Russell County Limited Power of Attorney for the Sale of Property Form (Kentucky)

All Russell County specific forms and documents listed below are included in your immediate download package:

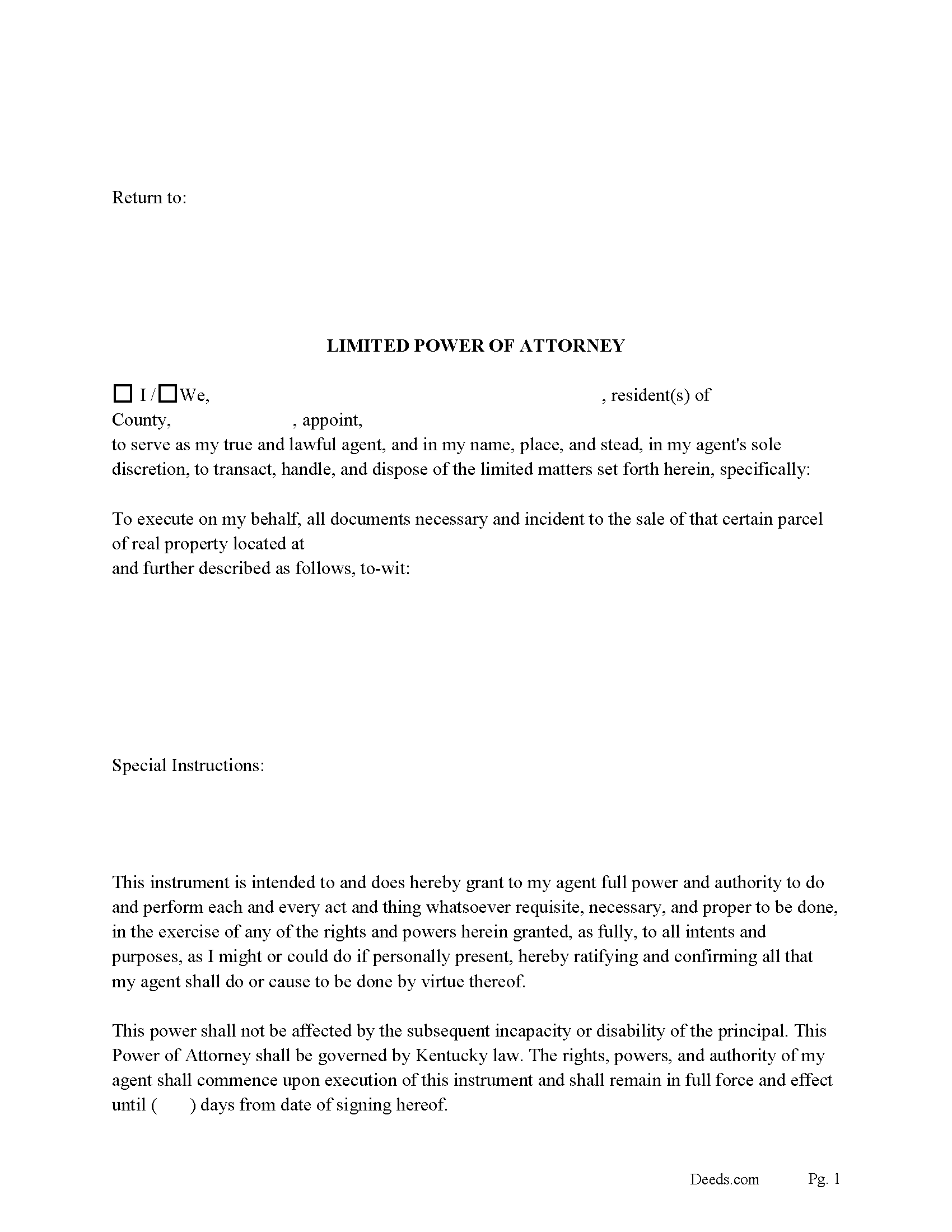

Limited Power of Attorney Form for the Sale of Property

Fill in the blank form formatted to comply with all recording and content requirements.

Included Russell County compliant document last validated/updated 5/26/2025

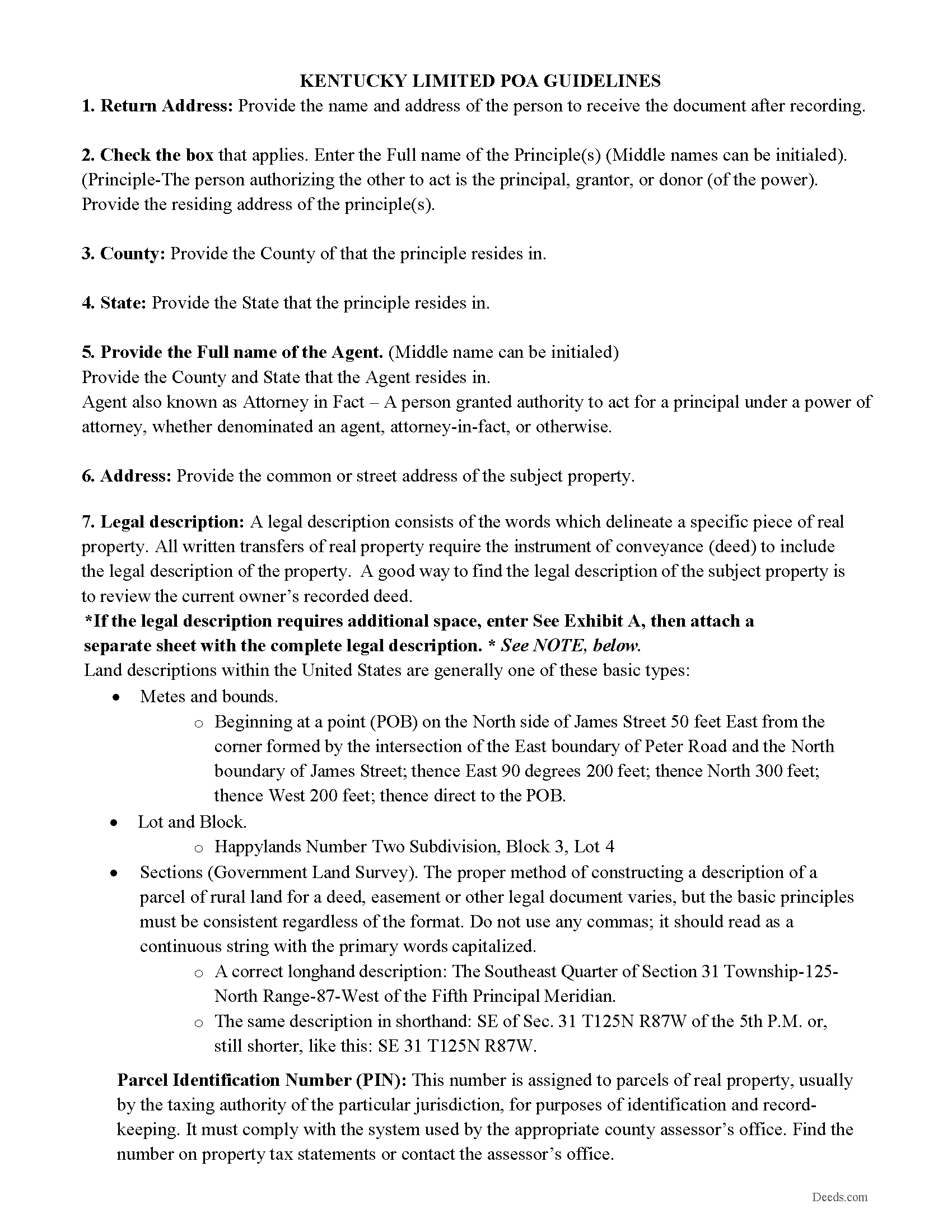

Limited POA Guidelines

Line by line guide explaining every blank on the form.

Included Russell County compliant document last validated/updated 6/4/2025

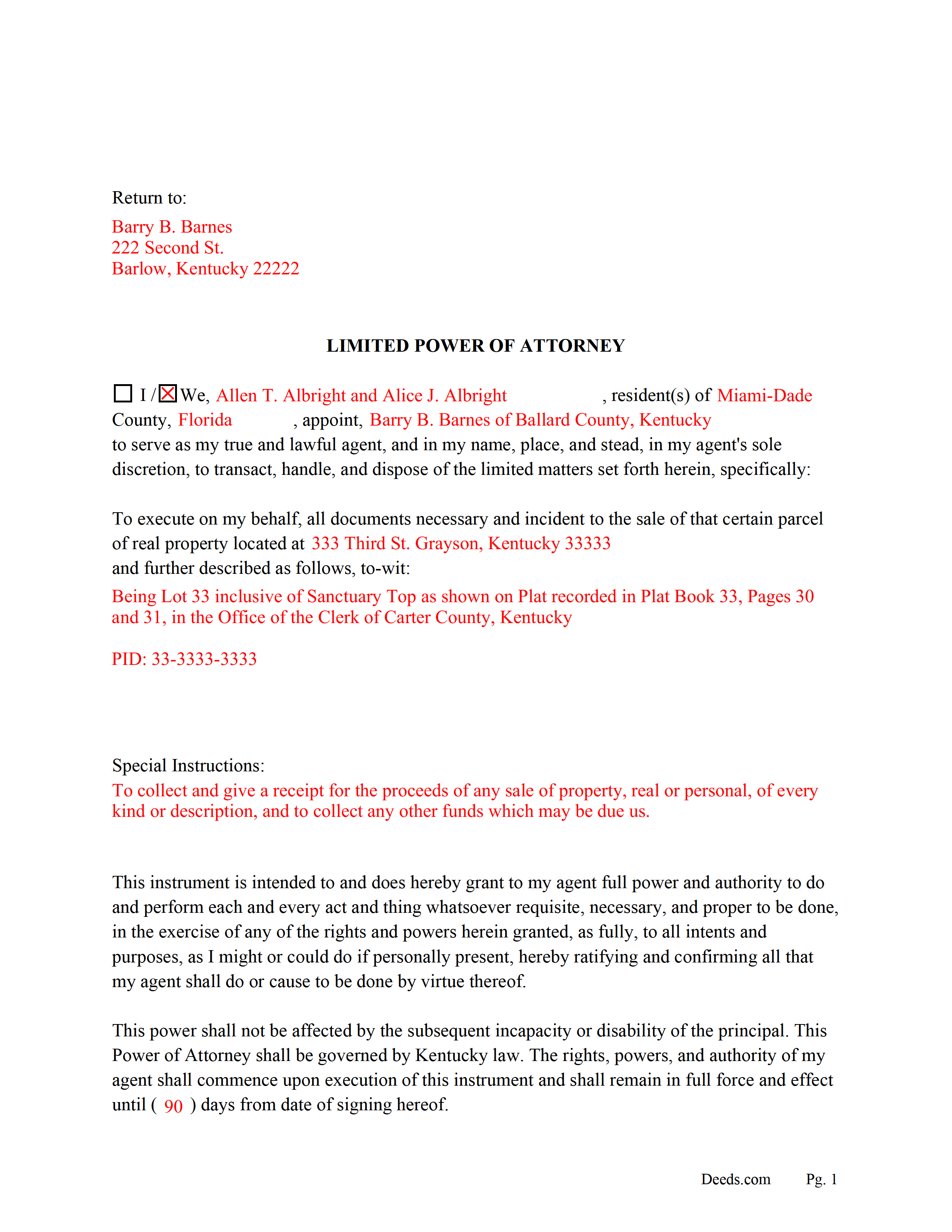

Completed Example of the Limited POA

Example of a properly completed form for reference.

Included Russell County compliant document last validated/updated 5/21/2025

The following Kentucky and Russell County supplemental forms are included as a courtesy with your order:

When using these Limited Power of Attorney for the Sale of Property forms, the subject real estate must be physically located in Russell County. The executed documents should then be recorded in the following office:

Russell County Clerk

410 Monument Sq, Jamestown, Kentucky 42629

Hours: 8:00 to 4:30 M-F; 8:00 to 11:00 Sat

Phone: (270) 343-2125

Local jurisdictions located in Russell County include:

- Jamestown

- Russell Springs

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Russell County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Russell County using our eRecording service.

Are these forms guaranteed to be recordable in Russell County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Russell County including margin requirements, content requirements, font and font size requirements.

Can the Limited Power of Attorney for the Sale of Property forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Russell County that you need to transfer you would only need to order our forms once for all of your properties in Russell County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Kentucky or Russell County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Russell County Limited Power of Attorney for the Sale of Property forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

This form is used for the SALE of real property. The principal designates an agent and empowers him/her to act in all necessary legal documents and instruments for the sale of a specific Kentucky property. This form includes a "Special Instructions" section where you can further limit or define the agent's powers/actions.

This Limited Power of Attorney becomes effective upon its execution.

457.060 Validity of power of attorney.

(1) A power of attorney executed in this state on or after July 14, 2018, is valid if its execution complies with KRS 457.050.

457.050 Execution of power of attorney.

(1) A power of attorney must be signed in the presence of two disinterested witnesses by the principal or in the principal's conscious presence by another individual directed by the principal to sign the principal's name on the power of attorney. If signed in the principal's conscious presence by another individual, the reason for this method of signing shall be stated in the power of attorney.

(2) A signature on a power of attorney is presumed to be genuine if the principal acknowledges the signature before a notary public or other individual authorized by law to take acknowledgments.

Effective: July 14, 2018

457.100 Termination of power of attorney or agent's authority.

(1) A power of attorney terminates when:

(e) The power of attorney provides that it terminates

In this form the Principal designates the termination date by entering the number of days it expires after its execution. 30, 60, 90 etc.

For Use in Kentucky only.

(Kentucky Limited POA-Sale Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Russell County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Russell County Limited Power of Attorney for the Sale of Property form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4562 Reviews )

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Pauline C.

June 29th, 2025

Everything that was stated to be included in my order was complete. Very satisfied

Thank you for your positive words! We’re thrilled to hear about your experience.

Jon I.

May 27th, 2020

I liked the information I download. Just what I was looking for.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Craig M.

August 24th, 2020

Fantastic! So much easier than going and recording it at the recorders office!

Glad we could help Craig, thanks for the kind words.

David K.

March 25th, 2019

Worked Great! First time go at the courthouse

Thank you!

Carol W.

September 6th, 2020

The guide and example provided made it so easy to complete the form. All was in order when I took it to the Register of Deeds. No hassles at all! Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Joe H.

February 10th, 2020

Very pleased with the service provided. Will use again if the need arises. Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Griselle M.

February 9th, 2021

This is my third time using Deeds.com and they don't disappoint. Their customer service is outstanding - absolutely excellent - via messages, I communicated with them immediately and 24/7 - on weekends and at night. I would not even try another service as they provide excellence which is so rare these days.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Susan Z.

February 1st, 2019

Helpful website. Couldn't use the forms for my situation and area

Thank you for your feedback Susan. We don't want you to have to pay for something you didn't use, we've gone ahead and canceled your order and payment. Have a great day!

GAYNELL G.

August 9th, 2022

THANKS

Thank you!

Robert B.

January 4th, 2021

Very easy to use.

Thank you for your feedback. We really appreciate it. Have a great day!

Bill M.

March 10th, 2021

PROS: Quick communication. Completed the task expediently.

CONS: Deciphering what was being referred to on the website when needing the proper classification wasn't clear. Had to delve through your unfamiliar territory. But managed.

OVERALL: Got the job done swiftly and the end result was satisfactory. Will use again.

Thank you!

Sylvia L.

January 10th, 2024

Very easy...found what I was looking for

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ronald S.

May 20th, 2019

got what i wanted

Thank you for your feedback. We really appreciate it. Have a great day!