Hamilton County Contractor Notice to Owner Form (Iowa)

All Hamilton County specific forms and documents listed below are included in your immediate download package:

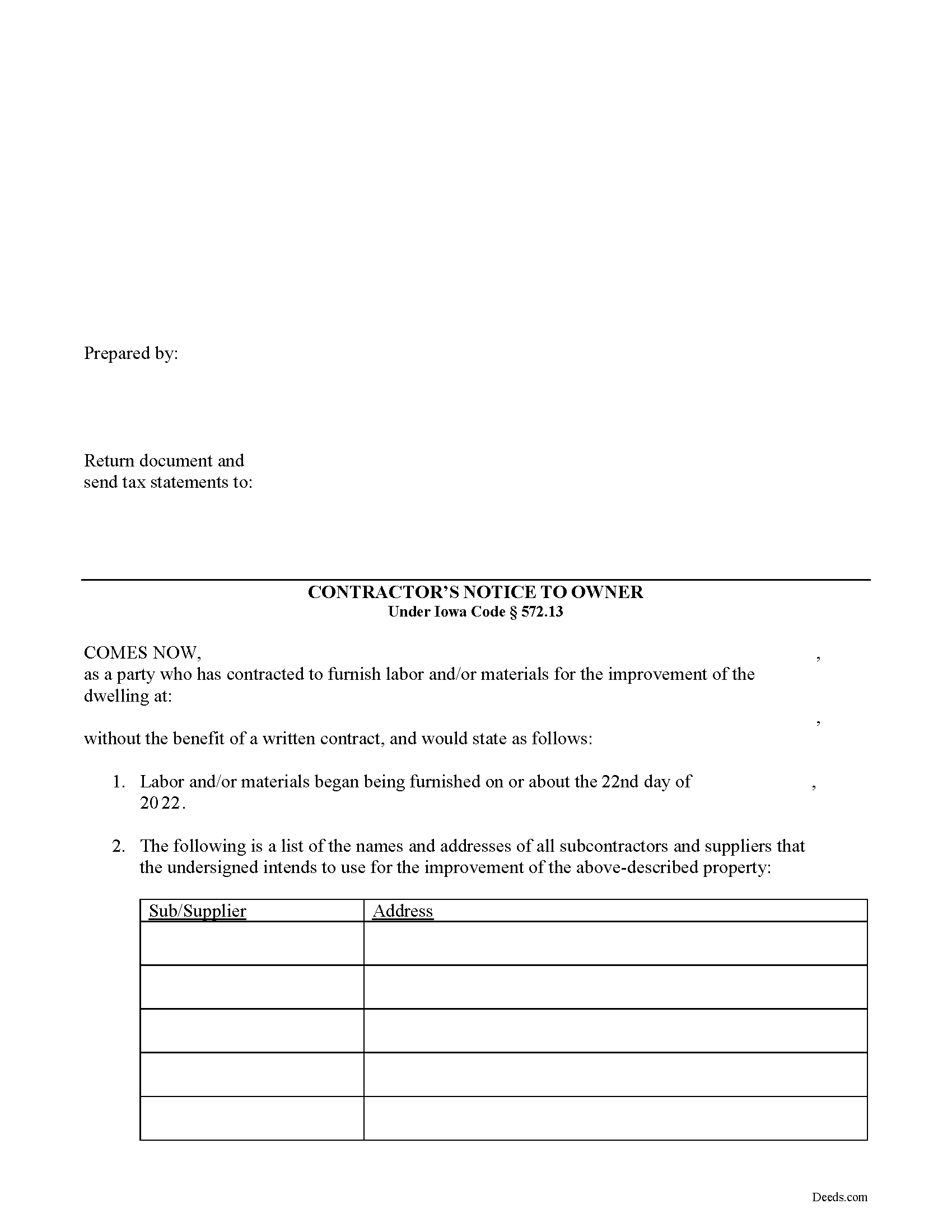

Contractor Notice to Owner Form

Fill in the blank Contractor Notice to Owner form formatted to comply with all Iowa recording and content requirements.

Included Hamilton County compliant document last validated/updated 5/2/2025

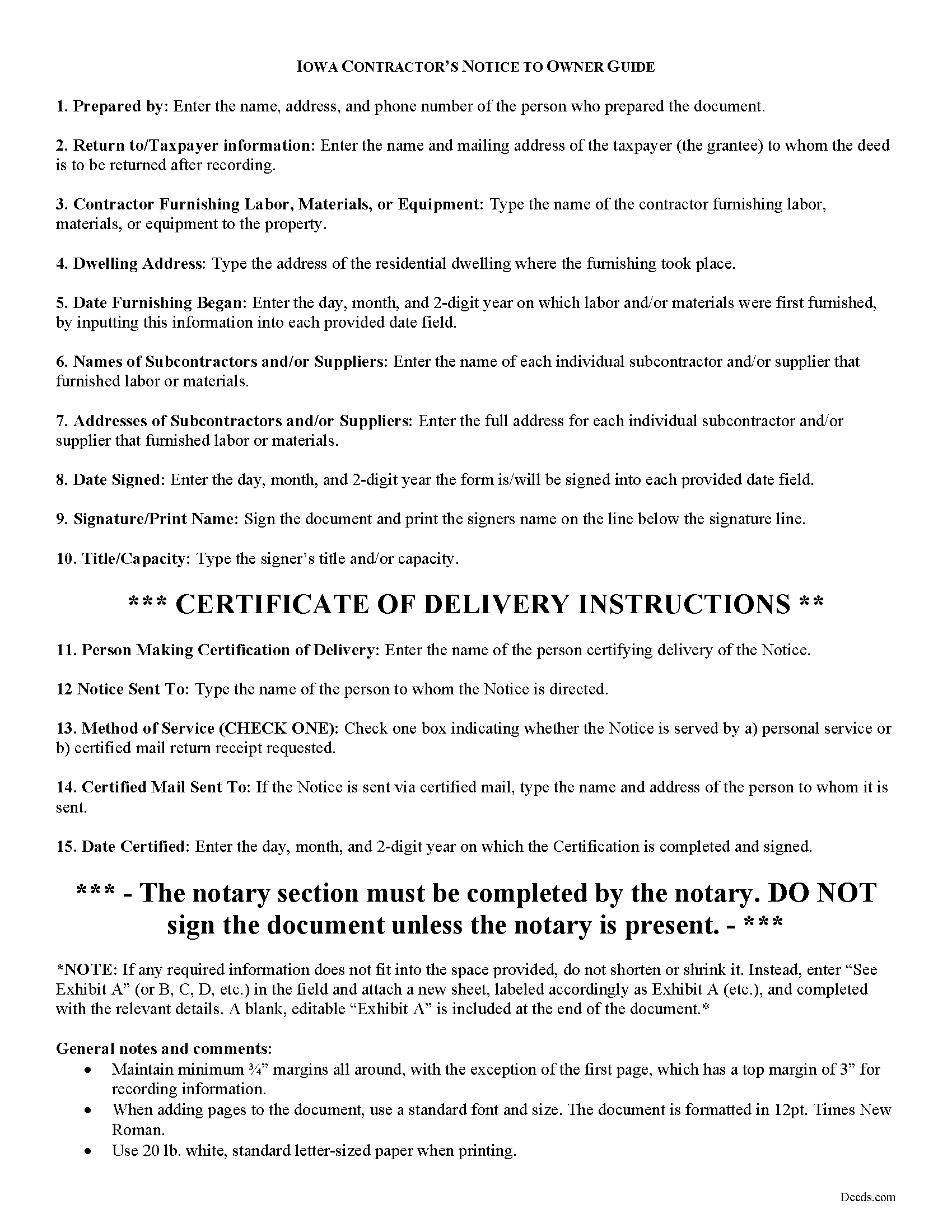

Contractor Notice to Owner Guide

Line by line guide explaining every blank on the form.

Included Hamilton County compliant document last validated/updated 6/9/2025

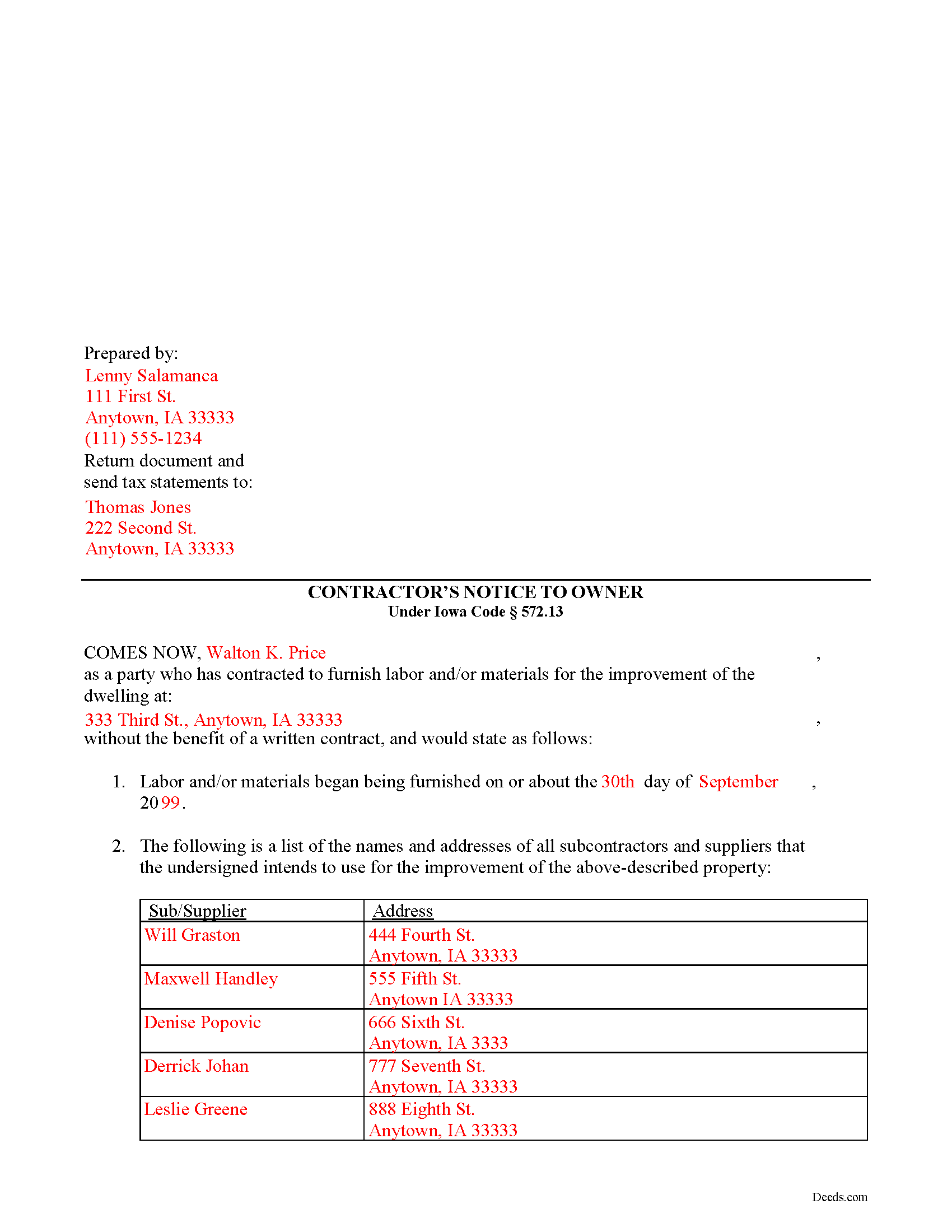

Completed Example of the Contractor Notice to Owner Document

Example of a properly completed form for reference.

Included Hamilton County compliant document last validated/updated 4/28/2025

The following Iowa and Hamilton County supplemental forms are included as a courtesy with your order:

When using these Contractor Notice to Owner forms, the subject real estate must be physically located in Hamilton County. The executed documents should then be recorded in the following office:

Hamilton County Recorder

2300 Superior St, Suite 6 / PO Box 126, Webster City, Iowa 50595

Hours: 8:00am to 4:30pm M-F

Phone: (515) 832-9535

Local jurisdictions located in Hamilton County include:

- Blairsburg

- Ellsworth

- Jewell

- Kamrar

- Randall

- Stanhope

- Stratford

- Webster City

- Williams

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Hamilton County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Hamilton County using our eRecording service.

Are these forms guaranteed to be recordable in Hamilton County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hamilton County including margin requirements, content requirements, font and font size requirements.

Can the Contractor Notice to Owner forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Hamilton County that you need to transfer you would only need to order our forms once for all of your properties in Hamilton County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Iowa or Hamilton County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Hamilton County Contractor Notice to Owner forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Liability of an Owner to the Original Contractor in Iowa

An owner of a building, land, or improvement upon which a subcontractor's mechanic's lien may be filed, is not required to pay the original contractor any compensation for work done or material furnished for the building, land, or improvement until the expiration of ninety (90) days after the completion of the building or improvement. I.C. 572.13(1). However, payment may be due sooner if the original contractor furnishes the owner with one of the following: a) receipts and waivers for any claims for mechanics' liens, signed by all persons who furnished material or performed labor for the building, land, or improvement; or b) good and sufficient bond to be approved by the owner, on the condition that the owner will be relieved from liability for any loss which the owner may sustain by reason of the filing of mechanics' liens by subcontractors. I.C. 572.13(1).

An original contractor entering into a contract for an owner-occupied dwelling and who has contracted or will contract with a subcontractor to provide labor or furnish material for the dwelling must include the following notice in any written contract with the owner and shall provide the owner with a copy of the written contract:

"Persons or companies furnishing labor or materials for the improvement of real property may enforce a lien upon the improved property if they are not paid for their contributions, even if the parties have no direct contractual relationship with the owner."

I.C. 572.13(2).

If there is no written contract between the original contractor and the dwelling owner, the original contractor must, within ten (10) days of commencement of work on the dwelling, provide a written notice to the dwelling owner stating the name and address of all subcontractors that the contractor intends to use for the construction and, that the subcontractors or suppliers may have lien rights in the event they are not paid for their labor or material used on this site. Id. The notice must be updated as additional subcontractors and suppliers are used from the names disclosed on any earlier notices. Id.

This notice is essential as any original contractor who fails to provide notice is not entitled to lien rights. Id.

This article is provided for informational purposes only and should not be relied upon as a substitute for the advice from a legal professional. Please contact an Iowa attorney with any questions about sending notice to a dwelling owner or anything else with regard to mechanic's liens.

Our Promise

The documents you receive here will meet, or exceed, the Hamilton County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hamilton County Contractor Notice to Owner form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4563 Reviews )

JAMES D.

July 10th, 2025

Slick as can be and so convenient.rnrnWorked like a charm

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Kathleen T.

March 25th, 2020

Perfect in every way, the guide was a big help in a few areas that I had questions on. Overall the average person should have no issues with the forms.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Steven b.

November 21st, 2021

We used this document in 2018 and it was acceptable to Jackson County Missouri. It worked and is valid.

Very happy with the product.

Thanks for the kind words, glad to see you back again. Have a great day!

Margie H.

June 9th, 2021

Great

Thank you!

Timmy S.

December 18th, 2019

The form gave me a perfect place to start. I was looking for something regarding time-shares, so the form was not perfect, but the register of deeds worked with me to get it right. I would not have even been able to start without the form from deeds.com

Thank you for your feedback. We really appreciate it. Have a great day!

Lisa D.

February 3rd, 2020

Love this site! They are very fast in retrieving information. Will use this site again.

Thank You for this service!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Earnest K.

January 8th, 2025

I used the "personal representative's deed." There were a few errors, after I went to record it at the county recorder's office. For #7, it should've stated "The estate of Joe Schmoe, hereby grants Mr. Personal Representative....." instead of, "I Mr. Personal Representative, as personal representative, hereby grant to personal representative...." rnrnThe person at the recorder's office said you cannot state "you are granting property to yourself."rnrnJust fix that, and everything else is fine.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Sheila P.

August 16th, 2021

My first time using Deeds.com. Loved the process.

It was quick, easy and Deeds.com provided timely responses. Definitely appreciate not having to make a trip to the recorder of deeds.

Thank you for your feedback. We really appreciate it. Have a great day!

David L.

November 19th, 2021

Good quick service. The forms helped guide and explain each section and question.

Thank you for your feedback. We really appreciate it. Have a great day!

John K.

December 28th, 2020

The sample completed form was a big help. While not exactly on point with my situation, it was enough to help me complete it on my own

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jean T.

January 3rd, 2024

It's wonderful that these forms are easily accessible!

Thank you for your feedback. We really appreciate it. Have a great day!

Joseh R.

May 6th, 2020

Very pleased! Forms easy to understand and use. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Paul R.

October 22nd, 2021

Worked very quickly and smoothly.

Helps if you know what documents you need. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!