Orange County Transfer on Death Deed Revocation Form

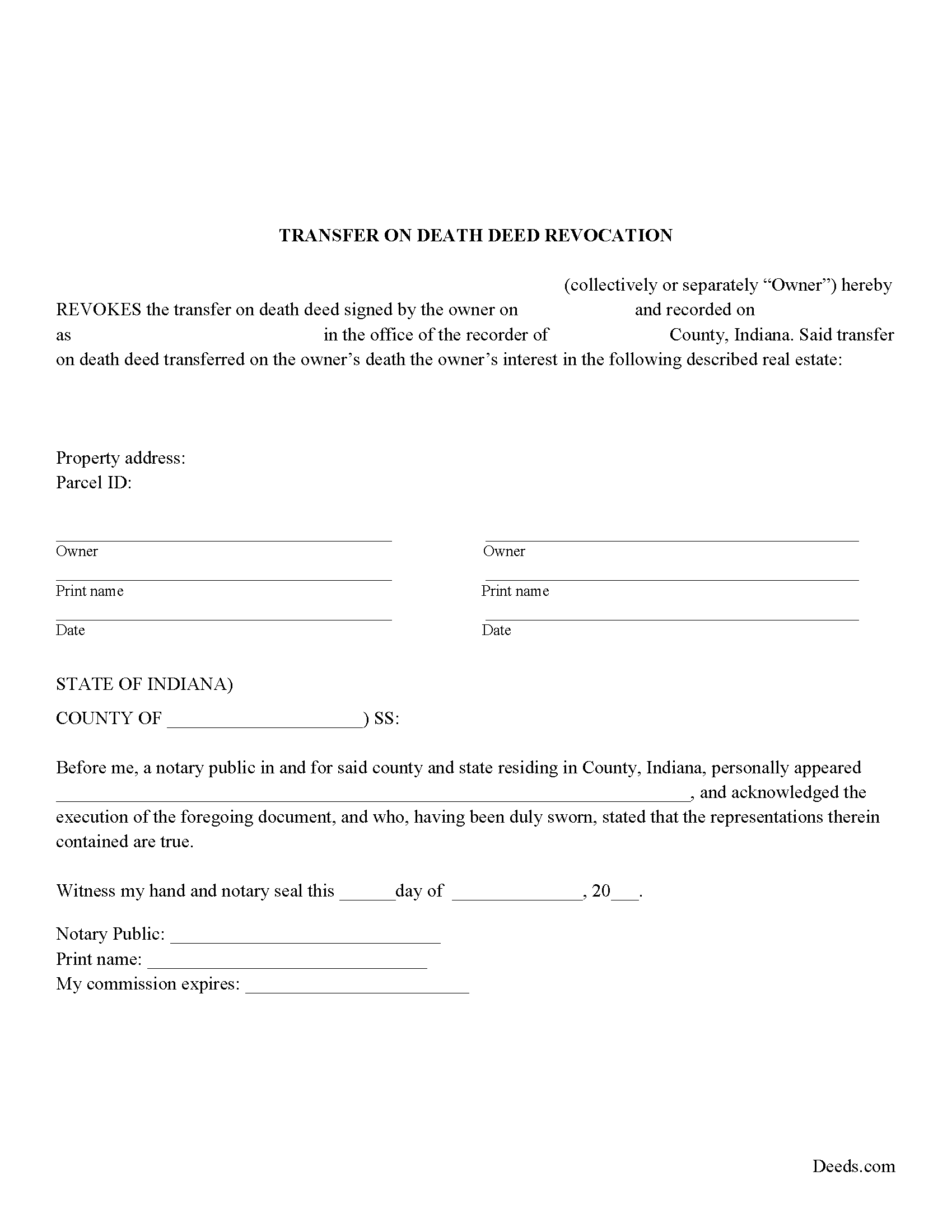

Orange County Transfer on Death Revocation Form

Fill in the blank form formatted to comply with all recording and content requirements.

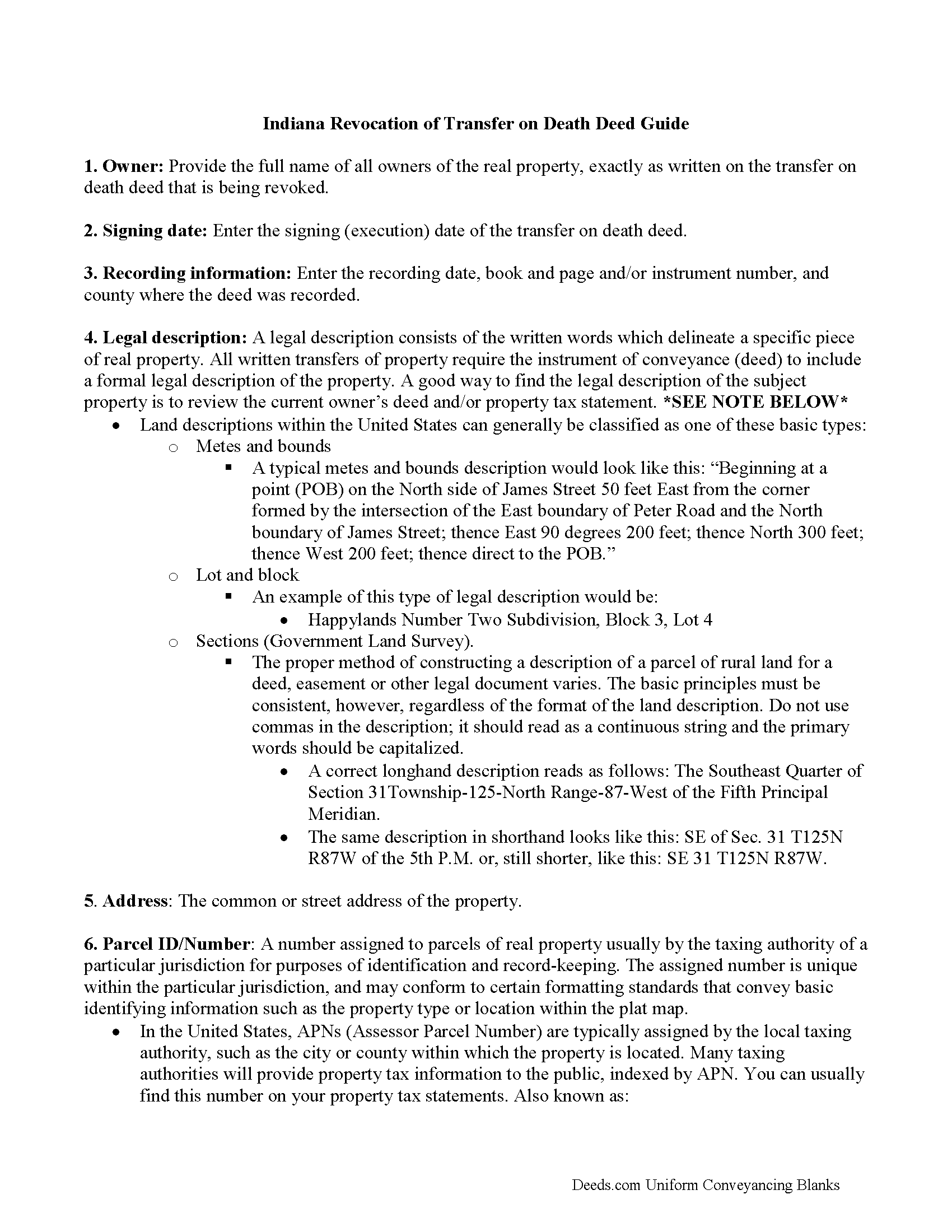

Orange County Transfer on Death Revocation Guide

Line by line guide explaining every blank on the form.

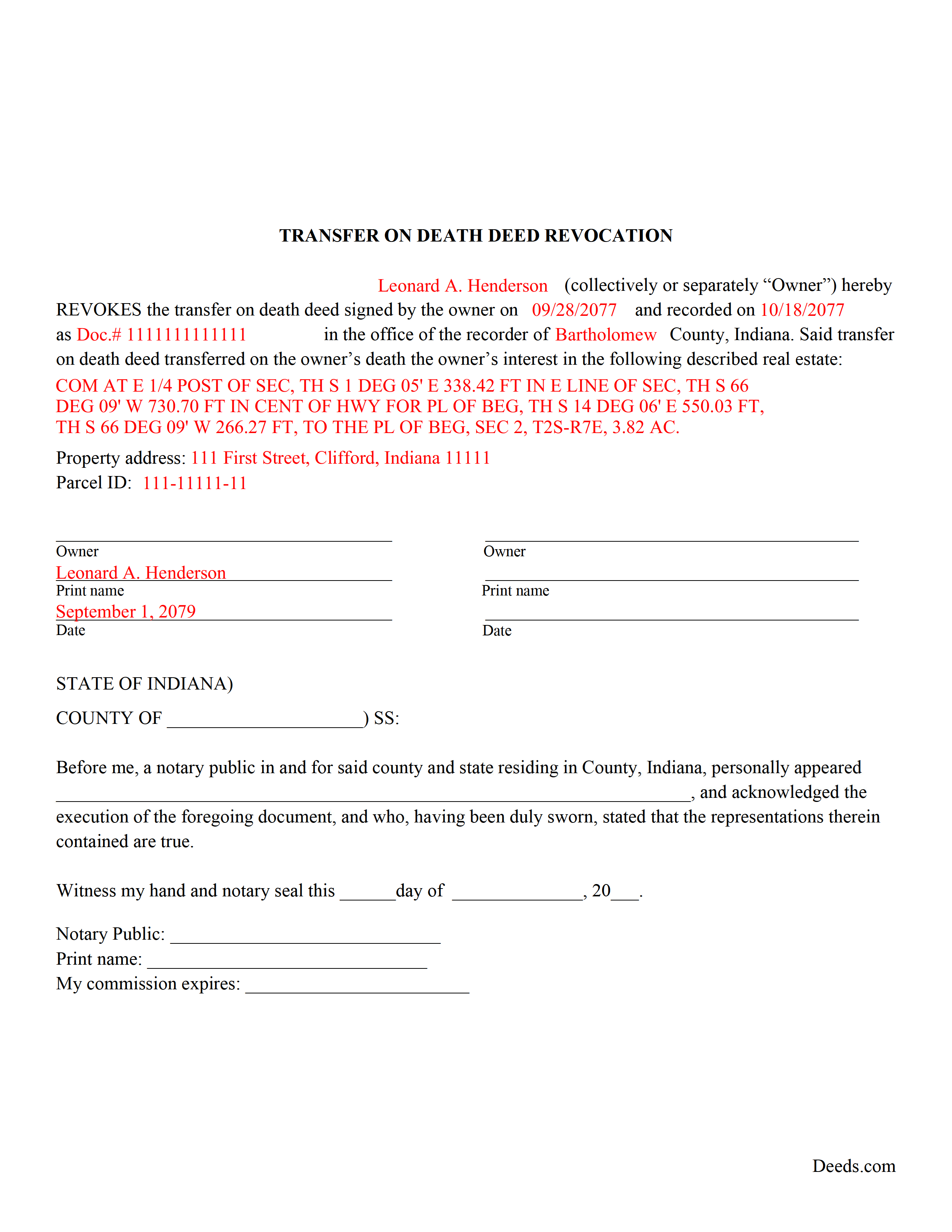

Orange County Completed Example of the Transfer on Death Revocation Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Indiana and Orange County documents included at no extra charge:

Where to Record Your Documents

Orange County Recorder

Paoli, Indiana 47454

Hours: 8:00 to 4:00 M-F

Phone: (812) 723-7114

Recording Tips for Orange County:

- Double-check legal descriptions match your existing deed

- Ask if they accept credit cards - many offices are cash/check only

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Orange County

Properties in any of these areas use Orange County forms:

- French Lick

- Orleans

- Paoli

- West Baden Springs

Hours, fees, requirements, and more for Orange County

How do I get my forms?

Forms are available for immediate download after payment. The Orange County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Orange County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Orange County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Orange County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Orange County?

Recording fees in Orange County vary. Contact the recorder's office at (812) 723-7114 for current fees.

Questions answered? Let's get started!

Use this form when the land owner wishes to completely cancel a previously recorded transfer on death deed. A revocation of transfer on death deed allows the owner to formally revoke the future conveyance and enter that change in the public record.

According to IC 32-17-14-16, there are two primary ways to revoke a transfer on death deed in Indiana:

If the real estate owner (grantor) decides to change the beneficiary or modify the way in which beneficiaries will hold title to the property when the owner dies, he/she simply completes and records a new transfer on death deed with the updated information.

If the land owner wishes to completely cancel a previously recorded transfer on death deed, a revocation may be a better idea. A properly executed revocation of transfer on death deed allows the owner to formally revoke the future conveyance and enter that change in the public record.

(Indiana Transfer on Deed Revocation Package includes form, guidelines, and completed example)

Important: Your property must be located in Orange County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed Revocation meets all recording requirements specific to Orange County.

Our Promise

The documents you receive here will meet, or exceed, the Orange County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Orange County Transfer on Death Deed Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Curtis G.

May 18th, 2020

Easy to use.

Thank you!

Zachary F.

February 1st, 2022

I am a lawyer and purchased a specialized type of deed for a special scenario. The product received was functional, but not great. Wording is slightly clunky and the form layout was not convenient for making a professional final product. The wording also didn't contemplate a remote-state probate, which is a common scenario. Something about the PDF prevented me from doing cut and paste, so I had to do OCR to get the relevant text for inserting in my existing draft deed. Finally, while the site claims it is customized for the exact state and county, it does not appear to be well-customized for that purpose and I had to use other language (not sourced from the deeds.com document) to meet local norms.

Thank you for your feedback. We really appreciate it. Have a great day!

Pamela B.

May 29th, 2021

The process was not difficult but I don't think that it suited my needs. There were several fields that were not applicable to me but I had to enter something to proceed. I also filled out the other form and mailed it in with some documentation that the electronic service did not ask for. Questions of my attempt are still unanswered. I hope I didn't waste time with this process. We shall see. Thank you.

Thank you!

Nancy J.

September 9th, 2020

It is helpful that an example of filled out form is included.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sylvia H.

July 21st, 2022

Thank you so much for making it easy and professionally trustworthy. You are the best!!!

Thank you!

Anna C.

March 14th, 2022

While I don't know if my filing will be accepted which is the penultimate test, I was happy with the product.

Thank you!

Michelle I.

April 19th, 2022

I'm happy to have found your service. Very pleased.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

DENISE E.

February 25th, 2021

I just submitted a beneficiary deed and it was accepted immediate and then recorded the next day! I like that I receive email messages notifying me of the process. The process was super easy and seamless. It's saved me so much time that I did not have to drive to downtown Phoenix to have this document record it. I love Deeds.com.

Thank you for your feedback. We really appreciate it. Have a great day!

Larry L.

September 18th, 2023

Easy, quick and responsive for recording purposes.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lucinda L.

December 29th, 2021

mostly good; however, you need to update the annual exclusion gift amount from $14,000 to $15,000 (where it has ben for several years), and you need to make your Gift Deed final paragraph be gender neutral like "they" or "he or she" rather than just"he". We women lawyers and our women clients appreciate that.

Thank you for your feedback. We really appreciate it. Have a great day!

James S.

December 2nd, 2020

It worked great. But it turns out I didn't need it.

Thank you!

Elvira N.

January 6th, 2021

Very useful, it even includes a guide on filling out the deed form!

Thank you!

Deborah D.

June 1st, 2023

What I thought was gonna be a long drawn out tedious process was literally 10min tops... The help was quick and a load off. Thanks y'all.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Steven N.

November 7th, 2024

I was introduced to Deeds.com from my title company. I wanted the title company to do a courtesy recording for me and they suggested Deeds.com. Best suggestion in a while. The interface to use the website was seemlessly easy. The communication with the service staff was thorough and prompt. After the initial verification process (which the photo app was a little tricky), everything was easy. Will use them again.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Rene S.

December 23rd, 2022

Amazing forms and great value. That may sound like hyperbole talking about legal forms but it's not, you really are getting way more than you pay for here.

Thank you for your feedback. We really appreciate it. Have a great day!