Warrick County Transfer on Death Deed Beneficiary Affidavit Form

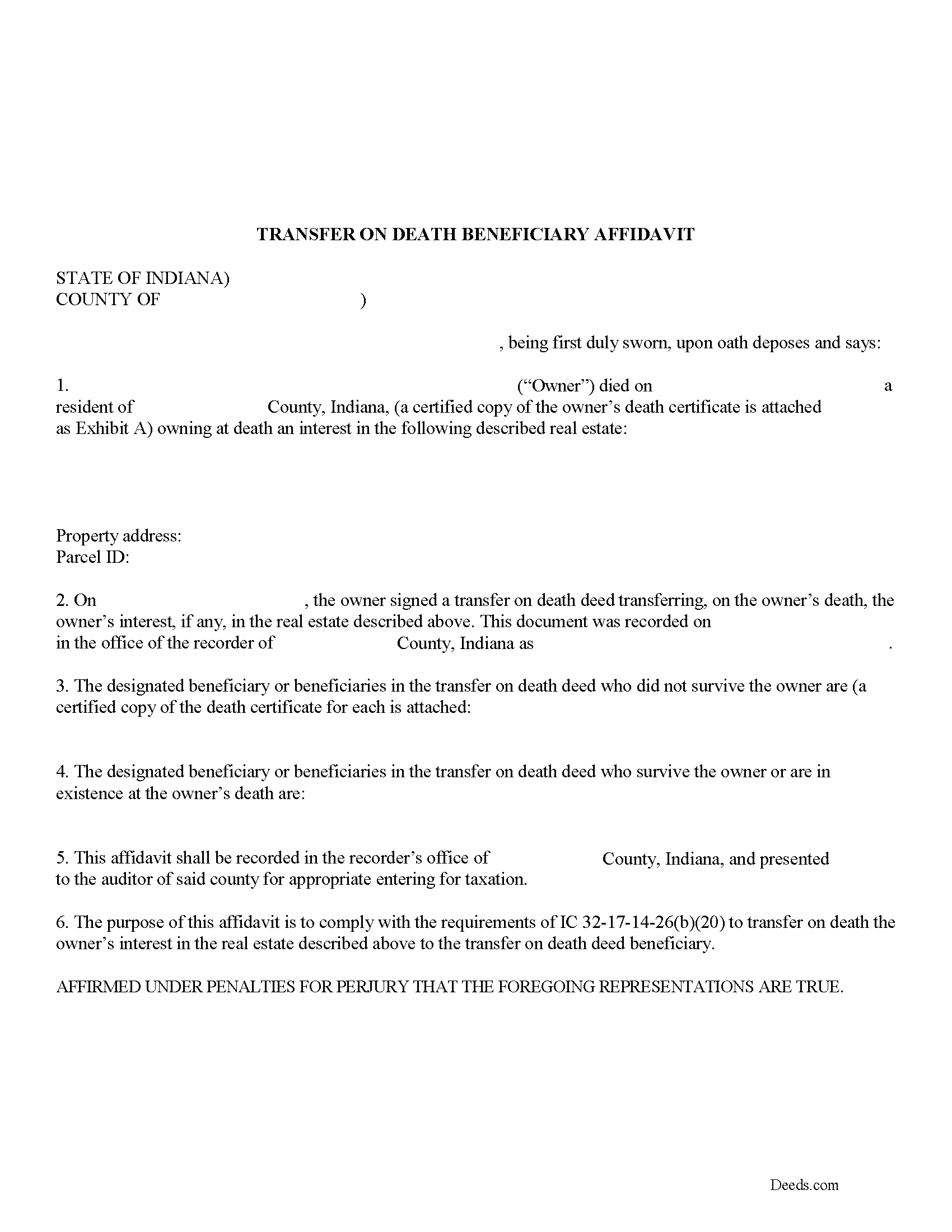

Warrick County Transfer on Death Deed Beneficiary Affidavit Form

Fill in the blank form formatted to comply with all recording and content requirements.

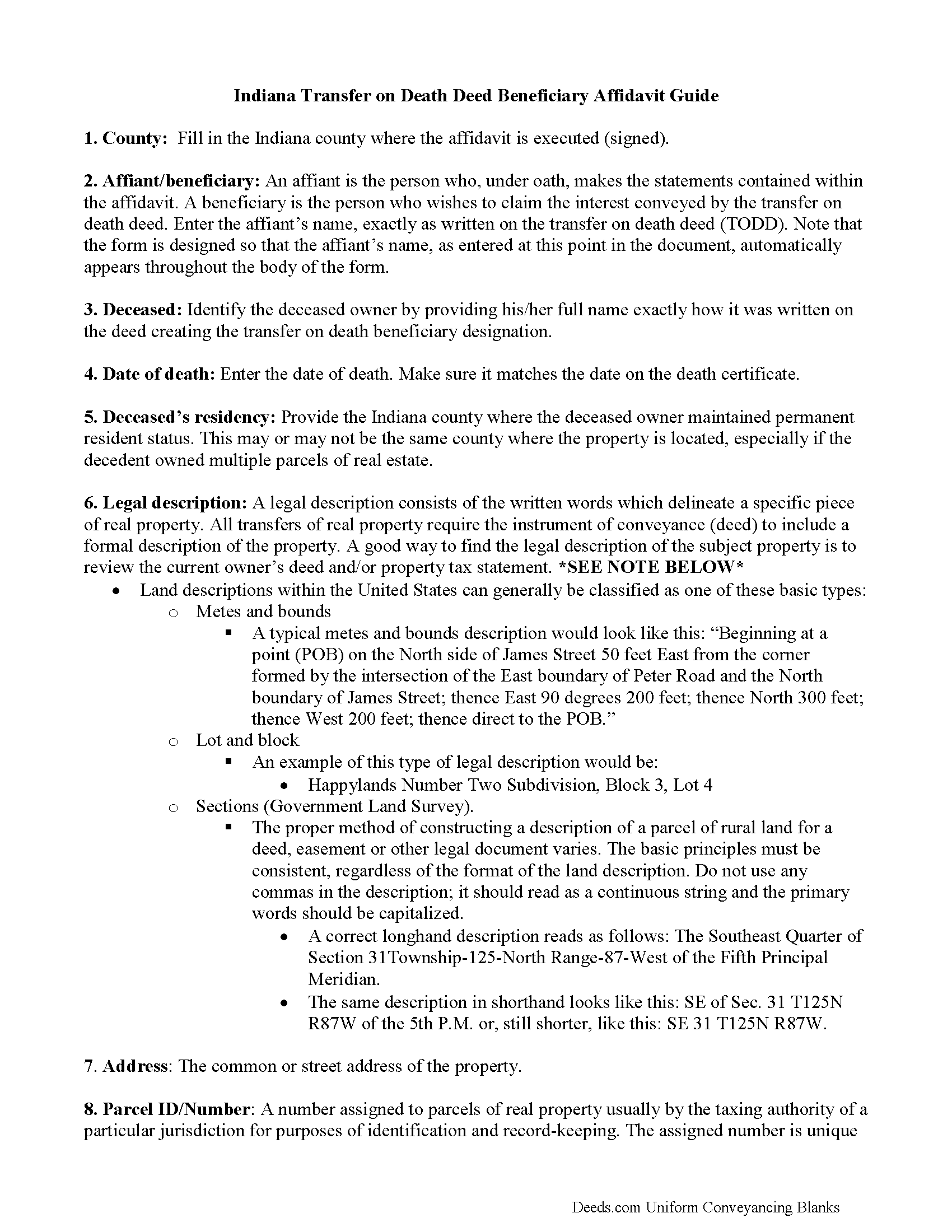

Warrick County Transfer on Death Deed Beneficiary Affidavit Guide

Line by line guide explaining every blank on the form.

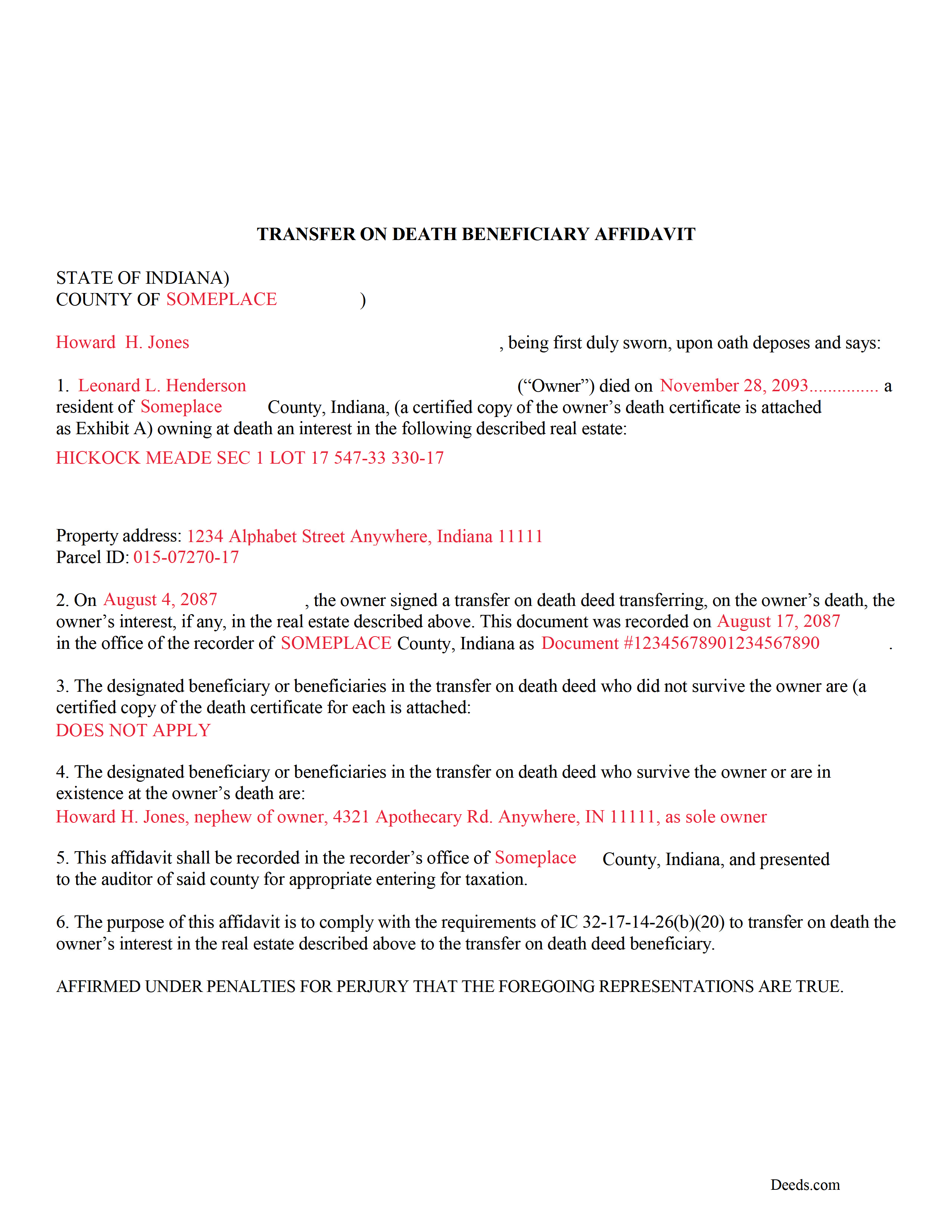

Warrick County Completed Example of the Transfer on Death Deed Beneficiary Affidavit Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Indiana and Warrick County documents included at no extra charge:

Where to Record Your Documents

Warrick County Recorder

Boonville, Indiana 47601

Hours: 8:00 to 4:00 Monday through Friday

Phone: (812) 897-6165

Recording Tips for Warrick County:

- Ensure all signatures are in blue or black ink

- Double-check legal descriptions match your existing deed

- Documents must be on 8.5 x 11 inch white paper

- Request a receipt showing your recording numbers

- Ask for certified copies if you need them for other transactions

Cities and Jurisdictions in Warrick County

Properties in any of these areas use Warrick County forms:

- Boonville

- Chandler

- Elberfeld

- Folsomville

- Lynnville

- Newburgh

- Tennyson

Hours, fees, requirements, and more for Warrick County

How do I get my forms?

Forms are available for immediate download after payment. The Warrick County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Warrick County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Warrick County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Warrick County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Warrick County?

Recording fees in Warrick County vary. Contact the recorder's office at (812) 897-6165 for current fees.

Questions answered? Let's get started!

Indiana's transfer on death deeds are a useful way to convey ownership rights to property without the need for probate. The rules for claiming the property are defined in IC 32-17-14-26(b)(20). Primarily, the statute explains that the beneficiary must complete a transfer on death beneficiary affidavit containing specific details of the deed, present that affidavit to the local auditor to verify any transfer taxes, and then submit it to the county recorder who will enter it, and therefore the finalized conveyance, into the public record.

Beneficiaries listed on Indiana transfer on death deeds may use this form, which meets the statutory requirements, to claim ownership of the real property described in the deed.

(Indiana TOD Deed Beneficiary Affidavit Package includes form, guidelines, and completed example)

Important: Your property must be located in Warrick County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed Beneficiary Affidavit meets all recording requirements specific to Warrick County.

Our Promise

The documents you receive here will meet, or exceed, the Warrick County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Warrick County Transfer on Death Deed Beneficiary Affidavit form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

ARTHEMEASE B.

November 8th, 2021

You made a very confusing process very easy. Your response was timely. I will definitely use you again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jonathan F.

September 4th, 2020

An excellent service. Makes filing deeds so much easier than having to go to the courthouse or use FedEx. I will be a customer for the rest of my legal career.

Thank you!

Ellen D.

November 25th, 2019

Fantastic service! The forms were available to download instantly and they were perfect for my situation. Easy to use on my older computer. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Bernard H.

February 1st, 2019

The site is clear and easy to submit requests. I will be using again when needed. No problems and a pleasure to deal with.

Thank you for your feedback. We really appreciate it. Have a great day!

Laurence D.

October 26th, 2020

Quick and easy, and a good value for the money. Thanks, Deeds.com!

Thank you!

Carolyn M.

March 31st, 2022

Very helpful and informative. The online site walked you through step by step and if you had a question, which I did, I called with my question. Thanks again.

Thank you!

Darren G.

December 10th, 2021

Your beneficiary deed sample contains a error of the LDPS designation. I copied the designation of LPDS instead of the correct designation

Thank you for your feedback. We really appreciate it. Have a great day!

Carol T.

February 26th, 2020

Very east process. Good job!

Thank you for your feedback. We really appreciate it. Have a great day!

CAROLYN H.

July 14th, 2022

Thanks. Was simple and easy to use.

Thank you!

JAMES M.

July 17th, 2023

The forms are just what I needed! Easy to navigate.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jeffrey B.

August 1st, 2021

Love Deeds.com! I was a little confused as to how to go about Quitclaiming, but you made it very easy! Thank you SO much!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Heather R.

May 31st, 2019

Fast and convenient service.

Thank you Heather, we appreciate your feedback.

Kenneth J.

June 15th, 2021

Great product; Got the Job done.

Thank you!

Gene L.

August 5th, 2020

Worked perfect. Thanks.

Thank you!

Robert H.

December 2nd, 2021

I was surprised that how comprehensive your website is. I quickly found what I was looking for, and it was just what I needed.

Thank you!