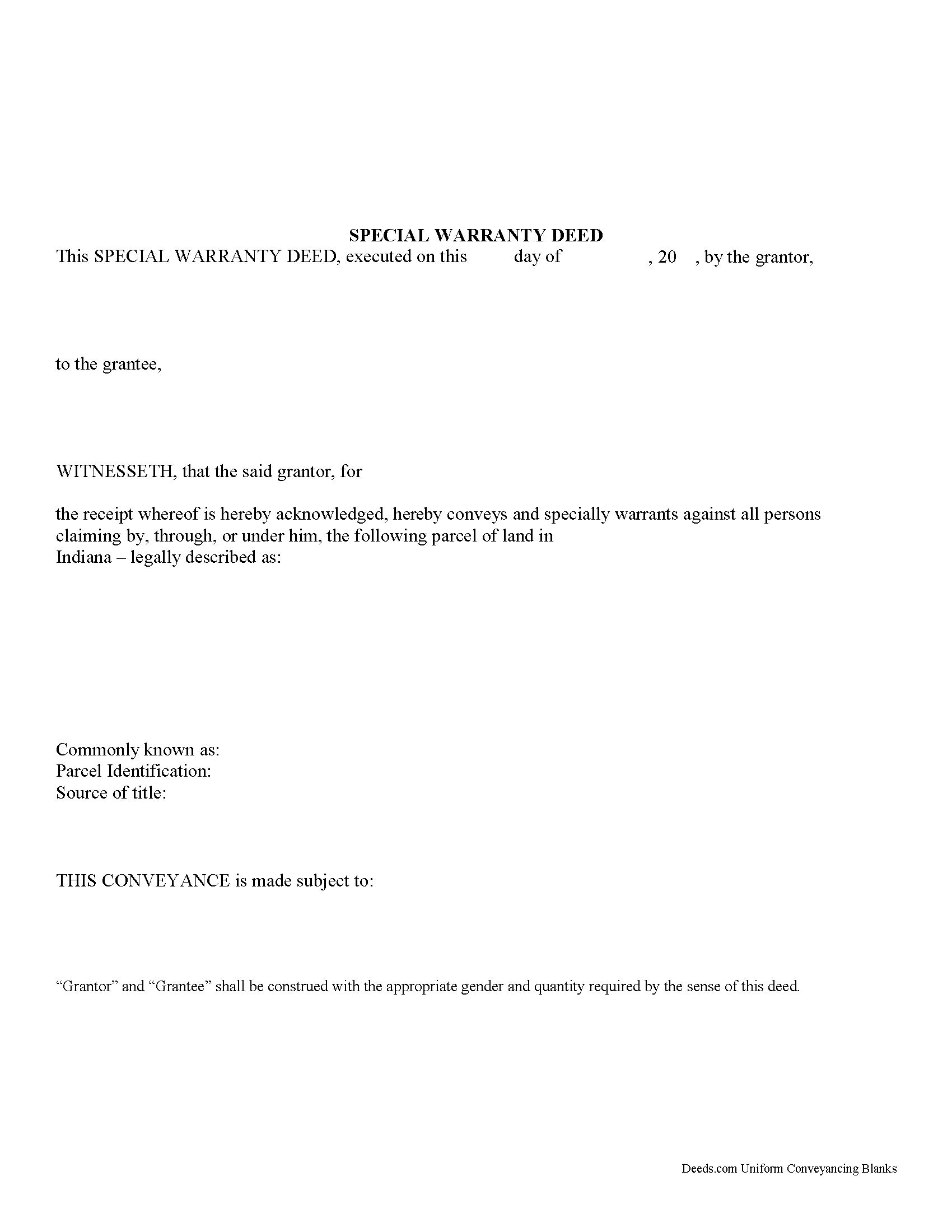

Perry County Special Warranty Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

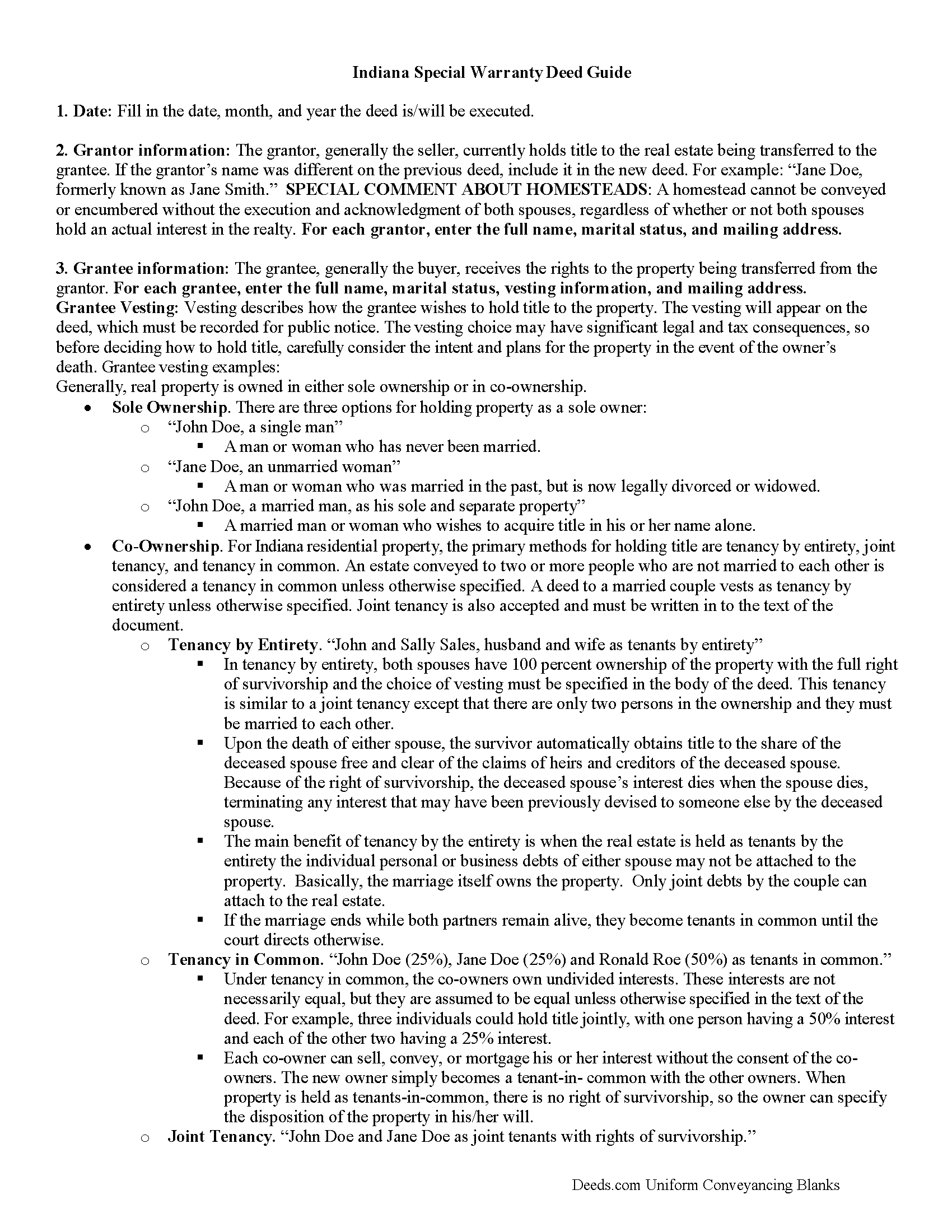

Perry County Special Warranty Deed Guide

Line by line guide explaining every blank on the form.

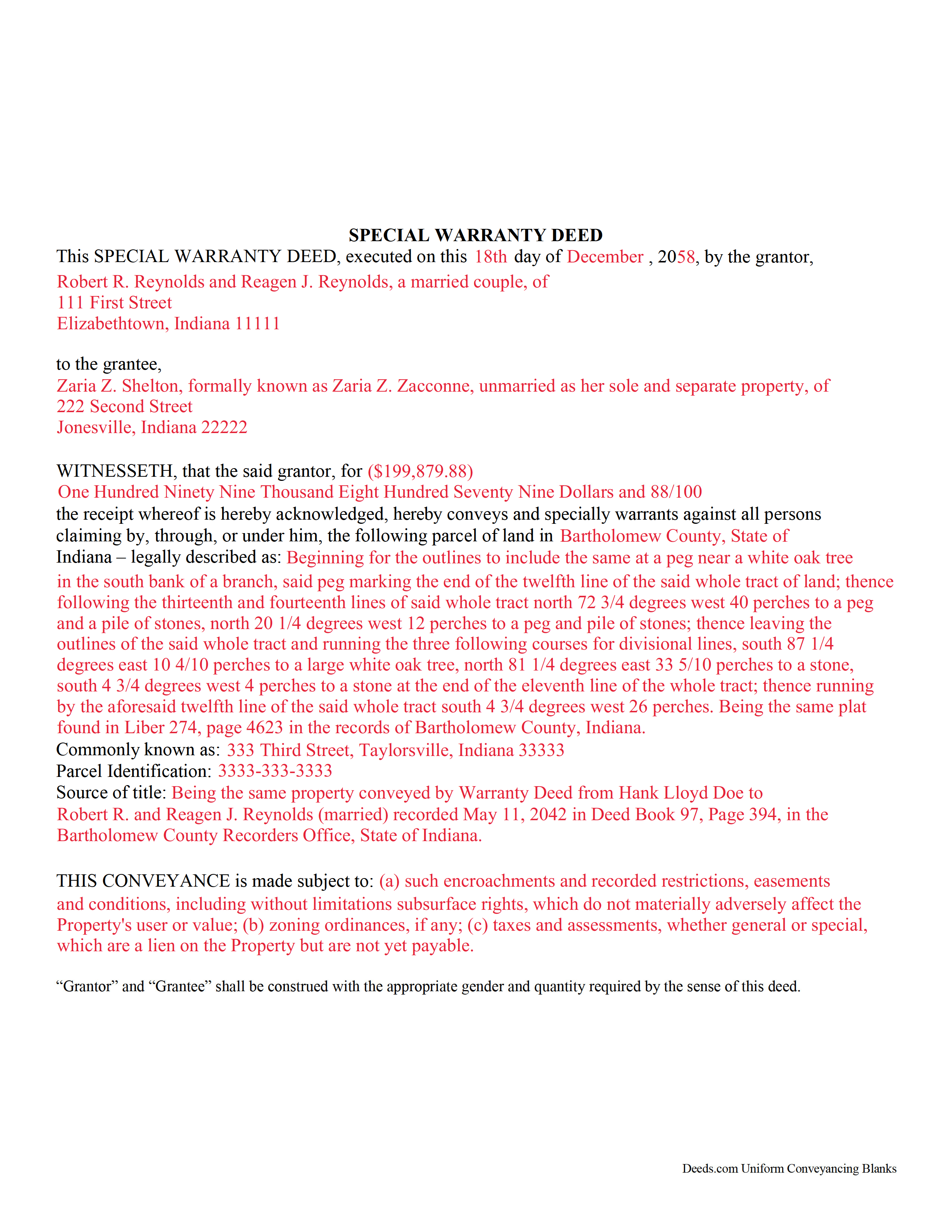

Perry County Completed Example of the Special Warranty Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Indiana and Perry County documents included at no extra charge:

Where to Record Your Documents

Perry County Recorder

Tell City, Indiana 47586

Hours: 8:00 to 4:00 Monday through Friday

Phone: (812) 547-4261

Recording Tips for Perry County:

- Double-check legal descriptions match your existing deed

- Check margin requirements - usually 1-2 inches at top

- Bring extra funds - fees can vary by document type and page count

- Recording fees may differ from what's posted online - verify current rates

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Perry County

Properties in any of these areas use Perry County forms:

- Branchville

- Bristow

- Cannelton

- Derby

- Leopold

- Rome

- Saint Croix

- Tell City

Hours, fees, requirements, and more for Perry County

How do I get my forms?

Forms are available for immediate download after payment. The Perry County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Perry County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Perry County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Perry County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Perry County?

Recording fees in Perry County vary. Contact the recorder's office at (812) 547-4261 for current fees.

Questions answered? Let's get started!

Although the Indiana Revised Code does not offer a statutory form for a special warranty deed, the statutes do contain language that is sufficient for a conveyance of real estate in fee simple (32-17-1-2). A special warranty deed, though it generally contains warranties of title, offers less protection for the buyer than a warranty deed. The grantor in a special warranty deed offers covenants pertaining only to the grantor's period of ownership. A grant deed that is worded according to 32-17-1-2 will contain the following covenants from the grantor and the grantor's heirs and personal representatives: (1) that the grantor is lawfully seized of the premises; (2) has good right to convey the premises; (3) guarantees the quiet possession of the premises; (4) guarantees that the premises are free from all encumbrances; and (5) will warrant and defend the title to the premises against the lawful claims of those claiming under the grantor (32-17-1-2).

In order to submit a special warranty deed to a county recorder in Indiana, it must be dated and signed, sealed, and acknowledged by the grantor. If a special warranty deed does not contain a proper acknowledgement, it can be proved before any of the officers listed in 32-21-2-3 of the Indiana Revised Code. Acknowledgements can be taken in the county where the deed is to be recorded, or in another county in Indiana, or in another state. If the deed is acknowledged in another county or state, it must be certified by the clerk of the circuit court in the county and state where the officer resides and must also be attested by the seal of that court (32-21-2-4). Acknowledgements taken before an officer having an official seal that is attested by the officer's official seal will be sufficient without a certificate. The certificate of acknowledgment, if required, should be written on the deed or attached to it and recorded with it (32-21-2-9). Unless the certificate of acknowledgement is recorded with the deed, the deed may not be received or read in evidence (32-21-2-11).

Special warranty deeds should be recorded with the county recorder in the county where the property is located. Unless a conveyance is made by deed and recorded within the time and manner provided by Indiana Statutes, the deed or other conveyance of real property is not valid and effectual against any person other than the grantor, the grantor's heirs and devisees, and those with notice of the conveyance (32-21-3-3). The priority of instruments is determined by the order in which they are filed by the county recorder.

(Indiana Special Warranty Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Perry County to use these forms. Documents should be recorded at the office below.

This Special Warranty Deed meets all recording requirements specific to Perry County.

Our Promise

The documents you receive here will meet, or exceed, the Perry County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Perry County Special Warranty Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Sandra G.

January 3rd, 2019

We were referred to the site by banking friend. It does take time to read through and figure out what a person needs, form-wise, to accomplish the goal. Once that was decided, check out and the download was very easy. What a great savings in cost and time.

Thank you Sandra, glad we could help. Also, please thank your friend for us. Have a wonderful day.

Lorna D.

September 12th, 2020

Haven't used the form yet. But hopefully it's the correct one.

Thank you!

Rhobe M.

May 8th, 2023

Very user friendly site. I was able to get the information I needed fast.

Thank you!

Virginia M.

August 26th, 2020

This was the easiest web page ive ever navigated .Found just what i needed fast !

Thank you!

Charlie T.

November 13th, 2020

I really like the service and will be definitely be using it again to submit future deeds.

Thank you!

Joseph K.

May 1st, 2020

I'm very impressed. We're a small nonprofit, and we usually walk our documents into our county offices for recording. So I was a little bit skeptical about how things would work if we did it electronically. But it was a smooth, quick, painless, and reasonably priced process. I expect that this will be our preferred method even after county offices re-open.

Thank you for your feedback. We really appreciate it. Have a great day!

Craig W.

August 18th, 2019

This is a great way to get paper work to the land love it

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joyce B.

July 25th, 2019

Very easy to purchase and download.

Thank you!

Tracy M.

July 9th, 2020

The form is easy to use. However, the quit claim deed form seems to be for parcel of land, because the word "real property" is not in the form.

Thank you for your feedback. We really appreciate it. Have a great day!

Samuel Shera Singh B.

November 6th, 2022

I found the documents I needed and so many more that I will utilize for business, personal and family needs. Also I made a purchase of an additional document I did not need that serves the same purpose as one I purchased and Deeds.com had no issue refunding the unnecessary document in an unbelievably quick response and refund. I would recommend this document provider to everyone including legal office management.

Thank you for your feedback. We really appreciate it. Have a great day!

Ed C.

June 16th, 2025

I purchased the DIY quitclaim deed forms for Florida and couldn’t be happier. The forms were clear, professional, and easy to follow. I had everything filled out and recorded without a single issue. Worth every penny — the site is great, and the forms are exactly what I needed. Highly recommend!

Thanks so much, Ed! We’re thrilled to hear that the Florida quitclaim deed forms worked perfectly for you and that the recording process went smoothly. We appreciate your trust and recommendation!

Susan Mary S.

August 24th, 2020

Thank you for the thorough assortment of forms!

Thank you for your feedback. We really appreciate it. Have a great day!

Maria W.

July 19th, 2022

Really, the best and easiest service given us to complete a process for recorder office! Thank you!!

Thank you!

Charles F.

April 28th, 2020

Hi Please do not take time to respond to my previous inquiry - - - I figured it out. Deeds.com is a great tool for those of us who have occasional need for your type of services. Thanks ! Chuck

Thank you!

Cody M.

May 28th, 2024

They respond fast, the process is simple, and it's obviously convenient. I'm not sure what else there is to say, other than it's I would say a reasonable fee to pay them to do it.

Thank you for your positive words! We’re thrilled to hear about your experience.