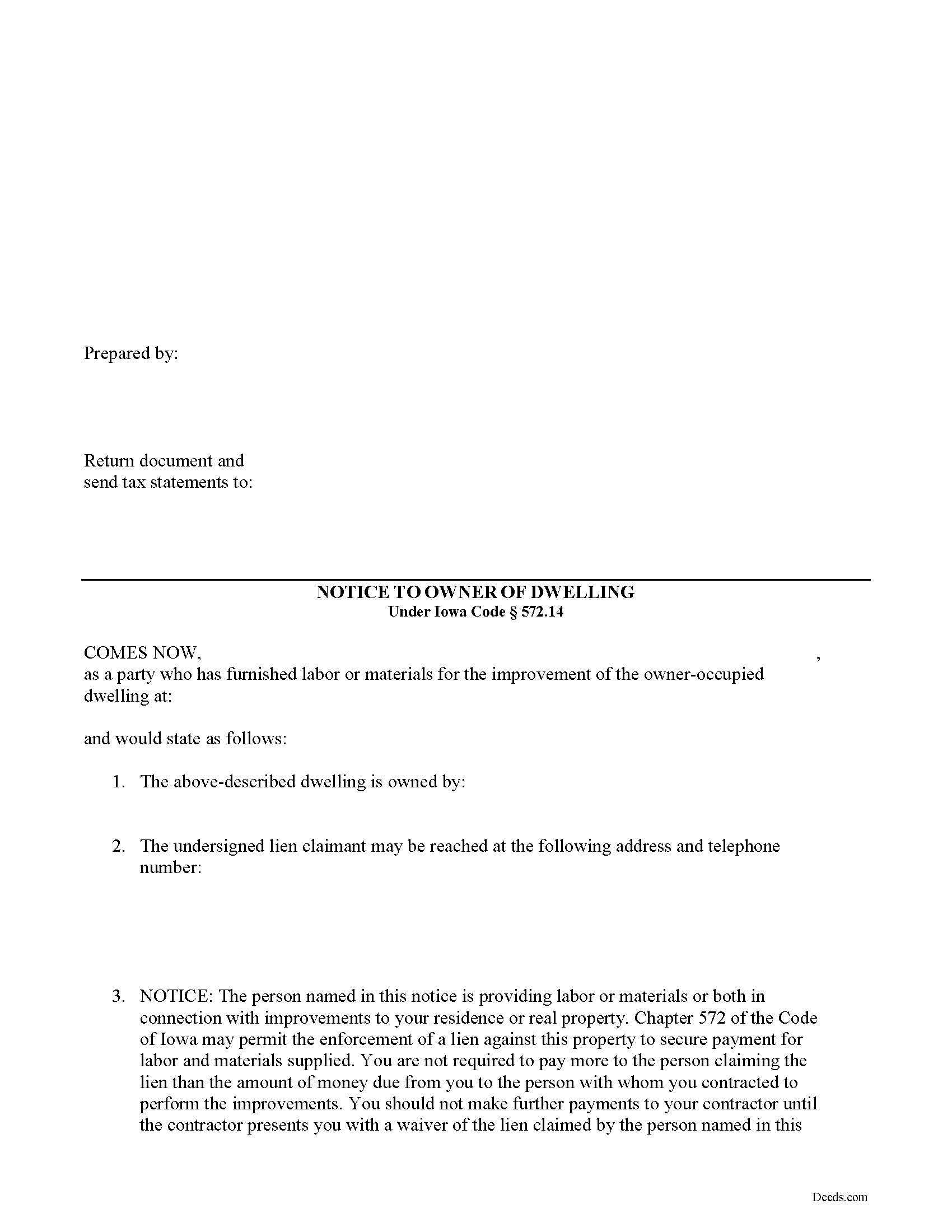

Plymouth County Subcontractor Notice to Owner Form

Plymouth County Subcontractor Notice to Owner Form

Fill in the blank Subcontractor Notice to Owner form formatted to comply with all Iowa recording and content requirements.

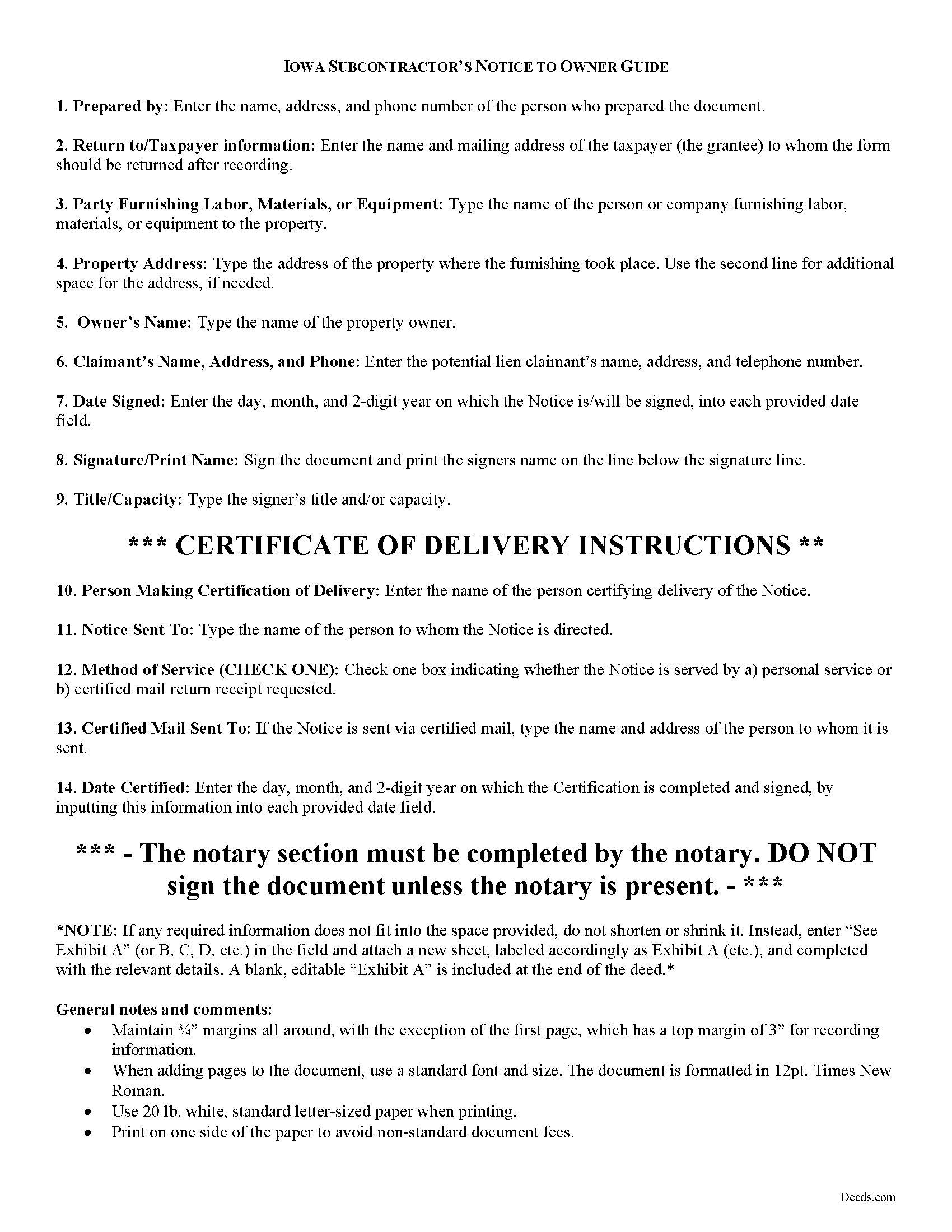

Plymouth County Subcontractor Notice to Owner Guide

Line by line guide explaining every blank on the form.

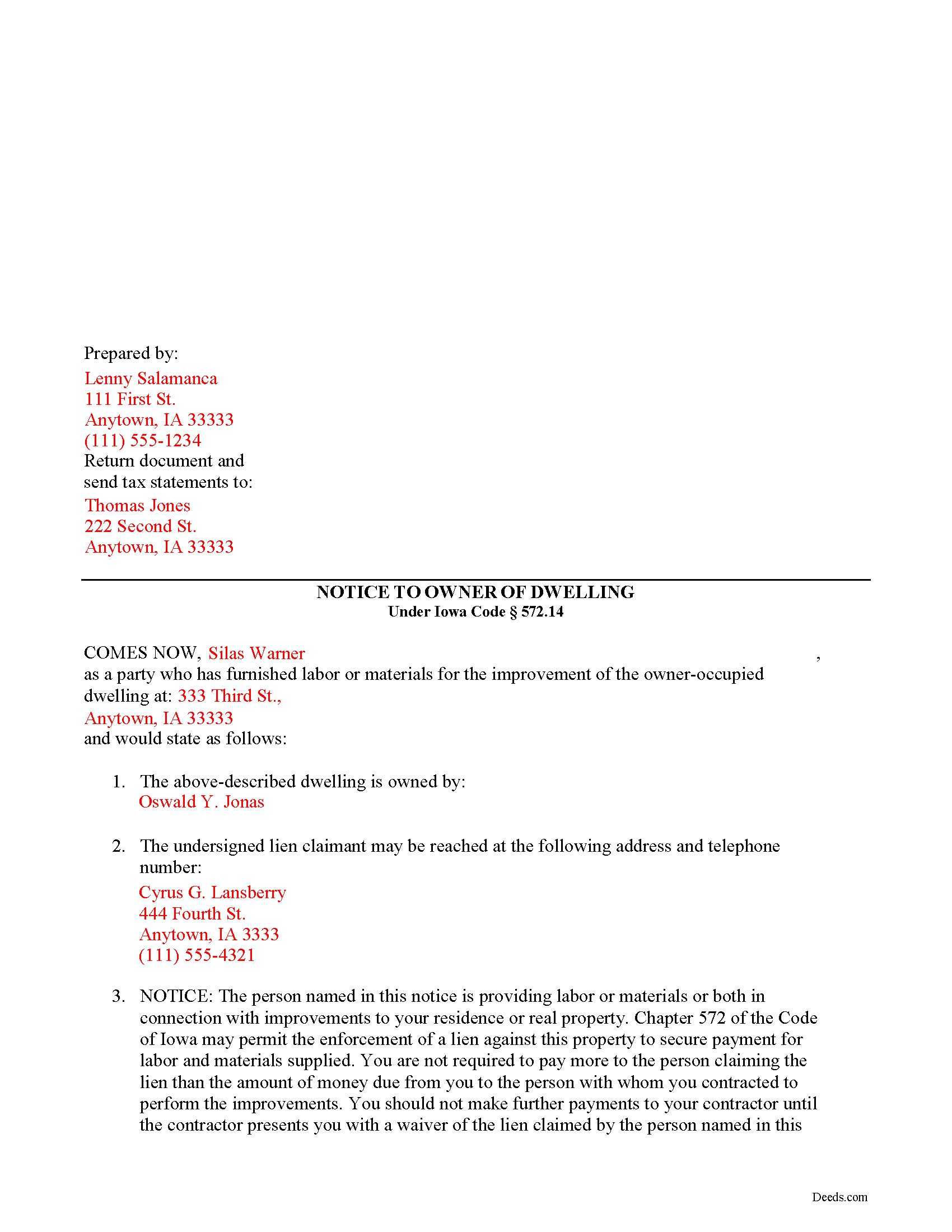

Plymouth County Completed Example of the Subcontractor Notice to Owner Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Iowa and Plymouth County documents included at no extra charge:

Where to Record Your Documents

Plymouth County Recorder

Le Mars, Iowa 51031

Hours: 8:00am to 5:00pm Monday through Friday

Phone: (712) 546-4020

Recording Tips for Plymouth County:

- Check that your notary's commission hasn't expired

- Both spouses typically need to sign if property is jointly owned

- Recorded documents become public record - avoid including SSNs

- Recording early in the week helps ensure same-week processing

Cities and Jurisdictions in Plymouth County

Properties in any of these areas use Plymouth County forms:

- Akron

- Brunsville

- Hinton

- Kingsley

- Le Mars

- Merrill

- Oyens

- Remsen

- Westfield

Hours, fees, requirements, and more for Plymouth County

How do I get my forms?

Forms are available for immediate download after payment. The Plymouth County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Plymouth County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Plymouth County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Plymouth County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Plymouth County?

Recording fees in Plymouth County vary. Contact the recorder's office at (712) 546-4020 for current fees.

Questions answered? Let's get started!

Subcontractors on a construction job occasionally need to fight for payment from the prime contractor. Many property owners are unaware of the participation of lower-tiered contractors on the job. These subcontractors can claim mechanic's lien rights against the property owner even if the owner paid the contractor in full. However, this right only exists if the owner is served proper notice. In turn, after receiving the notice, the owner can rightfully withhold payment from the contractor to ensure these other parties are paid as to avoid any liens against the owner.

A payment to the original contractor by the owner of any part or all of the contract price of the building or improvement within ninety (90) days after the date on which the last of the materials was furnished or the last of the labor was performed by a subcontractor, does not relieve the owner from liability to the subcontractor for the full value of any material furnished or labor performed upon the building, land, or improvement if the subcontractor files a lien within ninety (90) days after the date on which the last of the materials was furnished or the last of the labor was performed. I.C. 572.14(1).

In the case of an owner-occupied dwelling, a mechanic's lien is enforceable only to the extent of the balance due the principal contractor by the owner-occupant prior to the owner-occupant being served with the notice specified in subsection. I.C. 572.14(2).

This notice may be served by delivering it to the owner or the owner's spouse personally, or by mailing it to the owner by certified mail with restricted delivery and return receipt to the person mailing the notice, or by personal service as provided in the rules of civil procedure. Id.

The Notice to Owner contains: 1) the name of the owner, 2) the address of the property charged with the lien, 3) the name, address and telephone number of the lien claimant, and 4) a statement that the individual serving the Notice may have lien rights. I.C. 572.14(3).

This article is provided for informational purposes only and should not be relied upon as a substitute for the advice from a legal professional. Please contact an Iowa attorney with any questions about sending notice to property owners or anything else with regard to mechanic's liens.

Important: Your property must be located in Plymouth County to use these forms. Documents should be recorded at the office below.

This Subcontractor Notice to Owner meets all recording requirements specific to Plymouth County.

Our Promise

The documents you receive here will meet, or exceed, the Plymouth County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Plymouth County Subcontractor Notice to Owner form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4588 Reviews )

Carl S.

February 29th, 2020

Five Stars!

Thank you!

Joanne H.

February 14th, 2022

easy to download and use. this document. thank you

Thank you!

Susan G.

January 7th, 2023

I was pleased with the example of a completed beneficiary deed and instructions. It made filling out the deed very easy.

Thank you!

Michael H.

July 30th, 2019

Found documents I needed quickly and at a reasonable price. MH

Thank you for your feedback. We really appreciate it. Have a great day!

Gerald N.

January 22nd, 2022

Very nice website!

Thank you!

Melody P.

July 21st, 2021

Thanks once again for such great service!

Thank you!

Christopher V.

March 22nd, 2019

GREAT STUFF TKS

Thank you!

Linda D.

July 17th, 2019

It was easy to download the form I wanted BUT there were 2 other options listed for "open/download." I didn't want to risk more charges for something I couldn't determine I needed so I passed them up. There were a few others listed with the option to "view" so I did that, without down-loading, and there were no additional charges. I would've liked that opportunity for 2 others that didn't offer "view" so maybe deeds.com missed a sale?

Thank you for your feedback Linda. All the documents available for download in your account are included with your payment, no additional charges.

Jacqueline C.

August 15th, 2019

Was relieved to see your site actually delivered what I paid for.

Thank you!

Michael D.

June 14th, 2024

Quick and easy!

Thank you!

Janet J.

January 17th, 2020

The download process was quick and efficient. Here's hoping the printing process will be as easy. Appreciate this access to forms so much.

Thank you for your feedback. We really appreciate it. Have a great day!

Deborah G.

July 23rd, 2021

Absolutely wonderful customer service. I am very pleased with the service I received and highly recommend this to everyone.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cathy P.

March 18th, 2021

I purchased the La St. Tammany Parish Quit Claim Deed as a gift for a friend. Currently waiting on a lawyer to draft his second version of what a La Quit Claim should look like. I have downloaded this St. Tammany La packet for simplicity and double protection for my friend. So far, I really like what I see from Deeds.com, short and to the point. It's truly a breath of fresh air. Thank you so much. Layperson Cathy for a friend.

Thank you for your feedback. We really appreciate it. Have a great day!

Sherry P.

November 24th, 2020

It would be helpful to have a frequently asked questions section. That would make it easier to know I have the correct form. Sherry

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

May 28th, 2025

Deeds.com has become a great assistant to our firm! The service is of highest quality and consistently helpful to our law firm in its recording needs. It's summer in Arizona and no one I know wants to drive to downtown Phoenix to record a property deed so think I will add "grateful" to my praise.

Thank you, Mary! We appreciate your kind words and are glad to help make recording easier — especially when it means avoiding a summer trip to downtown Phoenix. We’re grateful for your continued trust.