Johnson County Discharge of Lien Form (Kentucky)

All Johnson County specific forms and documents listed below are included in your immediate download package:

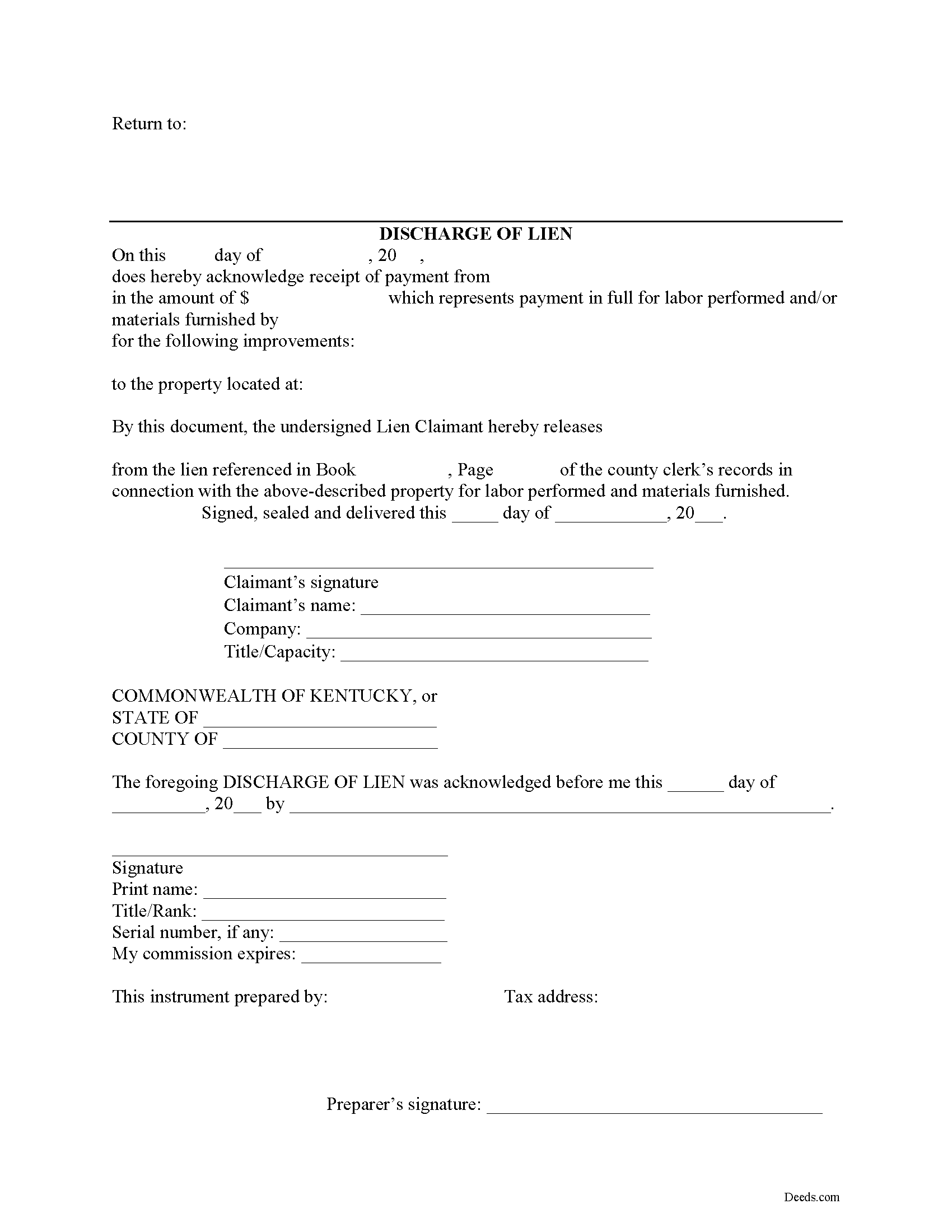

Discharge of Lien Form

Fill in the blank Discharge of Lien form formatted to comply with all Kentucky recording and content requirements.

Included Johnson County compliant document last validated/updated 6/5/2025

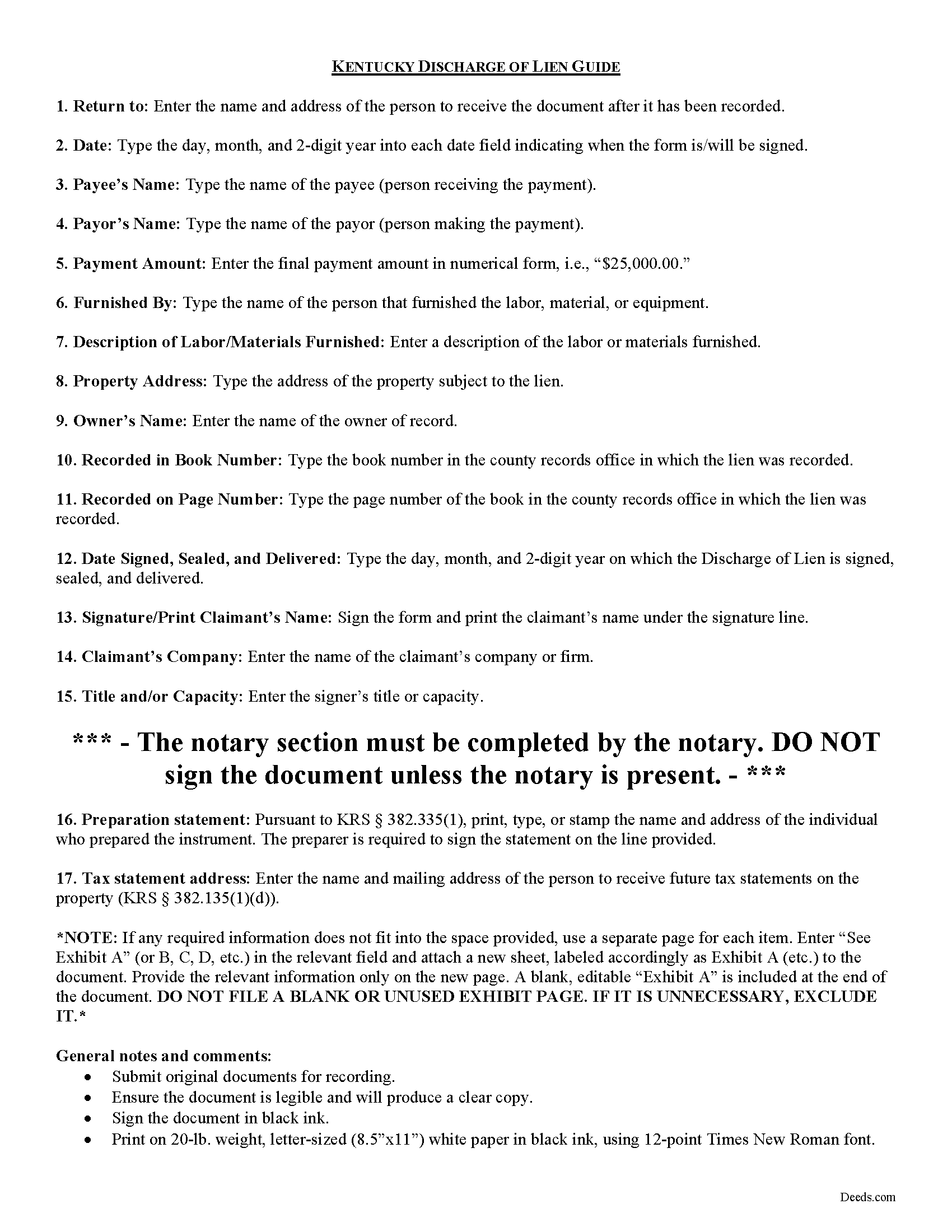

Discharge of Lien Guide

Line by line guide explaining every blank on the form.

Included Johnson County compliant document last validated/updated 4/29/2025

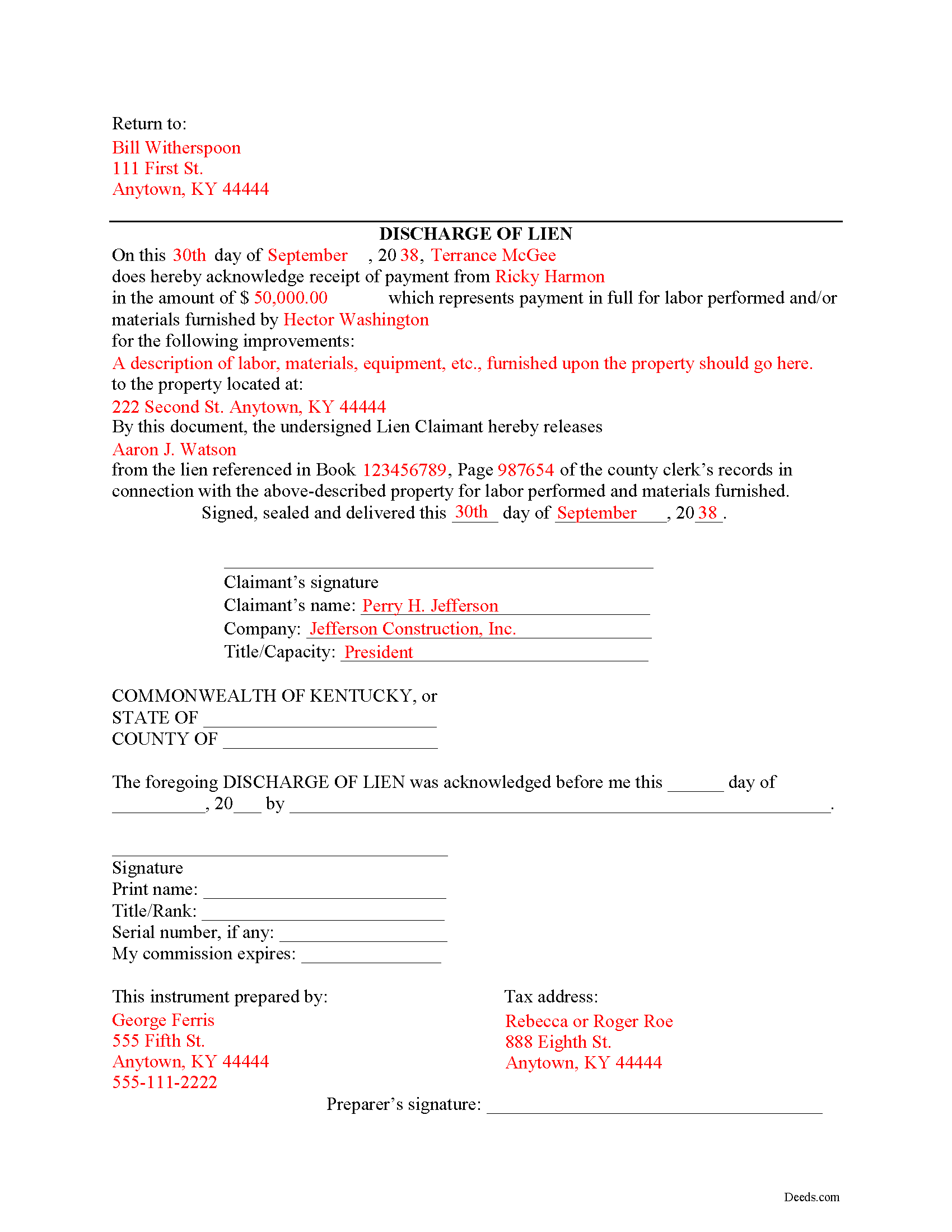

Completed Example of the Discharge of Lien Document

Example of a properly completed form for reference.

Included Johnson County compliant document last validated/updated 1/29/2025

The following Kentucky and Johnson County supplemental forms are included as a courtesy with your order:

When using these Discharge of Lien forms, the subject real estate must be physically located in Johnson County. The executed documents should then be recorded in the following office:

Johnson County Clerk

230 Court St, Rm 124, Paintsville, Kentucky 41240

Hours: 8:00am to 4:30pm M-F; Sat 8:30 to noon

Phone: (606) 789-2557

Local jurisdictions located in Johnson County include:

- Boons Camp

- East Point

- Flatgap

- Hagerhill

- Keaton

- Meally

- Oil Springs

- Paintsville

- River

- Sitka

- Staffordsville

- Stambaugh

- Thelma

- Tutor Key

- Van Lear

- West Van Lear

- Williamsport

- Wittensville

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Johnson County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Johnson County using our eRecording service.

Are these forms guaranteed to be recordable in Johnson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Johnson County including margin requirements, content requirements, font and font size requirements.

Can the Discharge of Lien forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Johnson County that you need to transfer you would only need to order our forms once for all of your properties in Johnson County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Kentucky or Johnson County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Johnson County Discharge of Lien forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Discharging a Lien in Kentucky

When a lien has been paid off in full or is no longer necessary for any other reason, best practices direct the claimant to file a document discharging the lien. Kentucky does not provide for a specific mechanism of discharging a lien, as a lien already expires twelve months after its filing without any enforcement action. This document, however, reduces the amount of time a lien is in effect.

File the Discharge of Lien document in the county where the property is located (this should be the same location where the statement of lien was originally filed). The Discharge of Lien contains then following information: 1) name of the payor and payee; 2) payment amount; 3) name of person who originally furnished labor or materials; 4) description of items furnished; 5) address of the property; 5) the owner's name, and 6) the book and page number where the lien was recorded. Once the Discharge of Lien is filed and recorded, the lien will be struck from the record.

This article is provided for information purposes only and should not be relied on as a substitute for the advice from a legal professional. If you have questions about discharging a lien, or any other issues related to liens in Kentucky, please speak with a licensed attorney.

Our Promise

The documents you receive here will meet, or exceed, the Johnson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Johnson County Discharge of Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4564 Reviews )

Michael G.

July 14th, 2025

Very helpful and easy to use

Your appreciative words mean the world to us. Thank you.

JAMES D.

July 10th, 2025

Slick as can be and so convenient.rnrnWorked like a charm

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

carrie m.

March 3rd, 2020

I was excited because I really wanted to see and get a copy of the Deed to my property. The personal/Staff responsible for setting up that plan did an excellent/outstanding job. Thanks so much and keep up the great work.

Carrie

Thank you for your feedback. We really appreciate it. Have a great day!

Shane S.

May 1st, 2021

Great forms, exactly what I needed. Easy to understand. No problems recording. Thanks!

Thank you!

Barbara K.

June 10th, 2023

Found what I needed quickly, easy website to maneuver. Like having a sample to look at along with instructions.

Thank you for your feedback. We really appreciate it. Have a great day!

Deborah Anne C.

July 16th, 2024

Easy, Comprehensive and most importantly Easy!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cynthia (Cindy) R.

August 24th, 2020

This has been the most seamless process I have ever experienced. Thank you for addressing my needs so quickly and professionally.

Thank you!

Kenneth S.

December 30th, 2018

Navigating the site was fine, but the service was not able to find my deed. Still have not received my refund.

Thanks for your feedback Kenneth. Sorry we were not able to pull the deed for your property. We voided your payment on December 28, 2018. Sometimes, depending on your financial institution, it can take a few days for the pending charge (hold) to expire.

James M.

January 3rd, 2023

It would be helpful to have a joint tenant example.

Thank you!

Carol F.

May 22nd, 2019

Instructions were easy to follow and it was reasonable

Thank you for your feedback. We really appreciate it. Have a great day!

David G.

September 2nd, 2020

Fill in the blanks portions are so limited, it makes it almost impossible to use.

Sorry to hear that David. Your order and payment has been canceled. We do hope that you find something more suitable to your needs elsewhere.

ELIZABETH M.

January 10th, 2020

Great service! Training was fast and we went over very detail.

Thank you!

April L.

November 13th, 2019

The warranty deed forms I received worked fine.

Thank you!

Jonnie G.

November 15th, 2019

I very much dreaded this whole endeavor but very pleasantly surprised. So far, so good. I feel much more confidant that the crucial form, when presented, will play well with the county.......

We appreciate your business and value your feedback. Thank you. Have a wonderful day!