Davis County Conditional Lien Waiver on Final Payment Form (Iowa)

All Davis County specific forms and documents listed below are included in your immediate download package:

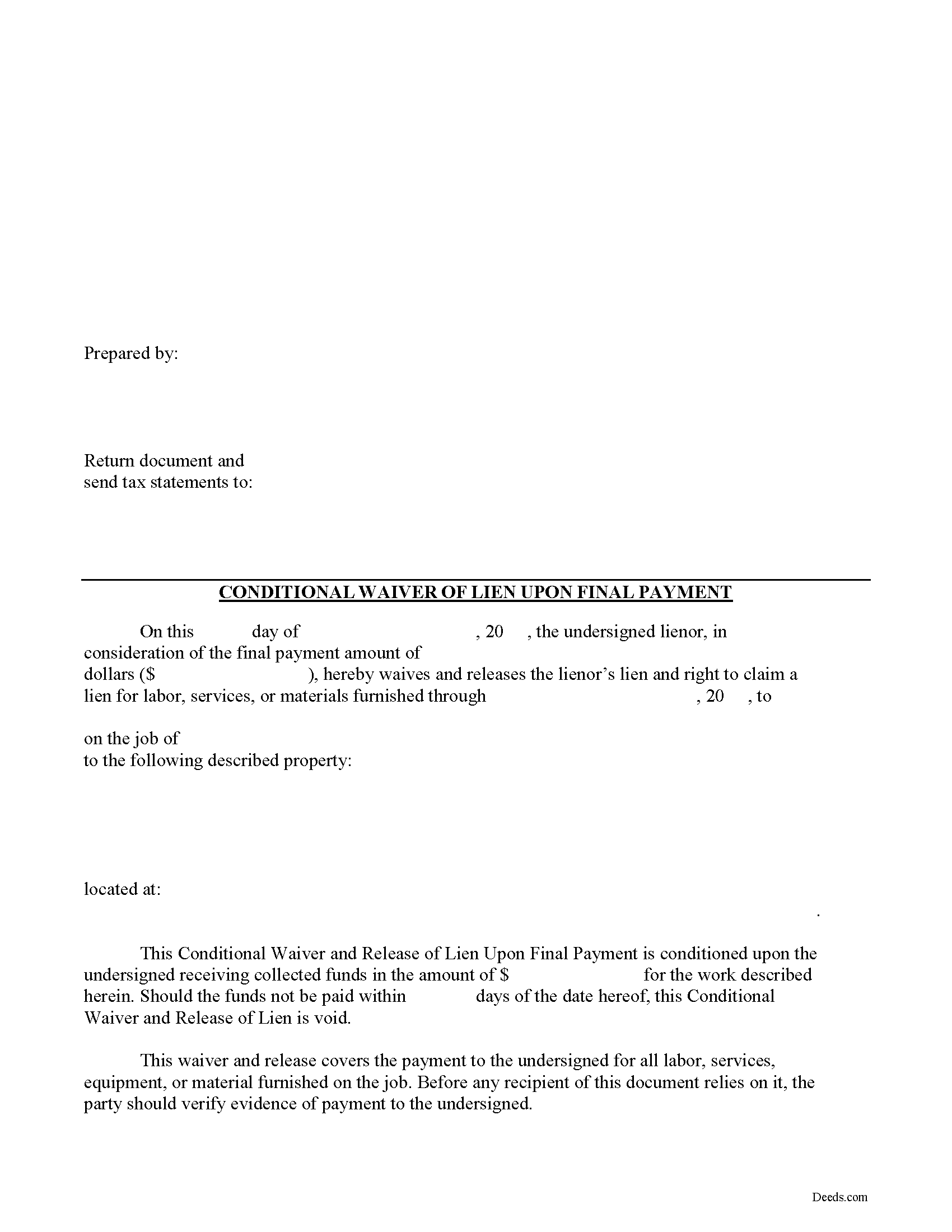

Conditional Lien Waiver on Final Payment Form

Fill in the blank Conditional Lien Waiver on Final Payment form formatted to comply with all Iowa recording and content requirements.

Included Davis County compliant document last validated/updated 6/10/2025

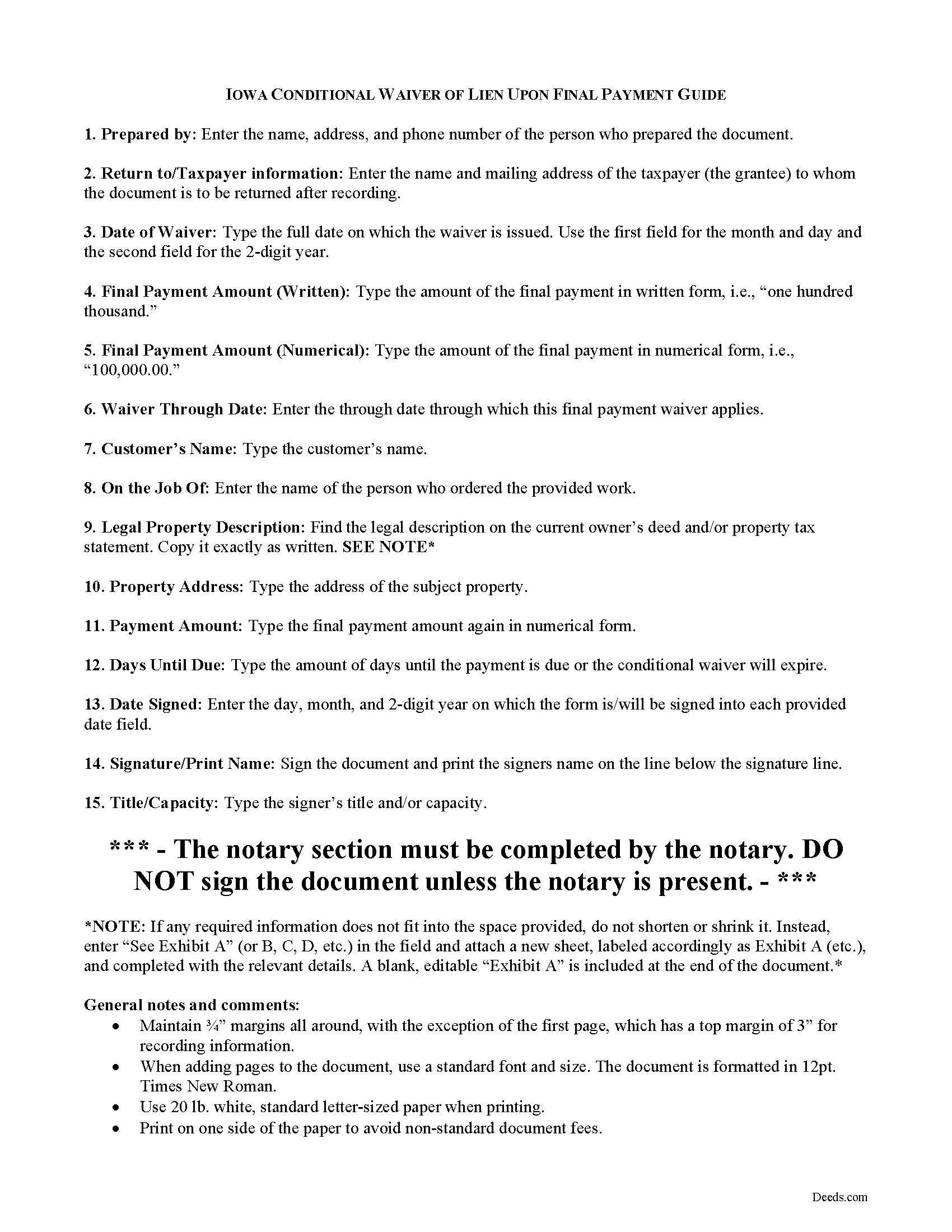

Conditional Lien Waiver on Final Payment Guide

Line by line guide explaining every blank on the form.

Included Davis County compliant document last validated/updated 5/15/2025

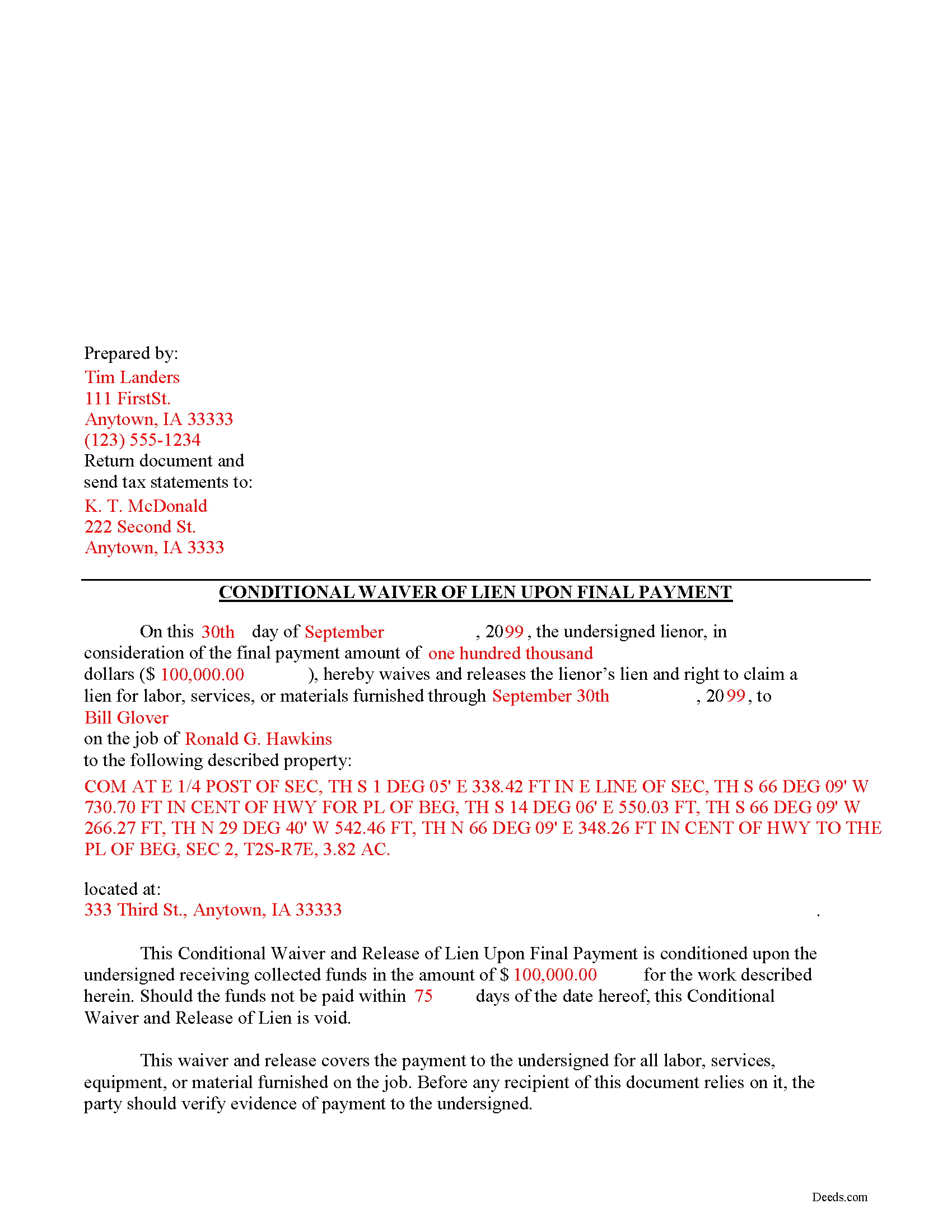

Completed Example of the Conditional Lien Waiver on Final Payment Document

Example of a properly completed form for reference.

Included Davis County compliant document last validated/updated 6/19/2025

The following Iowa and Davis County supplemental forms are included as a courtesy with your order:

When using these Conditional Lien Waiver on Final Payment forms, the subject real estate must be physically located in Davis County. The executed documents should then be recorded in the following office:

Davis County Recorder

100 Courthouse Sq, Suite 7, Bloomfield, Iowa 52537

Hours: 7:30 to 4:30 Monday through Friday

Phone: (641) 664-2321

Local jurisdictions located in Davis County include:

- Bloomfield

- Drakesville

- Floris

- Pulaski

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Davis County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Davis County using our eRecording service.

Are these forms guaranteed to be recordable in Davis County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Davis County including margin requirements, content requirements, font and font size requirements.

Can the Conditional Lien Waiver on Final Payment forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Davis County that you need to transfer you would only need to order our forms once for all of your properties in Davis County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Iowa or Davis County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Davis County Conditional Lien Waiver on Final Payment forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Mechanic's liens are governed under Chapter 572 of Iowa Code. A waiver is a conscious relinquishment of a right. In this case, the person granting the waiver is relinquishing the right to seek a mechanic's lien for all or part of the amount due. This assurance is usually enough to get the other party to pay. In Iowa, there are no statutory forms for waivers although according to the principles of contract law, the parties may agree to such modifications in writing.

Generally, waivers come in four varieties: conditional or unconditional, and based on a partial/progress or final payment. Conditional waivers only become effective after the responsible party's check clears the bank on which it was drawn, and provide more protection for the claimants. Unconditional waivers go into effect immediately, tend to favor the owners' interests, and should only be used after payment is confirmed. Waiving lien rights after a partial payment allows the claimant to retain some lien rights, but to release others based on the amount paid on the overall balance due. Waivers upon final payments remove the claimant's eligibility to place a lien because they state that the account is paid in full.

Regardless of the nature, waivers must identify the parties, the location of the project, relevant dates, and payments.

Claimants might use a final conditional waiver when the full and final payment is made, but concerns exist about the payment method. For instance, if there are any concerns a final check won't clear, opt for a conditional waiver. The waiver is only effective upon the payment going through within a specified number of days.

This article is provided for informational purposes only and should not be relied upon as a substitute for the advice from a legal professional. Please contact an Iowa attorney with any questions about sending notice to property owners or anything else with regard to mechanic's liens.

Our Promise

The documents you receive here will meet, or exceed, the Davis County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Davis County Conditional Lien Waiver on Final Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4564 Reviews )

Michael G.

July 14th, 2025

Very helpful and easy to use

Your appreciative words mean the world to us. Thank you.

JAMES D.

July 10th, 2025

Slick as can be and so convenient.rnrnWorked like a charm

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Joseph H.

May 21st, 2019

Form needed was accessed easily and printed for use

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Virginia M.

August 26th, 2020

This was the easiest web page ive ever navigated .Found just what i needed fast !

Thank you!

Ralph H.

October 22nd, 2022

They must have busy when I applied. The screen said it should be done in under10 mins unless heavier traffic. I was a little nervous because of a time deadline. It was completed in 45 mins and for under $30 it was worth every penny to have my deed details at my fingertips. So I give it a 5 on ease of use and quick handling. You can get it done less expensively, but great in a time crunch.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

WJ H.

December 6th, 2021

The Quit Claim Deed for the state of Ohio worked for me, saving me the cost of an attorney doing it. O.K., maybe that wouldn't have amounted to more than a few hundred dollars, but anywhere I thought I could save money (and learn something new on top of it) is something I want to do.

That said, be forwarned. While I'm not an attorney I'm not averse to spending many hours researching the lingo found in this kind of form and thoroughly understanding exactly how everything has to be filled in.

I should add that my ex-wife and I remain friends and she was the one giving me the property/house (thus, technically I filled out the forms on her behalf). Because there was no personal conflict, it made it easier to undertake.

Lastly, what others have said about the county office where you must file a Quit Claim Deed not being helpful, that's true in the sense that they do not want to be instructing non-attorneys on filling out the necessary forms. I did take a preliminary draft set of the forms to the county office but was VERY CAREFUL about explaining that I only needed a couple of questions answered about procedure for submitting the final documents. They were helpful once I made it clear I wasn't asking them for "legal advice". And their help was critical as the final submittals requires stopping at three different offices (MapDocuments, Auditor and finally the Recorder's office).

So I say thank you to Deeds.com. Their service for the Quit Claim Deed was invaluable.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Edward S.

June 10th, 2020

I was able to e-record 3 document with ease. The Middlesex registry of deeds is closed due to COVID-19 and this was my only option. Even if it was open, this is much faster and saves me time and money on parking ..etc. Great services.

Thank you!

Jeremy C.

May 13th, 2021

Really impressed with the speed and professionalism of the service. I would recommend putting a grey background on the form field inputs as I had trouble seeing them in the user interface, but otherwise I was really impressed and would happily return as a customer.

Thank you for your feedback. We really appreciate it. Have a great day!

Dorothy J F.

May 9th, 2024

Appreciated the prompt answers to my inquiries…

We are grateful for your engagement and feedback, which help us to serve you better. Thank you for being an integral part of our community.

David J.

November 12th, 2019

Excellent documents, downloaded quick, completed and printed with no problems. Thank you

Thank you!

James B.

June 9th, 2019

Reliable and fast. A great assest.

Thank you!

David C.

February 7th, 2021

I found it pretty easy to navigate, all worked well. Need a better example of excise tax. Lastly, your link in the email to get to this page doesn't work :)

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

james h.

June 15th, 2020

Service was quick and easy to use. I got not only the necessary forms, but instructions and sample forms filled out. Highly recommended.

Thank you!

Barbara M.

August 2nd, 2020

Easy to do.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!