Calhoun County Court Officer Deed Form

Calhoun County Court Officer Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

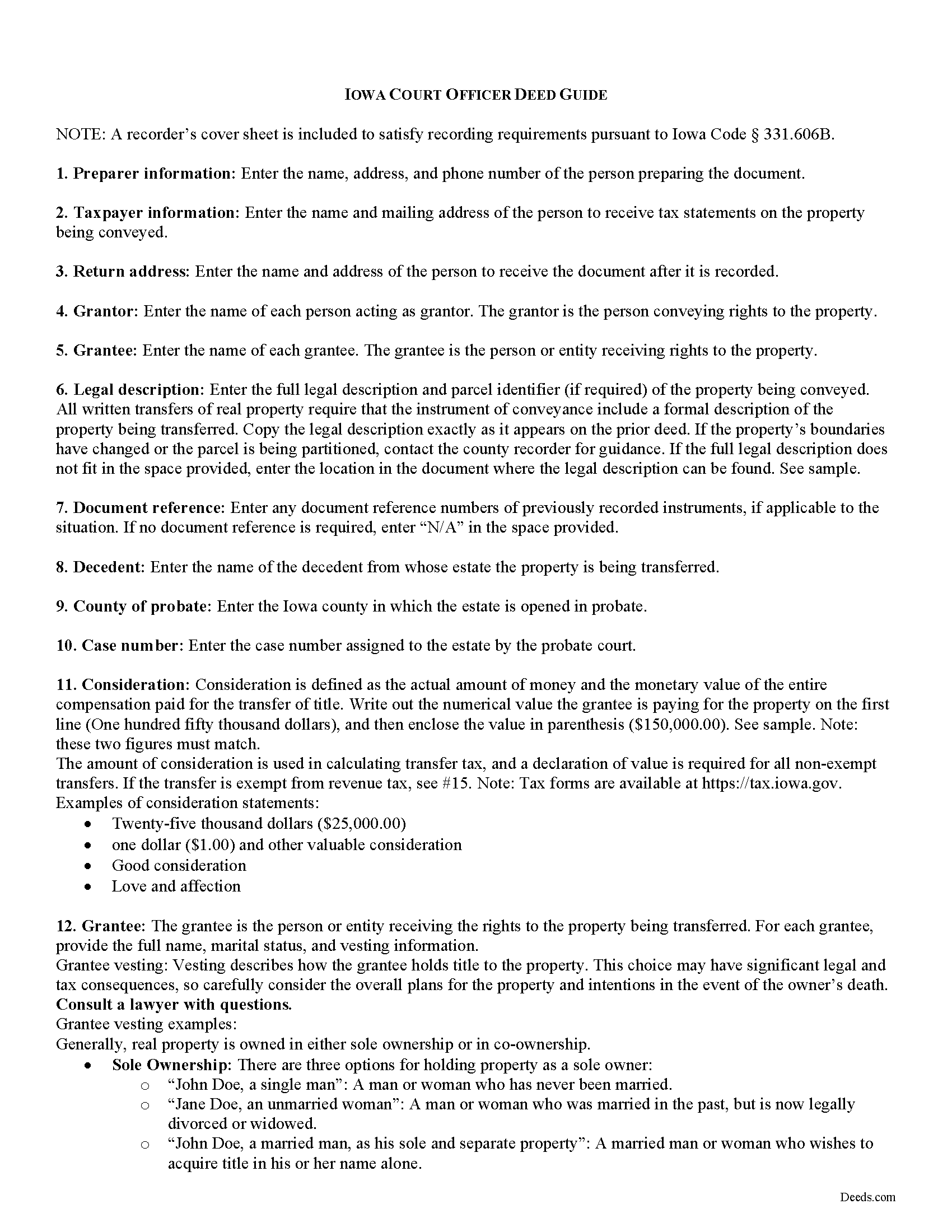

Calhoun County Court Officer Deed Guide

Line by line guide explaining every blank on the form.

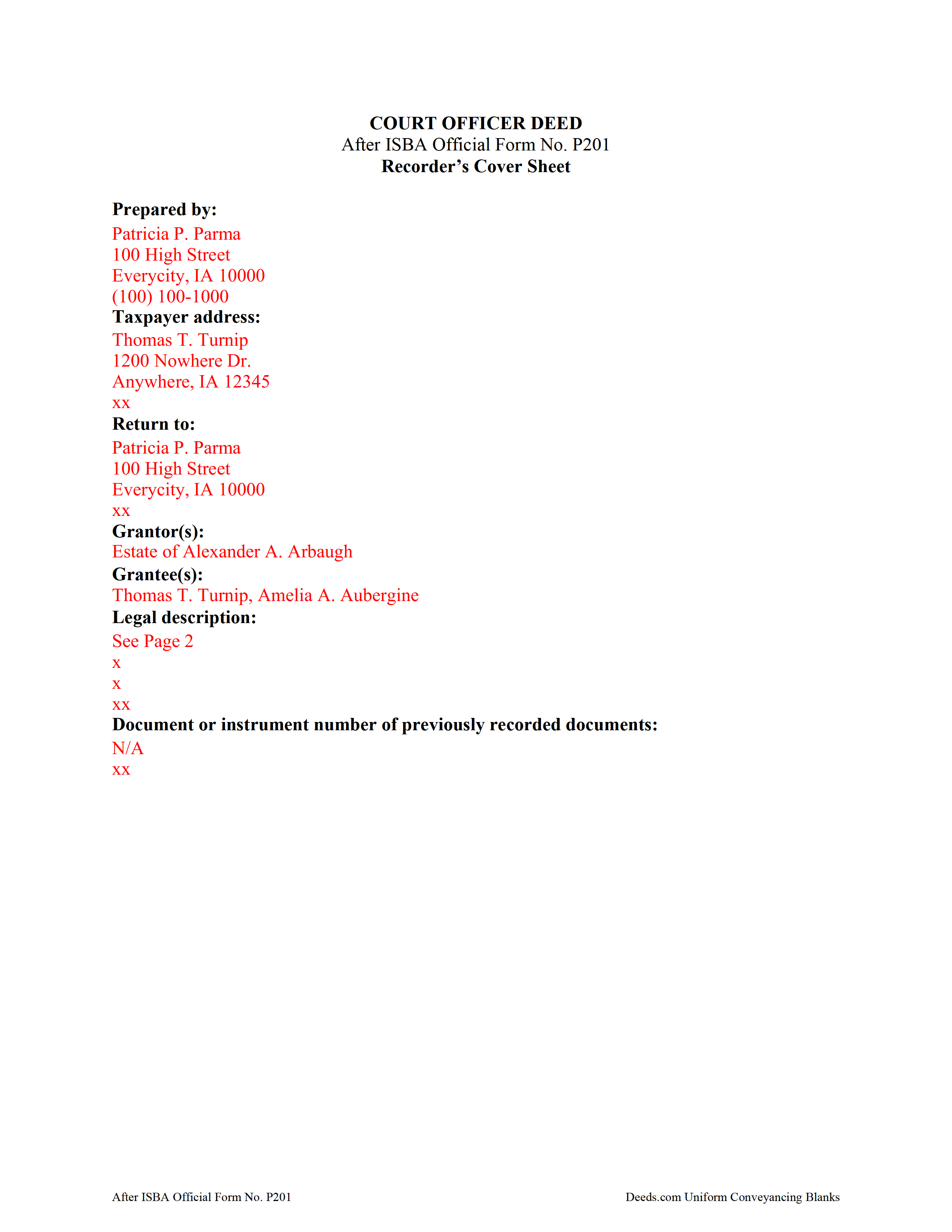

Calhoun County Completed Example of the Court Officer Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Iowa and Calhoun County documents included at no extra charge:

Where to Record Your Documents

Calhoun County Recorder

Rockwell City, Iowa 50579

Hours: 8:30 to 4:30 M-F

Phone: (712) 297-8121

Recording Tips for Calhoun County:

- Ensure all signatures are in blue or black ink

- Leave recording info boxes blank - the office fills these

- Recording fees may differ from what's posted online - verify current rates

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Calhoun County

Properties in any of these areas use Calhoun County forms:

- Farnhamville

- Jolley

- Knierim

- Lake City

- Lohrville

- Lytton

- Manson

- Pomeroy

- Rockwell City

- Somers

Hours, fees, requirements, and more for Calhoun County

How do I get my forms?

Forms are available for immediate download after payment. The Calhoun County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Calhoun County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Calhoun County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Calhoun County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Calhoun County?

Recording fees in Calhoun County vary. Contact the recorder's office at (712) 297-8121 for current fees.

Questions answered? Let's get started!

When a property owner dies in Iowa, title to his or her real property passes by means of the decedent's will, or, in the absence of a will, via the laws of intestate succession established in the probate code, codified at chapter 633 of the Iowa Code.

Probate is the court procedure through which a decedent's will is proved and his or her estate is settled. The probate process takes place in the county in which the decedent was domiciled at the time of his or her death.

Pursuant to designation in the decedent's will or priority to administer the decedent's estate, as established by Iowa Code 633.227, the court appoints a personal representative (PR) who will oversee the estate's administration. The PR is either called an executor, when named by a decedent's will, or an administrator, in the absence of a will or lack of designation in a will. Regardless, the fiduciary duties of the personal representative remain the same, including marshalling the decedent's assets, paying debts and valid claims on the estate, and distributing the remainder of the estate to beneficiaries.

Title to real property that does not transfer outside of the probate process by means of a survivorship interest or trust must pass by means of a deed. Depending on the situation, a PR may be directed by the terms of a will to sell real property, or might need to consolidate the estate by selling property. The PR will need to petition the court for an order of sale if a power of sale is not set forth in a will. In Iowa, PRs use a court officer deed to transfer property from a decedent's estate to a distributee or purchaser.

A court officer's deed must meet all state and local standards, and might also require additional supporting documentation. The completed deed is executed and signed by the PR of the decedent's estate and recorded in the office of the recorder of land records in the county where the subject real property is situated. Iowa requires additional documentation when recording land records, including a Ground Water Hazard Statement (GWHS) and a Declaration of Value (DOV), unless a revenue tax exemption is claimed on the face of the conveyancing document.

As always, consult a lawyer with any questions regarding estate administration and court officer deeds in Iowa.

(Iowa Court Officer Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Calhoun County to use these forms. Documents should be recorded at the office below.

This Court Officer Deed meets all recording requirements specific to Calhoun County.

Our Promise

The documents you receive here will meet, or exceed, the Calhoun County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Calhoun County Court Officer Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Alan E.

August 11th, 2021

I couldn't be happier with this service. They're helpful, quick and thorough. They make filing government documents very easy.

Thank you for your feedback. We really appreciate it. Have a great day!

Jason J.

May 20th, 2025

My first submission was super quick and easy. I had trouble with the second submission, as I was not aware of what the county would require, but the team at Deeds.com walked me through every step of the process. Will definitely use again and refer business partners to Deeds.com!

Thank you, Jason! We’re glad your first submission went smoothly and appreciate your patience with the second. County requirements can vary, and we’re always here to help make the process as simple as possible. We look forward to assisting you — and your business partners — again soon!

Jason James H.

January 17th, 2019

Th forms were correct, exactly what I needed.

Thanks Jason, we appreciate the feedback.

Margaret S.

August 2nd, 2021

Very nice. easy to use and not too expensive.

Thank you!

A. S.

February 27th, 2019

First, I am glad that you gave a blank copy, an example copy, and a 'guide'. It made it much easier to do. Overall I was very happy with your products and organization... however, things got pretty confusing and I have a pretty 'serious' law background in Real Estate and Civil law. With that said, I spent about 10+ hours getting my work done, using the Deed of Trust and Promissory note from you and there were a few problems: First, it would be FANTASTIC if you actually aligned your guide to actually match the Deed or Promissory Note. What I mean is that if the Deed says 'section (E)' then your guide shouldn't be 'randomly' numbered as 1,2,3, for advice/instructions, but should EXACTLY match 'section (E)'. Some places you have to 'hunt' for what you are looking for, and if you did it based on my suggestion, you wouldn't need to 'hunt' and it would avoid confusion. 2nd: This one really 'hurt'... you had something called the 'Deed of Trust Master Form' yet you had basically no information on what it was or how to use it. The only information you had was a small section at the top of the 'Short Form Deed of Trust Guide'. Holy Cow, was that 'section' super confusing. I still don't know if I did it correctly, but your guide says only put a return address on it and leave the rest of the 16 or so page Deed of Trust beneath it blank... and then include your 'Deed of Trust' (I had to assume the short form deed that I had just created) as part of it. I had to assume that I had to print off the entire 17 page or so title page and blank deed. I also had to assume that the promissory note was supposed to be EXHIBIT A or B on the Short Form Deed. It would be great if someone would take a serious look at that short section in your 'Short Form Deed of Trust Guide' and realize that those of us using your products are seriously turning this into a county clerk to file and that most of us, probably already have a property that has an existing Deed... or at least can find one in the county records if necessary... and make sure that you make a distinction between the Deed for the property that already exists, versus the Deed of Trust and Promissory note that we are trying to file. Thanks.

Thank you for your feedback. We'll have staff review the document for clarity. Have a great day!

Brenda Y.

January 14th, 2020

Five stars rating for sure. All so easy to download and print from your home computer. I live in rural Arizona and have no store to run in to like the lady at the County office told me, so Deeds.com is the best. Brenda Y.

Thank you for your feedback. We really appreciate it. Have a great day!

Donald P.

November 12th, 2019

Very fast and efficient. Easy to fill out but was upset the latest tax exemptions ruled in 2014 did not seem to be included. Exclusion of sale to blood relatives, etc. _ the one I needed.

Thank you for your feedback. We really appreciate it. Have a great day!

Cyndi E.

March 25th, 2022

Outstanding service! So efficient and easy! Within 2 hours my document was reviewed, invoiced and forwarded to the DC ROD. This saved me so much time.

Thank you!

Stephen M.

September 15th, 2022

The process to record took five minutes of my time, and within 45 minutes, my document was recorded! Simple, efficient and affordable! Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Linda D.

April 27th, 2019

It was quick & easy so thank you!

Thank you Linda.

Luis C.

May 10th, 2019

Excellent forms but the instructions are not to clear.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael L.

April 25th, 2024

Professional, simple. Very good.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Charles D.

November 17th, 2020

Very easy to download, very easy to use. Good examples to answer questions.

Thank you!

James L.

April 13th, 2025

Intimidating subject made exceedingly simple.

Thank you for your positive words! We’re thrilled to hear about your experience.

Barbara A.

January 27th, 2023

Much easier than going to the courthouse!

Thank you for your feedback. We really appreciate it. Have a great day!