Taylor County Court Officer Deed Form (Iowa)

All Taylor County specific forms and documents listed below are included in your immediate download package:

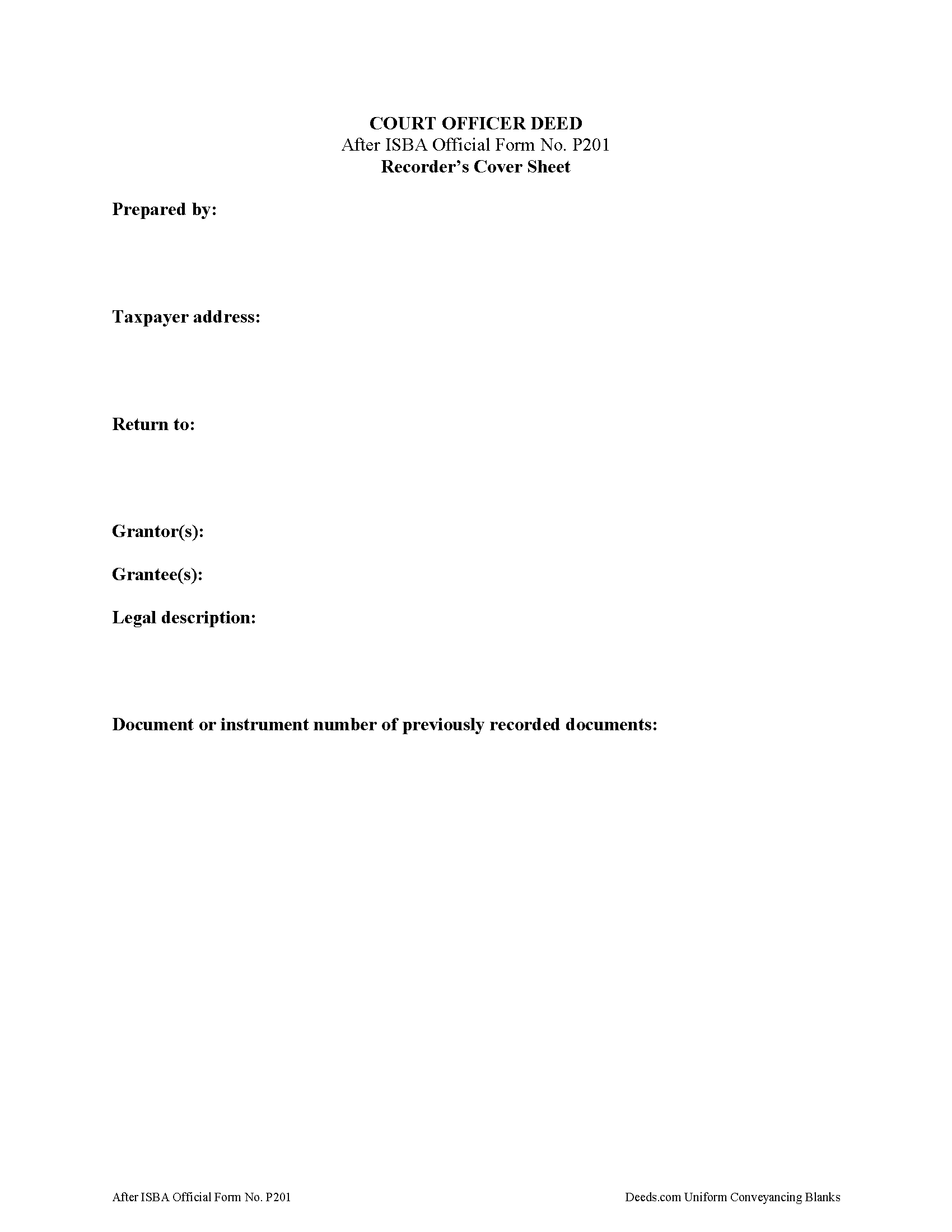

Court Officer Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Taylor County compliant document last validated/updated 4/8/2025

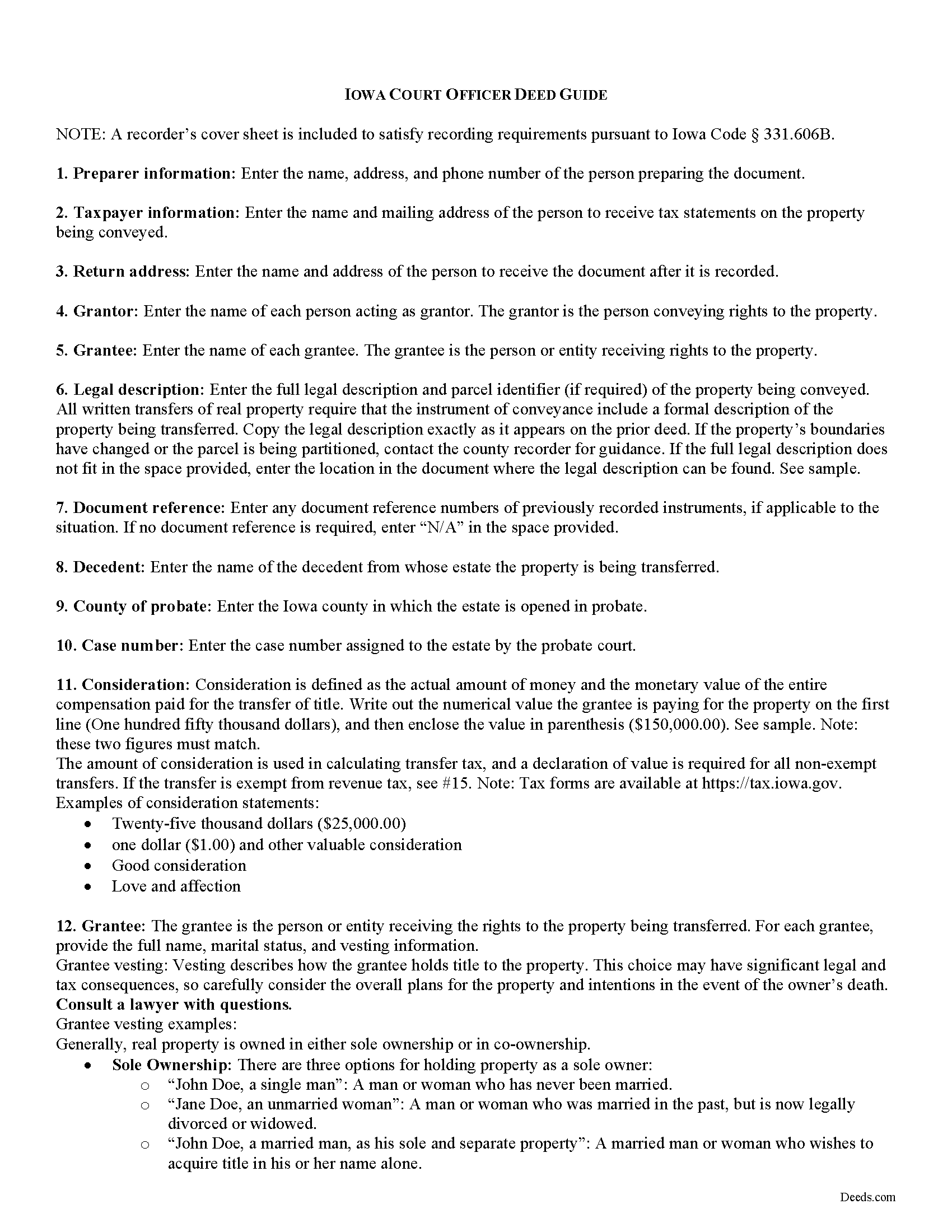

Court Officer Deed Guide

Line by line guide explaining every blank on the form.

Included Taylor County compliant document last validated/updated 7/10/2025

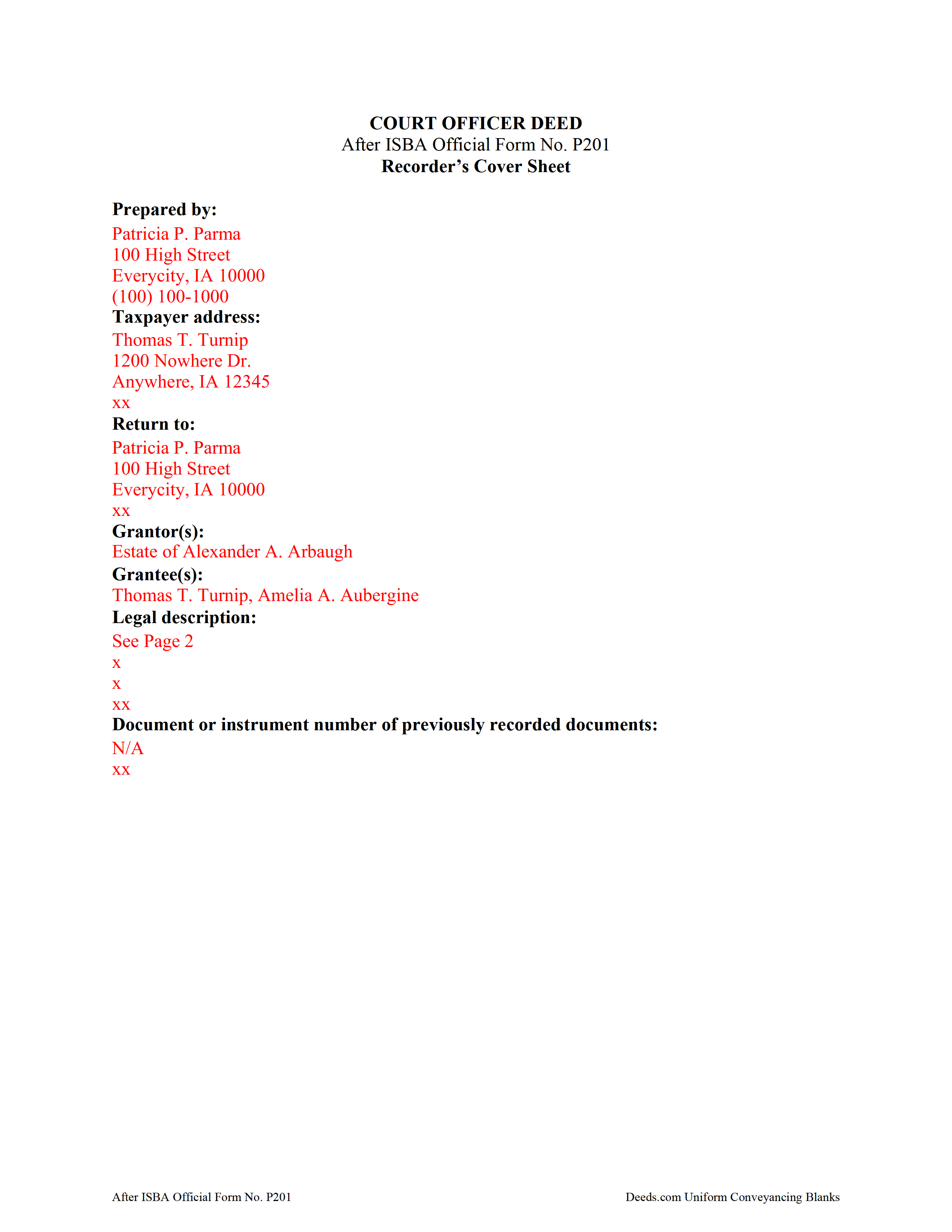

Completed Example of the Court Officer Deed Document

Example of a properly completed form for reference.

Included Taylor County compliant document last validated/updated 2/20/2025

The following Iowa and Taylor County supplemental forms are included as a courtesy with your order:

When using these Court Officer Deed forms, the subject real estate must be physically located in Taylor County. The executed documents should then be recorded in the following office:

Taylor County Recorder

Courthouse - 405 Jefferson St, Bedford, Iowa 50833

Hours: 8:00am to 4:30pm.M-F

Phone: (712) 523-2275

Local jurisdictions located in Taylor County include:

- Bedford

- Blockton

- Clearfield

- Gravity

- Lenox

- New Market

- Sharpsburg

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Taylor County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Taylor County using our eRecording service.

Are these forms guaranteed to be recordable in Taylor County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Taylor County including margin requirements, content requirements, font and font size requirements.

Can the Court Officer Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Taylor County that you need to transfer you would only need to order our forms once for all of your properties in Taylor County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Iowa or Taylor County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Taylor County Court Officer Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

When a property owner dies in Iowa, title to his or her real property passes by means of the decedent's will, or, in the absence of a will, via the laws of intestate succession established in the probate code, codified at chapter 633 of the Iowa Code.

Probate is the court procedure through which a decedent's will is proved and his or her estate is settled. The probate process takes place in the county in which the decedent was domiciled at the time of his or her death.

Pursuant to designation in the decedent's will or priority to administer the decedent's estate, as established by Iowa Code 633.227, the court appoints a personal representative (PR) who will oversee the estate's administration. The PR is either called an executor, when named by a decedent's will, or an administrator, in the absence of a will or lack of designation in a will. Regardless, the fiduciary duties of the personal representative remain the same, including marshalling the decedent's assets, paying debts and valid claims on the estate, and distributing the remainder of the estate to beneficiaries.

Title to real property that does not transfer outside of the probate process by means of a survivorship interest or trust must pass by means of a deed. Depending on the situation, a PR may be directed by the terms of a will to sell real property, or might need to consolidate the estate by selling property. The PR will need to petition the court for an order of sale if a power of sale is not set forth in a will. In Iowa, PRs use a court officer deed to transfer property from a decedent's estate to a distributee or purchaser.

A court officer's deed must meet all state and local standards, and might also require additional supporting documentation. The completed deed is executed and signed by the PR of the decedent's estate and recorded in the office of the recorder of land records in the county where the subject real property is situated. Iowa requires additional documentation when recording land records, including a Ground Water Hazard Statement (GWHS) and a Declaration of Value (DOV), unless a revenue tax exemption is claimed on the face of the conveyancing document.

As always, consult a lawyer with any questions regarding estate administration and court officer deeds in Iowa.

(Iowa Court Officer Deed Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Taylor County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Taylor County Court Officer Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4563 Reviews )

JAMES D.

July 10th, 2025

Slick as can be and so convenient.rnrnWorked like a charm

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Anna C.

February 9th, 2021

It was more detailed than the forms on other website, plus cheaper. I do not have date it was recorded in 2000 but did have date of warranty deed. Will that be ok with Recorder? Also did not want to date it today till I know when and where the Recorders office is located.

Thank you for your feedback. We really appreciate it. Have a great day!

FRANCIS P.

July 17th, 2022

Finding what I needed was easy. The payment process was easy. Using what I found was easy. Easy-peasy and GREAT results. Professional and succinct all for the price of a steak dinner. I'll be back to DEEDS.COM when I need any paperwork/forms related to deeds.

Thank you for your feedback. We really appreciate it. Have a great day!

Patrick A.

April 13th, 2019

Real value. Excellent forms, guidance & samples. Included Homestead Exemption form & info are also valuable & greatly appreciated.

Thank you for your feedback. We really appreciate it. Have a great day!

Jo Ann M.

August 18th, 2022

Easy from the download to just fill out and print. Good instructions to follow. A cover letter form would be a extra plus

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Randall S.

September 19th, 2021

I have had great success with this so far. The site had the correct forms and I was able complete the documents. It seems like a great resource!

Thank you for your feedback. We really appreciate it. Have a great day!

Rose H.

March 22nd, 2021

I am so glad I found this resource! As the Executor of a family members estate I wanted to save money by bypassing a lawyer as it seemed pretty straight forward to tranfer a Life Estate to the remainderman. (I had original deeds). But talking with 3 different states and 4 different counties - none of which seemed to need the same documents, I was almost ready to dump this in a lawyer's lap. This resource makes it simple!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kathryn M.

May 1st, 2019

Never know an online service was available for recording county documents. It was so easy and simple and FAST! Within a matter of a couple hours it's done. I would definitely recommend Deeds.com to anyone.

Thank you Kathryn, we really appreciate that.

Ellen D.

November 25th, 2019

Fantastic service! The forms were available to download instantly and they were perfect for my situation. Easy to use on my older computer. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Cedric W.

January 2nd, 2021

This process was very easy to go through, from beginning to end. It was fast, precise and got the job done without me having to leave my computer. If opportunities arise, I will definitely use deeds.com again.

Thank you for your feedback. We really appreciate it. Have a great day!

Connie E.

December 25th, 2018

Great service! Easy to download and view. Florida should have the Revocable Transfer on Death (TOD)deed, that many other States have. That's the one I really wanted. This one will do in the meantime.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joseph W.

March 11th, 2021

good place to get documents and it seems like a sound place to get forms. Self explainitory and helpful

Thank you!

Sheri S.

May 25th, 2024

So happy to have found this site. It’s just what I was looking for.

We are grateful for your feedback and looking forward to serving you again. Thank you!