Carter County Affidavit of Descent Form (Kentucky)

All Carter County specific forms and documents listed below are included in your immediate download package:

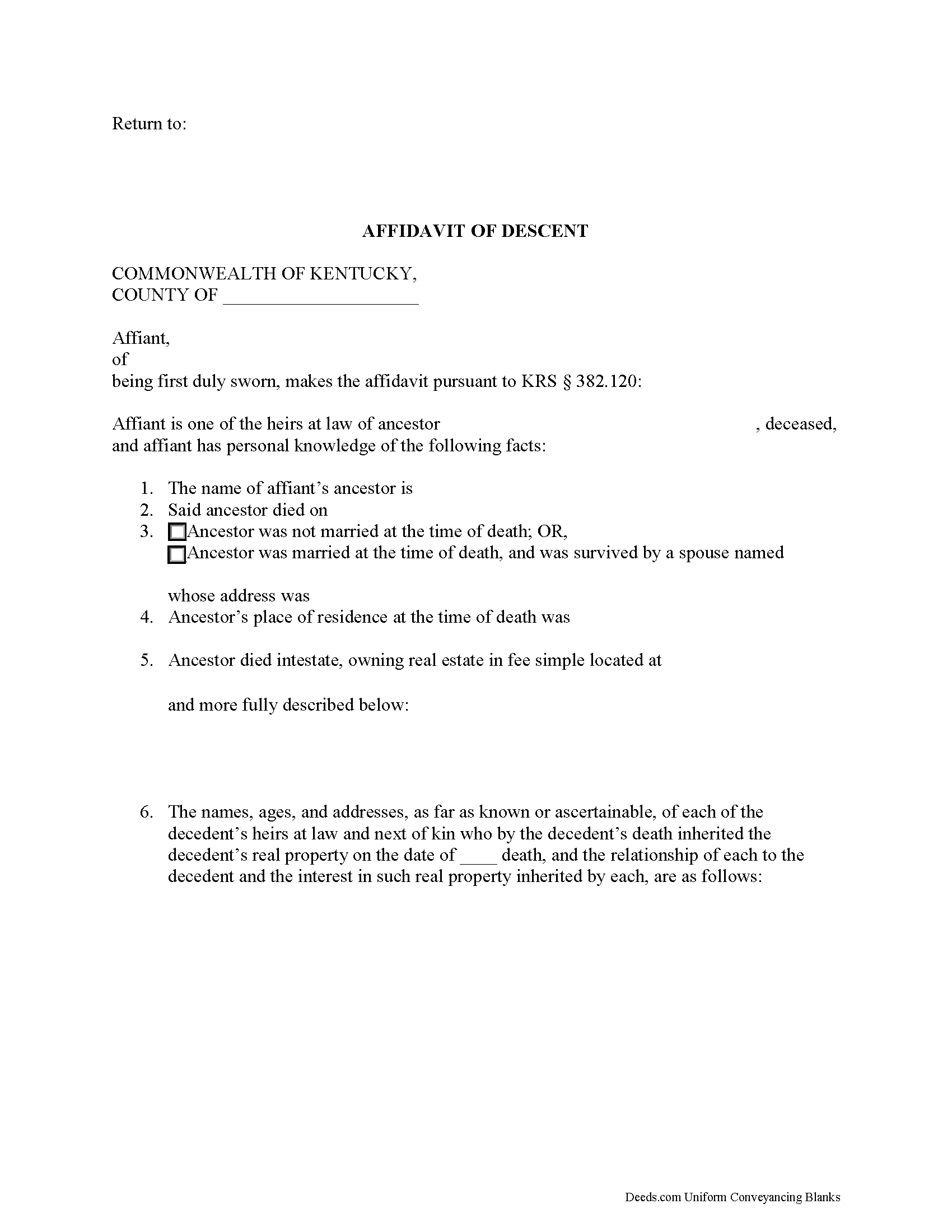

Affidavit of Descent Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Carter County compliant document last validated/updated 5/9/2025

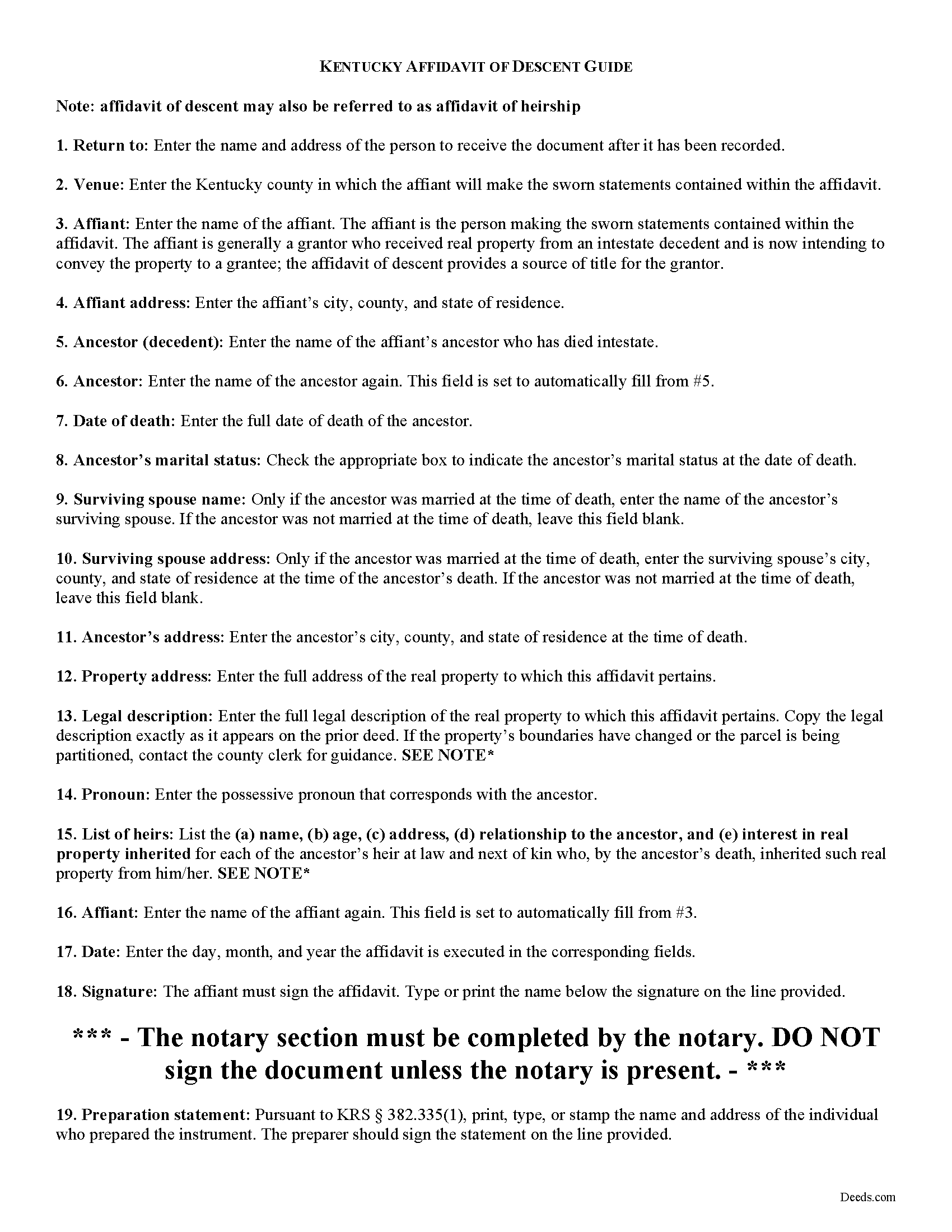

Affidavit of Descent Guide

Line by line guide explaining every blank on the form.

Included Carter County compliant document last validated/updated 5/7/2025

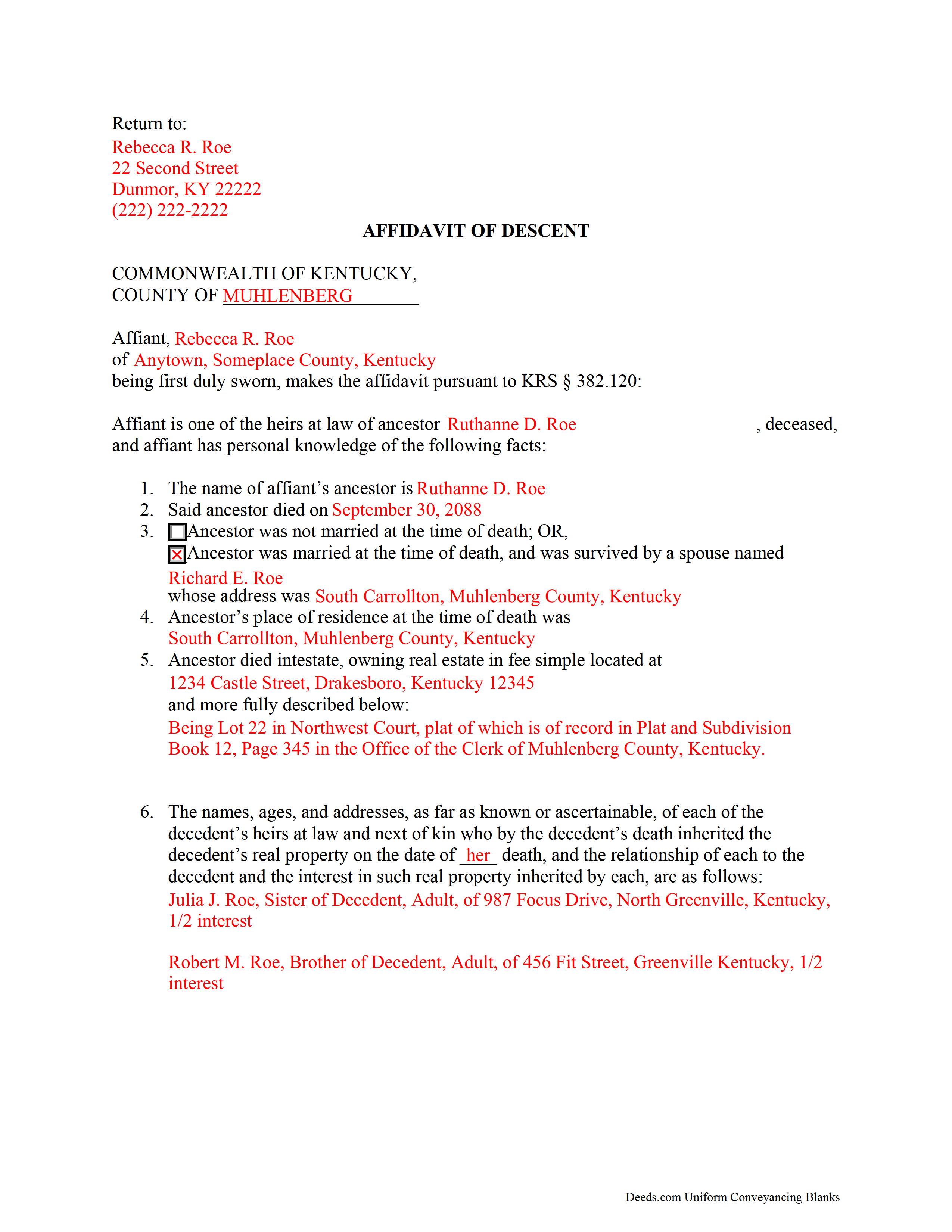

Completed Example of the Affidavit of Descent Form

Example of a properly completed form for reference.

Included Carter County compliant document last validated/updated 3/21/2025

The following Kentucky and Carter County supplemental forms are included as a courtesy with your order:

When using these Affidavit of Descent forms, the subject real estate must be physically located in Carter County. The executed documents should then be recorded in the following office:

Carter County Clerk

300 West Main St, Rm 227, Grayson, Kentucky 41143

Hours: 8:30 to 4:00 M-F / They will also be open the last Saturday of every month from 8:30 a.m. until noon.

Phone: (606) 474-5188

Local jurisdictions located in Carter County include:

- Carter

- Denton

- Grahn

- Grayson

- Hitchins

- Olive Hill

- Soldier

- Willard

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Carter County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Carter County using our eRecording service.

Are these forms guaranteed to be recordable in Carter County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Carter County including margin requirements, content requirements, font and font size requirements.

Can the Affidavit of Descent forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Carter County that you need to transfer you would only need to order our forms once for all of your properties in Carter County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Kentucky or Carter County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Carter County Affidavit of Descent forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

An affidavit of descent (alternately, affidavit of heirship) under KRS 382.120 establishes a source of title for a grantor who is transferring property he or she acquired from an intestate estate.

The affidavit must be filed before the grantor can record a deed conveying the subject property. Pursuant to Kentucky statute, the affiant (person making the sworn statements contained within the affidavit) may be the grantor or any one (1) of the heirs at law or next of kin of the ancestor of the grantor, or of two (2) residents of the Commonwealth of Kentucky.

The affidavit must recite the ancestor's name, date of death, and place of residence, as well as information regarding the ancestor's surviving spouse, if applicable. In addition, the affidavit must state that the ancestor died intestate (without a will), and contain a list of the names, ages, and addresses of each of the ancestor's heirs at law and next of kin, and include everyone's relationship to the ancestor and the interest in real property he or she inherited by the ancestor's death.

The affiant must sign the document before a notary public before filing in the office of the county clerk of the county wherein the subject real property is situated.

Contact a lawyer with questions about Kentucky legal documents or other inquiries related to probate.

(Kentucky Affidavit of Descent Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Carter County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Carter County Affidavit of Descent form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4562 Reviews )

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Pauline C.

June 29th, 2025

Everything that was stated to be included in my order was complete. Very satisfied

Thank you for your positive words! We’re thrilled to hear about your experience.

Ronald T H.

June 21st, 2019

Wow ! Easy to use. Thanks Ron Holt

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Nawal F.

June 1st, 2023

Friendly user

Thank you!

LAWRENCE S.

January 9th, 2022

I am mostly satisfied with my Deeds.Com experience. Not sure if you can do anything about this, but since it is fairly common, I thought the Quit Claim Form would have a section specifically for adding spouse to a deed.

Thank you for your feedback. We really appreciate it. Have a great day!

Cary C.

February 8th, 2021

I am very grateful for this service! But I was quite surprised to see the fees went up over 50%! The last 5 or 6 recordings I have done we each only $25.00.

Thank you,

Sally Center

Thank you for your feedback. We really appreciate it. Have a great day!

Turto T.

February 5th, 2021

The documents were accurate and event well packaged. They contained all the information that was needed to establish revocable trusts and transfer the property into the trusts. All of this with decent price.

Thank you for your feedback. We really appreciate it. Have a great day!

ELOISA F.

May 27th, 2021

Once I had everything right;the recording was fast and easy. I was updated at every juncture and apprised of my mistakes in order to fix and record my deed. To improve service: I think that several different examples and scenarios would have helped. If you have different names from your children; birth certificates and marriage certificates are a requirement in Clark County, NV. If you want to add anyone to the deed in a Quit Claim Deed; you have to add yourself as a grantee even if you are the grantor along with the other grantees.

Thank you for your feedback. We really appreciate it. Have a great day!

Julie P.

June 30th, 2024

Quick & easy to use. Spoke a lawyer and saved hundreds by doing it myself.

Thank you for your feedback Julie, we appreciate you.

Cynthia M.

July 5th, 2019

I wanted the Lady Bird Deed for my estate, and it was very easy to download, fill out and file. My county records department accepted it with no issue. Thank you Deeds.com! You saved me over $500.00!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Masud K.

June 20th, 2020

Deeds.com did an excellent job in providing me the Real Estate documents I needed. You delivered the documents fast and they were accurate. I greatly appreciate your help. Thanks for everything

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Hilary C.

October 9th, 2020

Within 10 minutes I had my Deed!!! Fantastic!!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Sherrl F.

June 3rd, 2021

I had a excellent experience using DEEDS.COM. Very clear directions and site was easy to use. I paid the fee to have my deed electronically filed and it was done the day I requested it be filed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Garrett R.

May 24th, 2022

I am a real estate attorney in CA. These Wyoming model deeds look too basic and barely adequate: no usual name and address at the top for tax statements and who recorded it. Some old fashioned legalese that only obfuscates. I won't use them. Your background info was good though.

Thank you for your feedback. We really appreciate it. Have a great day!