Grant County Transfer on Death Deed Beneficiary Affidavit Form

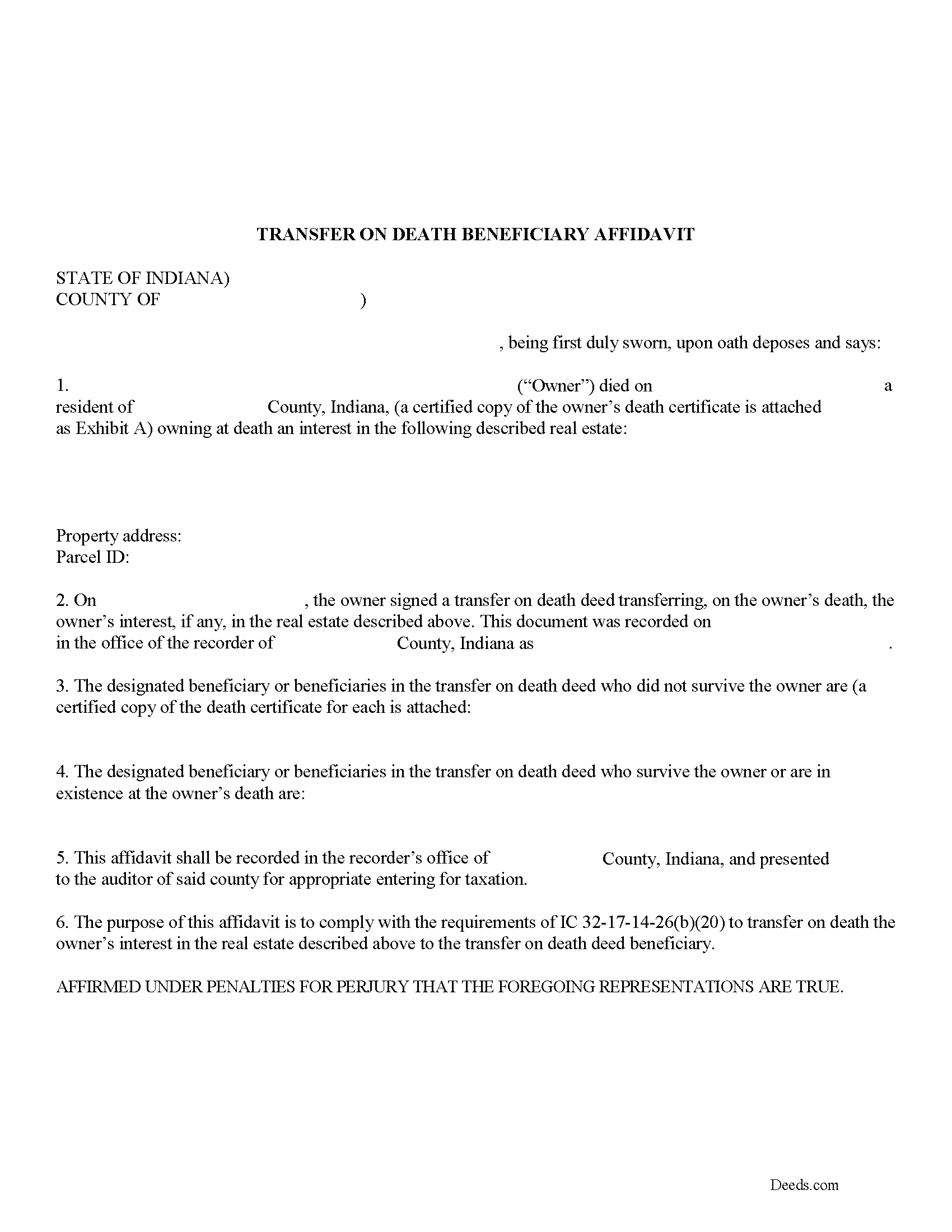

Grant County Transfer on Death Deed Beneficiary Affidavit Form

Fill in the blank form formatted to comply with all recording and content requirements.

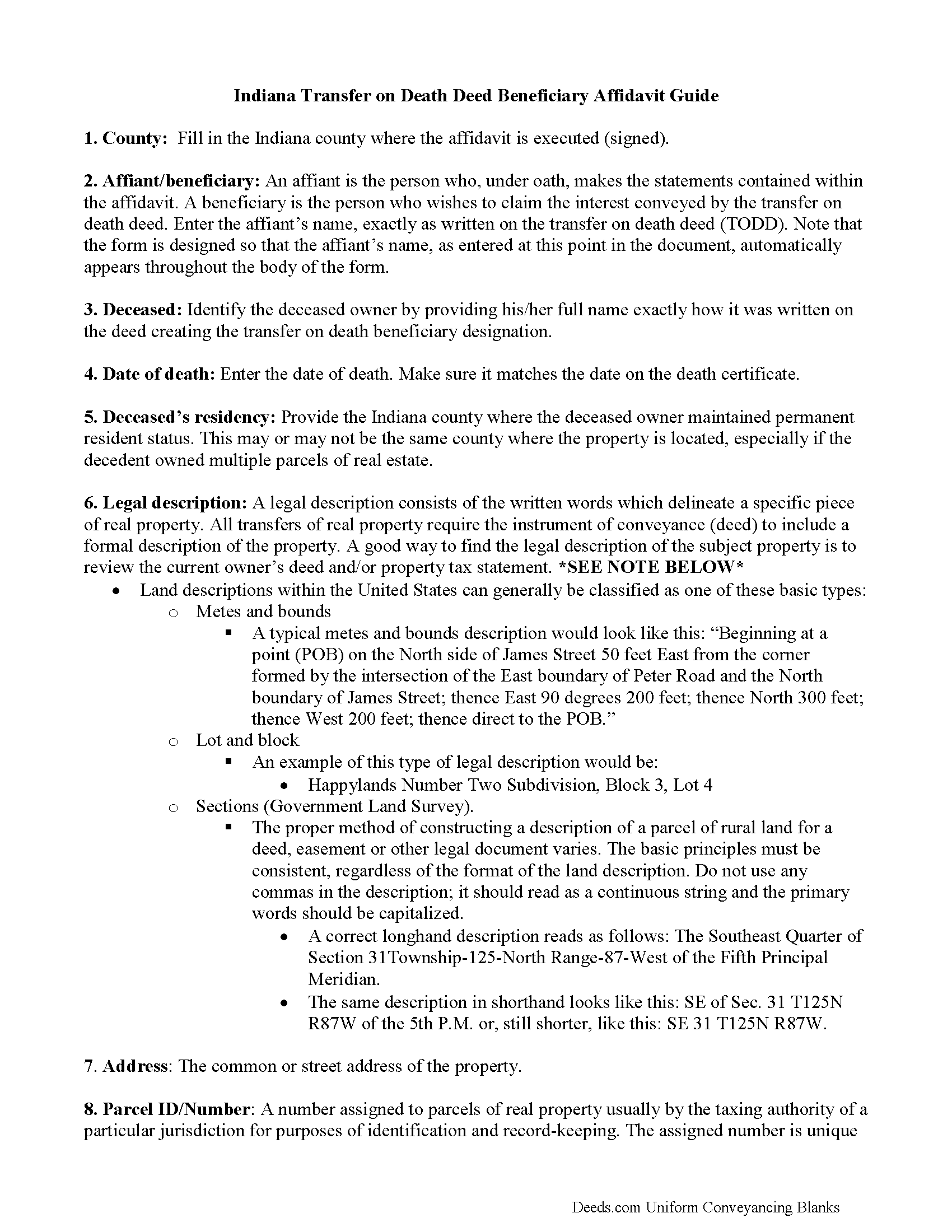

Grant County Transfer on Death Deed Beneficiary Affidavit Guide

Line by line guide explaining every blank on the form.

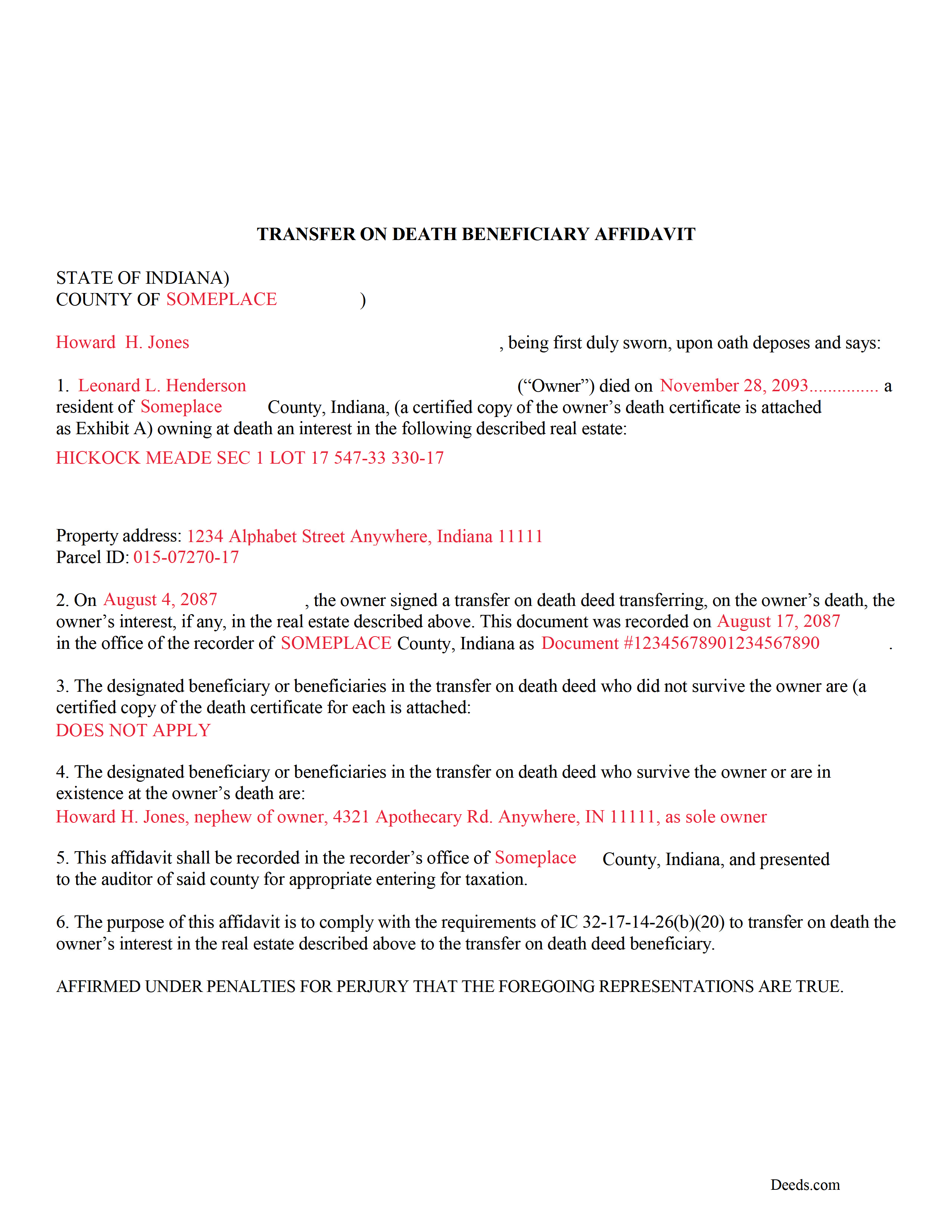

Grant County Completed Example of the Transfer on Death Deed Beneficiary Affidavit Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Indiana and Grant County documents included at no extra charge:

Where to Record Your Documents

Grant County Recorder

Marion, Indiana 46953

Hours: 8:00 a.m. - 4:00 p.m. Monday-Friday

Phone: (765) 668-6559

Recording Tips for Grant County:

- Check that your notary's commission hasn't expired

- Verify all names are spelled correctly before recording

- Both spouses typically need to sign if property is jointly owned

- Make copies of your documents before recording - keep originals safe

Cities and Jurisdictions in Grant County

Properties in any of these areas use Grant County forms:

- Fairmount

- Fowlerton

- Gas City

- Jonesboro

- Marion

- Matthews

- Swayzee

- Sweetser

- Upland

- Van Buren

Hours, fees, requirements, and more for Grant County

How do I get my forms?

Forms are available for immediate download after payment. The Grant County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Grant County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Grant County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Grant County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Grant County?

Recording fees in Grant County vary. Contact the recorder's office at (765) 668-6559 for current fees.

Questions answered? Let's get started!

Indiana's transfer on death deeds are a useful way to convey ownership rights to property without the need for probate. The rules for claiming the property are defined in IC 32-17-14-26(b)(20). Primarily, the statute explains that the beneficiary must complete a transfer on death beneficiary affidavit containing specific details of the deed, present that affidavit to the local auditor to verify any transfer taxes, and then submit it to the county recorder who will enter it, and therefore the finalized conveyance, into the public record.

Beneficiaries listed on Indiana transfer on death deeds may use this form, which meets the statutory requirements, to claim ownership of the real property described in the deed.

(Indiana TOD Deed Beneficiary Affidavit Package includes form, guidelines, and completed example)

Important: Your property must be located in Grant County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed Beneficiary Affidavit meets all recording requirements specific to Grant County.

Our Promise

The documents you receive here will meet, or exceed, the Grant County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Grant County Transfer on Death Deed Beneficiary Affidavit form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Ann C.

December 27th, 2019

This service is the absolute BOMB! I wish every business ran as fast and efficiently as you all do! Seriously - No joke! Thank you guys!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rachelle S.

March 21st, 2021

Wow that was easy

Thank you!

Ernest S.

July 30th, 2019

Took it to the Courthouse and the Register of Deeds said,"well Done" Thanks you so much.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

jennifer e.

September 1st, 2020

EXCELLENT, PROMPT SERVICE. I will definitely use again .HIGHLY RECOMMEND.

Thank you for your feedback. We really appreciate it. Have a great day!

Patricia G.

January 19th, 2021

Oh my goodness! Y'all are an answer to prayers! You provided all the forms necessary in one convenient packet, and at a VERY reasonable price! I can't thank y'all enough for helping my family & myself with what could've been a difficult and expensive situation! God bless you for your time and talent!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Vicki L.

July 4th, 2020

Quick results with accurate information and thorough information.

Thank you!

Sam A.

September 26th, 2022

User friendly website and deeds are very easy to maneuver. I'm very happy with everything Deeds.com has to offer. It truly helped me with the business that I had to take care of.

Thank you!

William T.

July 6th, 2024

Very informative and user friendly. Thank you.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Dee S.

October 24th, 2023

Great service and so quick at responding!

We are motivated by your feedback to continue delivering excellence. Thank you!

Linda F.

August 1st, 2025

I can't recommend working with Deeds.com enough. I had been given incorrect information from another document service. The helpful staff member at Deeds.com that assisted in the submission of the recording was exceptionally helpful in making sure what I was submitting included the necessary elements required by the county. I am very thankful I chose Deeds.com for my eRecording service. Thank you!!

Thank you, Linda! We’re so glad our team could assist in making sure your submission met the county’s requirements. It means a lot that you chose Deeds.com after a frustrating experience elsewhere. We appreciate your trust and kind words!

Gary M.

February 13th, 2024

This was such an easy experience

We are grateful for your feedback and looking forward to serving you again. Thank you!

RALPH B.

September 22nd, 2019

THE BEST SERVICE WAS ON TIME AS STATED DID ALL THE WORK NEED IN A VERY PROFESSIONAL MANNER GREAT FOLLOW UP AND THE OFFICE STAFF IS FANTASTIC IN RESPONSE AND DOING WHAT I NEED TO HAVE DONE WOULD RECOMMEND THIS COMPANY TO ANYONE WHO NEEDS THIS SERVICE

Thank you!

Carol W.

September 6th, 2020

The guide and example provided made it so easy to complete the form. All was in order when I took it to the Register of Deeds. No hassles at all! Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Renasha P.

October 6th, 2019

I was searching information about my boyfriend family home and received the results in a timely manner. I now have the information that we were seeking.

Thank you for your feedback. We really appreciate it. Have a great day!

Wendy B.

December 20th, 2019

Really appreciate you he quick response and solution to my problem!! Thank you!!

Thank you for your feedback. We really appreciate it. Have a great day!