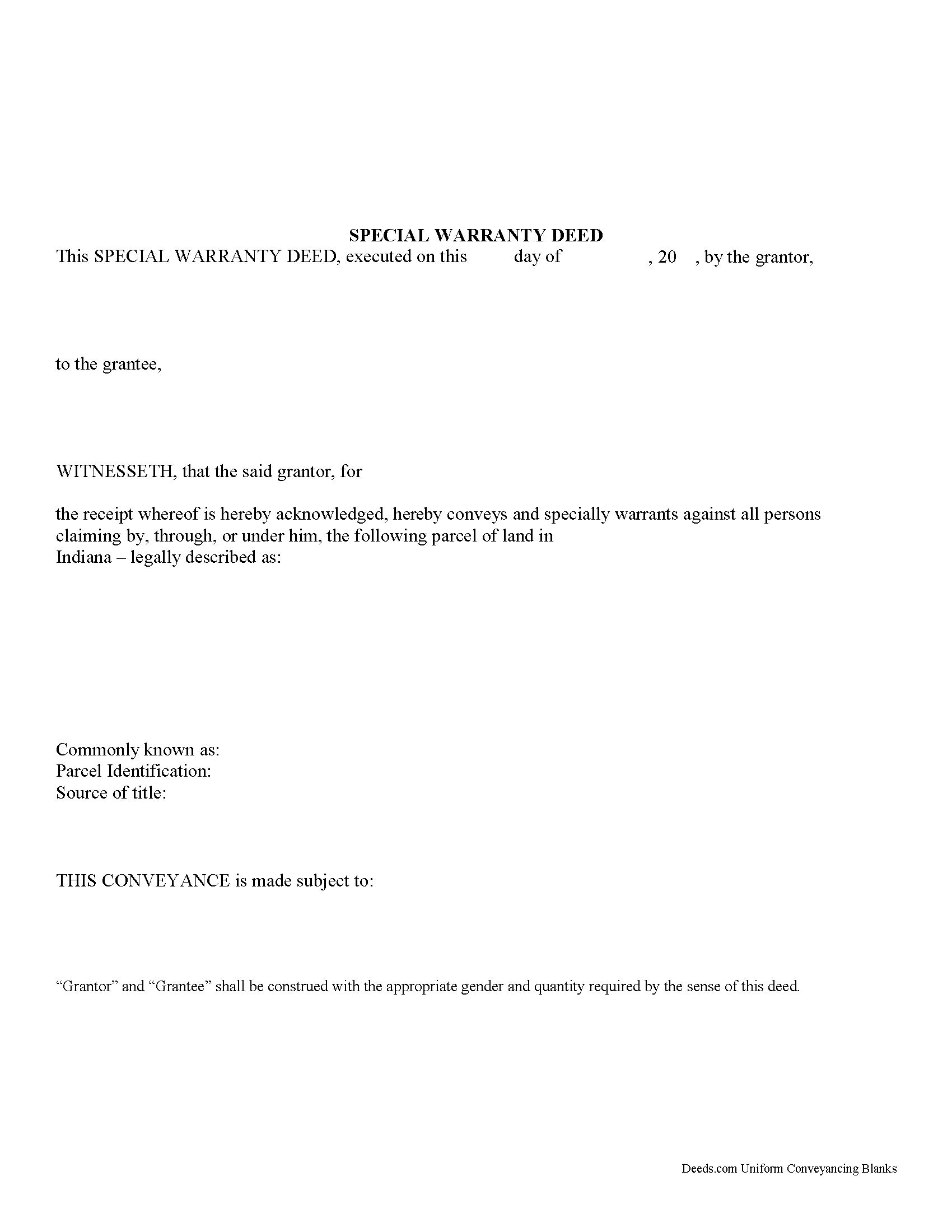

Scott County Special Warranty Deed Form

Scott County Special Warranty Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

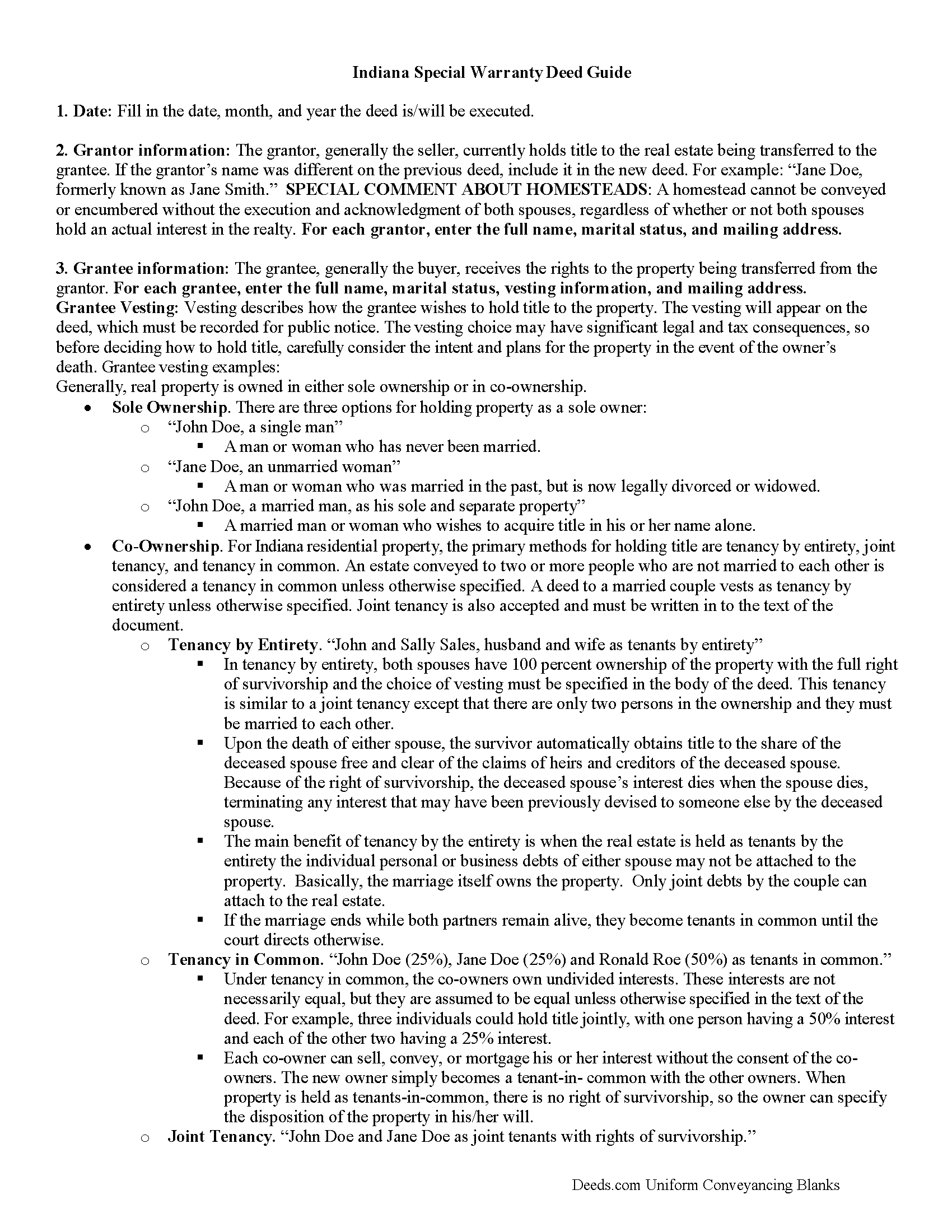

Scott County Special Warranty Deed Guide

Line by line guide explaining every blank on the form.

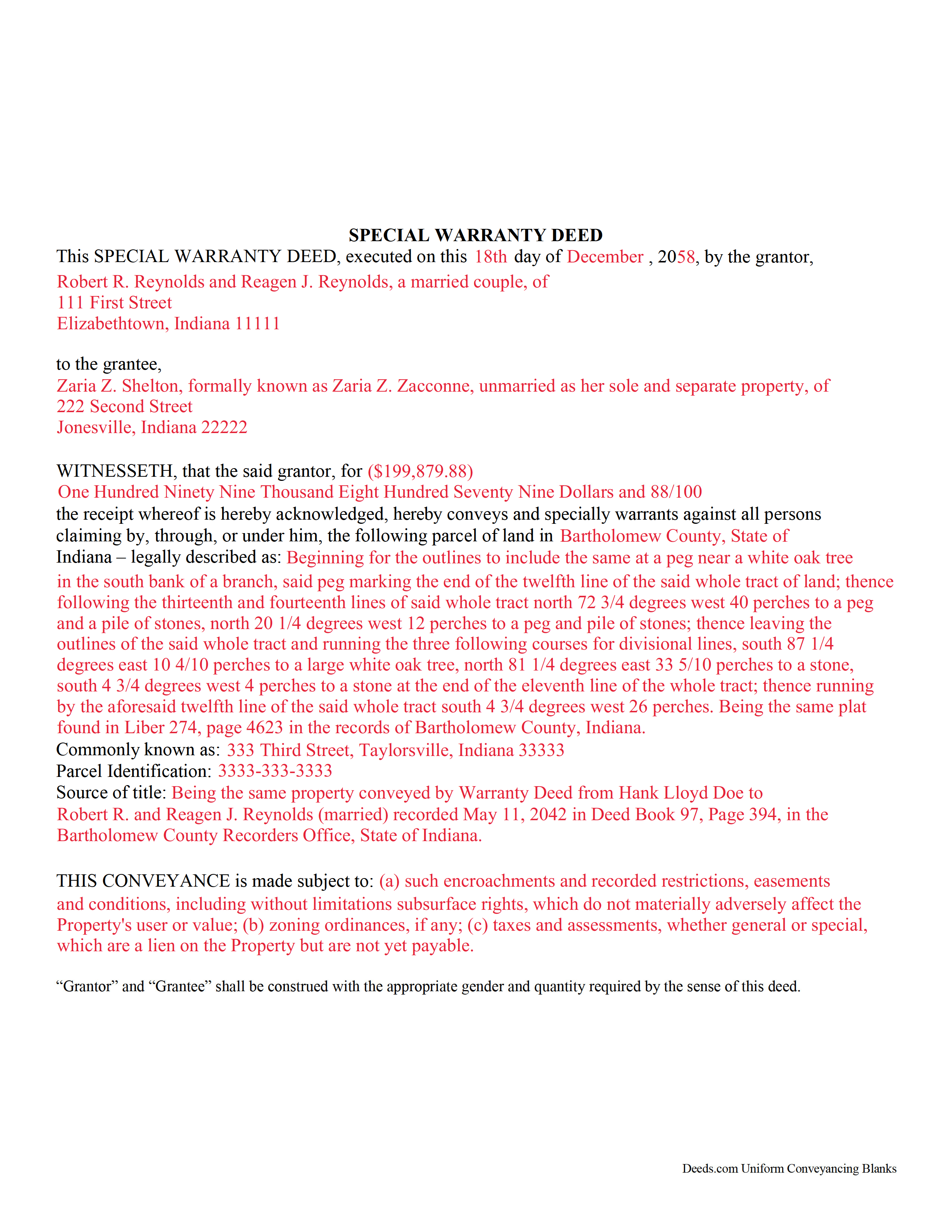

Scott County Completed Example of the Special Warranty Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Indiana and Scott County documents included at no extra charge:

Where to Record Your Documents

Scott County Recorder

Scottsburg, Indiana 47170

Hours: 8:00 to 4:00 Monday through Friday

Phone: (812) 752-8442

Recording Tips for Scott County:

- Ensure all signatures are in blue or black ink

- Check that your notary's commission hasn't expired

- Documents must be on 8.5 x 11 inch white paper

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Scott County

Properties in any of these areas use Scott County forms:

- Austin

- Lexington

- Scottsburg

- Underwood

Hours, fees, requirements, and more for Scott County

How do I get my forms?

Forms are available for immediate download after payment. The Scott County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Scott County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Scott County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Scott County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Scott County?

Recording fees in Scott County vary. Contact the recorder's office at (812) 752-8442 for current fees.

Questions answered? Let's get started!

Although the Indiana Revised Code does not offer a statutory form for a special warranty deed, the statutes do contain language that is sufficient for a conveyance of real estate in fee simple (32-17-1-2). A special warranty deed, though it generally contains warranties of title, offers less protection for the buyer than a warranty deed. The grantor in a special warranty deed offers covenants pertaining only to the grantor's period of ownership. A grant deed that is worded according to 32-17-1-2 will contain the following covenants from the grantor and the grantor's heirs and personal representatives: (1) that the grantor is lawfully seized of the premises; (2) has good right to convey the premises; (3) guarantees the quiet possession of the premises; (4) guarantees that the premises are free from all encumbrances; and (5) will warrant and defend the title to the premises against the lawful claims of those claiming under the grantor (32-17-1-2).

In order to submit a special warranty deed to a county recorder in Indiana, it must be dated and signed, sealed, and acknowledged by the grantor. If a special warranty deed does not contain a proper acknowledgement, it can be proved before any of the officers listed in 32-21-2-3 of the Indiana Revised Code. Acknowledgements can be taken in the county where the deed is to be recorded, or in another county in Indiana, or in another state. If the deed is acknowledged in another county or state, it must be certified by the clerk of the circuit court in the county and state where the officer resides and must also be attested by the seal of that court (32-21-2-4). Acknowledgements taken before an officer having an official seal that is attested by the officer's official seal will be sufficient without a certificate. The certificate of acknowledgment, if required, should be written on the deed or attached to it and recorded with it (32-21-2-9). Unless the certificate of acknowledgement is recorded with the deed, the deed may not be received or read in evidence (32-21-2-11).

Special warranty deeds should be recorded with the county recorder in the county where the property is located. Unless a conveyance is made by deed and recorded within the time and manner provided by Indiana Statutes, the deed or other conveyance of real property is not valid and effectual against any person other than the grantor, the grantor's heirs and devisees, and those with notice of the conveyance (32-21-3-3). The priority of instruments is determined by the order in which they are filed by the county recorder.

(Indiana Special Warranty Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Scott County to use these forms. Documents should be recorded at the office below.

This Special Warranty Deed meets all recording requirements specific to Scott County.

Our Promise

The documents you receive here will meet, or exceed, the Scott County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Scott County Special Warranty Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Beverly A.

June 13th, 2019

The forms are incredibly easy to fill out. Thanks for the examples!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kasie K.

May 15th, 2020

This was such an easy transaction and quicker than if I went to the recording office. During this time of COVID19 and not being able to record documents in person it helped us to get what we needed and quickly. Thank you!

Thank you!

ronnie y.

May 8th, 2019

nice to get everything I need for the county that the property is located.

Thank you for your feedback. We really appreciate it. Have a great day!

Juston P.

August 24th, 2022

The service provided was exactly what I needed. The downloadable deed and supporting documents allowed me to move forward with the days project. Everything I needed to file my documents from two states away and at two in the morning! I highly recommend this site. I found it to be the easiest, most expedient and cost effective method to get up to date legal forms for filing land deeds.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John H.

April 22nd, 2019

Re: Idaho Affidavit of Successor: Decedent's residence may be a state other than Idaho. Death certificate documnet# field is too small.

Thank you for your feedback. We have emailed you an amended document to address your specific needs outlined in your feedback, hope this helps. Have a wonderful day.

VICKI R.

July 15th, 2020

Thank you for your helpful information.

Thank you!

Daniel N.

June 28th, 2024

Deeds.com provided the document template and instructions I needed, right when I needed them. I was able to navigate through an unfamiliar process with exactly the support I needed at an affordable and fair price. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Judith F.

June 29th, 2022

Was easy to use the eRecording service.

Thank you!

Clarence F.

January 25th, 2022

very easy to use !!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sara S.

January 8th, 2021

Deed.com was very user friendly, made recording convenient and fast responses. I do recommend.

Thank you for your feedback. We really appreciate it. Have a great day!

randall a.

July 16th, 2019

As advertised. good value.

Thank you for your feedback. We really appreciate it. Have a great day!

Connie H.

January 18th, 2019

I really appreciated the detailed instructions provided with the document. The instructions made it easy to fill it out correctly. Filed the document with the courthouse the next day and have received confirmation that it has been filed.

Thanks Connie! Have a great day!

Janice T.

September 14th, 2020

The downloads were a great help in understanding of both what a Warranty Deed was and how to follow the steps as well as filling out the forms.

Thank you for your feedback. We really appreciate it. Have a great day!

Pamela B.

November 23rd, 2019

Fantastic system, so easy to use even for a simpleton like me.

Thank you!

Lawrence R.

February 4th, 2020

Forms do not allow enough space for fields and cutoff. Need to expand the fields to allow for more writing. I ended up re-typing to be able to include full property description. Would be nice if available in Word format rather than only PDF format.

Thank you for your feedback. We really appreciate it. Have a great day!