Lyon County Executor Deed with Power of Sale Form (Kansas)

All Lyon County specific forms and documents listed below are included in your immediate download package:

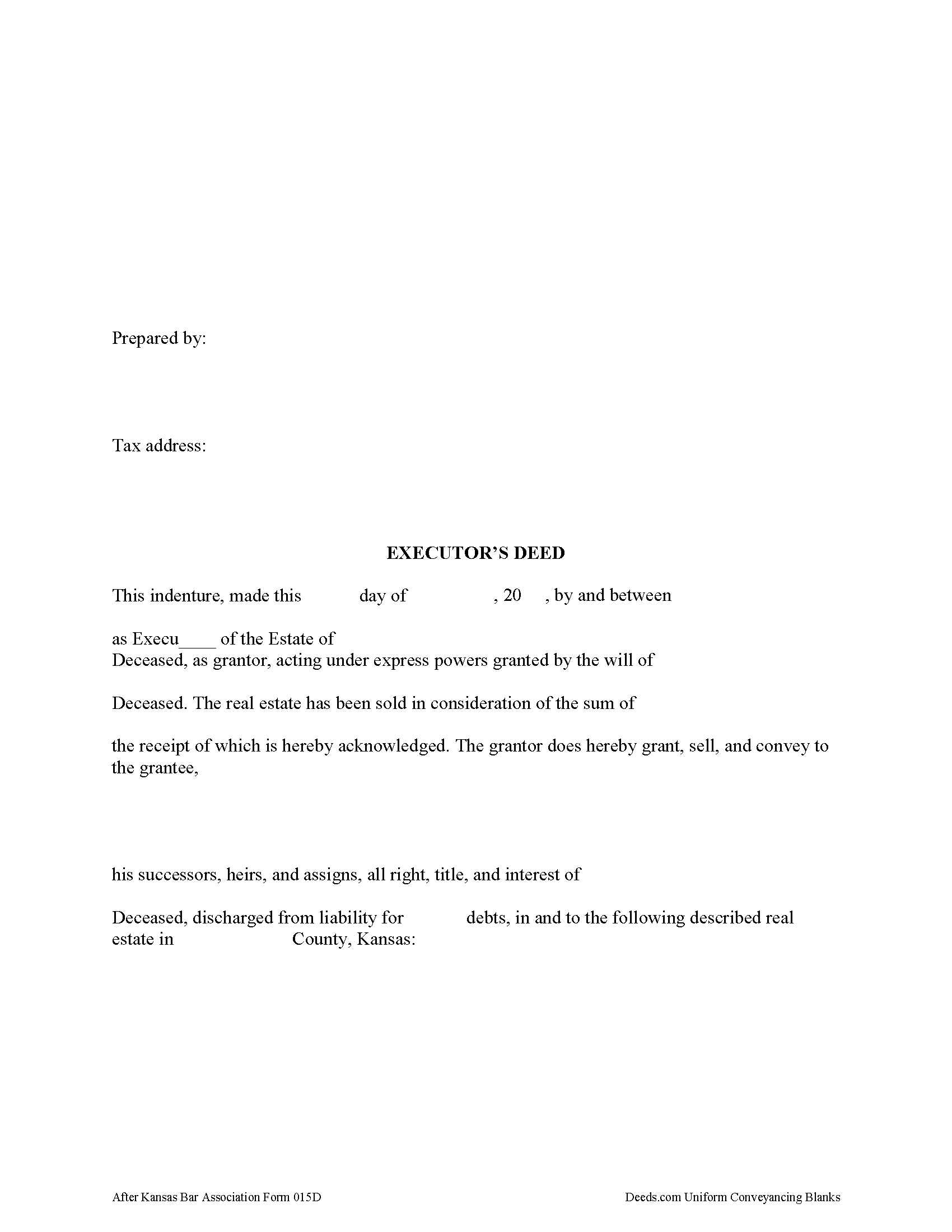

Executor Deed with Power of Sale Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Lyon County compliant document last validated/updated 3/17/2025

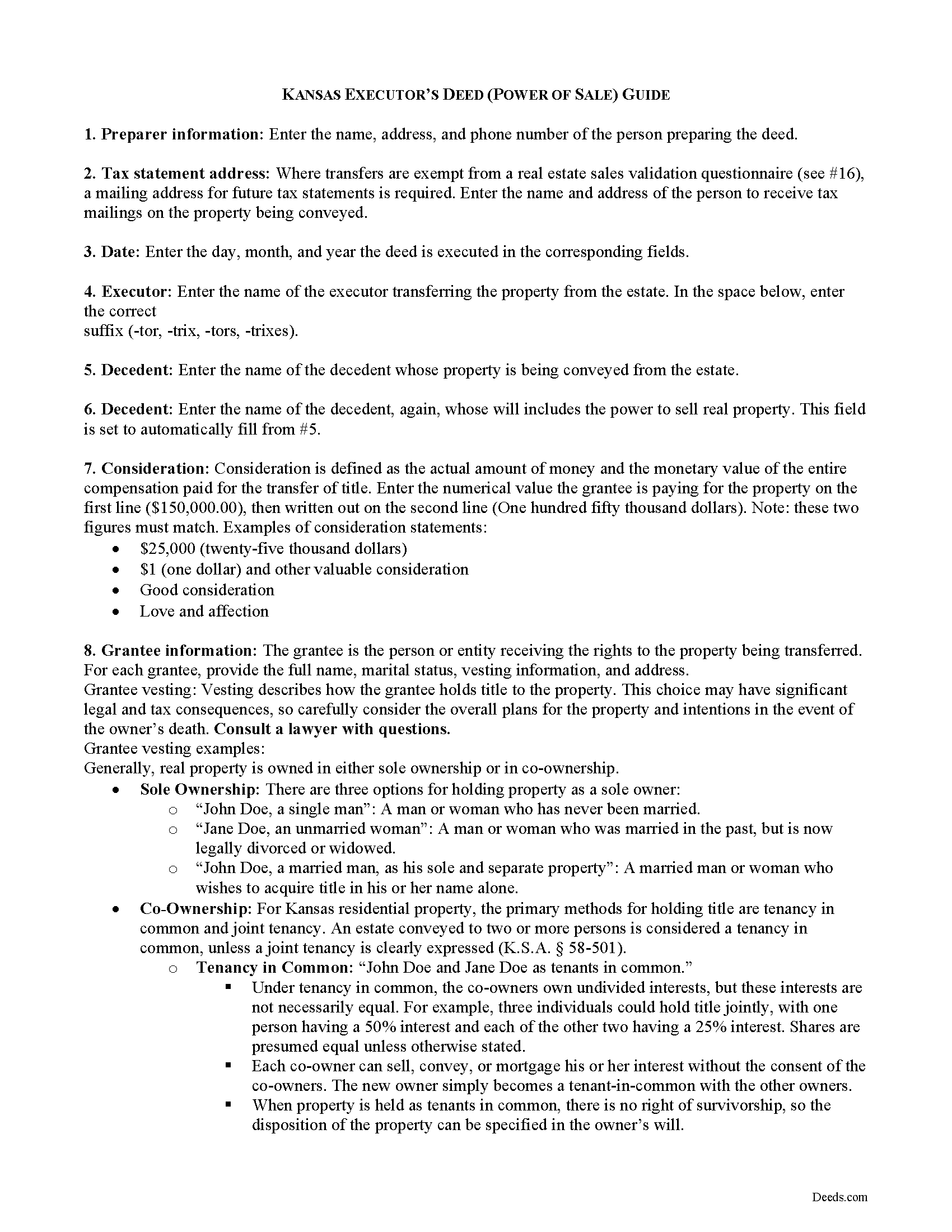

Executor Deed with Power of Sale Guide

Line by line guide explaining every blank on the form.

Included Lyon County compliant document last validated/updated 7/2/2025

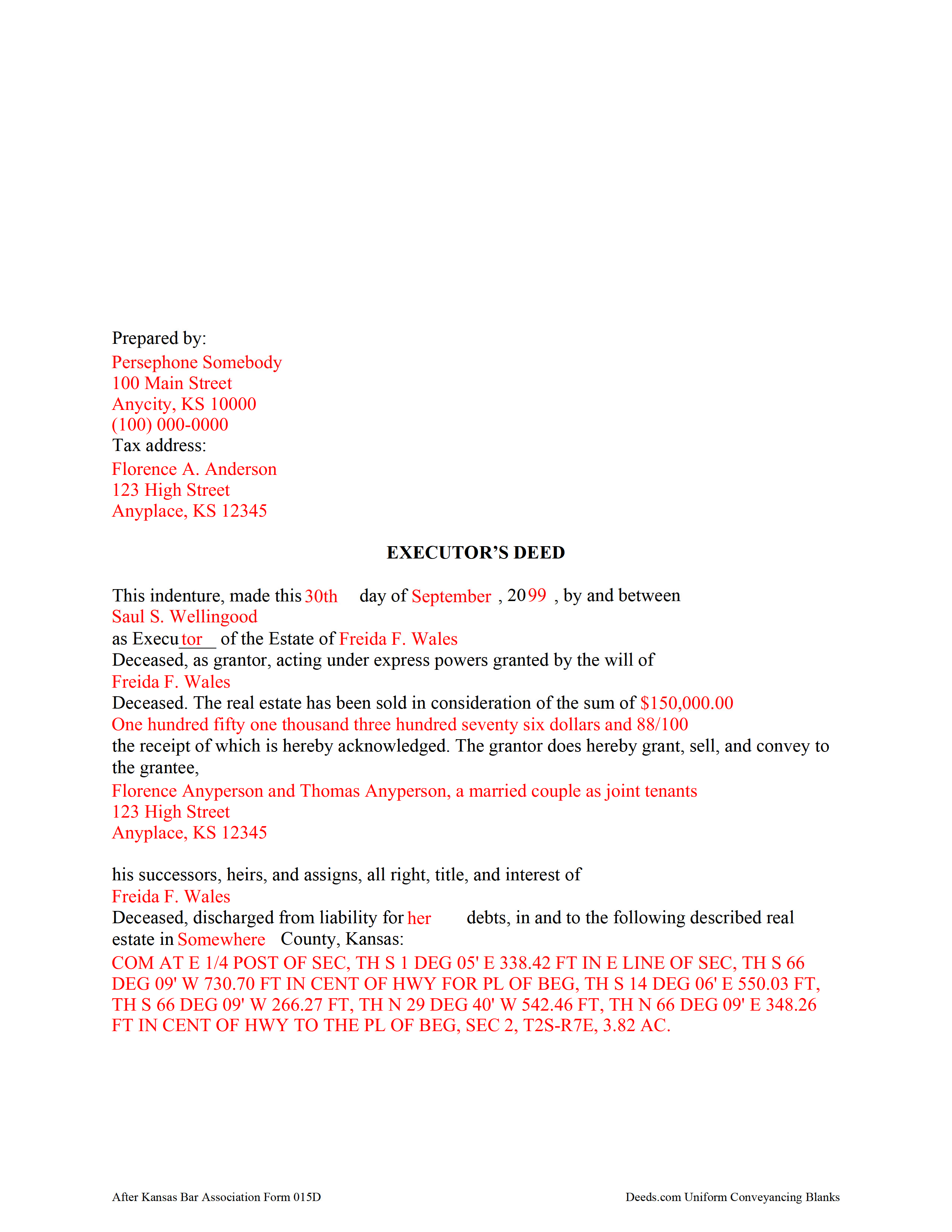

Completed Example of the Executor Deed with Power of Sale Document

Example of a properly completed form for reference.

Included Lyon County compliant document last validated/updated 5/27/2025

The following Kansas and Lyon County supplemental forms are included as a courtesy with your order:

When using these Executor Deed with Power of Sale forms, the subject real estate must be physically located in Lyon County. The executed documents should then be recorded in the following office:

Lyon County Register of Deeds

Courthouse - 430 Commercial St, 1st floor, Emporia, Kansas 66801

Hours: 8:00am-5:00pm M-F

Phone: (620) 341-3241

Local jurisdictions located in Lyon County include:

- Admire

- Allen

- Americus

- Emporia

- Hartford

- Neosho Rapids

- Olpe

- Reading

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Lyon County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Lyon County using our eRecording service.

Are these forms guaranteed to be recordable in Lyon County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lyon County including margin requirements, content requirements, font and font size requirements.

Can the Executor Deed with Power of Sale forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Lyon County that you need to transfer you would only need to order our forms once for all of your properties in Lyon County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Kansas or Lyon County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Lyon County Executor Deed with Power of Sale forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

When the decedent dies testate (with a will), naming a personal representative (PR) of his or her estate, the PR is called an executor. An executor may need to sell the decedent's real property to raise money to pay the estate's debts or for other reasons in the best interest of the estate.

An order for sale is required before an executor can transfer real property, unless the decedent's will includes a power of sale.

Use an executor's deed with power of sale after the district court has issued an order for sale to convey real property from the estate. In addition to meeting all state and local standards for conveyances of real property, the deed includes a recitation of facts concerning the executor, the decedent, the order for sale, and the subject property being transferred. The executor signs the completed form in the presence of a notary public prior to recording.

Supplemental documentation may be required, depending on the nature of the transfer. Consult a lawyer with questions about estate administration in Kansas.

(Kansas Executor Deed with POS Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Lyon County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lyon County Executor Deed with Power of Sale form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4563 Reviews )

JAMES D.

July 10th, 2025

Slick as can be and so convenient.rnrnWorked like a charm

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael T.

October 17th, 2019

Good site. Two things to note.

1. The Documentary Transfer Tax Exemption sheet, the word "computer" is used when I think it should be "computed" Error in state form?

2. The California Trust Guide could have a watermark which is less distracting. Kind of hard to read the print with the DEEDS.COM logo so prominent.

Thank you for your feedback. We really appreciate it. Have a great day!

Don R.

January 26th, 2022

From Pennsylvania here. Documents are great and easy to fill out however you are lacking a couple of things. You only provide the option for a Grant Deed when you purchase by your county which is Mercer County for me. Why not give the ability to get a Warranty Deed that better protects the Grantee?

Also, being from Pennsylvania and in a county that mined Buituminous Coal we are required to include the Coal Severance Notice and Bituminous Mine Subsidence and Land Conservation Act Notice. You can check the box on your Deed form that they are required and attached but you do not provide the verbiage or form for this. You state that you know what each county requires and include everything required but you do not include these two required Notices. This has been a requirement for years and the wording never changes. I had to look for these Notices and hand type this information and include it on another seperate page after the Notary section on the Deed. The Grantor has to sign the Coal Severance Notice and be witnessed by a Notary so I had to add another place for the Notary and will have to pay twice for witnessed signatures when it could have been included in your document. My Deed from 2003 was done that way and then the Notary statement after that so it was only one notarized witness of signature.

Thank you for your feedback. We really appreciate it. Have a great day!

Carl R.

August 26th, 2020

Wonderful forms even for an simpleton like me. Thank goodness there are people that actually know what they are doing.

Thanks for the kind words Carl.

Barbara G.

May 12th, 2021

High rating, great site and forms were exactly what I needed. Thanks for being there for me.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Don M.

September 17th, 2022

Easy to set up account. If I am presented with a chance to review the service, I will do that after I have received it.

Thank you!

Johnnie G.

July 6th, 2020

We had hoped, as this was direct through our State recorder's office, State-specific data would be pre-filled in. Also there is no help when transferring the home title from a Revocable Trust to the living Trustee and new spouse (no example given, no help for which code to use). And the example doesn't match the prior deed revision format submitted by our attorney. So, not the best experience. We may have to get an attorney involved...what we were hoping to avoid

Thank you for your feedback. We really appreciate it. Have a great day!

Michael K.

January 11th, 2021

The link for the note guidelines just shows the same directions as for the mortgage. Other than that, very helpful.

Thank you for your feedback. We really appreciate it. Have a great day!

Beverly D.

June 4th, 2022

Deeds.com was a great experience in helping me get some important documents recorded.I would recommend them to anyone wanting documents recorded in a timely manner.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Earline S.

December 24th, 2018

Total package. Very prompt with complete instructions & example to complete forms. If you don't want to hire a lawyer, this is pretty simple & will bypass probate.

Thank you, we really appreciate your feedback.

Elijah H.

December 24th, 2018

Deeds.com worked very well for me. Very Simple packet. And my County uses the same website

Thanks for the kinds words Elijah, we really appreciate it.

Zina J.

October 30th, 2019

Deeds.com supplied exactly what I needed to complete a quitclaim. Deeds.com saved me $180, supplied the necessary forms, and a sample page to use as a guide. I recommend Deeds.com.

Thank you!

Lori G.

October 28th, 2020

This was so easy and seemless. I wish I had found deeds.com for eRecording sooner! I submitted my documents from the comfort of my office, they were great about communicating in a timely manner with updates. The next day I had copies of my recorded documents! I would highly recommend deeds.com!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!