Kearny County Mineral Deed with Quitclaim Covenants Form (Kansas)

All Kearny County specific forms and documents listed below are included in your immediate download package:

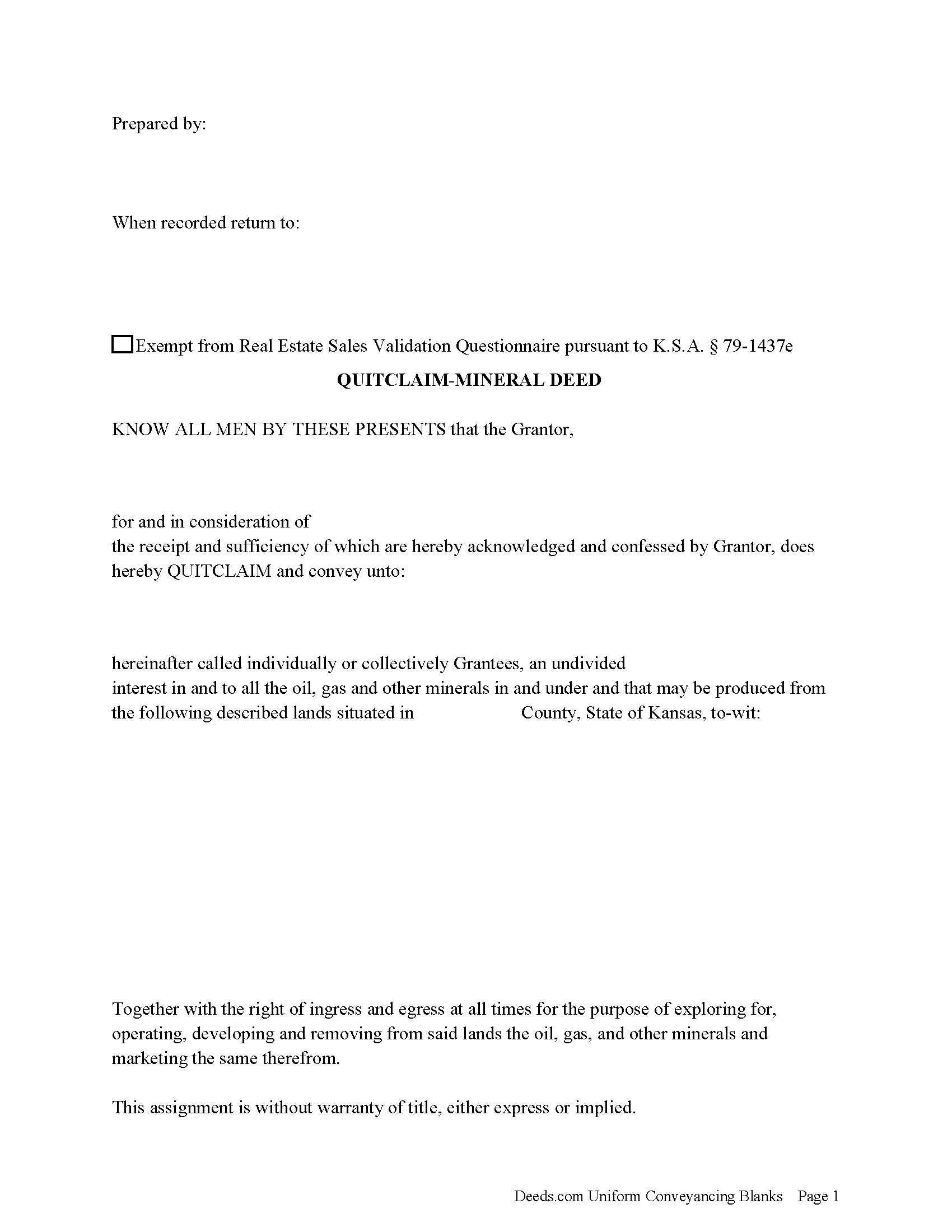

Mineral Deed with Quitclaim Covenants Form

Fill in the blank Mineral Deed with Quitclaim Covenants form formatted to comply with all Kansas recording and content requirements.

Included Kearny County compliant document last validated/updated 10/22/2024

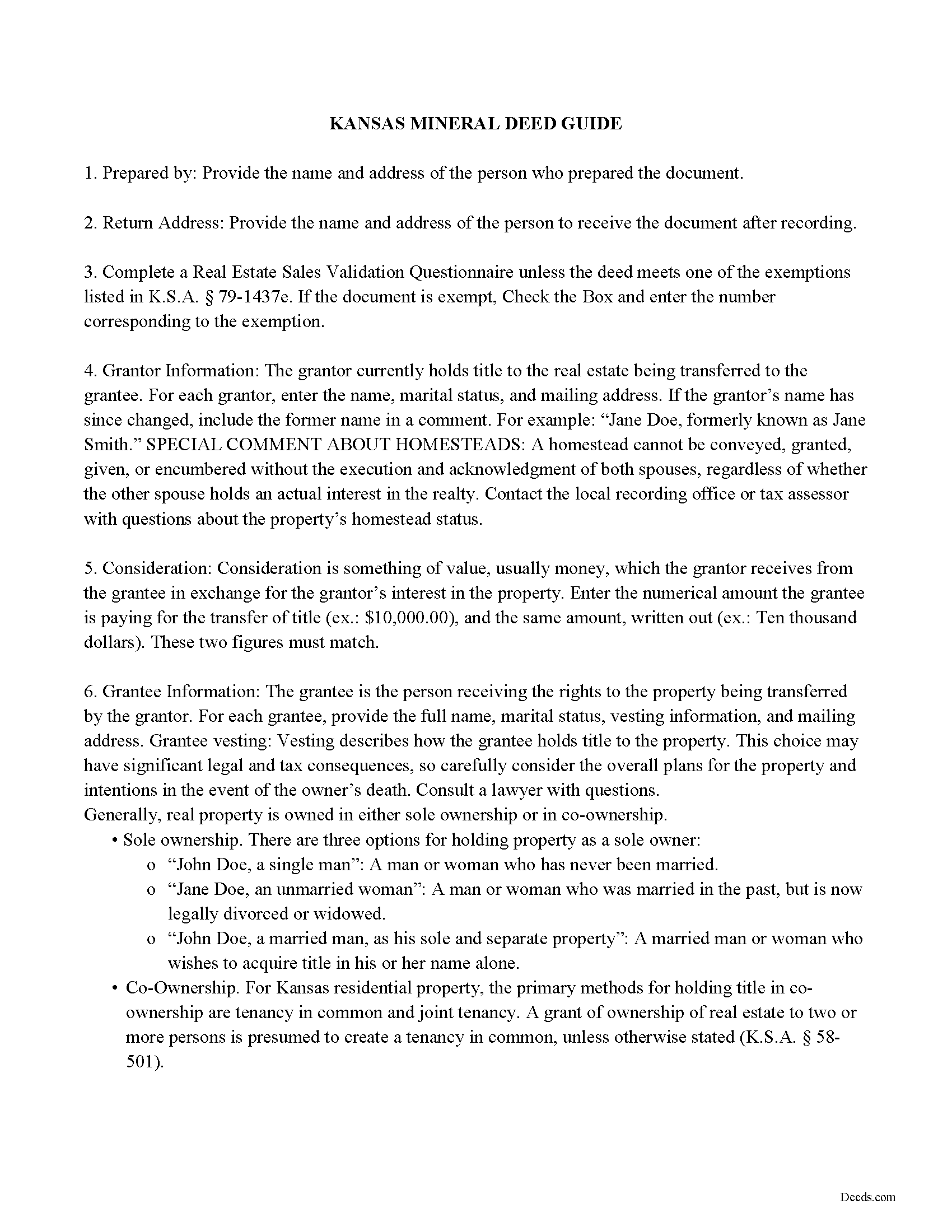

Mineral Deed with Quitclaim Covenants Guide

Line by line guide explaining every blank on the Mineral Deed with Quitclaim Covenants form.

Included Kearny County compliant document last validated/updated 6/9/2025

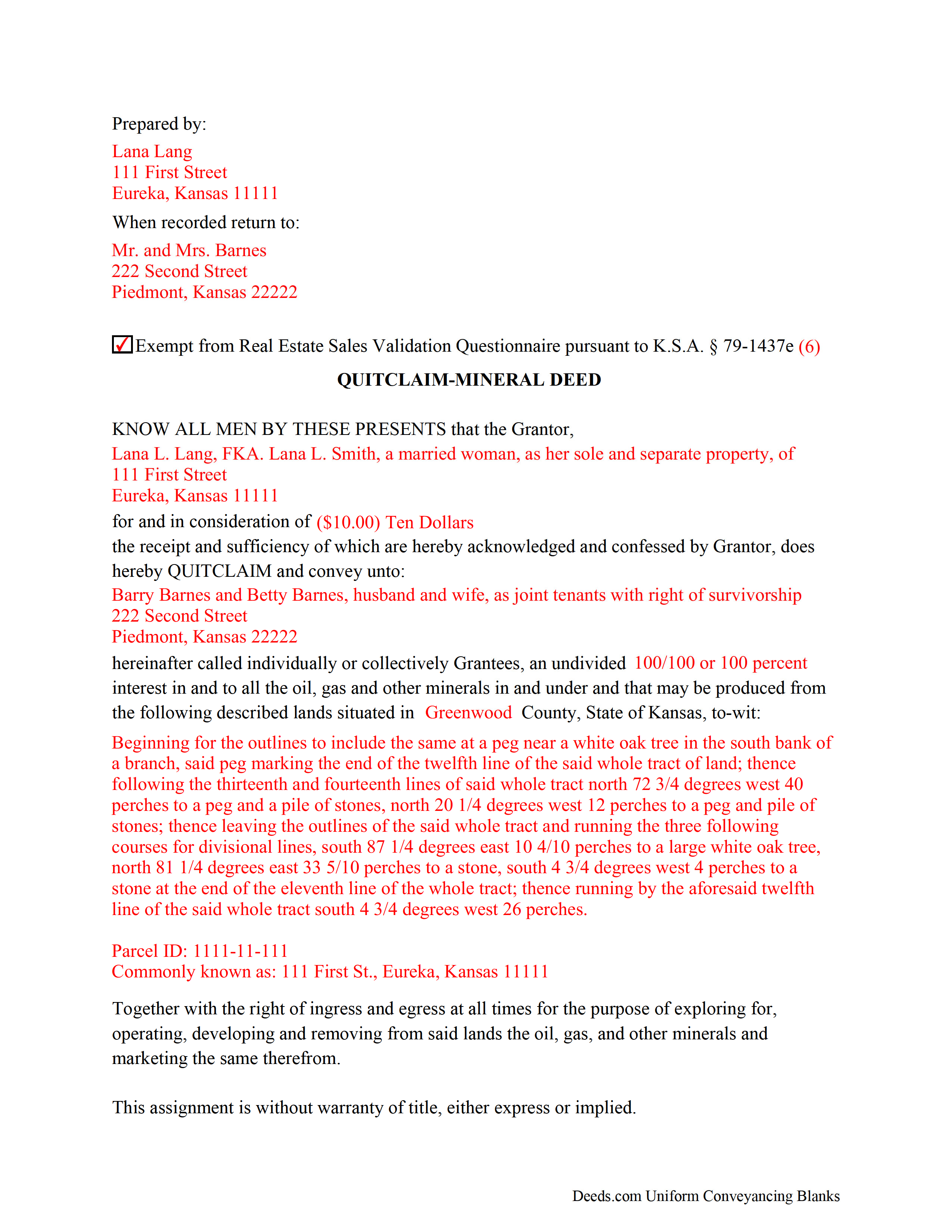

Completed Example of the Mineral Deed with Quitclaim Covenants Document

Example of a properly completed Kansas Mineral Deed with Quitclaim Covenants document for reference.

Included Kearny County compliant document last validated/updated 6/23/2025

The following Kansas and Kearny County supplemental forms are included as a courtesy with your order:

When using these Mineral Deed with Quitclaim Covenants forms, the subject real estate must be physically located in Kearny County. The executed documents should then be recorded in the following office:

Kearny County Register of Deeds

304 North Main St / PO Box 42, Lakin, Kansas 67860

Hours: 8:00am-5:00pm M-F

Phone: (620) 355-6241

Local jurisdictions located in Kearny County include:

- Deerfield

- Lakin

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Kearny County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Kearny County using our eRecording service.

Are these forms guaranteed to be recordable in Kearny County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Kearny County including margin requirements, content requirements, font and font size requirements.

Can the Mineral Deed with Quitclaim Covenants forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Kearny County that you need to transfer you would only need to order our forms once for all of your properties in Kearny County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Kansas or Kearny County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Kearny County Mineral Deed with Quitclaim Covenants forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

The General Mineral Deed in Kansas Quitclaims oil, gas, and mineral rights from the grantor to the grantee. THIS IS NOT A LEASE. There are no Exceptions or Reservations included.

The transfer includes the oil, gas and other minerals of every kind and nature. The Grantor can stipulate the percentage of Mineral Rights the Grantee will receive.

This general mineral deed gives the grantee the right to access, for the purpose of mining, drilling, exploring, operating and developing said lands for oil, gas, and other minerals, and storing handling, transporting and marketing of such.

The seller, or grantor Quitclaims the mineral rights and does NOT accept responsibility to any discrepancy of title (This assignment is without warranty of title, either express or implied)

Uses: Mineral deeds with quitclaim are often used in situations where the grantor wants to quickly release any interest they might have in mineral rights, such as in settling estates, resolving disputes, clearing up uncertainties about ownership in a title's history or when mineral rights have previously been severed or fragmented from surface rights and cloud a title, making it difficult to transfer property. Resolution often involves the holder(s) of the mineral rights, quit-claiming any rights he/she/they have or might have in the subject property.

Use of this document can have a permanent effect on your rights to the property, if you are not completely sure of what you are executing seek the advice of a legal professional.

(Kansas Mineral Deed with Quitclaim Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Kearny County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Kearny County Mineral Deed with Quitclaim Covenants form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4563 Reviews )

JAMES D.

July 10th, 2025

Slick as can be and so convenient.rnrnWorked like a charm

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Debra B.

April 14th, 2020

I was very glad to have this option for filing a form as it would have taken 4 days due to offices being closed to the public during the COVID 19 epidemic. I found the process to be fairly simple and I was able to file the document within 24 hours.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

joni e.

October 25th, 2019

It was everything that I needed. The county clerk's office kept telling me to get a lawyer for this form, but I didn't need one. Saved myself hundreds of dollars. I've used them many times.

Thank you for your feedback. We really appreciate it. Have a great day!

Julie C.

July 21st, 2020

The process worked great! It's a great solution for recording documents at the county during the pandemic and in the future if you don't want to leave home!!

Thank you!

Stephen W.

May 16th, 2020

It provided the forms I could not find elsewhere.

Thank you.

Thank you!

Randal R.

December 20th, 2019

While disappointed that my request could not be filled, I understand the issue, and appreciate the attempt and the responsiveness. I certainly will be back if the occasion arises!

Thank you!

Joni S.

February 6th, 2024

Excellent service, no hassle, easy to use, affordable, best service -- hands down. I thought it would be difficult for me to record a deed in Florida while residing in California but you made it so easy. I will tell everyone about your service.rnThank you.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Jason R.

April 28th, 2020

Very easy to use. Great examples.

Thank you for your feedback. We really appreciate it. Have a great day!

Monica T.

January 8th, 2025

Super easy to use. Very pleased. The turn around time was very fast. I have another one pending.rnThank you!

We are grateful for your feedback and looking forward to serving you again. Thank you!

Bonnie A.

September 27th, 2021

I wish you could send copy in mail

Thank you for your feedback. We really appreciate it. Have a great day!

Donald S.

July 7th, 2020

Good

Thank you!

Laurie S.

May 24th, 2023

This was amazingly easy to access.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sandrs T.

August 27th, 2020

It would be good to be able to print several documents at 1 time by highlighting them in the list without having to do one document at a time.

Thank you for your feedback. We really appreciate it. Have a great day!