Allegany County Trustee Deed Form (Maryland)

All Allegany County specific forms and documents listed below are included in your immediate download package:

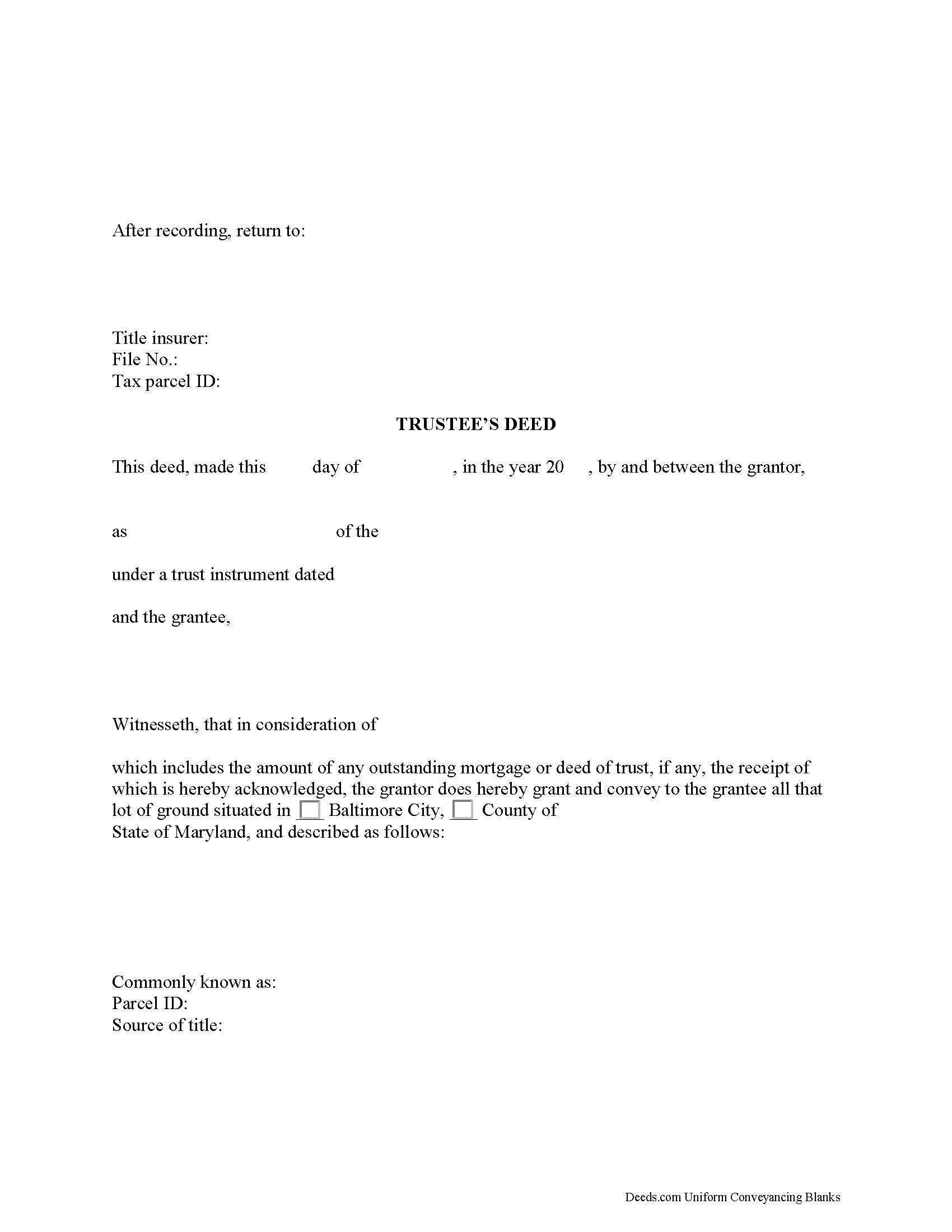

Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Allegany County compliant document last validated/updated 5/22/2025

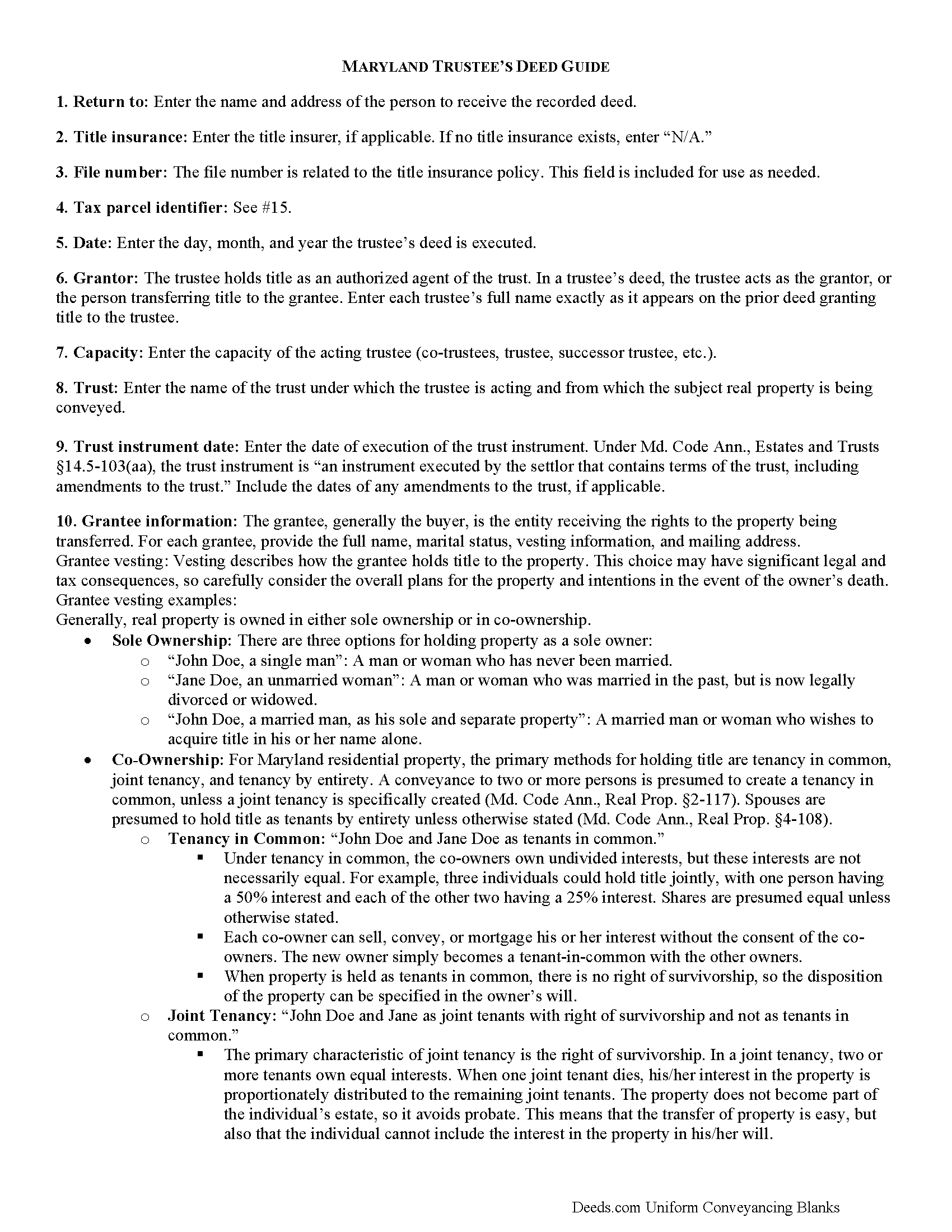

Trustee Deed Guide

Line by line guide explaining every blank on the form.

Included Allegany County compliant document last validated/updated 2/28/2025

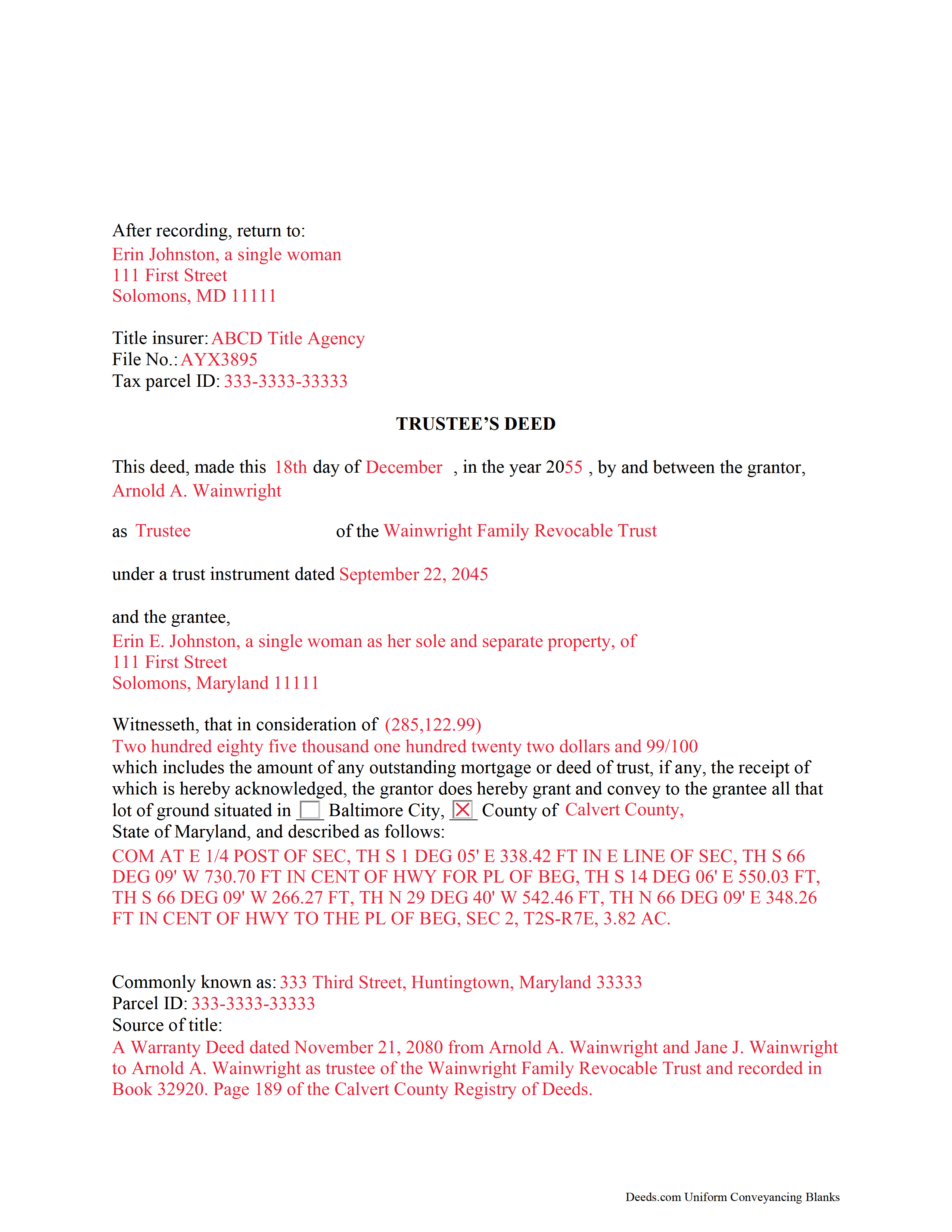

Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

Included Allegany County compliant document last validated/updated 4/17/2025

The following Maryland and Allegany County supplemental forms are included as a courtesy with your order:

When using these Trustee Deed forms, the subject real estate must be physically located in Allegany County. The executed documents should then be recorded in the following office:

Circuit Court Clerk

Courthouse - 30 Washington St, Cumberland, Maryland 21502

Hours: 8:30 to 4:30 M-F

Phone: (301) 777-5924

Local jurisdictions located in Allegany County include:

- Barton

- Corriganville

- Cumberland

- Eckhart Mines

- Ellerslie

- Flintstone

- Frostburg

- Little Orleans

- Lonaconing

- Luke

- Midland

- Midlothian

- Mount Savage

- Oldtown

- Pinto

- Rawlings

- Spring Gap

- Westernport

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Allegany County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Allegany County using our eRecording service.

Are these forms guaranteed to be recordable in Allegany County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Allegany County including margin requirements, content requirements, font and font size requirements.

Can the Trustee Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Allegany County that you need to transfer you would only need to order our forms once for all of your properties in Allegany County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Maryland or Allegany County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Allegany County Trustee Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Trusts formed in Maryland are governed by the Estates and Trusts Article of the Maryland Code. Effective since January 1, 2015, the Maryland Trust Act (MTA) under Title 14.5 is adapted from the Uniform Trust Code and supplements the prior Maryland Discretionary Trust Act codified under Title 14.

According to Black's Law Dictionary, 8th ed., a trust is "a property interest held by one person (the trustee) at the request of another (the settlor) for the benefit of a third party (the beneficiary)." The settlor executes a trust instrument establishing the terms of the trust and "contributes property to a trust" (Md. Code Ann., Estates and Trusts 14.5-103(v)(1)).

In a living trust, the trustee holds title to property at the request of the settlor, and as such, conveyances of trust property must be made through the trustee, who generally has a power of sale under the trust instrument. Transferring real property held in trust to another party requires the use of a trustee's deed.

Trustees' deeds take their name from the person conveying the property, rather than from the type of warranties of title they carry, as with warranty deeds or quitclaim deeds. In Maryland, the trustee's deed is a fee simple conveyance. The deed can contain certain covenants of title, such as special warranty language that warrants the title against claims arising under the grantor's tenure.

The trustee conveys title to real property held by the trust as the grantor of the trustee's deed. The deed names each acting trustee and the name and date of the trust on behalf of which they are acting in addition to vesting title in the name of the grantee. As with all documents affecting real property, the trustee' deed requires a legal description of the property conveyed, as well as a reference to the prior instrument under which the trustee as grantor received title.

In Maryland, consideration statements must include the actual amount of money paid for the transfer, including the amount of a mortgage or deed of trust assumed by the grantee. State transfer tax is calculated from the consideration, with an increased rate for the first-time Maryland homebuyers purchasing a principal place of residence.

Pursuant to Md. Code Ann., Real Prop. 3-104(f)(1), deeds require a signed statement that the document has been prepared by or under the supervision of a Maryland attorney, or a party listed on the instrument. The deed must be signed by each acting trustee in the presence of a notary public before submitted for recording. In addition to meeting state and local recording standards, trustee's deeds may also require supporting documentation, which may vary from case to case.

Contact an attorney with any questions regarding Maryland trusts and trustee's deeds.

(Maryland TD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Allegany County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Allegany County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4560 Reviews )

Pauline C.

June 29th, 2025

Everything that was stated to be included in my order was complete. Very satisfied

Thank you for your positive words! We’re thrilled to hear about your experience.

Ed H.

June 28th, 2025

I filled out the Kansas form and presented it to the Clerk of Deeds in Rawlins Co and there were no problems and no expensive attorney involved for a simple transaction.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Loretta W.

June 26th, 2025

Thank you for your excellent service

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ajinder M.

June 18th, 2020

wonderful.

saved my time and energy.

Absolutely love this service.

All the best

AJ

Thank you!

Michael B.

May 25th, 2021

Download was easy to complete, but difficult to revisit site to review purchased forms on line. Suggest you download everything at one sitting to make sure you get everything you need from your purchase.

Thank you!

LINDA J M.

November 18th, 2019

NO PROBLEMS. I LIKE THE DEED DOCUMENT AND INSTRUCTIONS. MADE IT EASY.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Shawn S.

August 30th, 2019

Seems to be exactly whst j needed. Great job!

Thank you!

Richard A.

February 17th, 2023

Deeds.com was easy to use and provided everything needed

to do a quitclaim deed!

Thank you!

John D.

September 30th, 2020

I was quite impressed by the quality of your documents and the ease of the download.

Thank you for your feedback. We really appreciate it. Have a great day!

darryl c.

July 24th, 2021

very easy to use website

Thank you!

Laura M.

November 12th, 2023

Very easy and I appreciate that when you hover over the blank, directions pop up and tell you what to put in that blank. I also appreciated that when I lost the original password, I sent an email and Deeds.com cancelled my order, refunded my account, so that I could start over.

It was a pleasure serving you. Thank you for the positive feedback!

William N.

July 16th, 2019

Every thing worked perfectly.

Thank you!

Lloyd F.

September 13th, 2019

We were very pleased at how quickly the forms showed up and the guide and copy of a sample filled in form

was very helpful.

We will defiantly use you again if the occasion arises, and will highly recommend your company to friends and family.

Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sherri P.

May 6th, 2020

I thought it was easy, but I wish it were faster. I uploaded my document Monday night (after 5pm) and got my invoice the next morning Tuesday paid it right away. and my document was not sent to me as recorded until Wednesday morning even though it was recorded the day earlier at 8:30am. So there was a delay of almost 24 hours letting me know that my document was recorded. So if they could speed that up so that we knew exactly when it got recorded immediately I would give it a million stars

Thank you!

Halilat S.

April 2nd, 2021

Excellent communications. Well done guys!

Thank you for your feedback. We really appreciate it. Have a great day!