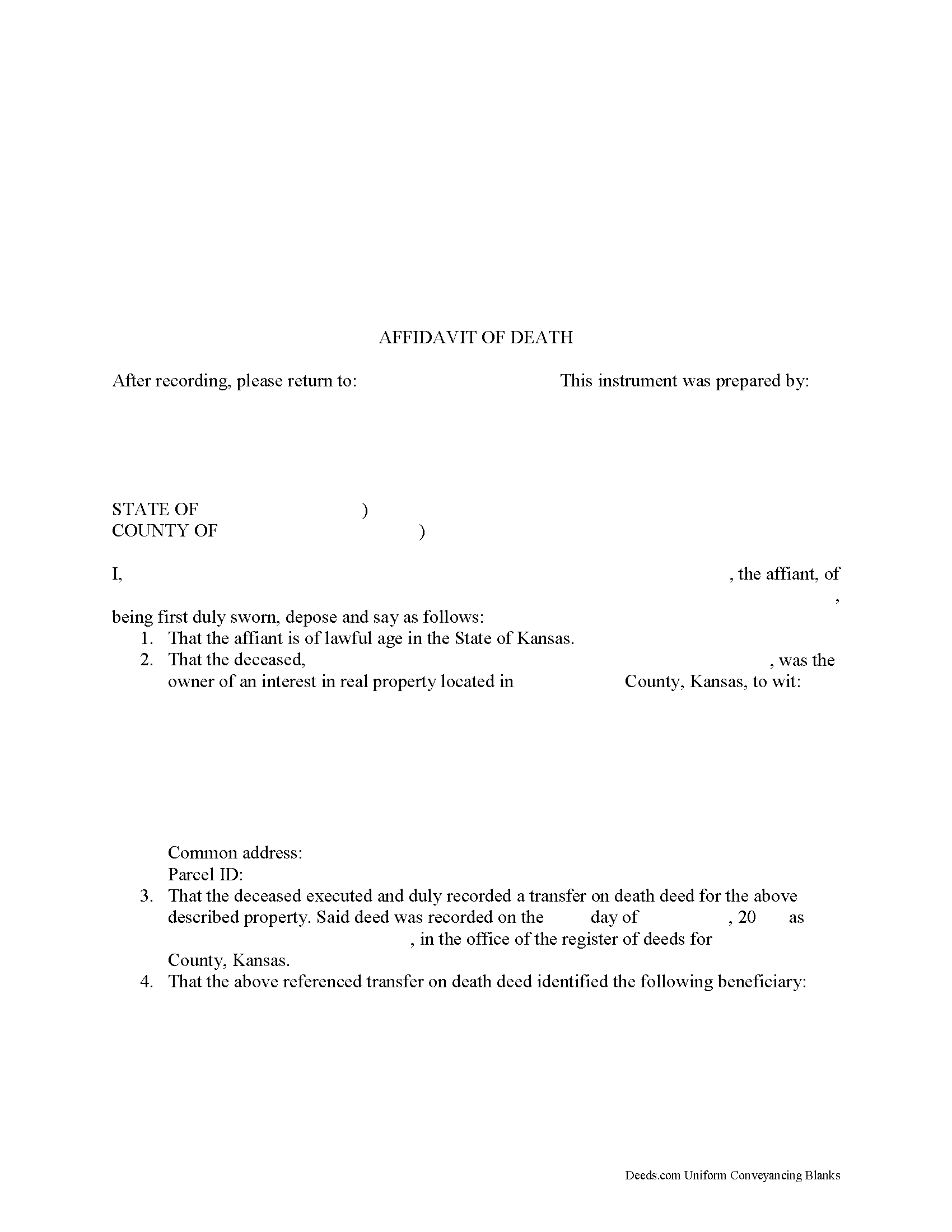

Scott County Transfer on Death Affidavit Form

Scott County Transfer on Death Affidavit Form

Fill in the blank form formatted to comply with all recording and content requirements.

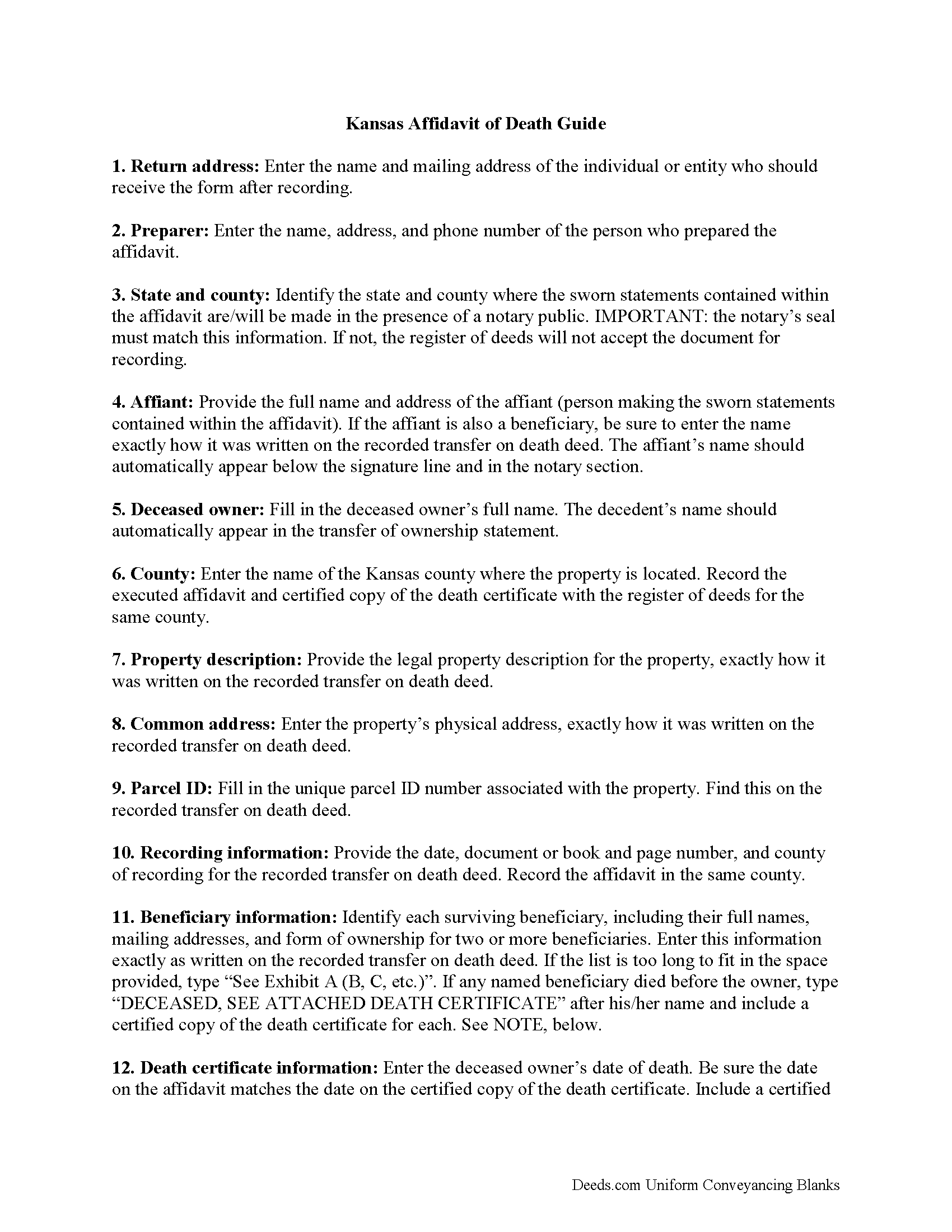

Scott County Transfer on Death Affidavit Guide

Line by line guide explaining every blank on the form.

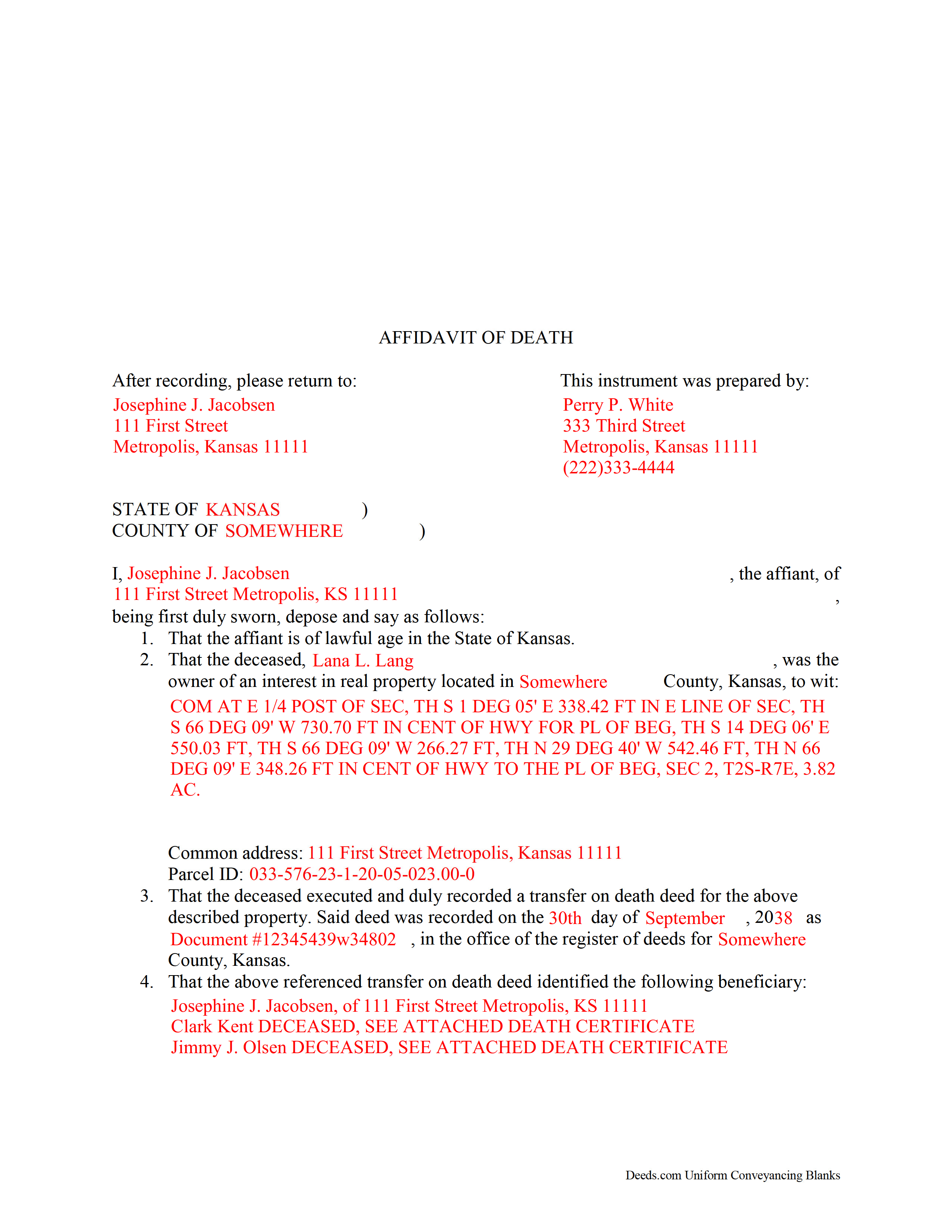

Scott County Completed Example of the Transfer on Death Affidavit Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kansas and Scott County documents included at no extra charge:

Where to Record Your Documents

Scott County Register of Deeds

Scott City, Kansas 67871

Hours: 8:00am-5:00pm M-F

Phone: (620) 872-3155

Recording Tips for Scott County:

- Ensure all signatures are in blue or black ink

- Bring your driver's license or state-issued photo ID

- Check margin requirements - usually 1-2 inches at top

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Scott County

Properties in any of these areas use Scott County forms:

- Scott City

Hours, fees, requirements, and more for Scott County

How do I get my forms?

Forms are available for immediate download after payment. The Scott County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Scott County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Scott County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Scott County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Scott County?

Recording fees in Scott County vary. Contact the recorder's office at (620) 872-3155 for current fees.

Questions answered? Let's get started!

Using a Kansas Affidavit of Death to Complete a Transfer on Death

In Kansas, the county assessor's office initiates the transfer of real property rights under a transfer on death deed. There are several steps to take, however, before that can happen.

When the property owner dies, an individual with personal knowledge of the intended transfer, whether the named beneficiary or someone else, makes the sworn statements contained within an affidavit of death. The affidavit, along with an official copy of the deceased owner's death certificate, is filed for record with the register of deeds for the county where the land is located.

The register of deeds then forwards the details to the county assessor's office, where they match the information on the affidavit with the deed records. After the assessor's office verifies the details, they begin the process to transfer the previous owner's rights to the beneficiary.

(Kansas Transfer on Death Affidavit Package includes form, guidelines, and completed example)

Important: Your property must be located in Scott County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Affidavit meets all recording requirements specific to Scott County.

Our Promise

The documents you receive here will meet, or exceed, the Scott County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Scott County Transfer on Death Affidavit form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Richard E.

August 10th, 2021

The QuitClaim deed does not provide enough space in the Grantor block at the top of the first page. In fact, all blocks should provide more space.

Thank you for your feedback. We really appreciate it. Have a great day!

Darlene P.

November 12th, 2021

Deeds.com was a money saver for me. It made a daunting task of preparing a Quit Claim Deed a very simple task. I was happy that my documentation was accepted by my state and County first round. Thank you Deeds.com

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert H.

April 18th, 2020

I am very pleased with your service.

Thank you!

Michelle H.

August 8th, 2020

Fast, easy and helpful. Highly recommend, my document was recorded within 24 hours.

Thank you!

ALEX A.

June 30th, 2020

Yes I appreciate your services everything so far looking good this shows the facts the reasons most of all format I enjoy it I hopefully I can use it for some other legal forms also for Fry's Baker's fraud title fraud I'm interested in a lot of services that will provide me with a preferences of a fraud situations on mortgage security loans but other than that the services are awesome and I appreciate it appreciate your services and I'll keep on using it and thanks again thumbs up

Thank you!

JOSE E.

March 19th, 2019

Thanks

Thank you!

Nancy A.

June 23rd, 2021

First time user and I was pleasantly surprised how quick and easy it was to get my Deed recorded. And the fee was not outrageous.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Linda W.

April 21st, 2020

The Quitclaim deed form was fine. Unfortunately, all I wanted to accomplish was to transfer property held in my name into my trust, but I could not any wording on the information you provided on how to accomplish this. It was not a sale, just a transfer from me to me as trustee.

Thank you for your feedback. We really appreciate it. Have a great day!

Karl L.

January 30th, 2025

Excellent Service Terrific Follow Up and Follow Throught

Your appreciative words mean the world to us. Thank you.

James R.

July 4th, 2019

Easy to understand instructions. Love the examples. Info on the deeds purpose easily comprehendible. Able to Kiosk record without difficulty. Am I pleased? Oh Yeah!!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Susan R.

July 31st, 2020

I found the documents I needed on Deeds.com. It was so easy to use and I received the items I purchased FAST! I'll be using their service again.

Thank you for your feedback. We really appreciate it. Have a great day!

Ruth K.

October 11th, 2022

this is the only site that helped me out

Thank you!

Gayela C.

September 13th, 2019

Easy to use and I really like having the guides that come along with the forms.

Thank you!

Hideo K.

September 12th, 2023

Very prompt and satisfied with the service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert P.

June 10th, 2019

excellent reference

Thank you for your feedback. We really appreciate it. Have a great day!