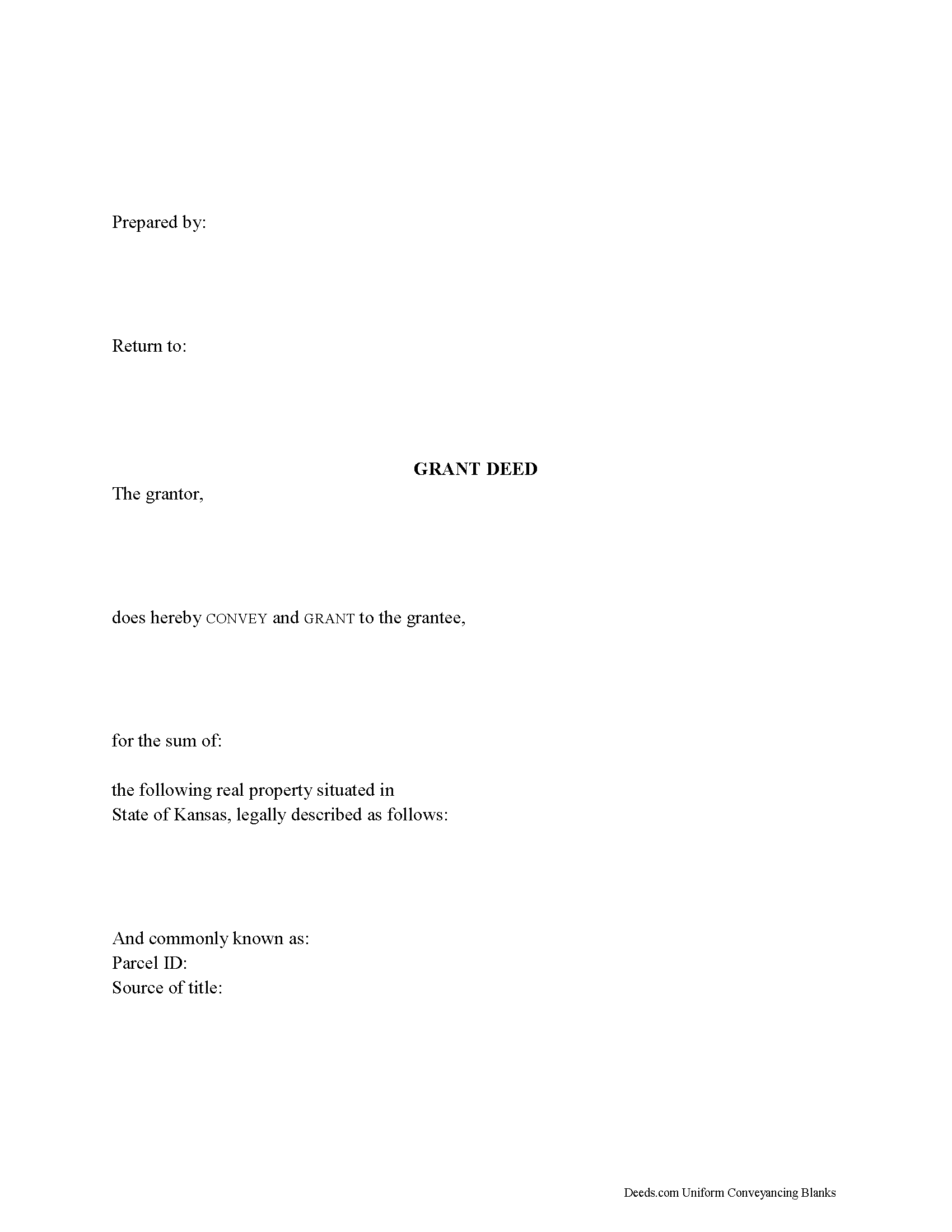

Neosho County Grant Deed Form

Neosho County Grant Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

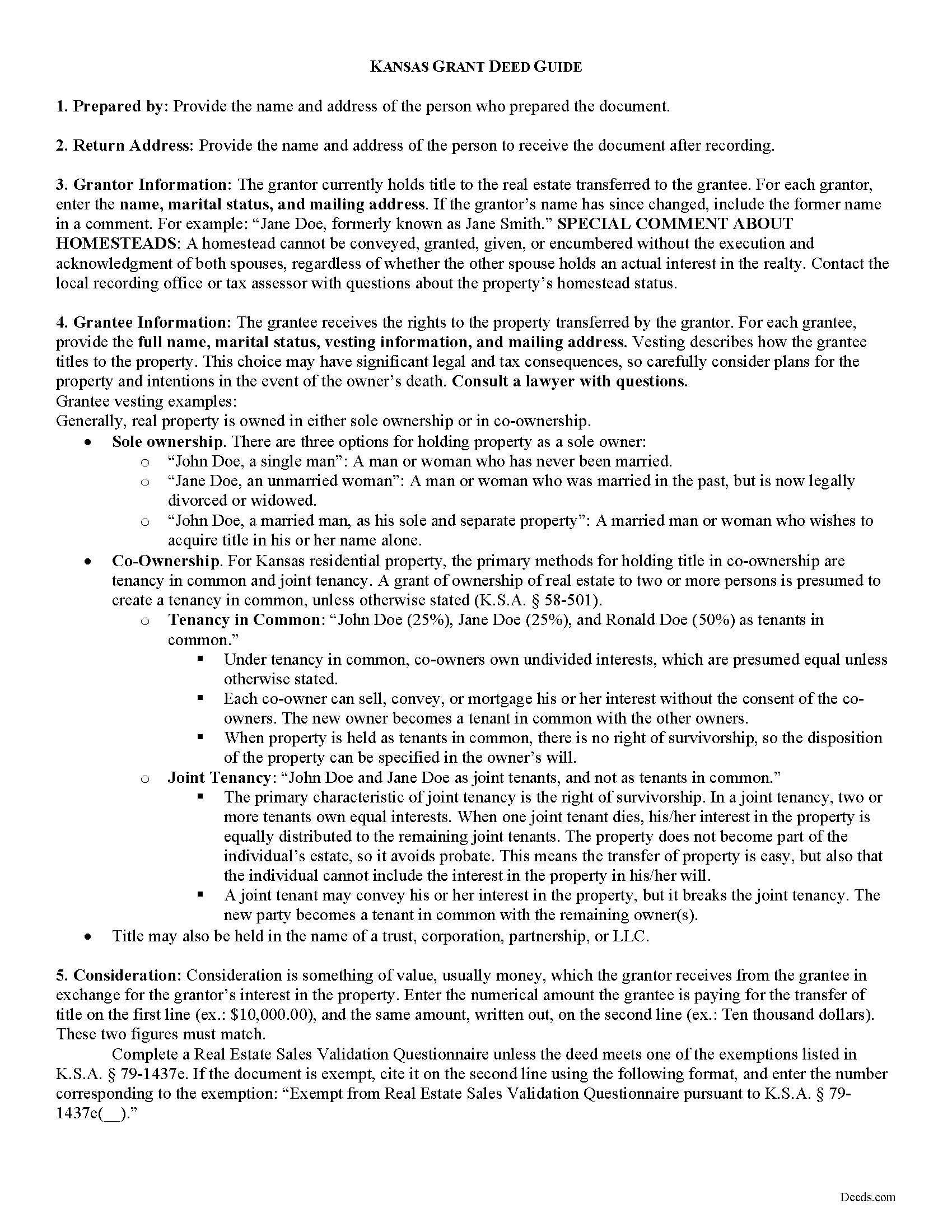

Neosho County Grant Deed Guide

Line by line guide explaining every blank on the form.

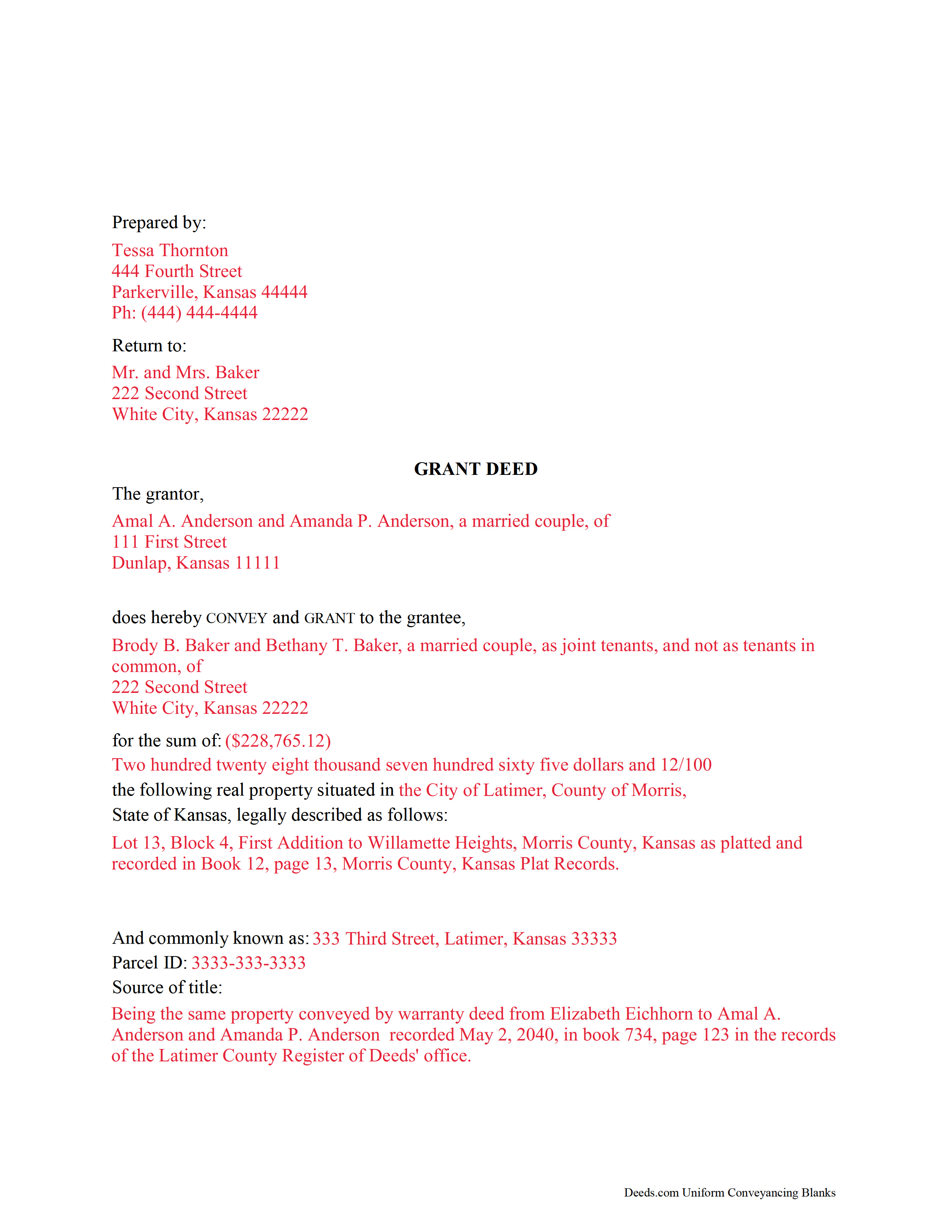

Neosho County Completed Example of the Grant Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kansas and Neosho County documents included at no extra charge:

Where to Record Your Documents

Neosho County Register of Deeds

Erie, Kansas 66733

Hours: 8:00am to 4:30pm M-F

Phone: (620) 244-3858

Recording Tips for Neosho County:

- Bring your driver's license or state-issued photo ID

- Leave recording info boxes blank - the office fills these

- If mailing documents, use certified mail with return receipt

Cities and Jurisdictions in Neosho County

Properties in any of these areas use Neosho County forms:

- Chanute

- Erie

- Galesburg

- Saint Paul

- Stark

- Thayer

Hours, fees, requirements, and more for Neosho County

How do I get my forms?

Forms are available for immediate download after payment. The Neosho County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Neosho County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Neosho County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Neosho County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Neosho County?

Recording fees in Neosho County vary. Contact the recorder's office at (620) 244-3858 for current fees.

Questions answered? Let's get started!

Real estate conveyances in Kansas are governed by Chapter 58, Section 22 of the Kansas Statutes, but the statutes do not specifically address grant deeds.

A grant deed is a legal document used to transfer, or convey, rights in real property from a grantor (seller) to a grantee (buyer). A recorded grant deed imparts notice of this transfer to all persons, including subsequent purchasers or mortgagees (K.S.A. 58-2222).

Within the deed are covenants, or guarantees, that the grantor has not previously sold the real property interest now being conveyed to the grantee, and that the property is being conveyed to the grantee without any liens or encumbrances, except for those specifically disclosed in the deed. Grant deeds do not generally require the grantor to defend title claims.

A lawful grant deed includes the grantor's full name and marital status, as well as the grantee's full name, marital status, mailing address, and vesting. Vesting describes how the grantee holds title to the property. For Kansas residential property, the primary methods for holding title in co-ownership are tenancy in common and joint tenancy. A grant of ownership of real estate to two or more persons is presumed to create a tenancy in common, unless otherwise stated (K.S.A. 58-501).

Include the complete legal description for the subject property, as well as its physical (street) address or common name and the derivation of title. Additionally, the form must meet state and local standards for recorded documents.

All deeds must be signed by the grantor, or by the party's lawful agent or attorney, and may be acknowledged or proved and certified in the manner prescribed by the Uniform Law on Notarial Acts (K.S.A. 58-2209).

The State Property Valuation Department requires a Real Estate Sales Validation Questionnaire with each deed unless it meets one of the exemptions provided in K.S.A. 79-1437e. Include the amount of consideration exchanged on the form (K.S.A. 79-1437g).

Submit the deed and any required supplemental documents for recording in the county where the property is located. In most cases, the deed will be returned to the grantee after recording. The register of deeds will forward the information to the county clerk, who will update records for mailing tax statements (K.S.A. 58-2221). Record the deed in the appropriate county to provide notice to third parties (K.S.A. 58-2223).

This article is provided for informational purposes only and is not a substitute for legal advice. Contact a lawyer with questions about limited warranty deeds or for any other issues related to the transfer of real property in Kansas.

(Kansas Grant Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Neosho County to use these forms. Documents should be recorded at the office below.

This Grant Deed meets all recording requirements specific to Neosho County.

Our Promise

The documents you receive here will meet, or exceed, the Neosho County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Neosho County Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4591 Reviews )

William A.

May 12th, 2020

great service and very accommodating generally, and especially during these times.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ma Luisa R.

July 2nd, 2020

Great service and fast

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Nancy S.

July 6th, 2021

Terrific service, I found just what I needed, and priced reasonably. The decision to purchase a form instead of trying to create one of my own was easy to make. I will return to this service again.

Thank you!

Michael O.

April 18th, 2019

Received everything that was promised.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Andrea R.

December 25th, 2020

I was pleasantly surprised as I didn't even know you can record a quit claim deed digitally. I am in the mortgage business so I will gladly refer all my clients to this website! Deeds.com was prompt and fast with the entire process. My document was recorded and completed in less than 24 hours! Thank you again!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Scott O.

April 3rd, 2022

Very efficient and surprisingly quick.

Thank you for your feedback. We really appreciate it. Have a great day!

Laurie F.

February 24th, 2019

I am so glad I found Deeds.com. You had exactly what I needed and made it easy to download. I have bookmarked you in the event of further inquiry. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lori G.

June 17th, 2019

I needed to add my husband to my deed. an attorney would charge me $275.00. I decided to file myself. This makes it easy. Not done w/the process yet. But so far so good! :)

Thank you for your feedback. We really appreciate it. Have a great day!

STANLEY K.

February 3rd, 2022

I AM DELIGHTED TO BE PARTY TO DEEDS.COM. THE PROCESS IS DOWN-TO-EARTH AND VERY USER FRIENDLY. I MUST SAY THAT JUST THE SAVINGS IN TRAVEL TIME AND MONEY IS IN ITSELF VERY REFRESHING. THIS ON LINE PROCESS IS SO CONVENIENT FOR MY OVERALL EFFORT AND OF COURSE FOR OUR CLIENTS AS WELL. I GOT BACKED UP IN RECORDING WHEN THE VIRUS BEGAN RAGING AND PERSONAL VISITS TO LAND RECORDS BECAME A THING OF THE PAST.I FOUND THE SITE WITH A SUGGESTION FROM DC LAND RECORDS' ASSISTANT BY PHONE. I ONLY WISH I'D KNOWN ABOUT THIS AWESOME SERVICE BEFORE 2020. HATS OFF TO DEEDS.COM!

Thank you for your feedback. We really appreciate it. Have a great day!

Bernique C.

May 18th, 2022

Was very pleased to be referred by another user for needed documents. Add me to "satisfied customers"

Thank you for your feedback. We really appreciate it. Have a great day!

Lorrie P.

January 8th, 2021

What a wonderful and easy task using deeds.com. I searched on line for the proper procedure to file a quit claim deed. It looked to confusing to do mysellf until I found deeds.com. With their instructions, I was able to fill out all the proper forms and file with the court in two days. Saved me at least a thousand dollars if I had an attorney do the same. Thank you. I will definitely use them again.

Thank you for your feedback. We really appreciate it. Have a great day!

Pamela P.

April 10th, 2021

Access to all the necessary forms was easy. The detailed guide very helpful for ensuring a customer can fill out the documents accurately.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Patricia J.

September 17th, 2020

Easy quick process to download at a reasonable price. Some good info provided.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Richard O.

February 18th, 2025

It has an easy-to-use interface and well-formatted, detailed forms. Consider adding AI agents to assist in completing these forms from data provided or available from public sources. Overall, I am very satisfied!

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Lori B.

June 8th, 2023

Great service. Very easy to follow instructions and examples. I would use again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!