Lincoln County Executor Deed Form

Last validated February 6, 2026 by our Forms Development Team

Lincoln County Executor Deed Form

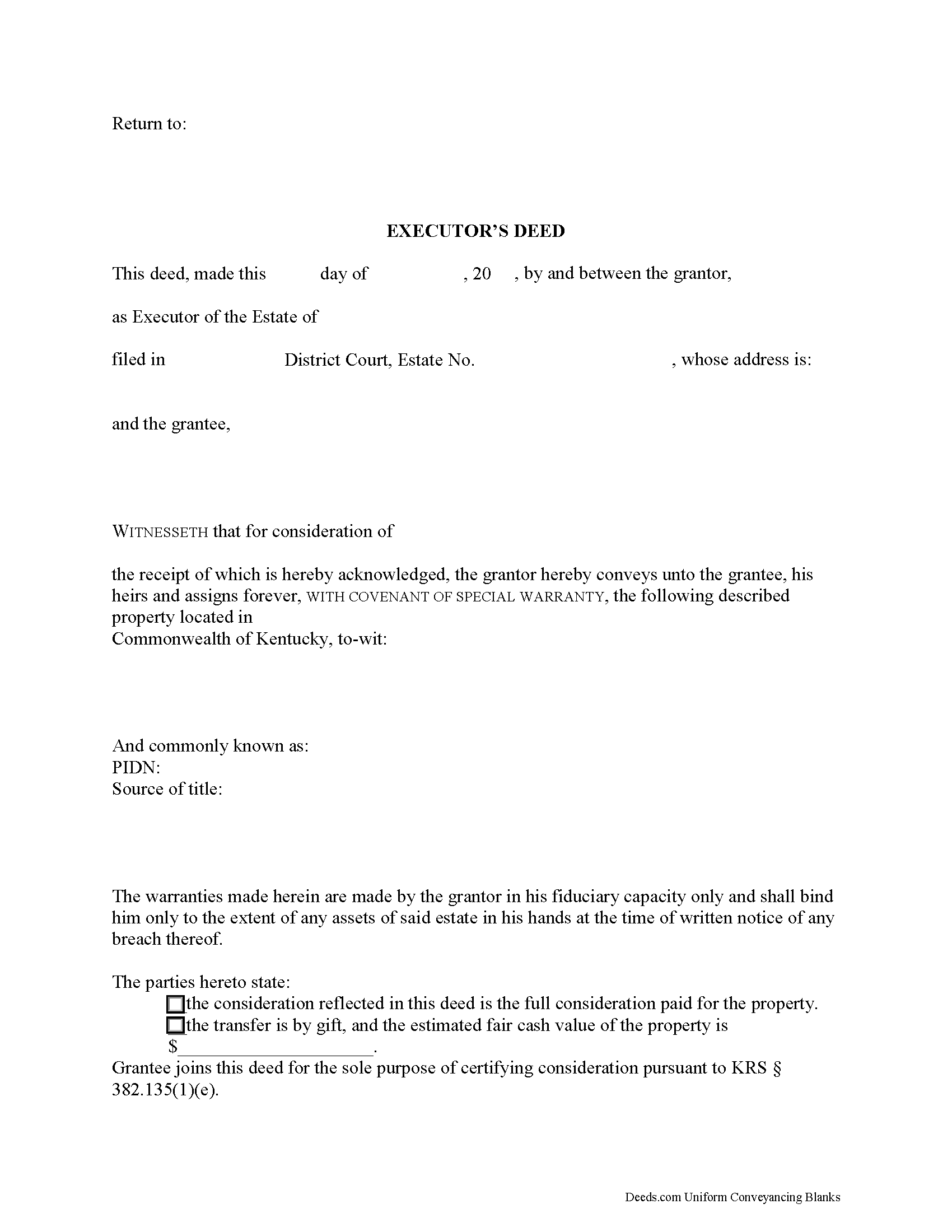

Fill in the blank form formatted to comply with all recording and content requirements.

Lincoln County Executor Deed Guide

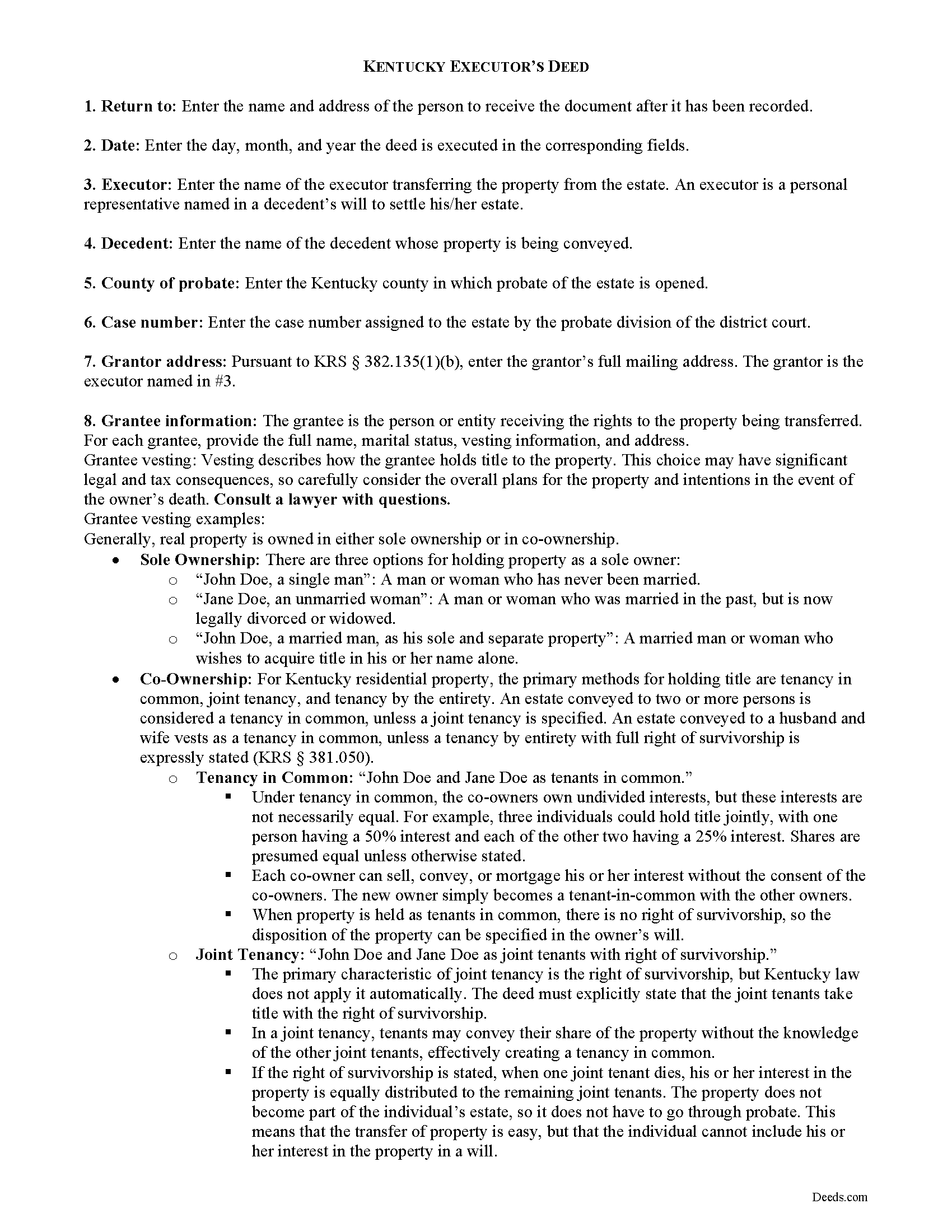

Line by line guide explaining every blank on the form.

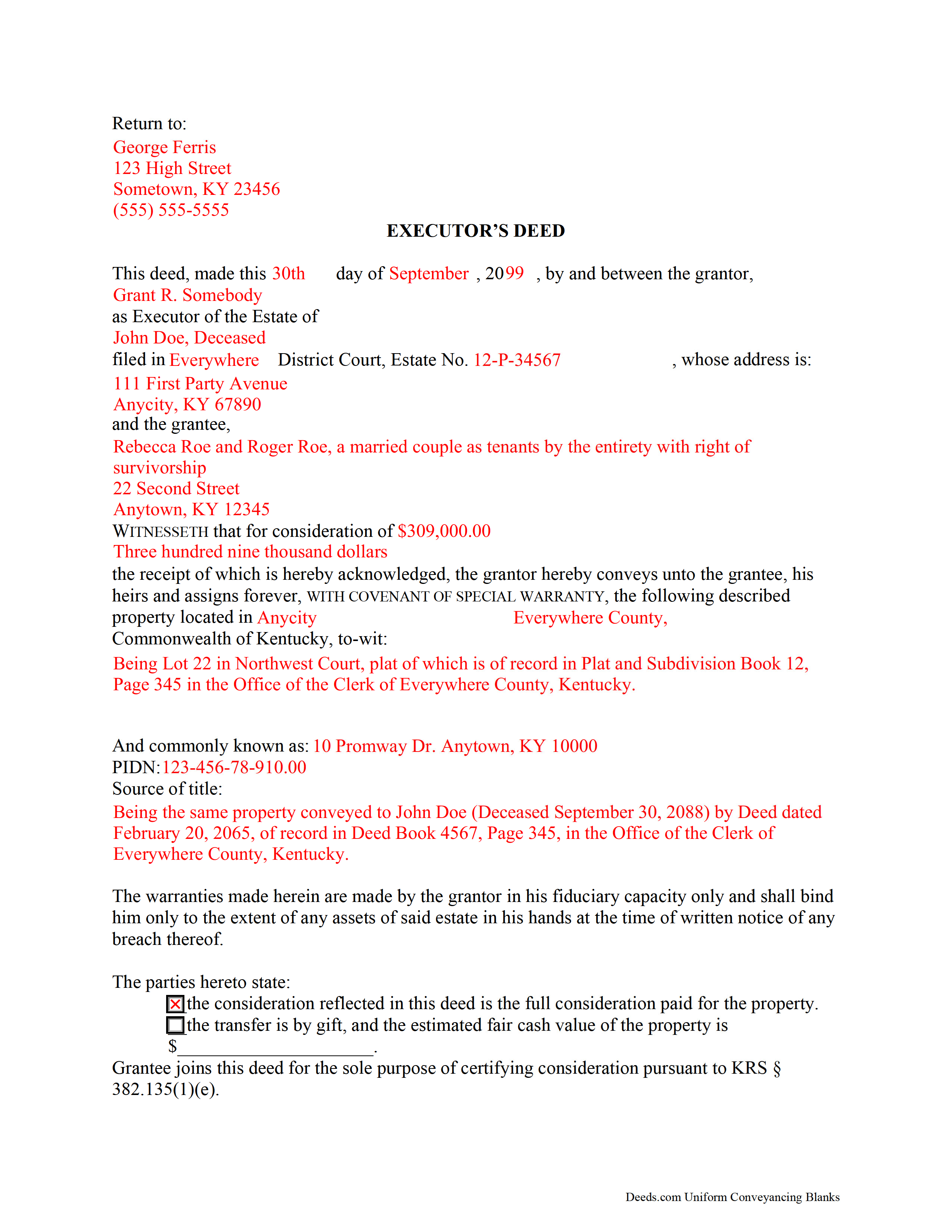

Lincoln County Completed Example of the Executor Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kentucky and Lincoln County documents included at no extra charge:

Where to Record Your Documents

Lincoln County Clerk

Stanford, Kentucky 40484

Hours: 8:00 to 4:00 Monday-Friday; 9:00 to 12:00 Saturday

Phone: (606) 365-4570

Recording Tips for Lincoln County:

- Bring your driver's license or state-issued photo ID

- Ask if they accept credit cards - many offices are cash/check only

- Documents must be on 8.5 x 11 inch white paper

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Lincoln County

Properties in any of these areas use Lincoln County forms:

- Crab Orchard

- Hustonville

- Kings Mountain

- Mc Kinney

- Stanford

- Waynesburg

Hours, fees, requirements, and more for Lincoln County

How do I get my forms?

Forms are available for immediate download after payment. The Lincoln County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Lincoln County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lincoln County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Lincoln County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Lincoln County?

Recording fees in Lincoln County vary. Contact the recorder's office at (606) 365-4570 for current fees.

Questions answered? Let's get started!

An executor's deed is a fiduciary instrument used in estate administration to transfer real property pursuant to the terms of a will and/or laws of descent. An executor is a personal representative who is named in a decedent's will to administer the decedent's estate.

Use an executor's deed to convey interest in real property to a grantee with a special warranty. This type of warranty affirms that, while the grantor/executor controlled the property, she never acted in a way to change the status of the title.

In addition to meeting state and local standards for real estate deeds, executor's deeds also include details about the decedent's probate case. A court order for sale is required before a transfer can be made, unless the decedent's will specifies a power of sale. Supporting documentation, such as an affidavit of real property transfer under KRS 382.135(4), is required before an executor can record the deed in the office of the county clerk.

Contact a lawyer with questions about Kentucky executor's deeds or other inquiries related to probate.

(Kentucky Executor Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Lincoln County to use these forms. Documents should be recorded at the office below.

This Executor Deed meets all recording requirements specific to Lincoln County.

Our Promise

The documents you receive here will meet, or exceed, the Lincoln County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lincoln County Executor Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4653 Reviews )

Bridgit L.

May 20th, 2020

I must admit I was a bit hesitant to record a document online, but I am impressed by how quickly the process took from the initial sign-on, uploading and recording! I will definitely use your services again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David N.

August 29th, 2020

It worked well for me. Now I need the actual lien form

Thank you!

steven L.

April 8th, 2020

download was fast and easy. if no problems with county recorder i will give 5 stars

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Deana A.

April 30th, 2020

Great forms and info, easy step-by-step guidance.

Thank you!

Norma J H.

April 27th, 2022

Your forms have been very helpful. I thank you very much for making them easy to use.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert B.

February 21st, 2020

Couldn't be more simple. Good product

Thank you!

Laurie R.

August 31st, 2022

FIVE STARS !!! Clear instructions Easy to navigate Thanks for making this easy for those of us who are not tech savvy

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mary-Ann K.

November 23rd, 2021

Very pleasantly pleased so far. Hope to hear from the town registrar Transfer On Death Deed accepted. Wish all legal proceedings were so simple . . .

Thank you for your feedback. We really appreciate it. Have a great day!

John H.

April 22nd, 2019

Re: Idaho Affidavit of Successor: Decedent's residence may be a state other than Idaho. Death certificate documnet# field is too small.

Thank you for your feedback. We have emailed you an amended document to address your specific needs outlined in your feedback, hope this helps. Have a wonderful day.

Joseph W.

March 11th, 2021

good place to get documents and it seems like a sound place to get forms. Self explainitory and helpful

Thank you!

Patrick K.

September 1st, 2020

Fast and easy to use. Great update communications

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

JERRY M.

March 11th, 2020

Had to modify the document form fill field to accept the information required. Had limited number of characters.

Thank you for your feedback. We really appreciate it. Have a great day!

Carol M.

April 26th, 2021

Very user friendly. Glad I found your site.

Thank you!

Charlotte H.

July 16th, 2022

Easy to use and download. Everything we needed with a guide for accuracy.

Thank you!

Molly S.

November 13th, 2020

I used deeds.com to record a deed because the recording office closed due to Covid 19. It was easy to sign up and upload the documents I needed recorded and within 24 hours possibly even less, the deeds were recorded. I am very happy with the service and the $15 fee was affordable and worth every penny to get it done so quickly.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!