Fulton County Trustee Deed with Warranty Form

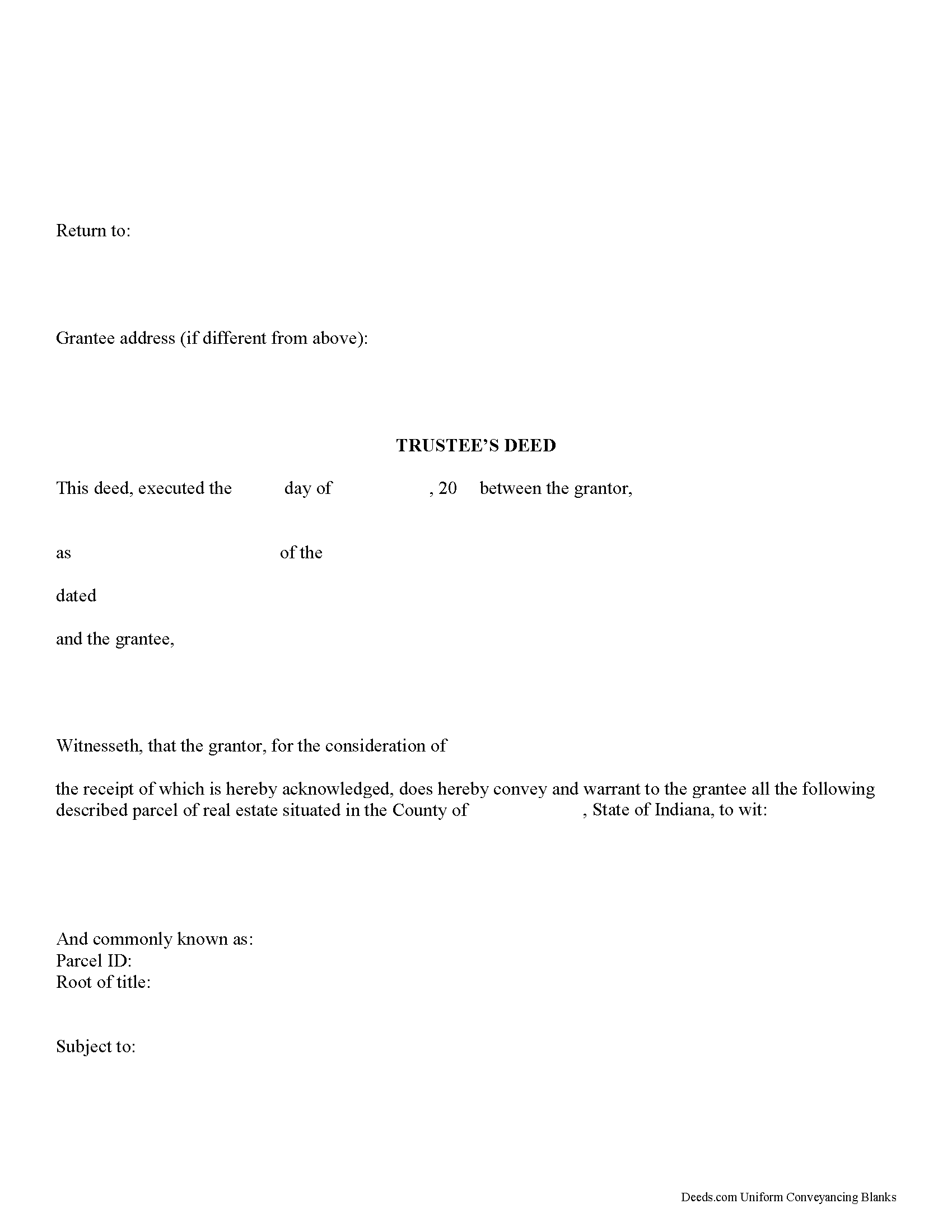

Fulton County Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

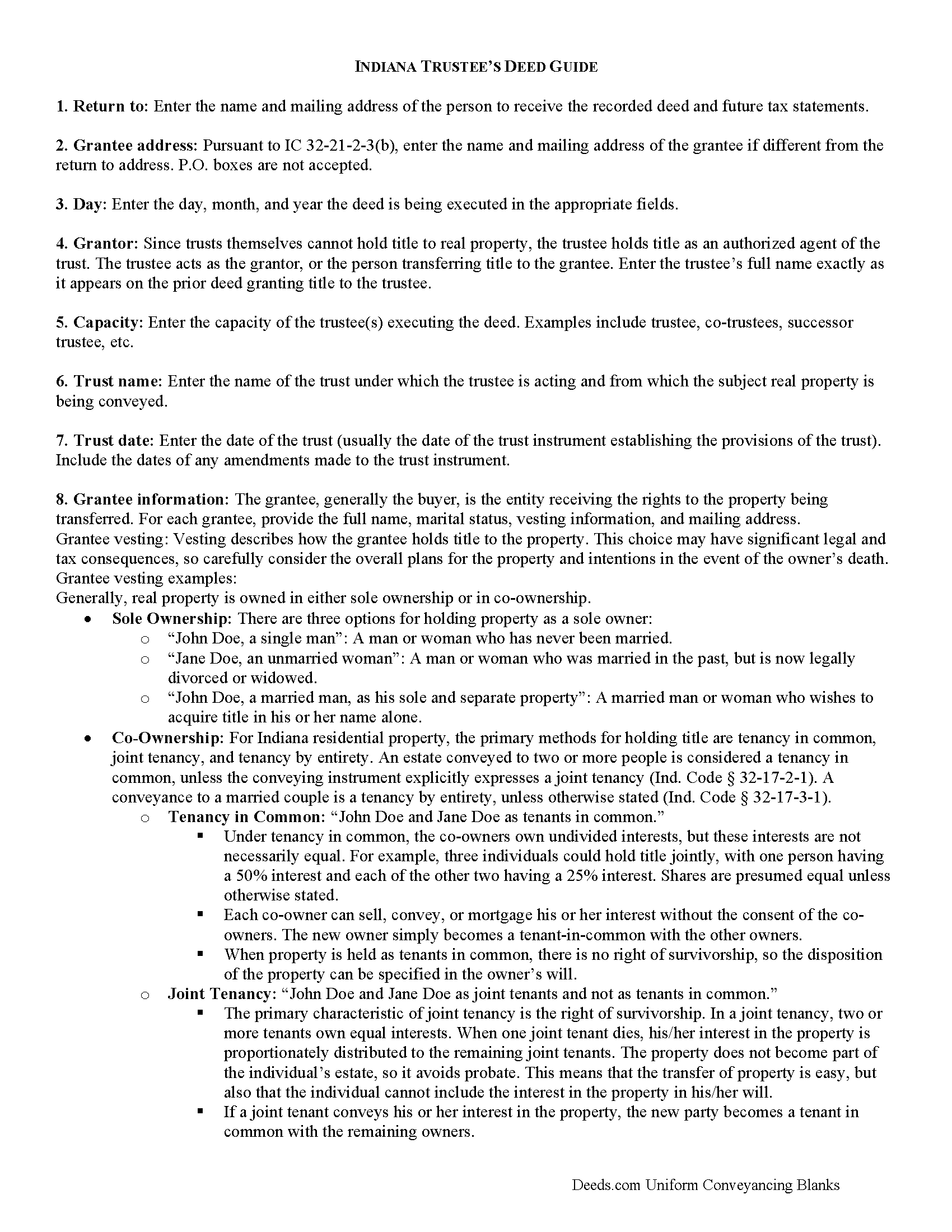

Fulton County Trustee Deed Guide

Line by line guide explaining every blank on the form.

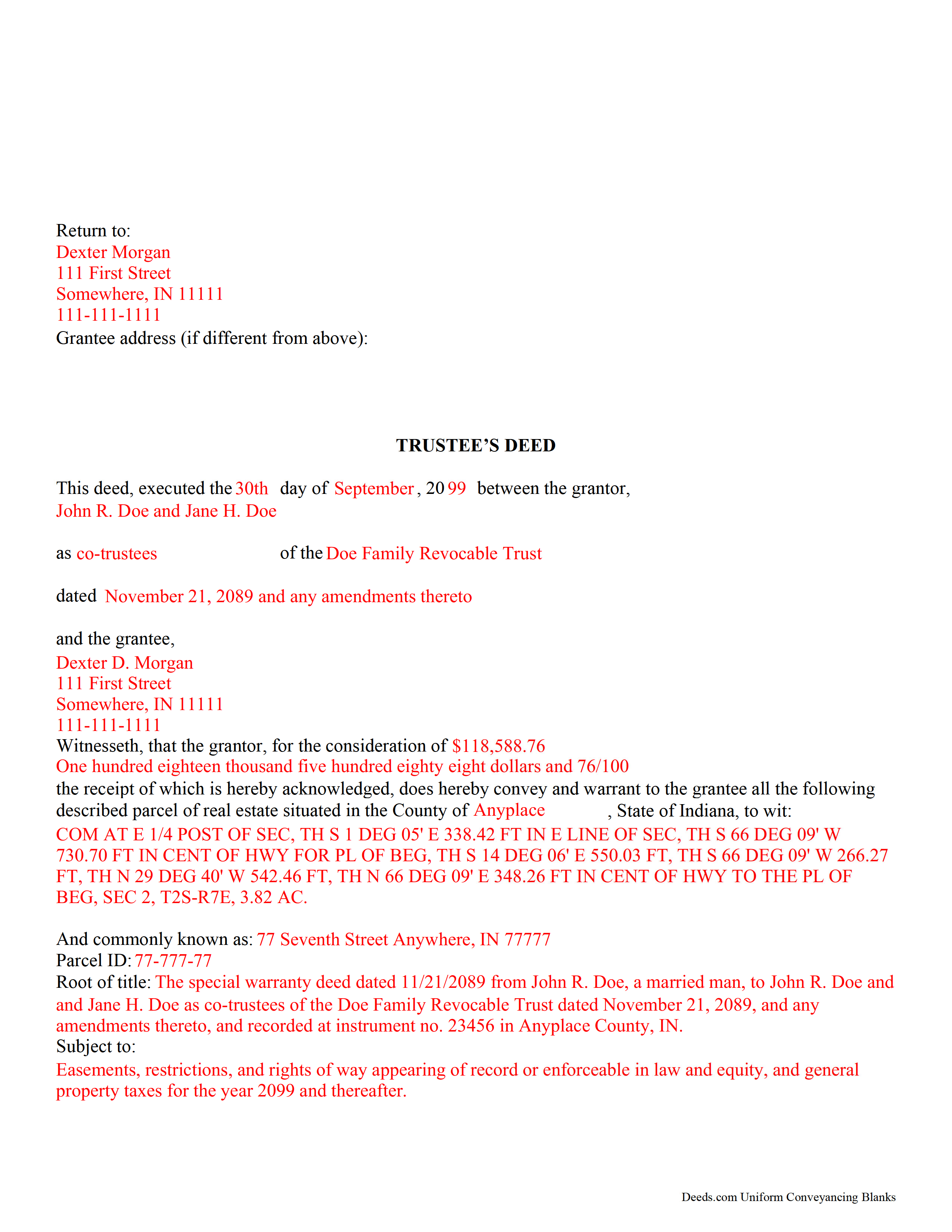

Fulton County Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Indiana and Fulton County documents included at no extra charge:

Where to Record Your Documents

Fulton County Recorder

Rochester, Indiana 46975

Hours: 8:30 to 4:00 M-F

Phone: (574) 223-2914

Recording Tips for Fulton County:

- Bring your driver's license or state-issued photo ID

- Documents must be on 8.5 x 11 inch white paper

- Double-check legal descriptions match your existing deed

- Recorded documents become public record - avoid including SSNs

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Fulton County

Properties in any of these areas use Fulton County forms:

- Akron

- Athens

- Delong

- Fulton

- Grass Creek

- Kewanna

- Leiters Ford

- Rochester

Hours, fees, requirements, and more for Fulton County

How do I get my forms?

Forms are available for immediate download after payment. The Fulton County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Fulton County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Fulton County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Fulton County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Fulton County?

Recording fees in Fulton County vary. Contact the recorder's office at (574) 223-2914 for current fees.

Questions answered? Let's get started!

Trustees use this form to transfer real property located in Indiana out of trust, with warranties of title as set out in Ind. Code 32-17-1-2. The deed should be executed by the trust's acting trustee(s).

A trustee's deed is an instrument used in trust administration to convey real property out of a trust. Unlike other forms of conveyance, which are named for the type of warranties they carry, the trustee's deed is named after the executing trustee.

The trustee is the administrator of a trust who is appointed by the settlor. The settlor is the person who funds the trust with assets -- in this case, real property. The settlor executes a trust instrument, which contains the provisions of the trust, including a designation of the trust's beneficiaries. This document is generally not of public record.

The trustee serves as the grantor in the trustee's deed. If there are multiple trustees or the trustee appears as a successor, this information is included also. The settlor does not enter directly into the transaction. In addition, the deed states the trust name and date under which the trustee is appearing, as well as any amendments made to the trust instrument.

All instruments of conveyance in Indiana require a legal description of the property begin conveyed, the grantee's information, and the root of title, as well as a "prepared by" statement and affirmation statement regarding the redaction of Social Security Numbers. All acting trustees must sign the deed in the presence of a notary public before the deed is recorded in the county in which the real property is situated.

Because trustees act in a fiduciary capacity, they may be asked to provide a certification of trust, demonstrating that the trust exists and their authority to enter into transactions on behalf of the trust.

The trustee's deed may require additional information depending on the situation. These instruments may or may not include warranties of title, so make sure to use the correct form for the situation. Consult a lawyer with specific questions or guidance in preparing a trustee's deed.

Important: Your property must be located in Fulton County to use these forms. Documents should be recorded at the office below.

This Trustee Deed with Warranty meets all recording requirements specific to Fulton County.

Our Promise

The documents you receive here will meet, or exceed, the Fulton County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Fulton County Trustee Deed with Warranty form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Doreen P.

December 13th, 2018

I have uploaded 2 documents for E recording, I have searched thinking it would prompt me to a business customer service contact info tel no. ? I am concerned as to the fees related to the recording of both instruments? please advise? thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Dennis E.

March 21st, 2019

Easy to complete form. Examples were very helpful in using correct verbiage for form. Also way less expensive than the $500 an attorney wanted to charge me for doing the very same thing!!!

Thanks Dennis, we appreciate you taking the time to leave your feedback.

Eduardo A.

January 22nd, 2022

Perfect, blank forms, just what I ordered. Easy to download, understand, and complete.

Thank you!

Roberta J B.

February 17th, 2021

User friendly

Thank you!

Andrew M.

March 20th, 2021

Very easy to find the Quitclaim Deed form I needed. It was correct format and was accepted by my bank.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Freddy S.

August 2nd, 2019

great job

Thank you!

Jorge F.

October 15th, 2021

It would be helpful for documents to be in word format as well and for PDF version not to be locked.

Thank you for your feedback. We really appreciate it. Have a great day!

Gary A.

March 15th, 2019

I believe this is the way to go without the need of a lawyer. Fast downloads, very informative, Now the work starts

Thank you Gary.

Shawn B.

November 17th, 2021

Deeds.com support is very quick and responsive. Would use again and recommend to others in need of e-recording.

Thank you for your feedback. We really appreciate it. Have a great day!

Pauletta C.

February 12th, 2022

worked like a charm

Thank you!

Tisha J.

November 10th, 2021

A quick and efficient way to record! Awesome customer service and SUPER FAST turnaround time.!

Thank you!

Maria S.

January 10th, 2019

The paperwork/forms are fine, but there isn't enough explanation for me to figure out how to file the extra forms (which I do need in my case). The main form, Deed Upon Death is fine. I think the price is pretty high for these forms. I wouldn't have purchased it because there are places to get them for much cheaper (about 6 dollars), but this site had the extra forms I wanted (property in a trust and another form). Unfortunately these were included as a "courtesy" and there are no instructions for them. So three stars for being clear about what was in the package, having the right forms that I need, but instructions for putting them to use and price took a couple of stars off. Downloading was easy and once you download you can type the info into the PDF--that makes working with the forms much easier.

Thank you for the feedback Maria. Regarding the supplement documents, it is best to get assistance from the agency that requires them. These are not legal documents, they should provide full support and guidance for them.

Jeanette S.

September 3rd, 2020

Your site was easy to figure out after a few mistakes on my part. Messages were returned quickly. Very convenient for our recording of documents. I will recommend using this method for recording in future. Thank you for working fast in our recording.

Thank you for your feedback. We really appreciate it. Have a great day!

DONNA P.

July 21st, 2020

Deeds.com was quick, efficient, and cost effective. Deeds.com works with individuals where I found other companies only offer services to title companies, settlement companies, etc. Thank you Deeds.com!

Thank you for your feedback. We really appreciate it. Have a great day!

Mary H.

January 31st, 2019

Your site was very informative and I was able to instantly and easily download the documents that I needed. I could not be happier with your service. Thank You Mary Harju

Thank you Mary, we really appreciate your feedback.