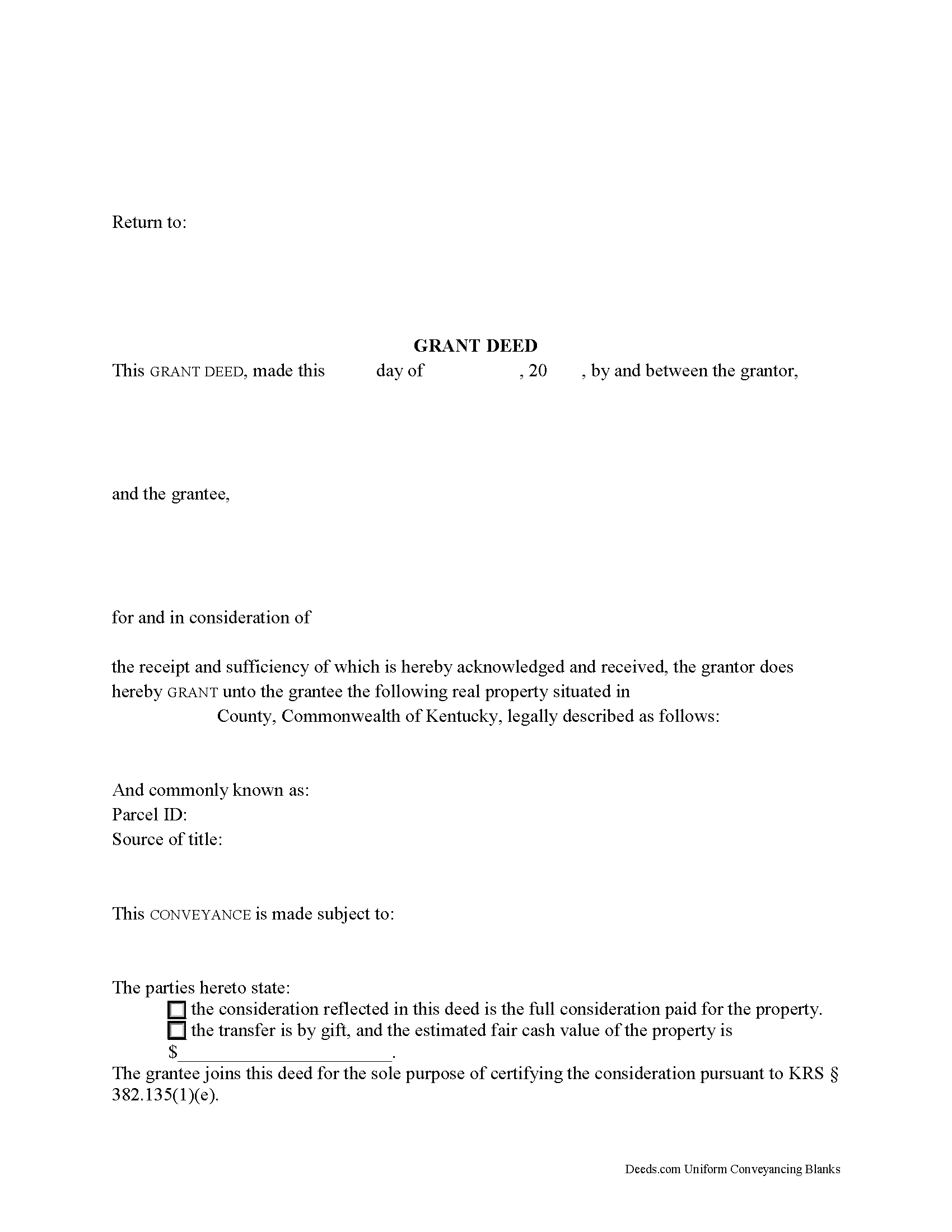

Wolfe County Grant Deed Form

Wolfe County Gift Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

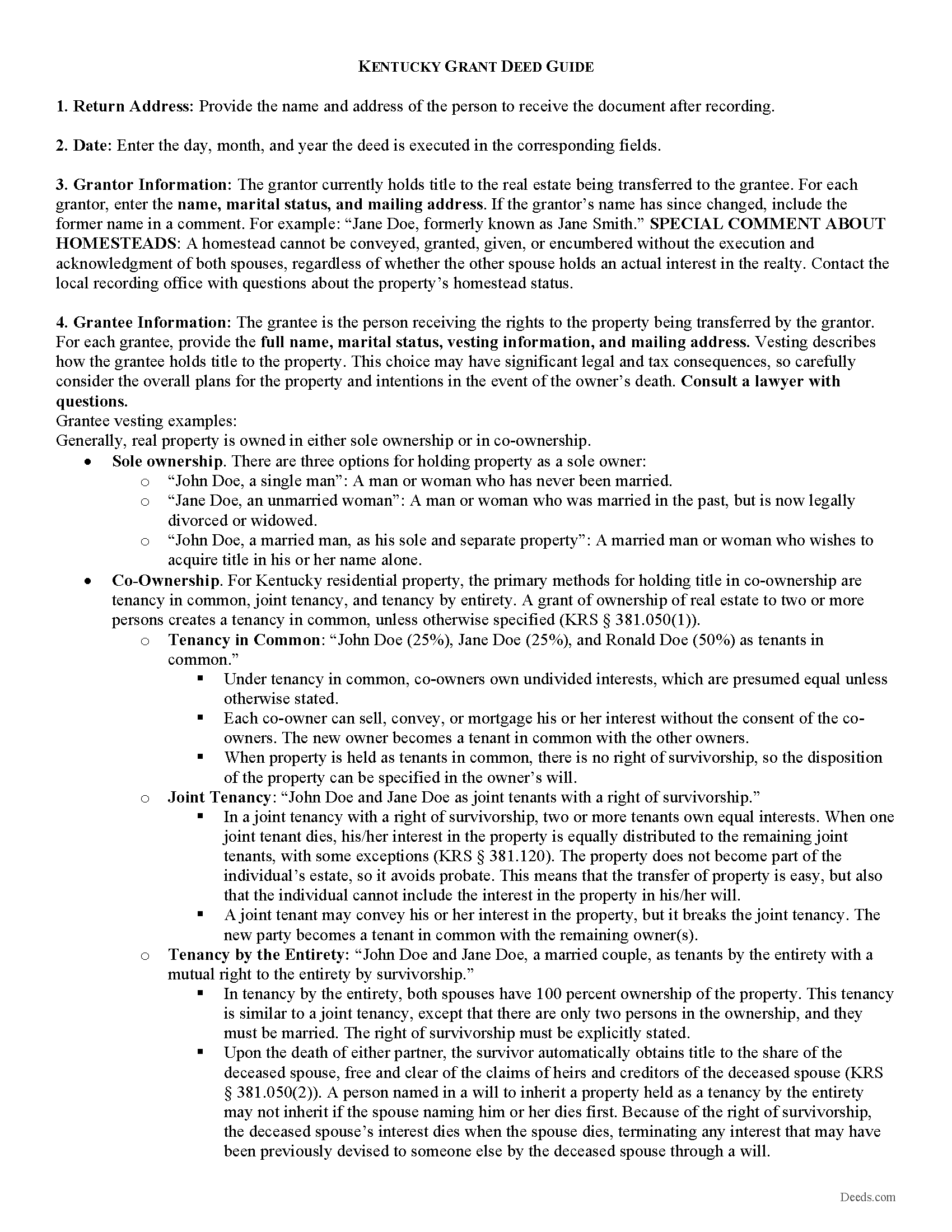

Wolfe County Grant Deed Guide

Line by line guide explaining every blank on the form.

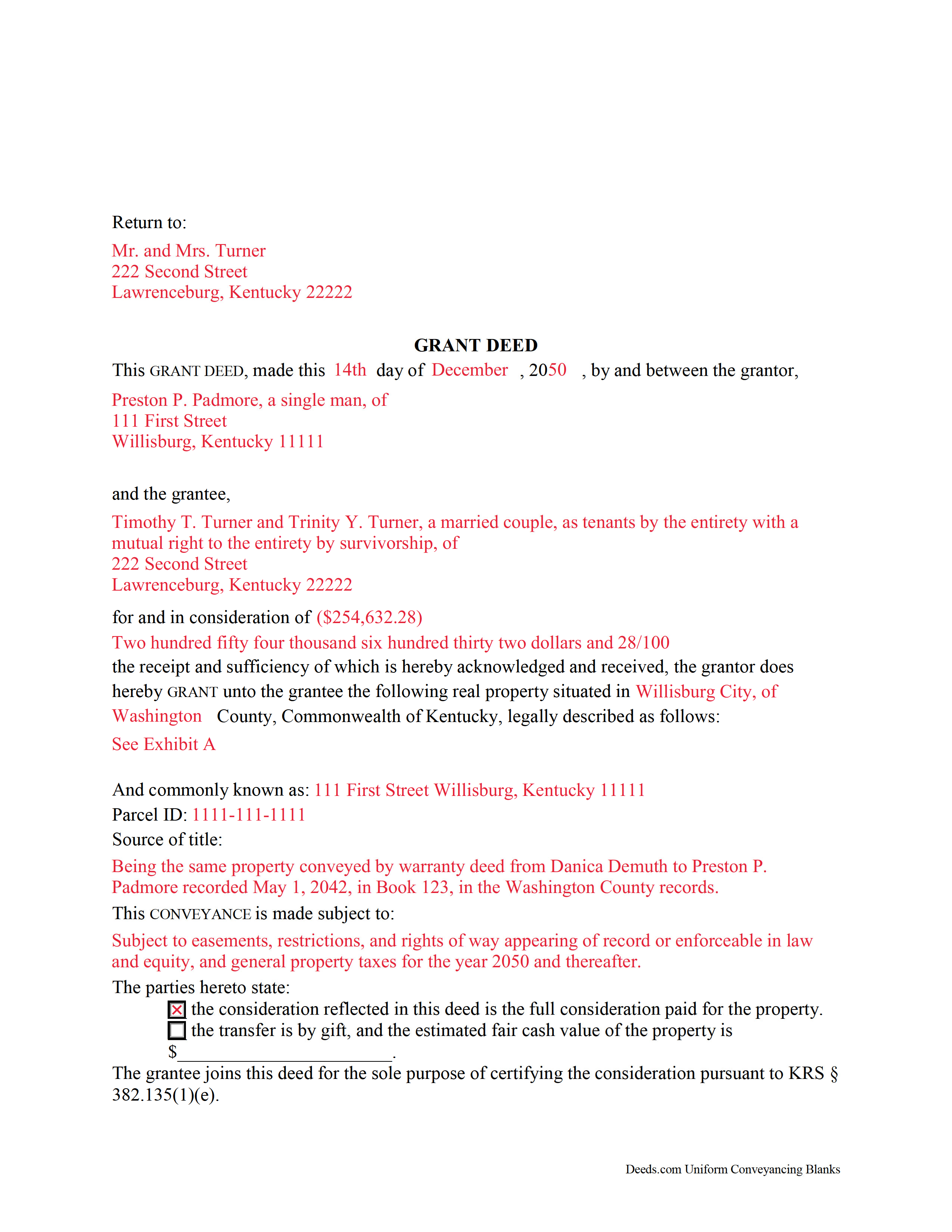

Wolfe County Completed Example of the Grant Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kentucky and Wolfe County documents included at no extra charge:

Where to Record Your Documents

Wolfe County Clerk

Campton, Kentucky 41301

Hours: 8:00am to 4:30pm M-F

Phone: (606) 668-3492

Recording Tips for Wolfe County:

- Ensure all signatures are in blue or black ink

- Check that your notary's commission hasn't expired

- Verify all names are spelled correctly before recording

- Request a receipt showing your recording numbers

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Wolfe County

Properties in any of these areas use Wolfe County forms:

- Bethany

- Campton

- Hazel Green

- Pine Ridge

- Rogers

Hours, fees, requirements, and more for Wolfe County

How do I get my forms?

Forms are available for immediate download after payment. The Wolfe County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Wolfe County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Wolfe County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Wolfe County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Wolfe County?

Recording fees in Wolfe County vary. Contact the recorder's office at (606) 668-3492 for current fees.

Questions answered? Let's get started!

Real estate conveyances in Kentucky are governed by Chapter 382 of the Kentucky Revised statutes, but the statutes do not specifically address grant deeds.

A grant deed is a legal document used to transfer, or convey, rights in real property from a grantor (seller) to a grantee (buyer). A recorded grant deed imparts notice of transfer to all persons, including subsequent purchasers or mortgagees. They contain covenants, or guarantees, that the grantor has not previously sold the real property interest being conveyed, and that the property is being conveyed to the grantee without any undisclosed liens or encumbrances. Grant deeds do not generally require the grantor to defend title claims.

The deed must meet all state and local standards for recorded documents. A lawful grant deed identifies the grantor and grantee, with their full names and addresses, and states how the grantee will hold title to the property. For Kentucky residential property, the primary methods for holding title in co-ownership are tenancy in common, joint tenancy, and tenancy by entirety. A grant of ownership of real estate to two or more persons creates a tenancy in common, unless otherwise specified (KRS 381.050(1)). It also includes a complete legal description and physical address of the property. Explain the source of the current grantor's title and include the in-care-of tax address where the property tax bill may be sent (KRS 382.110(2)). The preparer of the instrument must sign the document (KRS 382.335).

State either the full amount of consideration exchanged during the transfer, or if nominal or no consideration has been exchanged, the fair cash value of the property in the consideration certificate section pursuant to KRS 385.135. The county assesses a transfer tax on the consideration, due at the time of recording, unless the transaction is exempt under KRS 142.050.

After the grantor signs the completed deed in front of a notary, record it, along with any supplemental documentation necessary for the specific transaction, in the county in which the property is located (KRS 382.030, 382.110(1)). Recording provides public knowledge of the change in ownership and helps to maintain a clear chain of title.

This article is provided for informational purposes only and is not a substitute for legal advice. Contact a lawyer with questions about grant deeds or any other issues related to the transfer of real property in Kentucky.

(Kentucky Grant Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Wolfe County to use these forms. Documents should be recorded at the office below.

This Grant Deed meets all recording requirements specific to Wolfe County.

Our Promise

The documents you receive here will meet, or exceed, the Wolfe County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Wolfe County Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4586 Reviews )

crystal l.

January 16th, 2019

Another legal professional directed me to this site. The best advice I've received from the legal profession! Forms were instantly available, easily printed & exactly what I needed at a cost that was more than affordable!! I will definitely be back again!!

Thank you Crystal and please thank your associate for us. Have a fantastic day!

Cindy A.

January 14th, 2019

Easy to understand and use. However, need to add line for phone number for preparer - Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Greg F.

October 14th, 2022

Sorry that this a little late. I'm VERY HAPPY with everything. The deeds paperwork was just what I was looking for. It was very to fill out, it was different than n the folks used years ago. I called the county clerk, and they were very helpful. Thank you for the paperwork it was easy to use and understand.

Thank you for your feedback. We really appreciate it. Have a great day!

Amber H.

January 31st, 2019

after typing in the information, the printing is not in alignment - looks disorganized on the page and hard to read

Thank you for your feedback. We will flag the document for review.

lamar J.

January 18th, 2021

Easy to understand and work with Very pleased with the information I Received

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John C.

April 14th, 2019

Excellent find (Deeds.com) from a google search, first hit. This was exactly what we were looking for. It also got me to upgrade Adobe to be able to fill in the forms. Will be back for follow up as needed, but I think I got everything we needed in the first downloads. Appreciate a well done site like yours. Thanks John

Thank you for your feedback. We really appreciate it. Have a great day!

Leatrice K.

February 24th, 2021

I am how simple this site is to use. I am so thankful to be able to do this and not have to worry about traveling downtown. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joshua P.

July 27th, 2022

Easy fill in the blanks form. Just FYI make sure you have a copy of whatever deed you are changing and the tax records. You will want the language to be identical.

Thank you for your feedback. We really appreciate it. Have a great day!

Cynthia B.

July 21st, 2023

So simple to e-record my two documents. The communication was fast and very helpful. Thank you so much!

Thank you for your feedback. We really appreciate it. Have a great day!

Shannon D.

November 4th, 2020

Extremely easy site to use. We had our document e-recorded the same day and we didn't have to make a trip downtow!

Thank you!

David M.

July 30th, 2022

Very easy to use and modify if necessary. Spot on with each county requirement for recording and Notarizing

Thank you for your feedback. We really appreciate it. Have a great day!

Dennis D.

November 7th, 2019

Thanks for the efficient process and instructions.

Thank you for your feedback. We really appreciate it. Have a great day!

Steven C.

May 1st, 2019

Easy but a little overpriced

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kermit W.

November 5th, 2020

Straightforward instructions and very quick turnaround.

Thank you for your feedback. We really appreciate it. Have a great day!

Tressa P.

November 17th, 2020

This online service was very easy to use. I highly recommend Deeds.com. The quick response from the representative upon submitting your document is quick. If something needed to be adjusted they will send you message and you can in turn respond right away with a message. The pricing of this service is very reasonable.

Thank you!