Calhoun County Correction Deed Form

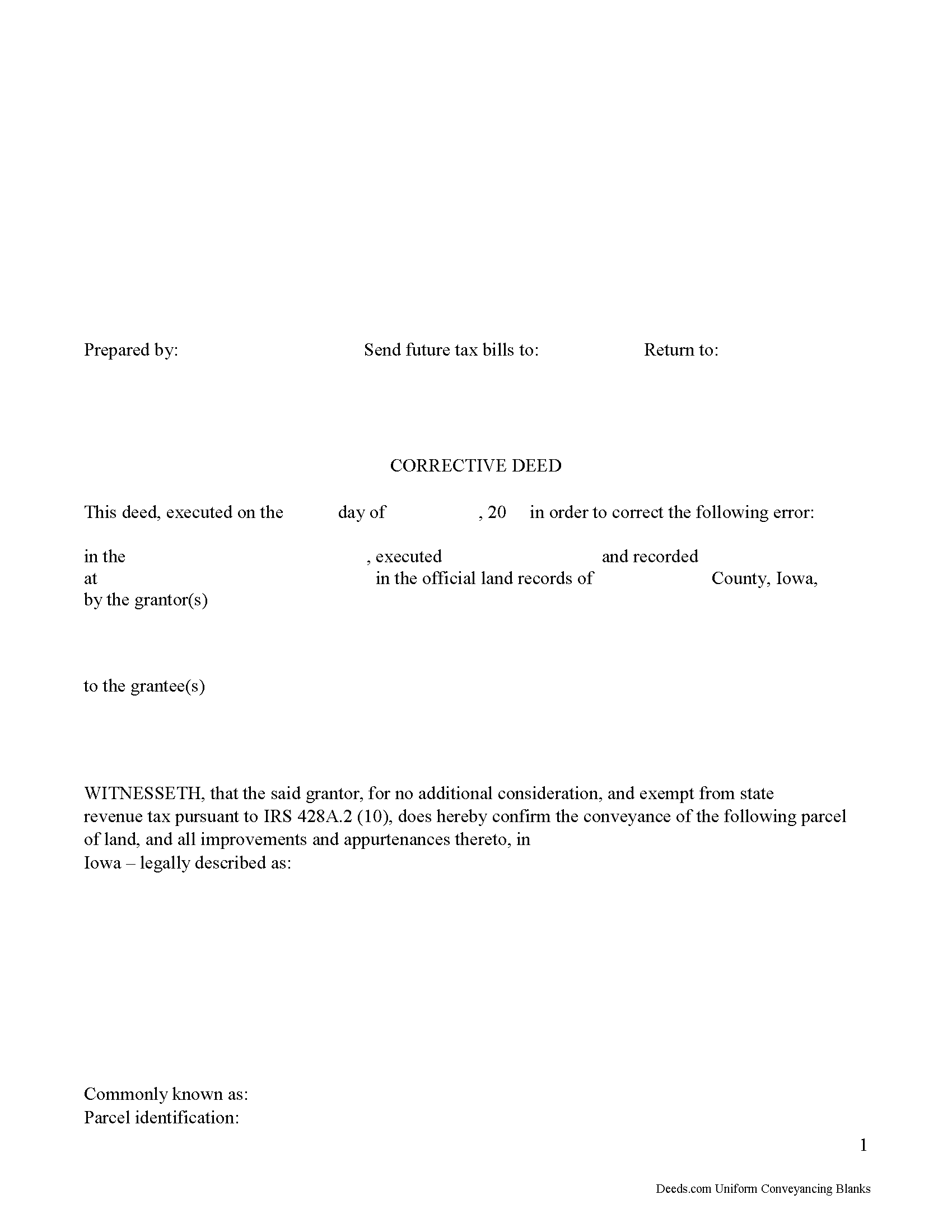

Calhoun County Corrective Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

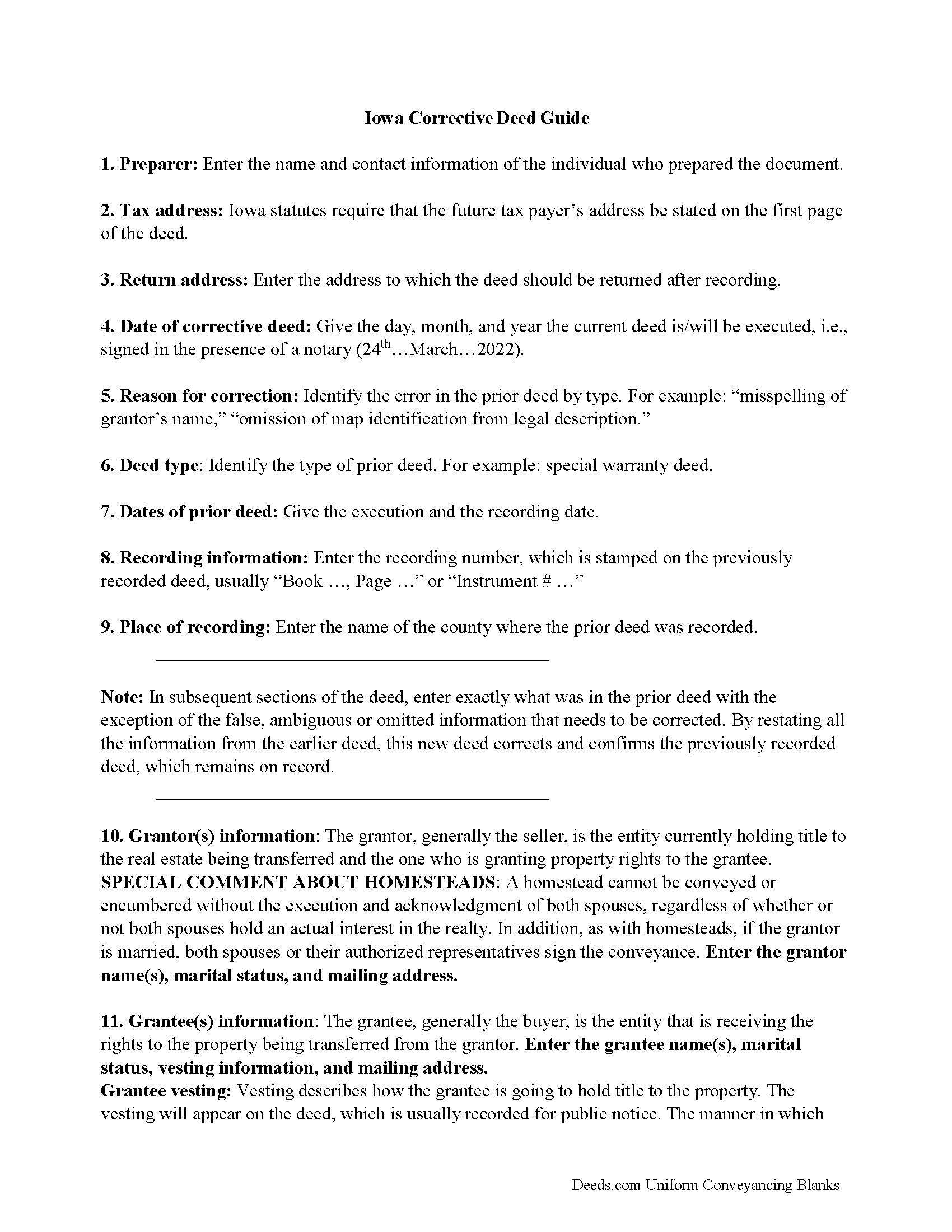

Calhoun County Corrective Deed Guide

Line by line guide explaining every blank on the form.

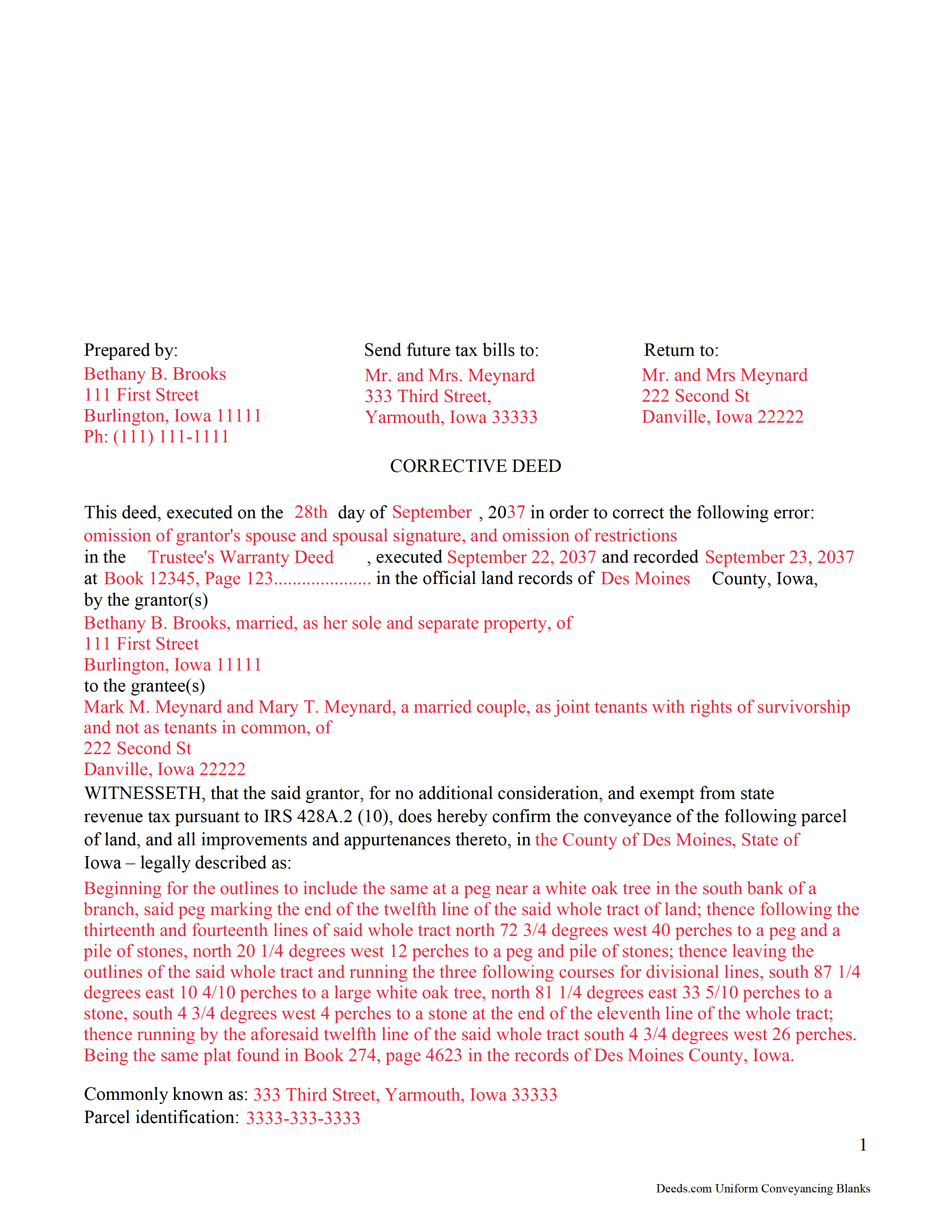

Calhoun County Completed Example of the Corrective Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Iowa and Calhoun County documents included at no extra charge:

Where to Record Your Documents

Calhoun County Recorder

Rockwell City, Iowa 50579

Hours: 8:30 to 4:30 M-F

Phone: (712) 297-8121

Recording Tips for Calhoun County:

- Bring your driver's license or state-issued photo ID

- Recorded documents become public record - avoid including SSNs

- Multi-page documents may require additional fees per page

Cities and Jurisdictions in Calhoun County

Properties in any of these areas use Calhoun County forms:

- Farnhamville

- Jolley

- Knierim

- Lake City

- Lohrville

- Lytton

- Manson

- Pomeroy

- Rockwell City

- Somers

Hours, fees, requirements, and more for Calhoun County

How do I get my forms?

Forms are available for immediate download after payment. The Calhoun County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Calhoun County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Calhoun County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Calhoun County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Calhoun County?

Recording fees in Calhoun County vary. Contact the recorder's office at (712) 297-8121 for current fees.

Questions answered? Let's get started!

In Iowa, use a correction deed to amend a previously recorded deed that contains a minor error.

A corrective deed is, in effect, an explanation and correction of an error in a prior instrument. As such, it passes no title and, except for the corrected item, reiterates and confirms the prior conveyance. It should be executed from the original grantor to the original grantee, and it needs to be recorded in order to be legally valid.

The correction deed must reference the original conveyance by type of error, date of execution and recording, as well as by recording number and location. Beyond that, it restates the information given in the prior deed, which remains on record and receives a cross-reference to the corrective instrument.

Deeds of correction are most appropriate for minor errors and omissions in the original deed, such as misspelled names, omission of marital status, or typos in the legal description. More substantial changes, such as adding a name to the title, changing the vesting information or the legal description of the property, may require a new deed of conveyance instead of a correction deed.

Correction deeds are exempt from state revenue tax pursuant to IRS 428A.2 (10) that exempts "deeds which, without additional consideration, confirm, correct, modify, or supplement a deed previously recorded." The exemption needs to be identified on the deed itself, or the declaration of value form must be submitted with the deed.

(Iowa Correction Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Calhoun County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Calhoun County.

Our Promise

The documents you receive here will meet, or exceed, the Calhoun County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Calhoun County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

David S.

March 7th, 2022

Very good website. All government should be that clear and efficient.

Thank you!

Tammy S.

October 6th, 2022

Easy to download, great guidelines, and samples of each form needed.

Thank you!

Joy Lynn W.

December 31st, 2020

Timely response and helpful....good job!

Thank you!

Celestine U.

February 24th, 2020

Very well done

Thank you!

Carolyn D.

March 18th, 2022

The sight provided exactly what I needed and was easy to use. I was able to download the type of Deed I used and was completely satisfied with the website.

Thank you!

Jacqueline H.

February 4th, 2021

Thank you for all your assistance and patience in doing the deed. I can honestly say that DEEDs.com will be permanently on my list as a go to company. I will use the company as a referral to friends and family.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Riley K G.

June 23rd, 2022

Awesome, way better than some other offerings out there. Unfortunately some people won't realize that until it's too late.

Thank you!

Armando R.

February 17th, 2021

Great service, quick and affordable. Thank you!

Thank you!

Terri B.

April 5th, 2021

It's worth the money. I would like to have seen a variety of examples showing different scenarios for completing a quitclaim deed.

Thank you!

Marc P.

March 4th, 2021

Simple and fast!

Thank you for your feedback. We really appreciate it. Have a great day!

Dorothea B.

October 2nd, 2019

The Affidavit- Death of Joint Tenant form you provided is not the same form as showed on the Los Angeles County property tax website. It appears that the LA county form requires entering additional info that is not included in your form.

Thank you!

DONALD L P.

January 15th, 2019

HAD WRONG PASSWORD; PROGRAM MADE CHANGE EASY.

Thank you!

AKILAH S.

March 14th, 2024

It was a little challenging and I had to call to speak to someone a few time but I got it done and and over with so I'm happy.

It was a pleasure serving you. Thank you for the positive feedback!

Donna G.

April 26th, 2023

Very happy with this service, comprehensive detailed instructions as well as correct forms for my location

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gary B.

September 28th, 2021

The whole experience was amazing. Your site was easy to work with and the staff was supper responsive. We were in and out in a flash!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!