Henry County Partial Unconditional Lien Waiver Form

Henry County Partial Unconditional Lien Waiver Form

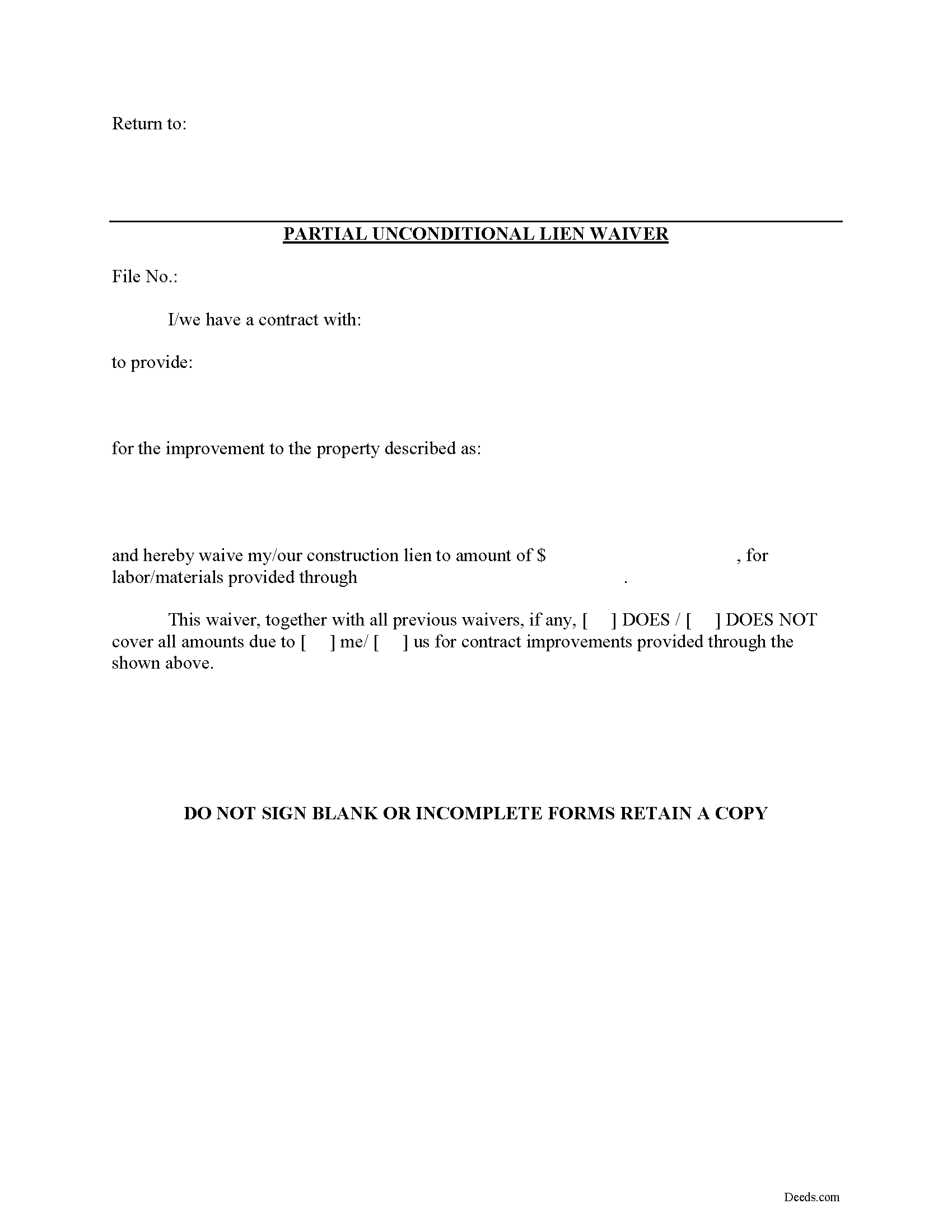

Fill in the blank Partial Unconditional Lien Waiver form formatted to comply with all Kentucky recording and content requirements.

Henry County Partial Unconditional Lien Waiver Form

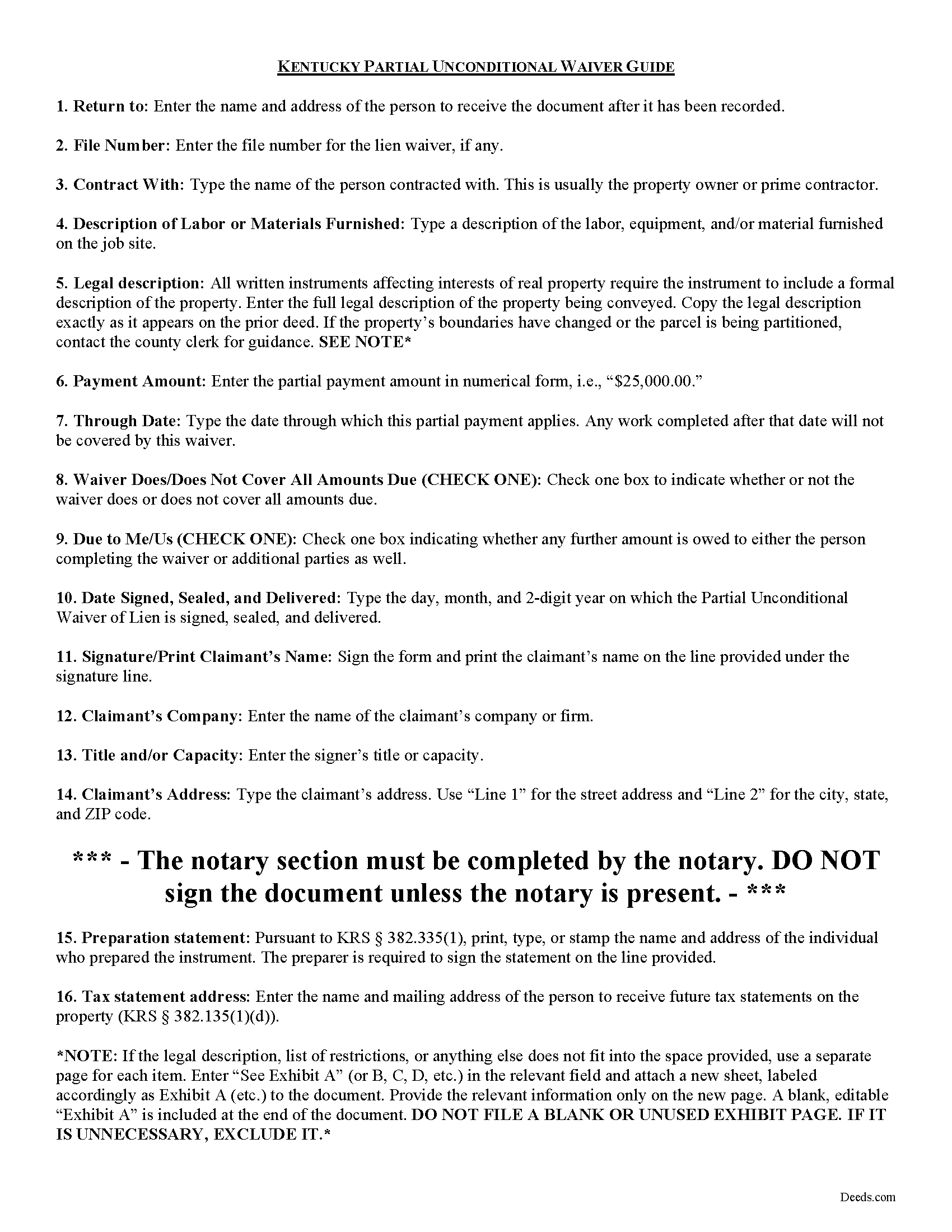

Line by line guide explaining every blank on the form.

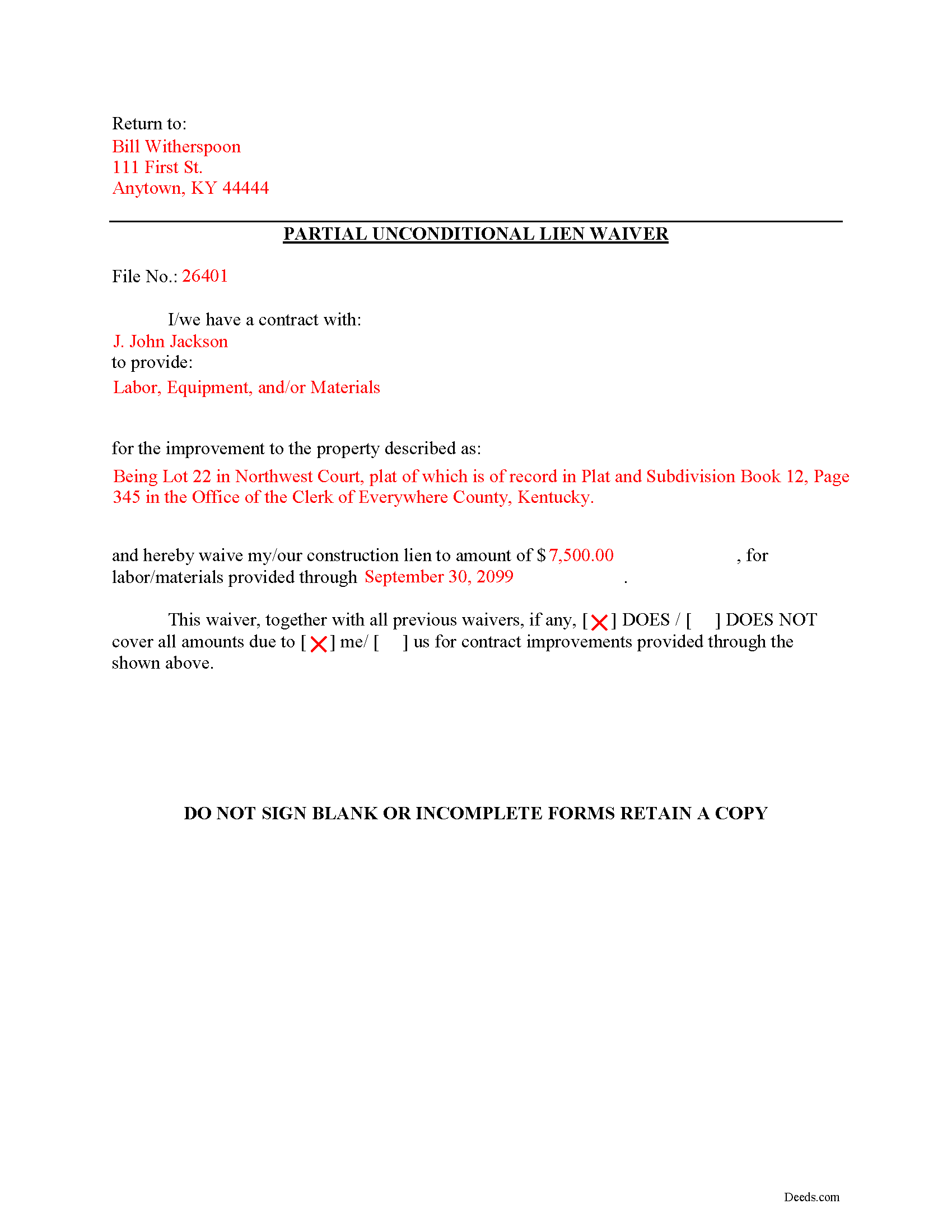

Henry County Completed Example of the Partial Unconditional Lien Waiver Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kentucky and Henry County documents included at no extra charge:

Where to Record Your Documents

Henry County Clerk

New Castle, Kentucky 40050

Hours: 8:00am - 5:30pm Monday; 8:00am - 4:00pm Tuesday - Friday

Phone: (502) 845-5705

Recording Tips for Henry County:

- Verify all names are spelled correctly before recording

- Ask about their eRecording option for future transactions

- Avoid the last business day of the month when possible

- Bring extra funds - fees can vary by document type and page count

- Verify the recording date if timing is critical for your transaction

Cities and Jurisdictions in Henry County

Properties in any of these areas use Henry County forms:

- Bethlehem

- Campbellsburg

- Eminence

- Lockport

- New Castle

- Pendleton

- Pleasureville

- Port Royal

- Smithfield

- Sulphur

- Turners Station

Hours, fees, requirements, and more for Henry County

How do I get my forms?

Forms are available for immediate download after payment. The Henry County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Henry County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Henry County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Henry County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Henry County?

Recording fees in Henry County vary. Contact the recorder's office at (502) 845-5705 for current fees.

Questions answered? Let's get started!

Mechanic's liens are governed under Chapter 376 of Kentucky Revised Statutes (K.R.S.). Although Kentucky law doesn't provide a required format for a waiver, claimants can use various types of lien waivers in order to simplify payments between contractors, subcontractors, customers, and property owners. A waiver is a knowing relinquishment of a right. In this case, the person granting the waiver is relinquishing the right to seek a mechanic's lien for all or part of the amount due. This assurance is usually enough to get the other party to pay.

Lien waivers are generally either based on a partial/progress payment or a final payment, and may be conditional or unconditional. Partial waivers release a portion of the lien rights, determined by the amount paid. Final waivers release all lien rights because the balance is paid in full. Conditional waivers give more protection to the claimant, and are dependent on any payments clearing the bank. Unconditional waivers give the advantage to the party responsible for paying, and take effect immediately upon recording, regardless of whether or not the bank covers the check.

Regardless of their nature, waivers must identify the parties, a description of the location and type of goods and/or services provided, significant dates, fees, and payments. Record the completed waiver in the office responsible for maintaining the land records for the county where the subject property is located.

A partial unconditional waiver is also used when a progress or partial payment is made, but signifies that lien rights are waived to the extent of the amount paid or purported to be paid. The waiver is not conditioned upon the actual receipt of that money, and the right to seek a lien for that amount is forfeited regardless of payment actually going through.

This article is provided for information purposes only and should not be relied upon as a substitute for the advice from a legal professional. Please speak with an attorney with questions about using a lien waiver, or for any other issues related to liens in Kentucky.

Important: Your property must be located in Henry County to use these forms. Documents should be recorded at the office below.

This Partial Unconditional Lien Waiver meets all recording requirements specific to Henry County.

Our Promise

The documents you receive here will meet, or exceed, the Henry County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Henry County Partial Unconditional Lien Waiver form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4577 Reviews )

Cathleen H.

January 25th, 2019

The pdf form is good; however, the input boxes merge into the line above so the text is hard to read when complete. I added a return before entering my data and this solved the problem.

Thank you for your feedback Cathleen. We will have staff take a look at the document for issues with the text fields. Have a great day!

Dale K.

August 11th, 2020

A very user friendly website!

Thank you!

Amy L B.

March 12th, 2025

easy to download forms and help is there if you need it!

Thank you, Amy! We appreciate your kind words and are glad you found the forms easy to download. Our team is always here if you ever need assistance. Thanks for choosing us!

Diana H.

February 10th, 2019

little expensive same document in other county is free. however quite fast in responding. and just what i needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael M.

January 11th, 2019

I downloaded the gift deed and I can not type my info onto it what am I doing wrong. Please advise

Sounds like you may be trying to complete the form in your browser. The document needs to be downloaded and saved to you computer, then opened in Adobe.

Curtis T.

May 12th, 2020

Deeds support was awesome and constant. Thank you.

Thank you!

OLGA R.

October 30th, 2020

Excellent Service for E-Recording. They work with you and guide you on every aspect.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Matthew T.

September 9th, 2020

I am a litigator based in Lee County that rarely needs to record deeds or mortgages. However, at times, the settlement or resolution of a dispute results in the conveyance of real property. I ended up in a situation where a deed to real property in Bradford County needed to be recorded on behalf of a client. My usual e-recording vendor does not include that County. Registering with Bradford County's regular e-recording vendor would have required an expensive and unnecessary annual fee. Deeds.com was easy to use, inexpensive and fast. I highly encourage its use, especially for lawyers that occasionally need to record instruments but do not do so regularly.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Novella M T.

January 5th, 2022

Amazing forms, nice to have something specific and not generic like some other sites. Getting the other required forms included is a nice bonus.

Great to hear Novella. We appreciate you taking the time to leave your feedback.

Dennis D.

August 4th, 2022

Heard about this service from a lawyer who said their offic used it quite a bit.

Thank you for your feedback. We really appreciate it. Have a great day!

Raj J.

December 2nd, 2020

Perfect, thanks

Thank you!

Ginger C.

April 8th, 2020

So far so good. Thank you for your prompt responses. Much appreciated.

Thank you!

Bruce L.

December 30th, 2023

Fantastic. The forms were easy to read and complete. Came with a guide and examples of how it looked completed Thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Julie K.

September 4th, 2023

The process for obtaining document itself was easy, and the included guide and example are great! I do have an issue with the format itself, though. The form has pre-defined text boxes, which cannot be altered without partially rebuilding the entire document. For the 'property description' field on the Mineral Deed form, the text box is not large enough for the rather lengthy legal description entered on my original plat. Fortunately, I have a copy of Adobe Pro, so I have been able to re-build the doc to accommodate this short-coming.

Thank you for taking the time to provide feedback on our legal form. We're pleased to hear that you found the process for obtaining the document and the included guide beneficial.

We understand and appreciate your concern regarding the formatting and size limitations of certain fields, especially the 'property description' field. Our forms are designed to adhere to specific formatting requirements that are often mandated for legal compliance. Making direct alterations to the document can result in them becoming non-conforming, which is why we advise customers to use an exhibit page when their legal description is extensive or does not fit.

Leadon N.

July 9th, 2022

Forms were easy to find, print, and complete.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!