Huntington County Transfer on Death Deed Revocation Form

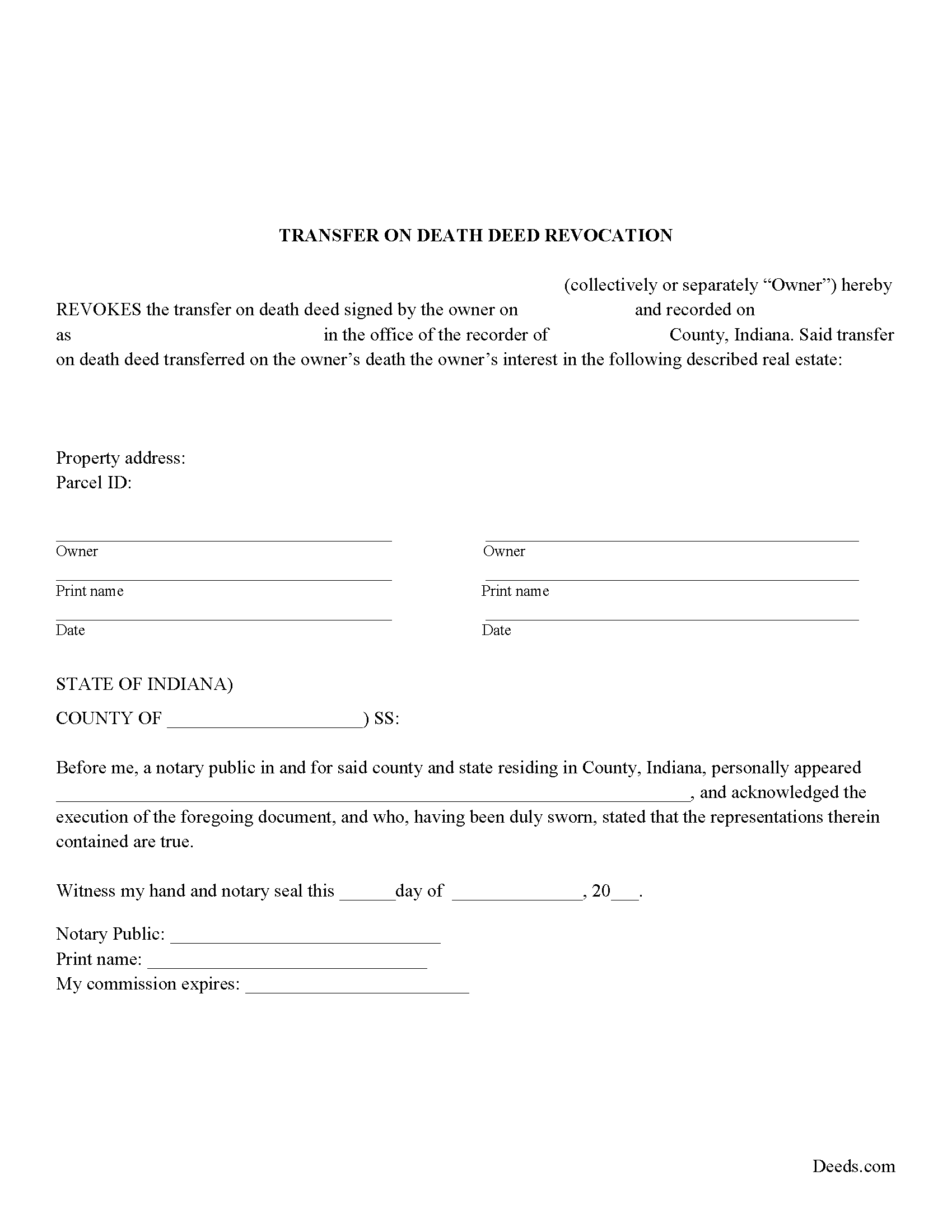

Huntington County Transfer on Death Revocation Form

Fill in the blank form formatted to comply with all recording and content requirements.

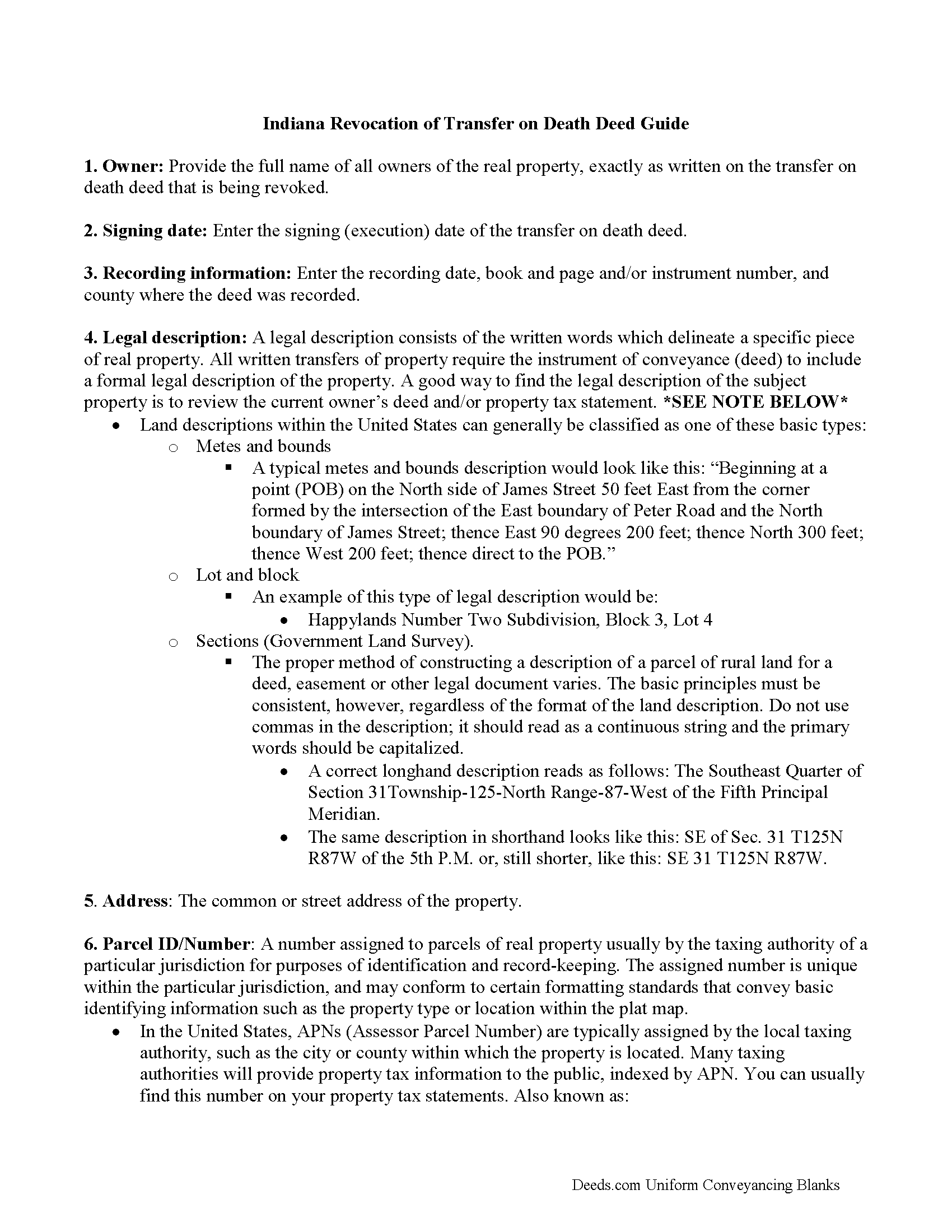

Huntington County Transfer on Death Revocation Guide

Line by line guide explaining every blank on the form.

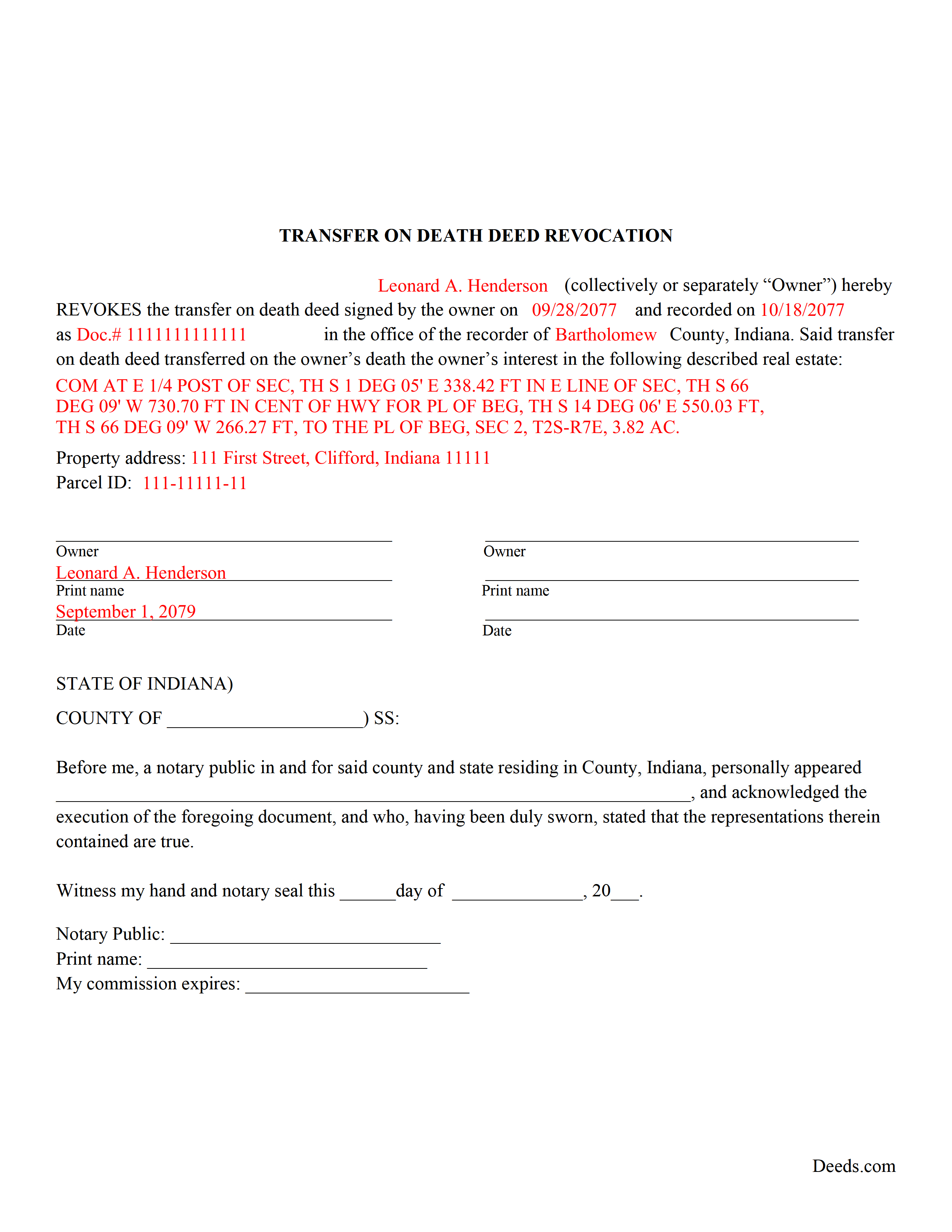

Huntington County Completed Example of the Transfer on Death Revocation Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Indiana and Huntington County documents included at no extra charge:

Where to Record Your Documents

Huntington County Recorder

Huntington, Indiana 46750

Hours: 8:00 to 4:30 M-F

Phone: (260) 355-2312

Recording Tips for Huntington County:

- Leave recording info boxes blank - the office fills these

- Make copies of your documents before recording - keep originals safe

- Mornings typically have shorter wait times than afternoons

Cities and Jurisdictions in Huntington County

Properties in any of these areas use Huntington County forms:

- Andrews

- Bippus

- Huntington

- Roanoke

- Warren

Hours, fees, requirements, and more for Huntington County

How do I get my forms?

Forms are available for immediate download after payment. The Huntington County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Huntington County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Huntington County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Huntington County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Huntington County?

Recording fees in Huntington County vary. Contact the recorder's office at (260) 355-2312 for current fees.

Questions answered? Let's get started!

Use this form when the land owner wishes to completely cancel a previously recorded transfer on death deed. A revocation of transfer on death deed allows the owner to formally revoke the future conveyance and enter that change in the public record.

According to IC 32-17-14-16, there are two primary ways to revoke a transfer on death deed in Indiana:

If the real estate owner (grantor) decides to change the beneficiary or modify the way in which beneficiaries will hold title to the property when the owner dies, he/she simply completes and records a new transfer on death deed with the updated information.

If the land owner wishes to completely cancel a previously recorded transfer on death deed, a revocation may be a better idea. A properly executed revocation of transfer on death deed allows the owner to formally revoke the future conveyance and enter that change in the public record.

(Indiana Transfer on Deed Revocation Package includes form, guidelines, and completed example)

Important: Your property must be located in Huntington County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed Revocation meets all recording requirements specific to Huntington County.

Our Promise

The documents you receive here will meet, or exceed, the Huntington County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Huntington County Transfer on Death Deed Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Lisa M.

August 30th, 2023

Awesome and so easy to use!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Glenda M.

November 9th, 2021

I am very pleased with my purchase of the Affidavit Death of Joint Tenant form. I previously purchased this form from the leading providing of DIY legal forms and it was rejected by the Registrar in my state. I then had to start over. Plus I needed a form that would show me a completed example and give me line-by-line instructions. Deeds.com filled the bill perfectly. Their website also let me know the last date the form was updated.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kathleen M.

April 14th, 2020

Your Service was excellent. Very responsive. Thank you.

Thank you!

Ginger C.

April 8th, 2020

So far so good. Thank you for your prompt responses. Much appreciated.

Thank you!

Faith D.

April 26th, 2023

That was really nice to use! Just don't have a computer but will go get copies. Thank you for being there.

Thank you!

Linda B.

March 26th, 2022

the forms are easy to understand. How do I go about getting the deed recorded and is there a charge.

Thank you for your feedback. We really appreciate it. Have a great day!

Mark S.

September 30th, 2020

Quick and easy. Had what I was searching for. Simple to pay and download.

Thank you!

Pamela G.

November 18th, 2020

I have an apple phone. I could not fill in the form to pay because apple phones do not have a dash that can be used when the field requires a phone number with a dash. I had to borrow an android phone in which the telephone keypad had a dash that could be used. It was easy to pay using an android phone but impossible to pay using an apple phone. Remove the requirement for dashes to allow apple phones to use this service.

Thank you!

Randy T.

January 22nd, 2019

I gave your site and forms 5 stars because it is very easy to use and included all the information needed to complete the form without having had a legal background.

Thank you Randy. Have a great day!

Kevin M.

April 2nd, 2022

good so far. will wait to see what happens

Thank you!

Mark M.

November 5th, 2020

Deeds was easy to use and worked as specified; they got the recording I needed done finished in one day!

Thank you for your feedback. We really appreciate it. Have a great day!

Wayne R.

February 22nd, 2021

Couldn't believe how simple it was to do such a very important family support task and the price was right! Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Scott D.

March 31st, 2025

I am very satisfied with the quality of the product I ordered. I have done similar property transfers/recording in the past on my own but paying for the forms and guidance is well worth it. The AI question area is extremely helpful. The example for the forms is perfect (as it has to be). I will absolutely use Deeds.com in the future for any related property needs. A+

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Janice S.

August 31st, 2022

All instructions and forms are very easy to read and fill-out. Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Carol N.

September 11th, 2019

Not helpful couldn't find anything

Thank you for your feedback Carol. Sorry to hear that you could not find what you were looking for. Have a wonderful day.