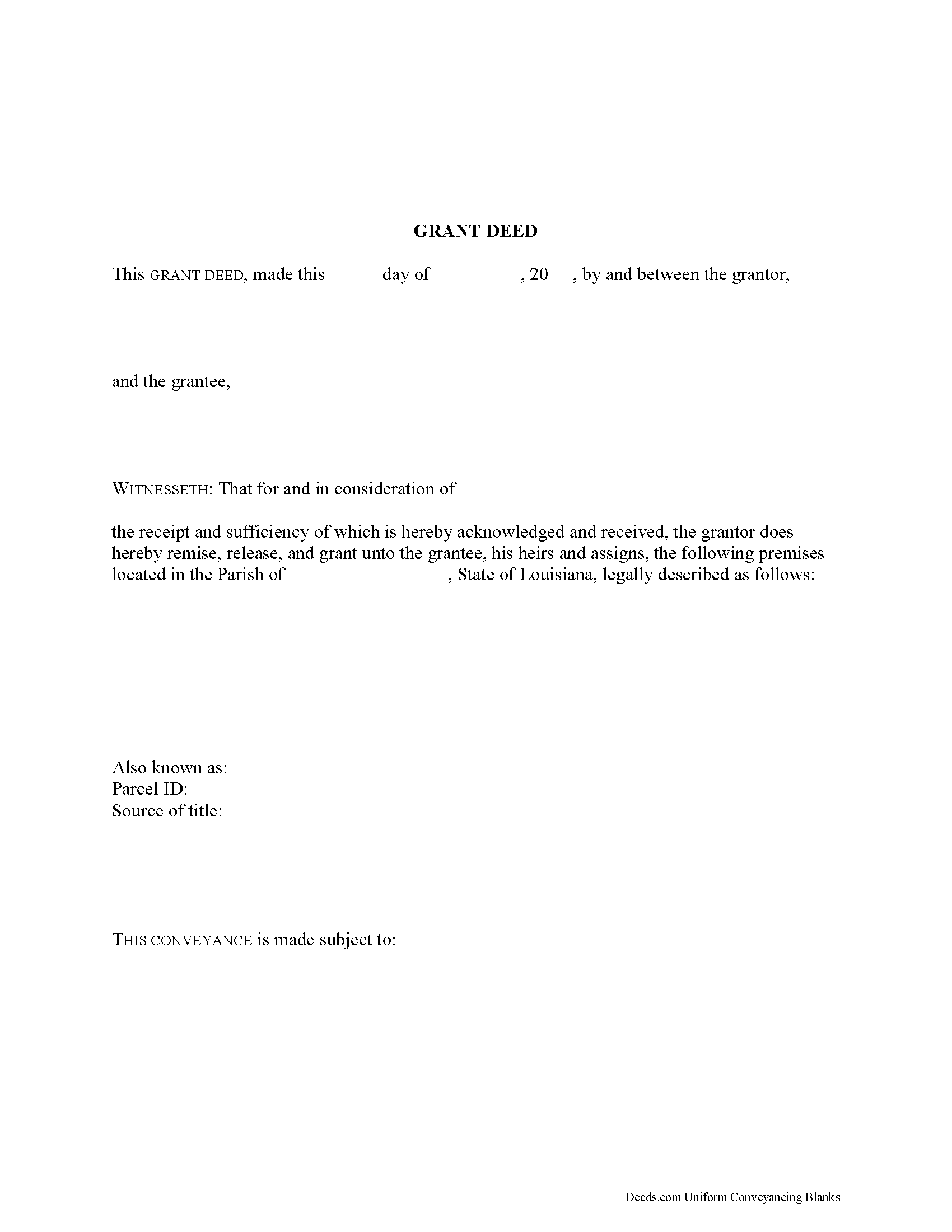

Red River Parish Grant Deed Form

Red River Parish Grant Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

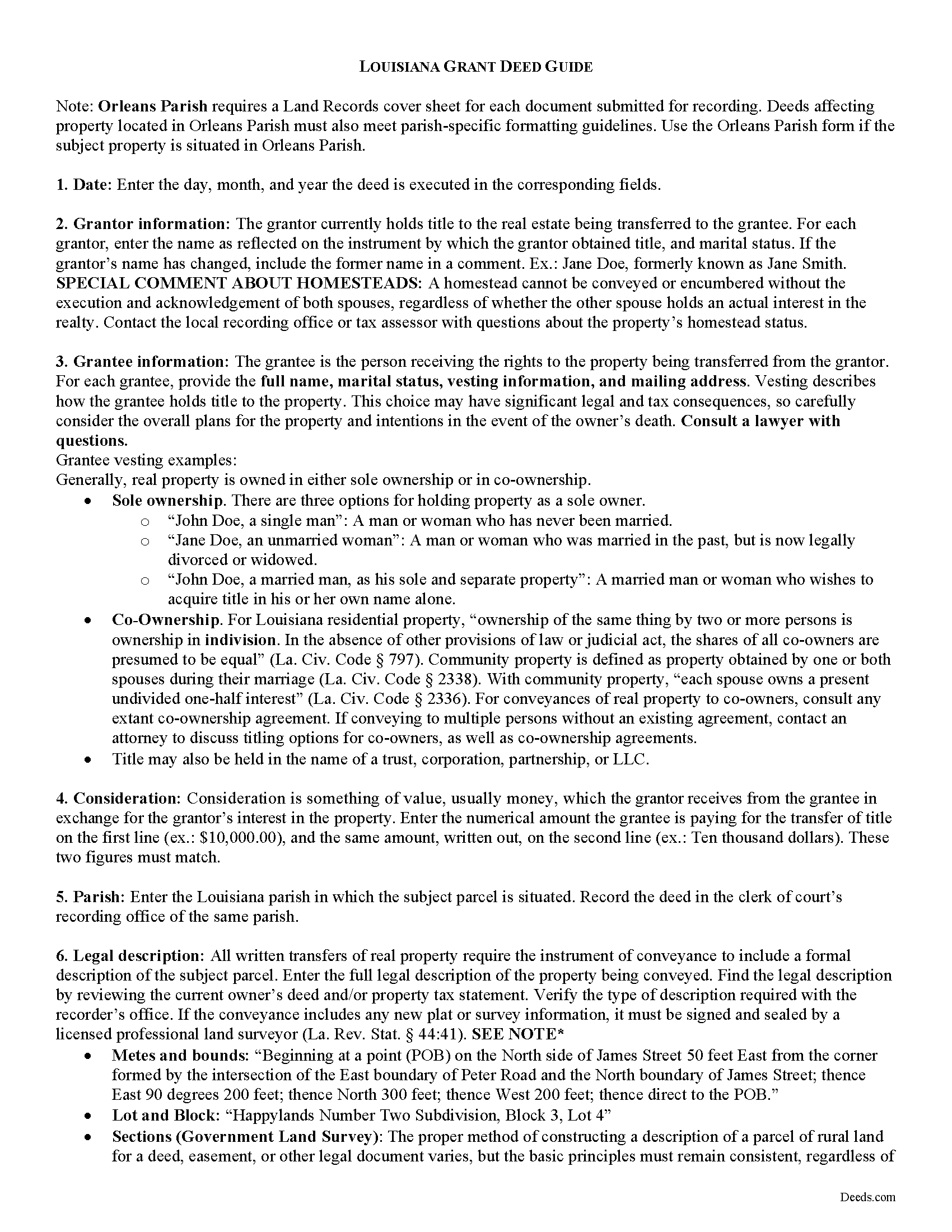

Red River Parish Grant Deed Guide

Line by line guide explaining every blank on the form.

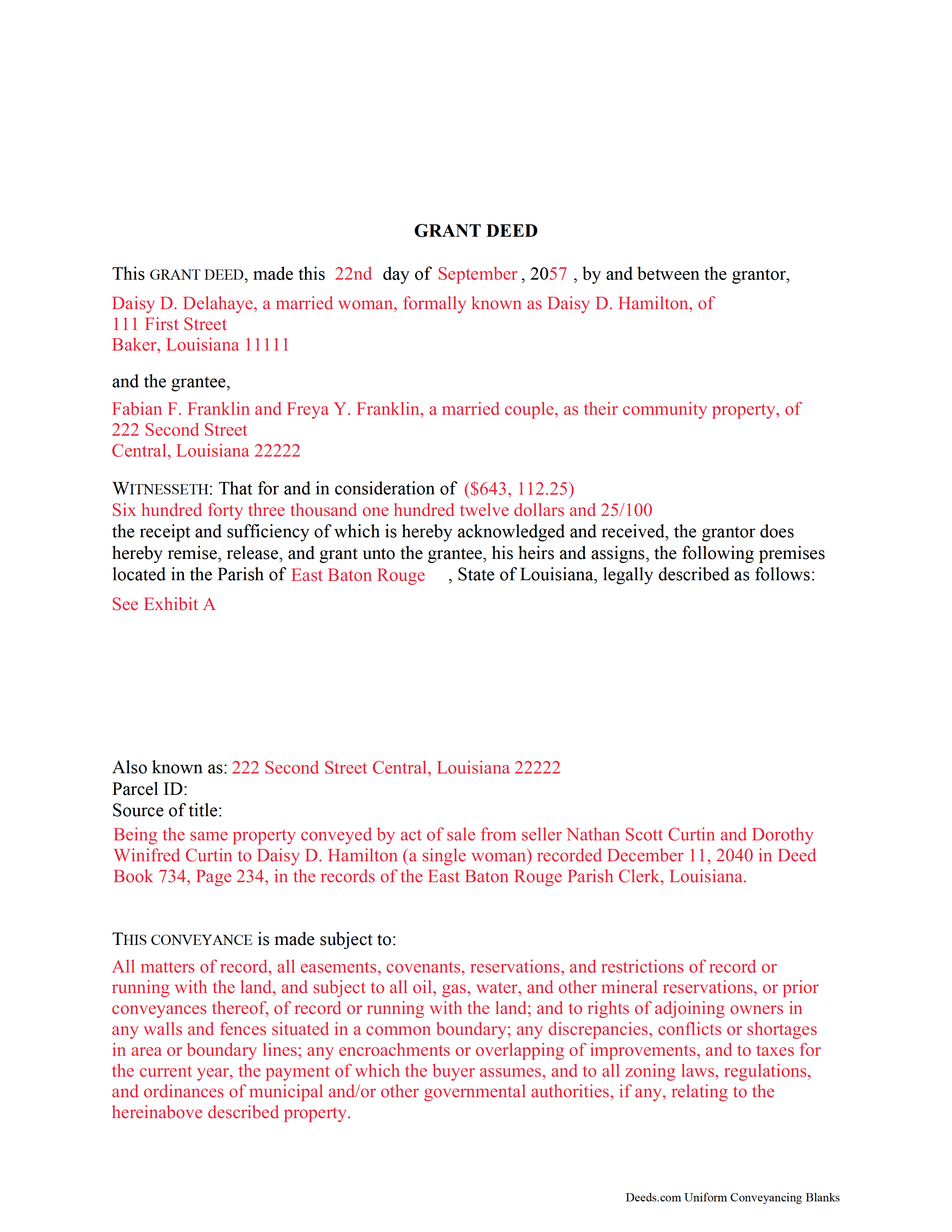

Red River Parish Completed Example of the Grant Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Louisiana and Red River Parish documents included at no extra charge:

Where to Record Your Documents

Red River Parish Clerk of Court

Coushatta, Louisiana 71019

Hours: 8:30 to 4:30 M-F

Phone: (318) 932-6741

Recording Tips for Red River Parish:

- Double-check legal descriptions match your existing deed

- White-out or correction fluid may cause rejection

- Bring extra funds - fees can vary by document type and page count

- Make copies of your documents before recording - keep originals safe

- Ask about accepted payment methods when you call ahead

Cities and Jurisdictions in Red River Parish

Properties in any of these areas use Red River Parish forms:

- Coushatta

- Hall Summit

Hours, fees, requirements, and more for Red River Parish

How do I get my forms?

Forms are available for immediate download after payment. The Red River Parish forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Red River Parish?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Red River Parish including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Red River Parish you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Red River Parish?

Recording fees in Red River Parish vary. Contact the recorder's office at (318) 932-6741 for current fees.

Questions answered? Let's get started!

Sales of immovable property in Louisiana are typically referred to as acts of sale or cash sales. As proof of the sale and transfer of title, the seller executes and records a deed in the land conveyancing records of the parish where the immovable property is located. Louisiana Statutes do not provide statutory forms for deeds.

Grant deeds convey fee simple title to the buyer with certain covenants on the part of the seller. They typically imply that the seller holds title to the subject property and has possession, unlike quitclaim deeds. A standard grant deed covenants that the seller has not previously sold the real property interest conveyed to the buyer and that the property is being conveyed to the seller without any liens or encumbrances apart from those disclosed in the instrument of conveyance [1].

In Louisiana, all sales contain the implied warranties that the buyer will have peaceful possession of the property and that such property is free of defects. Sellers also warrant that the thing sold "is fit for its intended use" (Civil Code Arts. 2475, 2524).

The promise that the property is free of defects is referred to as the warranty against redhibitory defects (CC 2520). A redhibitory defect is defined as a defect that renders the property useless, or its use would be so inconvenient that it is presumed that the buyer would not have purchased the property had he known about the defects (CC 2520). Louisiana law permits the parties to agree on a limitation of the warranty against redhibitory defects (CC 2548).

Pursuant to La. Civil Code Art. 2440, a sale or transfer of immovable property must be made by authentic act or by act under private signature. An authentic act is defined as an act executed before a notary public or other qualified officer in the presence of two witnesses, and signed by each person executing the act, each person witnessing the act, and each notary public before whom the act was executed (CC 1833(A)).

Louisiana's recording laws provide incentive to record. Because Louisiana is a "race" state, the person who records first, regardless of notice of a prior claim on the title, has priority of title. To provide notice to third parties and establish priority of title, file the deed in the recording office of the parish where the property is located.

La. Civil Code Art. 3352 sets forth the requirements for recorded acts. These include the full names and addresses of both parties to the transfer; the marital status of all individuals and whether there has been a change in marital status since the transferor obtained title; the property's address; and the notary's ID number or bar roll number and typed or printed name of the notary and witnesses. Conveyances of immovable property also require the name and address of the person responsible for all property taxes and assessments (RS 9:2721). This information should also be supplied to the tax assessor of the parish where the immovable property is located.

Recorded acts pertaining to an interest in real property should also include a legal description of the parcel, a derivation clause citing the seller's source of title, and the manner in which the buyer intends to hold title to the property.

Ownership of property is transferred as soon as there is agreement on the property transferred and the price for the transfer is fixed, though the property sold may not yet be delivered to the buyer (Civil Code Art. 2456). Delivery of immovable property occurs by law upon execution of the written act of transfer (CC 2477).

When recording the act, ensure compliance with all state and parish standards for recorded acts of sale. Contact the parish to verify additional requirements, such as cover sheets, are applicable. If the property is situated in the City of New Orleans, a transaction tax is due from the seller upon recording.

Consult a lawyer with questions regarding the legal implications of grant deeds, transfers of immovable property, and recording acts of sale in Louisiana.

[1] https://www.americanbar.org/newsletter/publications/law_trends_news_practice_area_e_newsletter_home/2011_summer/real_property_interests_deeds.html

(Louisiana Grant Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Red River Parish to use these forms. Documents should be recorded at the office below.

This Grant Deed meets all recording requirements specific to Red River Parish.

Our Promise

The documents you receive here will meet, or exceed, the Red River Parish recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Red River Parish Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4586 Reviews )

Elvira N.

January 6th, 2021

Very useful, it even includes a guide on filling out the deed form!

Thank you!

Frank H.

April 26th, 2021

All the forms downloaded are very comprehensive of Quit Claim transfers.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Catherine B.

October 26th, 2021

Was looking for information and forms relating to a trust my parents created, but what I purchased seems geared toward trusts containing real estate only, which is not what I needed. Clearly I missed something prior to purchasing something I can not use. Perhaps additional clarification for us without any experience is this area would be helpful.

Thank you for your feedback. We really appreciate it. Have a great day!

brian p.

October 12th, 2019

Good, easy to use, quit claim form worked as expected.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Anne J.

September 25th, 2023

I could not be happier with the service. Shortly after I uploaded my documents, my package was prepared and invoiced. It was only minutes before the document was recorded with the County I selected and returned to me with their seal for download.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Patrick M.

November 1st, 2019

Very useful and easy to use. Great value too. Especially liked the example.

Thank you for your feedback. We really appreciate it. Have a great day!

Kellie Z.

December 4th, 2020

Wow! So much simpler & faster than I had expected. I had thought it would take weeks to get filed & took days- yea! Super easy & speedy!

Thank you!

john o.

August 8th, 2020

very simple to use

Thank you!

Paul K.

August 18th, 2021

too much money

Thank you for your feedback. We really appreciate it. Have a great day!

Lorrie P.

January 8th, 2021

What a wonderful and easy task using deeds.com. I searched on line for the proper procedure to file a quit claim deed. It looked to confusing to do mysellf until I found deeds.com. With their instructions, I was able to fill out all the proper forms and file with the court in two days. Saved me at least a thousand dollars if I had an attorney do the same. Thank you. I will definitely use them again.

Thank you for your feedback. We really appreciate it. Have a great day!

Donna M.

November 22nd, 2021

Appreciated the ability to not only download the form but the instruction's AND a sample.

Thank you for your feedback. We really appreciate it. Have a great day!

Steven C.

May 1st, 2019

Easy but a little overpriced

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Paul B.

March 13th, 2025

Very efficient and easy to use process

Paul, we’re glad to hear you had a smooth and efficient experience! Making things easy for our customers is always our goal.

Kevin B.

March 31st, 2019

It looks like it can be a huge time saver. I did a deed and appeared very professional.

Thank you for your feedback. We really appreciate it. Have a great day!

Dorothy B.

November 4th, 2020

Love your deed service. Simple and easy.

Thank you!