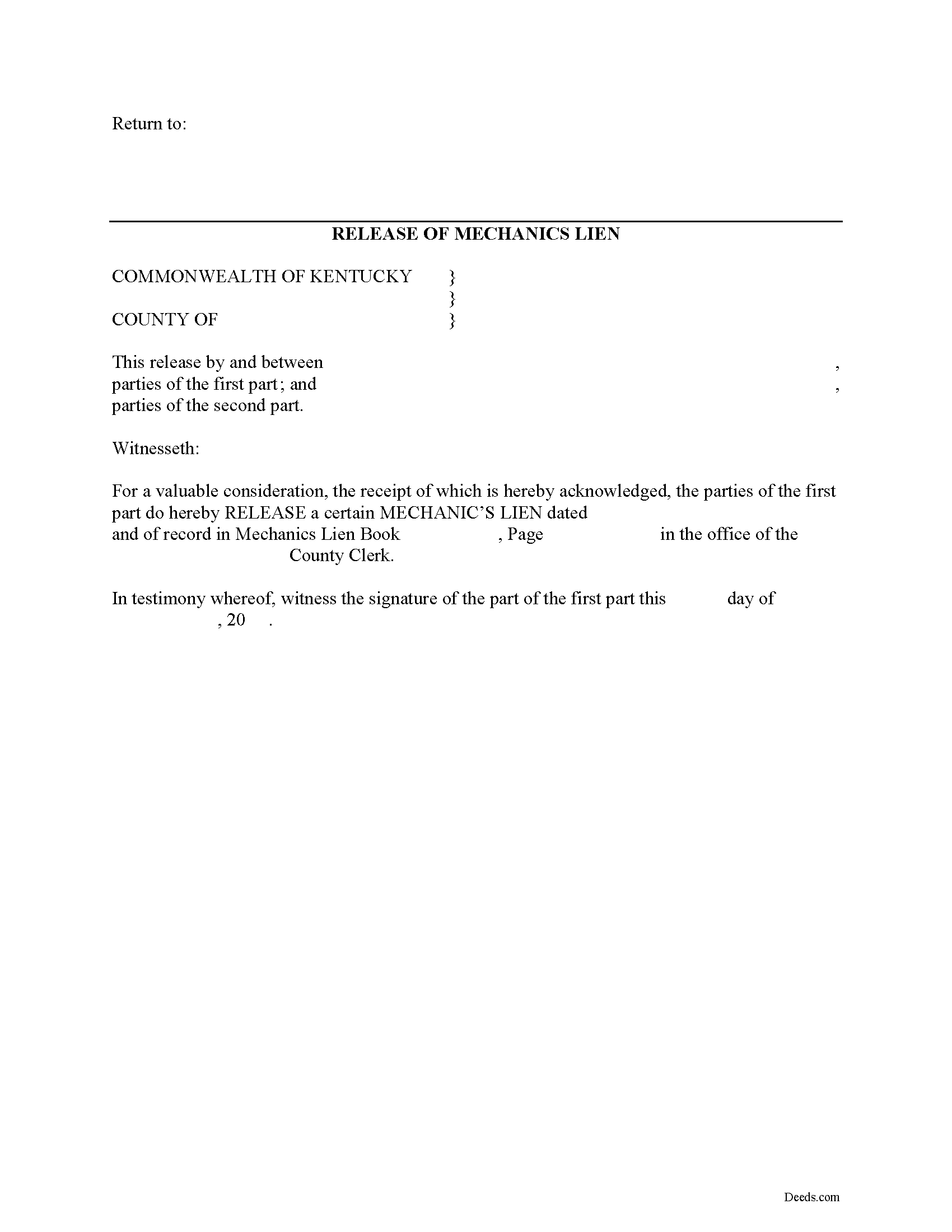

Marshall County Discharge of Lien by Bond Form

Marshall County Discharge of Lien by Bond Form

Fill in the blank Discharge of Lien by Bond form formatted to comply with all Kentucky recording and content requirements.

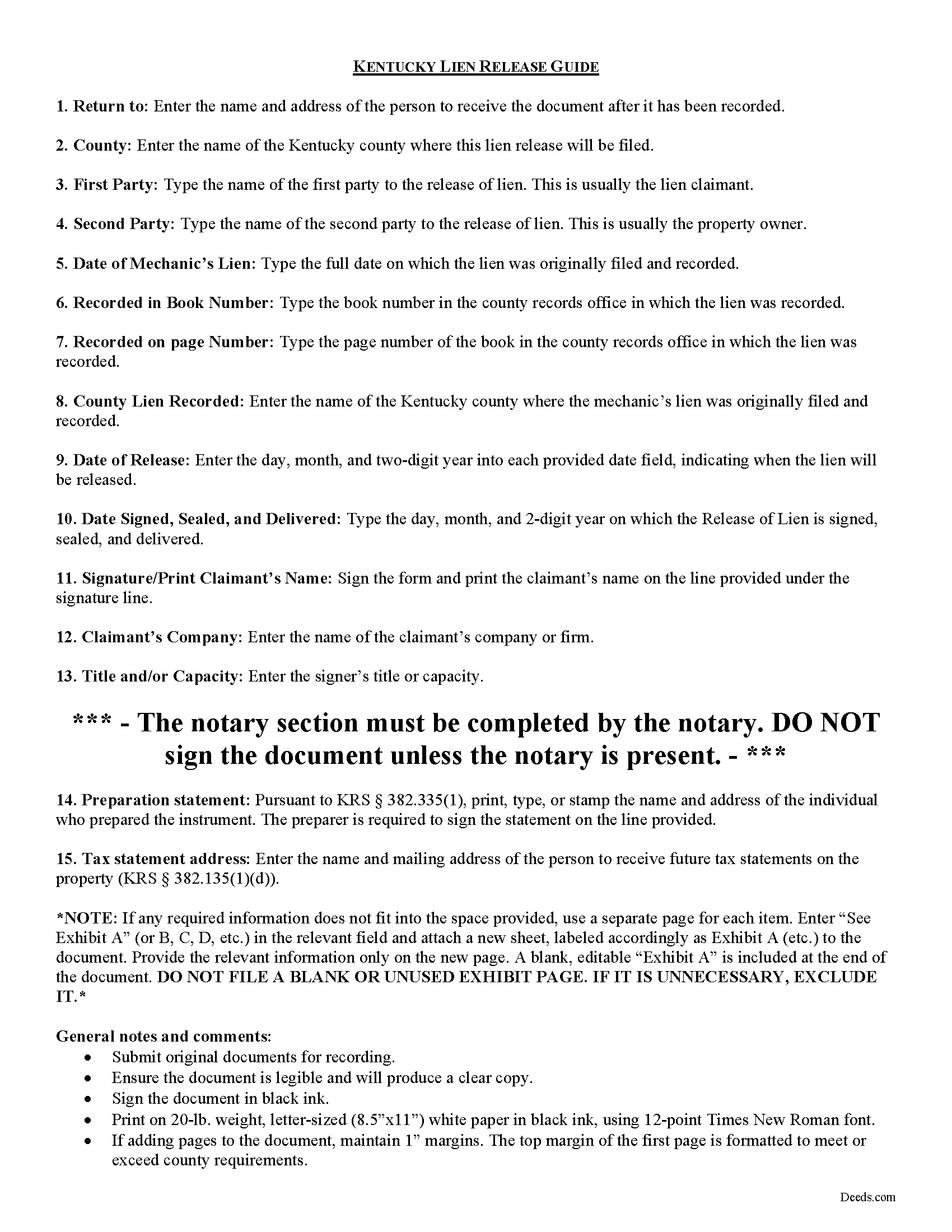

Marshall County Discharge of Lien by Bond Guide

Line by line guide explaining every blank on the form.

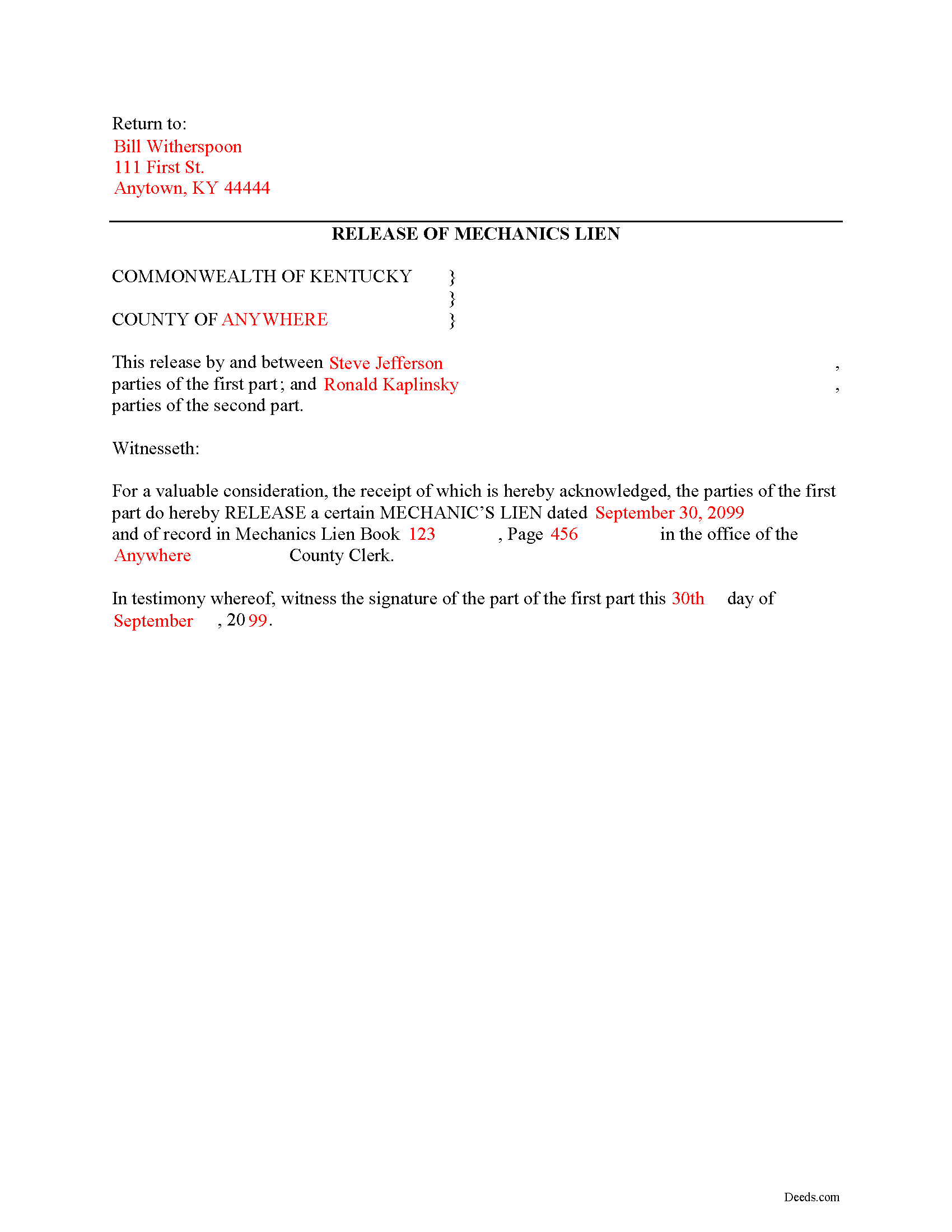

Marshall County Completed Example of the Discharge of Lien by Bond Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kentucky and Marshall County documents included at no extra charge:

Where to Record Your Documents

Marshall County Clerk

Benton, Kentucky 42025

Hours: 8:30 to 4:30 M-F

Phone: (270) 527-4740

Recording Tips for Marshall County:

- Documents must be on 8.5 x 11 inch white paper

- Check margin requirements - usually 1-2 inches at top

- Make copies of your documents before recording - keep originals safe

- Request a receipt showing your recording numbers

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Marshall County

Properties in any of these areas use Marshall County forms:

- Benton

- Calvert City

- Gilbertsville

- Hardin

Hours, fees, requirements, and more for Marshall County

How do I get my forms?

Forms are available for immediate download after payment. The Marshall County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Marshall County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Marshall County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Marshall County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Marshall County?

Recording fees in Marshall County vary. Contact the recorder's office at (270) 527-4740 for current fees.

Questions answered? Let's get started!

Release of Lien in Kentucky by Execution of Bond

Executing a bond is one way to remove mechanic's liens levied on a property. A bond is an amount that can be posted with a surety or other agency that guarantees payment to a contractor or other lien claimant. In return for this assurance, the claimants release the liens.

In Kentucky, the owner or claimant of a property covered by a lien, (or any contractor or other person contracting with the owner or claimant for the furnishing of improvements or services), may, at any time before a judgment is rendered to enforce the lien, execute with the county clerk in the county where the lien was filed, a bond for double the amount of the lien claimed. K.R.S. 376.100. The bond and release must be approved by the clerk and are conditioned upon the obligors satisfying any judgment that may be rendered in favor of the person asserting the lien. Id. So, if the lien is filed for $5,000, a bond of $10,000 must be executed to discharge the lien.

The release document identifies the parties, recording details of the filed lien, and the effective date of the release. The bond shall be preserved by the clerk, and upon its execution the lien upon the property shall be discharged. Id. The person asserting the lien may make the obligors in the bond parties to any action to enforce the claim, and any judgment recovered may be against all or any of the obligors on the bond. Id.

This article is provided for information purposes only and should not be relied on as a substitute for the advice from a legal professional. If you have questions about posting a bond to release a lien, or any other issues related to liens in Kentucky, please speak with a licensed attorney.

Important: Your property must be located in Marshall County to use these forms. Documents should be recorded at the office below.

This Discharge of Lien by Bond meets all recording requirements specific to Marshall County.

Our Promise

The documents you receive here will meet, or exceed, the Marshall County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Marshall County Discharge of Lien by Bond form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

John B.

November 15th, 2023

Fantastic service, easy to use, and supported the entire way through every process. Excellent service!

We are motivated by your feedback to continue delivering excellence. Thank you!

LeAnne A.

July 6th, 2021

Documents are helpful and much appreciated. Grateful for this service when an attorney is not required.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rebecca M.

December 28th, 2021

This was pretty easy to fill out. The directions on all of the forms was very good. This should make life much easier at the County Recorder. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jennifer K.

March 4th, 2021

User friendly!

Thank you!

Kimberly H.

June 24th, 2021

Excellent and Helpful as well as patient. Great Service.

Thank you!

Tiffany J.

December 26th, 2020

Easy steps to create an account, will recommend to anyone.

Thank you for your feedback. We really appreciate it. Have a great day!

John Z.

April 14th, 2022

This was an easy to use program. Easy payment. documents are on my desktop ready to fill out. I will have to update after my property transfer. Zuna

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Hanna M.

June 10th, 2019

Very helpful information! Thank you for your service!

Thank you!

Rebecca F.

November 4th, 2021

Forms were great. I wasn't able to find them anywhere. Even the county recorder didn't have them

Thank you for your feedback. We really appreciate it. Have a great day!

Duane L.

September 5th, 2020

Easy to use with very helpful directions.

Thank you!

thomas C.

July 7th, 2020

Thank you for being there for me when I couldn't get it done myself. I was a little confused with the operation at first but then became easy. I will definitely be using you again and again. Even after the pandemic is over.It's approximately 15 miles one way to downtown Orlando to do what you did for me sitting at my house

Glad we could help Thomas, have a great day!

Catherine M.

April 30th, 2021

Great service, very efficient and super fast.

Thank you!

Linda W.

June 24th, 2019

Very easy to use. They had the exact document I was looking for.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gregory h.

February 15th, 2023

OUtsdtanding. Quick and easy, both of which are a huge plus

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cynthia N.

February 25th, 2021

great service, quick and easy!

Thank you!