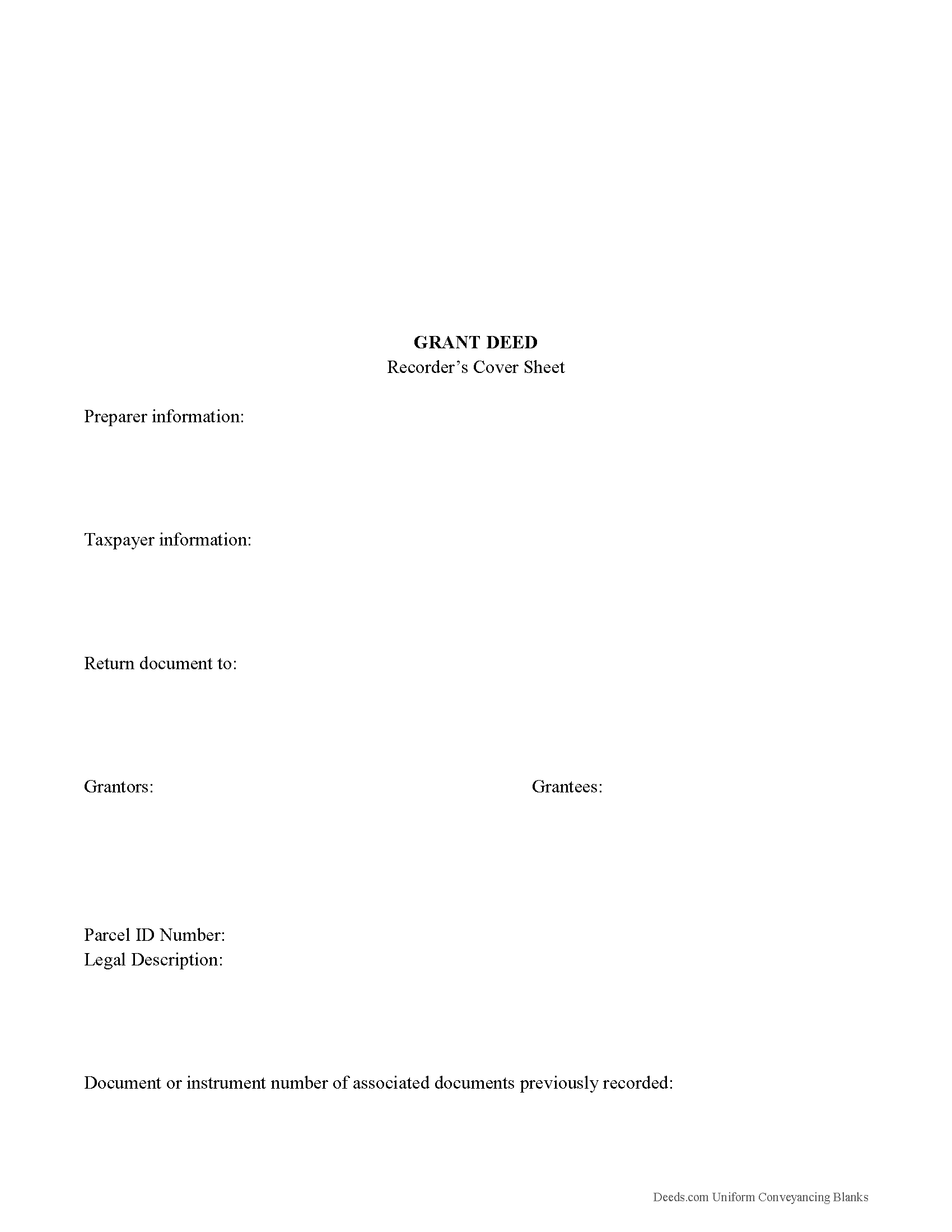

Ida County Grant Deed Form

Ida County Grant Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

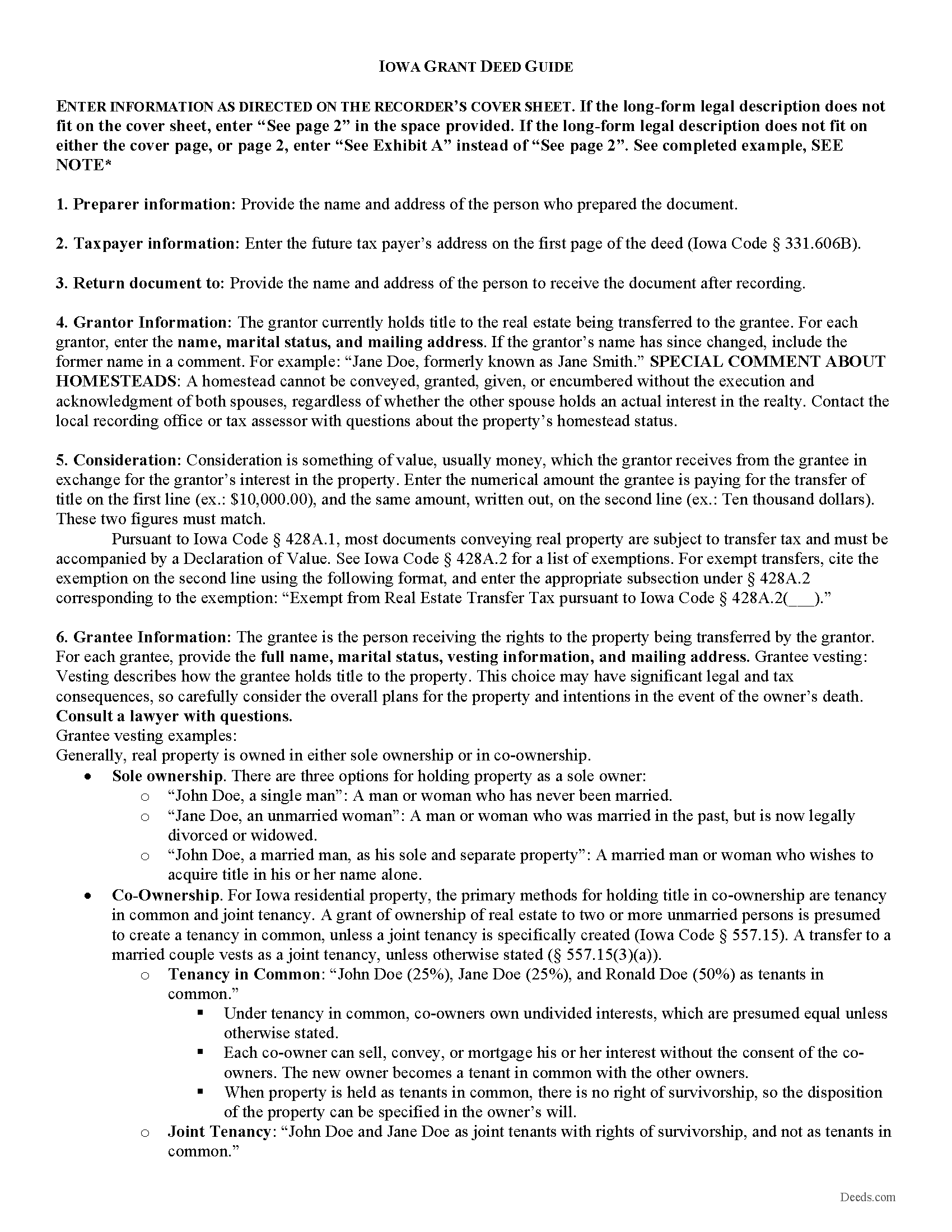

Ida County Grant Deed Guide

Line by line guide explaining every blank on the form.

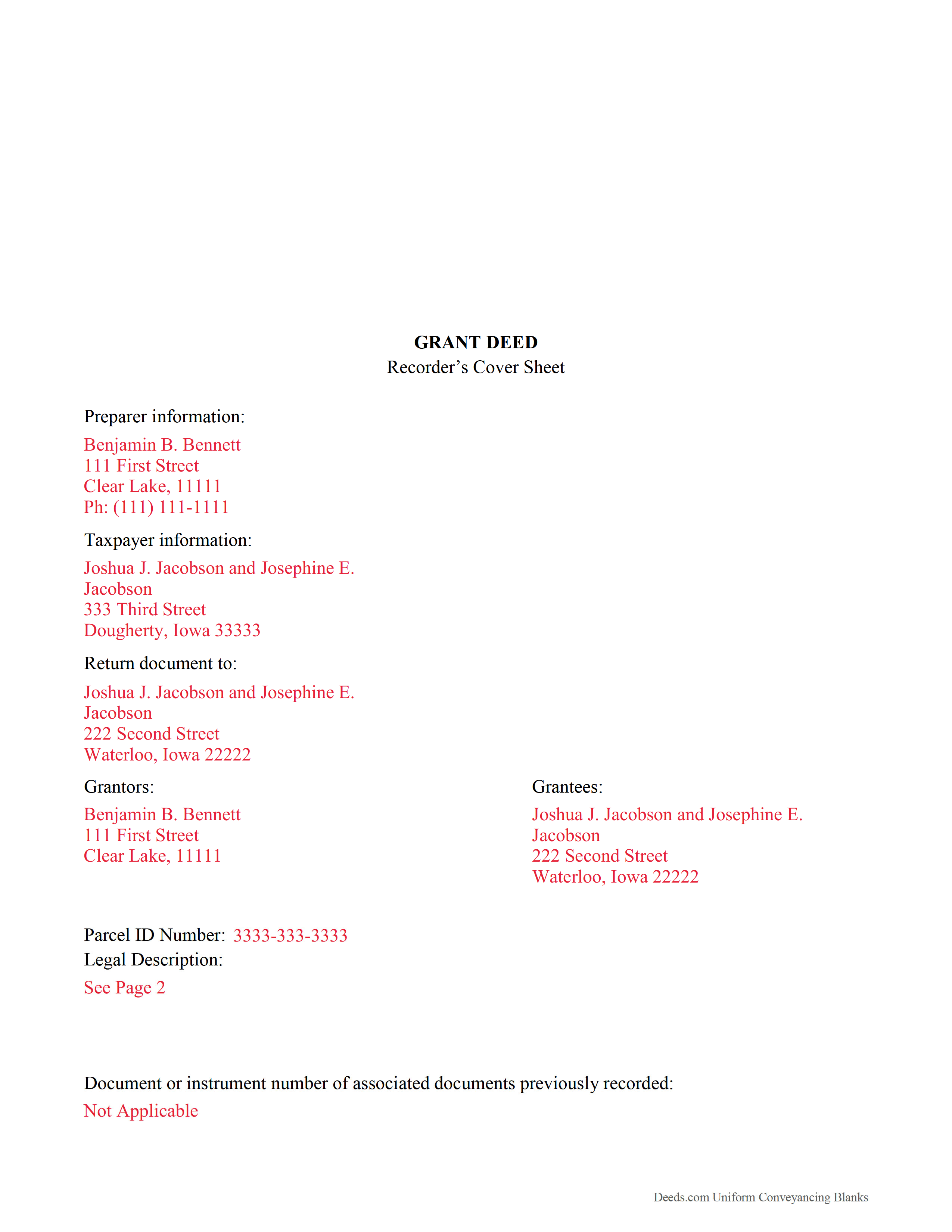

Ida County Completed Example of the Grant Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Iowa and Ida County documents included at no extra charge:

Where to Record Your Documents

Ida County Recorder

Ida Grove, Iowa 51445

Hours: 8:00am to 4:30pm Monday through Friday

Phone: (712) 364-2220

Recording Tips for Ida County:

- Ensure all signatures are in blue or black ink

- White-out or correction fluid may cause rejection

- Double-check legal descriptions match your existing deed

- Make copies of your documents before recording - keep originals safe

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Ida County

Properties in any of these areas use Ida County forms:

- Arthur

- Battle Creek

- Galva

- Holstein

- Ida Grove

Hours, fees, requirements, and more for Ida County

How do I get my forms?

Forms are available for immediate download after payment. The Ida County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Ida County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Ida County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Ida County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Ida County?

Recording fees in Ida County vary. Contact the recorder's office at (712) 364-2220 for current fees.

Questions answered? Let's get started!

A grant deed is a legal document used to transfer, or convey, rights in real property from a grantor (seller) to a grantee (buyer). It contains implied covenants that the grantor has not previously sold the real property interest now being conveyed, and that the property is being conveyed without any undisclosed liens or encumbrances. Grant deeds typically do not require the grantor to defend claims against the title.

A lawful deed includes the grantor's full name and marital status, as well as the grantee's full name, marital status, mailing address, and vesting. Vesting describes how the grantee holds title to the property. For Iowa residential property, the primary methods for holding title in co-ownership are tenancy in common and joint tenancy. A grant of ownership of real estate to two or more unmarried persons is presumed to create a tenancy in common, unless a joint tenancy is specifically created (Iowa Code 557.15). A transfer to a married couple vests as a joint tenancy, unless otherwise stated (Iowa Code 557.15(3)(a)).

As with any conveyance of real estate, a grant deed requires a complete legal description of the parcel. Recite the source of title to establish a clear chain of title, and detail any restrictions associated with the property. Finally, the deed must meet all state and local standards for recorded documents.

Deeds in Iowa must be signed by the grantor. The acknowledgment (notary) of the deed, whether made within the State of Iowa, outside the state, outside the United States, or under federal authority, should comply with the provisions of chapter 9b of the Iowa Statutes. Once acknowledged, file it in the recorder's office for the county where the property is located.

Include all relevant documents, affidavits, forms, and fees with the along with the deed for recording. For example, most deeds require a Real Estate Transfer Groundwater Hazard Statement (Iowa Code Section 558.69). The local recording office can help determine which supplemental documentation, if any, is necessary for the transaction.

This article is provided for informational purposes only and is not a substitute for the advice of an attorney. Contact an attorney with any questions about grant deeds, or for other issues related to the transfer of real property in Iowa.

(Iowa Grant Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Ida County to use these forms. Documents should be recorded at the office below.

This Grant Deed meets all recording requirements specific to Ida County.

Our Promise

The documents you receive here will meet, or exceed, the Ida County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Ida County Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Philip F.

August 2nd, 2024

Quick, user-friendly, and complete! Thank you

We are grateful for your feedback and looking forward to serving you again. Thank you!

David M.

July 30th, 2022

Very easy to use and modify if necessary. Spot on with each county requirement for recording and Notarizing

Thank you for your feedback. We really appreciate it. Have a great day!

Deborah P.

May 14th, 2020

Great site. Official. Easy to use. Less expensive than those other sites as well. Saved me approximately $20! My records were available immediately. I highly recommend this site.

Thank you!

Mark W.

December 19th, 2022

Great form and easy to complete. Sending a sample and instructions was very helpful. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Pamela L.

November 10th, 2019

The packet was very comprehensive and easy to use (I had just one question that wasn't clearly explained). II appreciate that the forms are kept up to date.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Janice U.

July 26th, 2019

So far everything is going really well. Thank you!

Thank you!

SheRon F.

March 21st, 2022

It was a quick and easy process and deeds.com was very helpful and dealt with a very stressful situation, painless.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Bryan C.

September 5th, 2021

Your service is sweet. It is self-explanatory and easy to download. I am excited about finding your website.

Thank you!

Chris M.

May 9th, 2024

The personal attention and the ease of use is beyond any other service I have used. Thank you for making my work so much easier.

Thank you for your positive words! We’re thrilled to hear about your experience.

Christina W.

September 4th, 2019

I stand corrected. I received my report and it was exactly what I requested.

Thank you!

Jessica B.

September 23rd, 2021

Amazing service. Immediate responses at all hours of the day and prevent late in the evening! Patient and friendly. I will say that Adobe scan did not work well for me. Notes app for IOS has a scan feature and that seemed to work best.

Thank you for your feedback. We really appreciate it. Have a great day!

JACQUELINE R.

March 23rd, 2021

We have been waiting for a Title Company to put a release of Lien together for the past 3 months. I figured it was taking way to long and decided to use template here instead. In less than hour I was able to add all the information on the template and provide forms to our Seller to use. We were buying and he didnt think they were necessary. But I refused to pay him in full until he agreed to sign papers at the bank, and of course in front of a notary. We turned around and filed the Release of lien paperwork at County Clerks office, we officially own our house. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Mary Ann G.

April 16th, 2019

Couldn't find the deed form that I needed. Needs to have a short summary to determine the correct form.

Sorry to hear that Mary Ann, we appreciate your feedback.

Christine K.

February 12th, 2021

While I was initially disappointed I could not go to the local County to file my paperwork due to Covid-19, I was thrilled to work with Deeds.com. Their staff was INCREDIBLY FAST, super knowledgeable and the whole process happened from my computer in minutes. Very positive experience.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mary Ann H.

February 4th, 2021

The Deeds.com website was clear and easy to follow. I completed it about 20 minutes. I appreciate the convenience of doing it from home and that I will receive a copy by mail.

Thank you for your feedback. We really appreciate it. Have a great day!