Marshall County Limited Power of Attorney for the Sale of Property Form

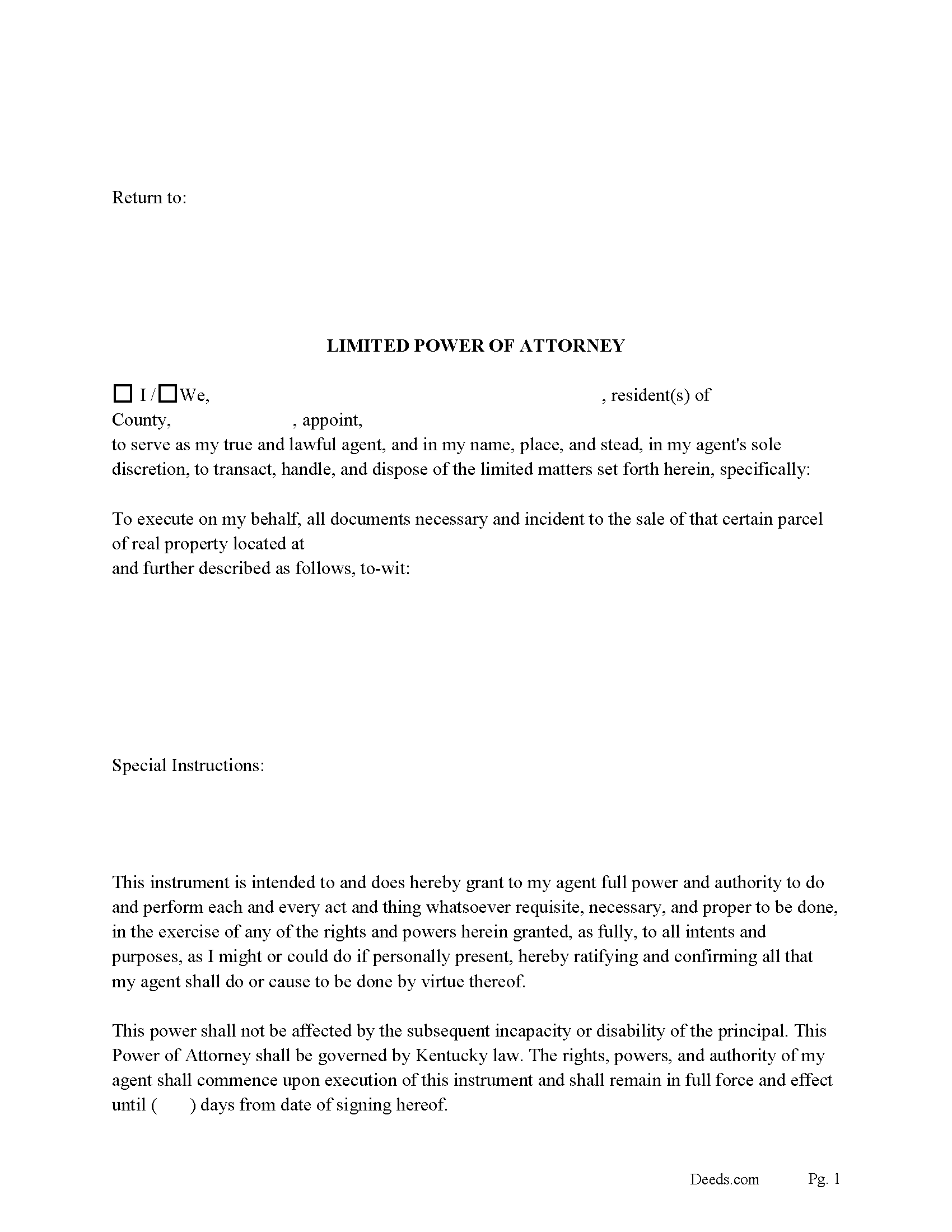

Marshall County Limited Power of Attorney Form for the Sale of Property

Fill in the blank form formatted to comply with all recording and content requirements.

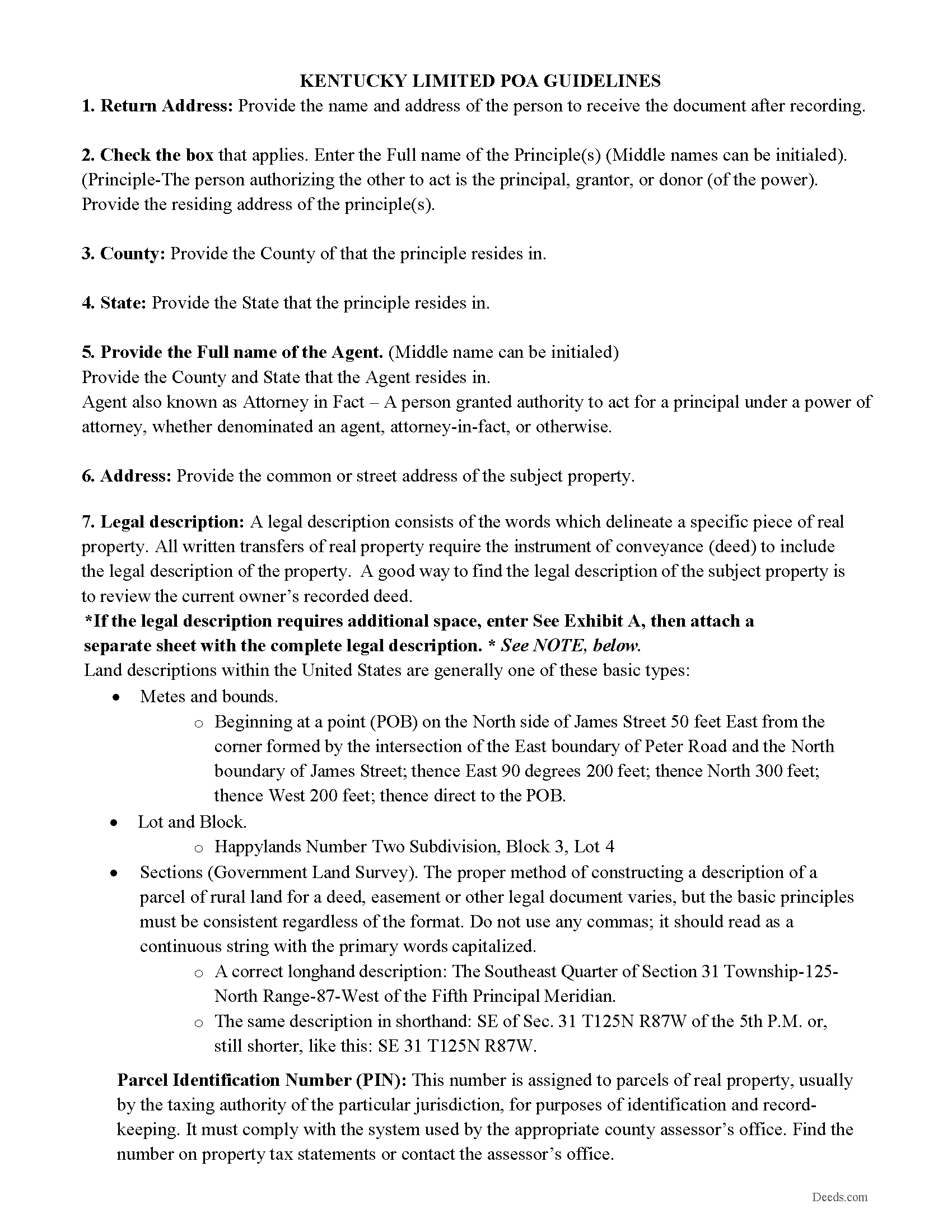

Marshall County Limited POA Guidelines

Line by line guide explaining every blank on the form.

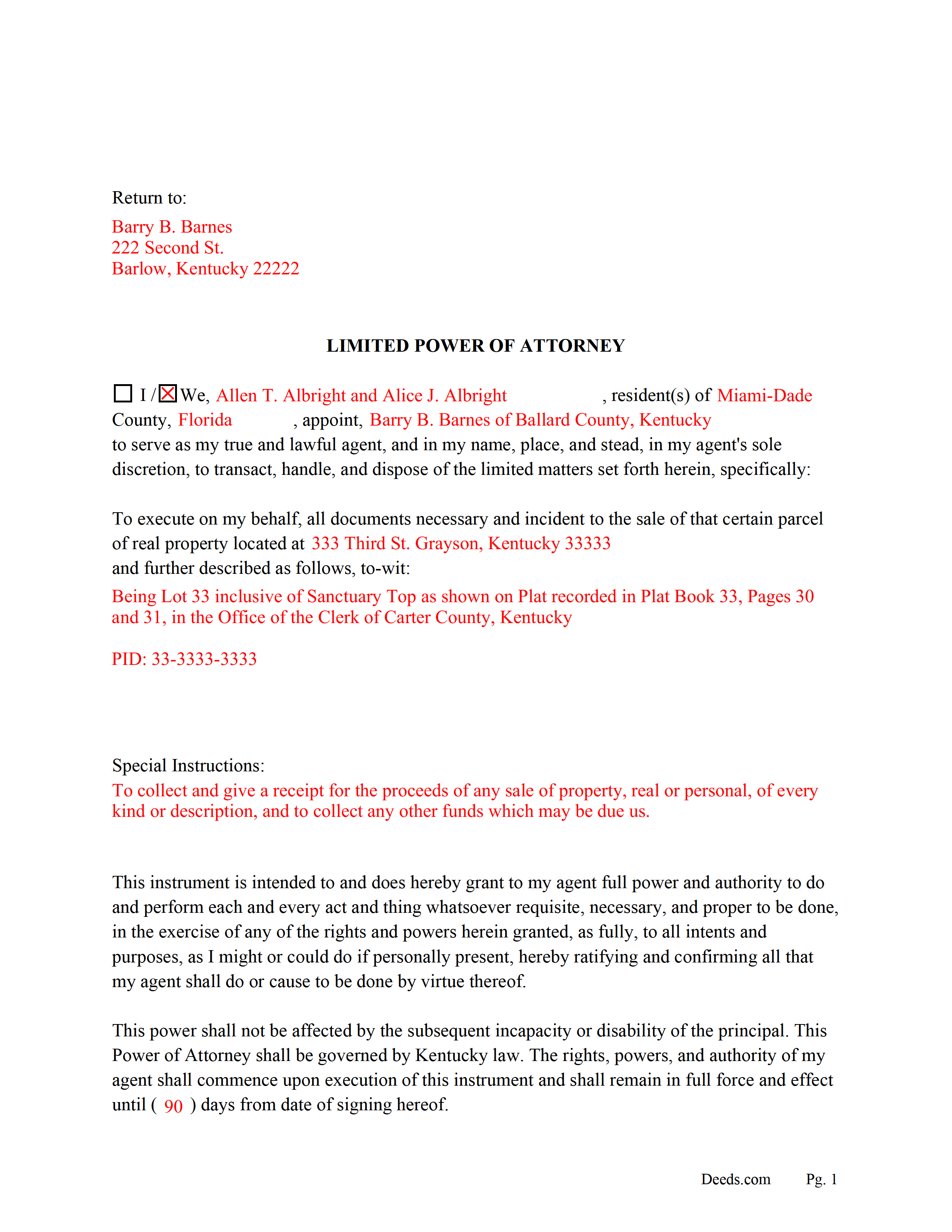

Marshall County Completed Example of the Limited POA

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kentucky and Marshall County documents included at no extra charge:

Where to Record Your Documents

Marshall County Clerk

Benton, Kentucky 42025

Hours: 8:30 to 4:30 M-F

Phone: (270) 527-4740

Recording Tips for Marshall County:

- Ensure all signatures are in blue or black ink

- Verify all names are spelled correctly before recording

- Check that your notary's commission hasn't expired

- Double-check legal descriptions match your existing deed

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Marshall County

Properties in any of these areas use Marshall County forms:

- Benton

- Calvert City

- Gilbertsville

- Hardin

Hours, fees, requirements, and more for Marshall County

How do I get my forms?

Forms are available for immediate download after payment. The Marshall County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Marshall County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Marshall County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Marshall County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Marshall County?

Recording fees in Marshall County vary. Contact the recorder's office at (270) 527-4740 for current fees.

Questions answered? Let's get started!

This form is used for the SALE of real property. The principal designates an agent and empowers him/her to act in all necessary legal documents and instruments for the sale of a specific Kentucky property. This form includes a "Special Instructions" section where you can further limit or define the agent's powers/actions.

This Limited Power of Attorney becomes effective upon its execution.

457.060 Validity of power of attorney.

(1) A power of attorney executed in this state on or after July 14, 2018, is valid if its execution complies with KRS 457.050.

457.050 Execution of power of attorney.

(1) A power of attorney must be signed in the presence of two disinterested witnesses by the principal or in the principal's conscious presence by another individual directed by the principal to sign the principal's name on the power of attorney. If signed in the principal's conscious presence by another individual, the reason for this method of signing shall be stated in the power of attorney.

(2) A signature on a power of attorney is presumed to be genuine if the principal acknowledges the signature before a notary public or other individual authorized by law to take acknowledgments.

Effective: July 14, 2018

457.100 Termination of power of attorney or agent's authority.

(1) A power of attorney terminates when:

(e) The power of attorney provides that it terminates

In this form the Principal designates the termination date by entering the number of days it expires after its execution. 30, 60, 90 etc.

For Use in Kentucky only.

(Kentucky Limited POA-Sale Package includes form, guidelines, and completed example)

Important: Your property must be located in Marshall County to use these forms. Documents should be recorded at the office below.

This Limited Power of Attorney for the Sale of Property meets all recording requirements specific to Marshall County.

Our Promise

The documents you receive here will meet, or exceed, the Marshall County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Marshall County Limited Power of Attorney for the Sale of Property form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Judith F.

May 6th, 2022

The form I needed was perfect!

Thank you!

Jay T.

August 6th, 2020

I filled out the deed, had it notarized, and recorded. No problems. I put this off for so long. Once I had the form it was recorded in one day.

Thank you for your feedback. We really appreciate it. Have a great day!

John R.

November 6th, 2019

All the material included made preparing the quit claim deed very easy. Good product.

Thank you for your feedback. We really appreciate it. Have a great day!

George S.

September 16th, 2021

Excellent product- very easy to use. Will use again...

Thank you for your feedback. We really appreciate it. Have a great day!

Tullea S.

October 15th, 2024

Although I didn't get what I needed, the customer service is outstanding. I got a text asking if I needed any help. He canceled my subscription right away and was very helpful. He responded quickly each time.

We are delighted to have been of service. Thank you for the positive review!

Carol O.

April 3rd, 2023

Easy process as I had an example of my other property deeds to work from plus my most current Real Estate Tax forms.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Chris B.

March 3rd, 2023

Accurate information and easy to use website.

Thank you for your feedback. We really appreciate it. Have a great day!

ROBERT P.

August 26th, 2022

Got what I needed

Thank you!

Ruth K.

October 11th, 2022

this is the only site that helped me out

Thank you!

Brian R.

May 12th, 2020

Your website is very informative, and easy to use.The purchase and download process was clear and went well. I would add that your Virginia Quitclaim Deed Guide is very comprehensive and informative. This combined with the example form you provide is most helpful. Thank You. Brian R

Thank you for your feedback. We really appreciate it. Have a great day!

Gail W.

September 19th, 2019

Deeds.com had the forms I needed, along with completed examples. Fast download. Easy to use site. Thanks!

Thank you!

Dora O.

August 27th, 2024

Best platform to buy forms. Simple and easy.

It was a pleasure serving you. Thank you for the positive feedback!

Willie P.

May 13th, 2020

Your service was excellent

Thank you for your feedback. We really appreciate it. Have a great day!

ARNOLD E.

May 3rd, 2019

SO FAR SO GOOD! I AM STILL COMPLETING THE QUIT CLAIM DEED. THANKS....ARNIE

Thank you Arnold, we really appreciate your feedback.

Earl L.

February 13th, 2019

Fair!

Thank you!