Carroll County Trustee Deed Form (Maryland)

All Carroll County specific forms and documents listed below are included in your immediate download package:

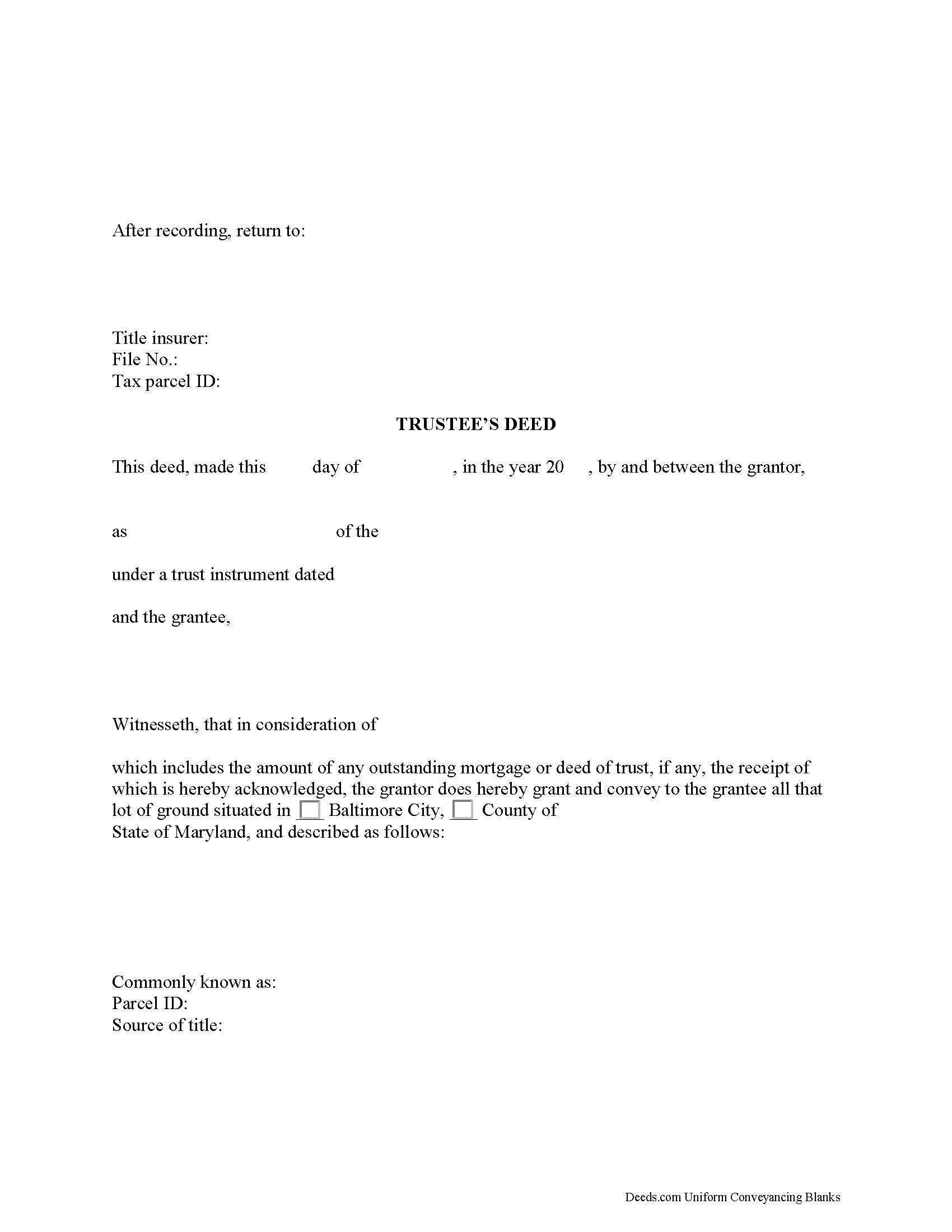

Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Carroll County compliant document last validated/updated 5/22/2025

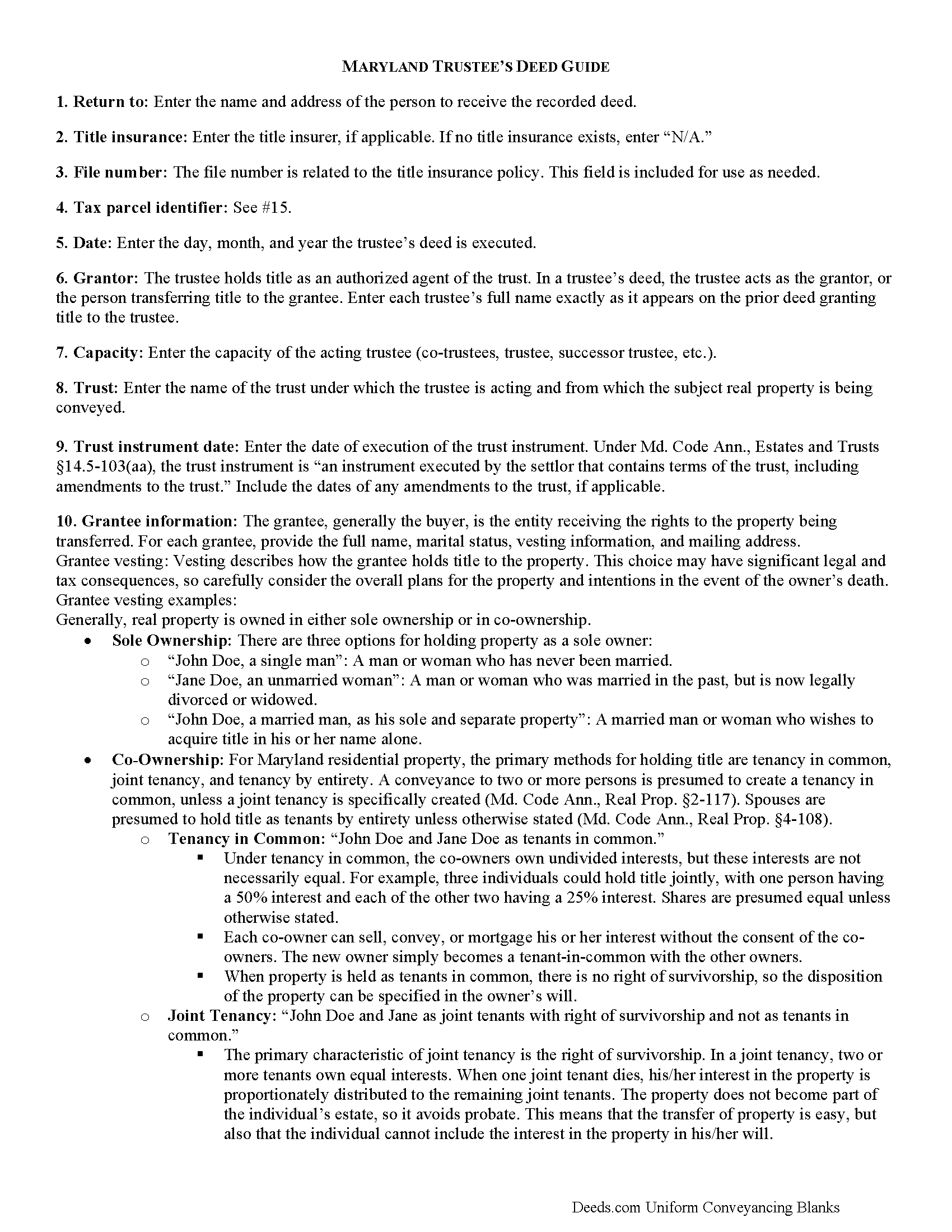

Trustee Deed Guide

Line by line guide explaining every blank on the form.

Included Carroll County compliant document last validated/updated 2/28/2025

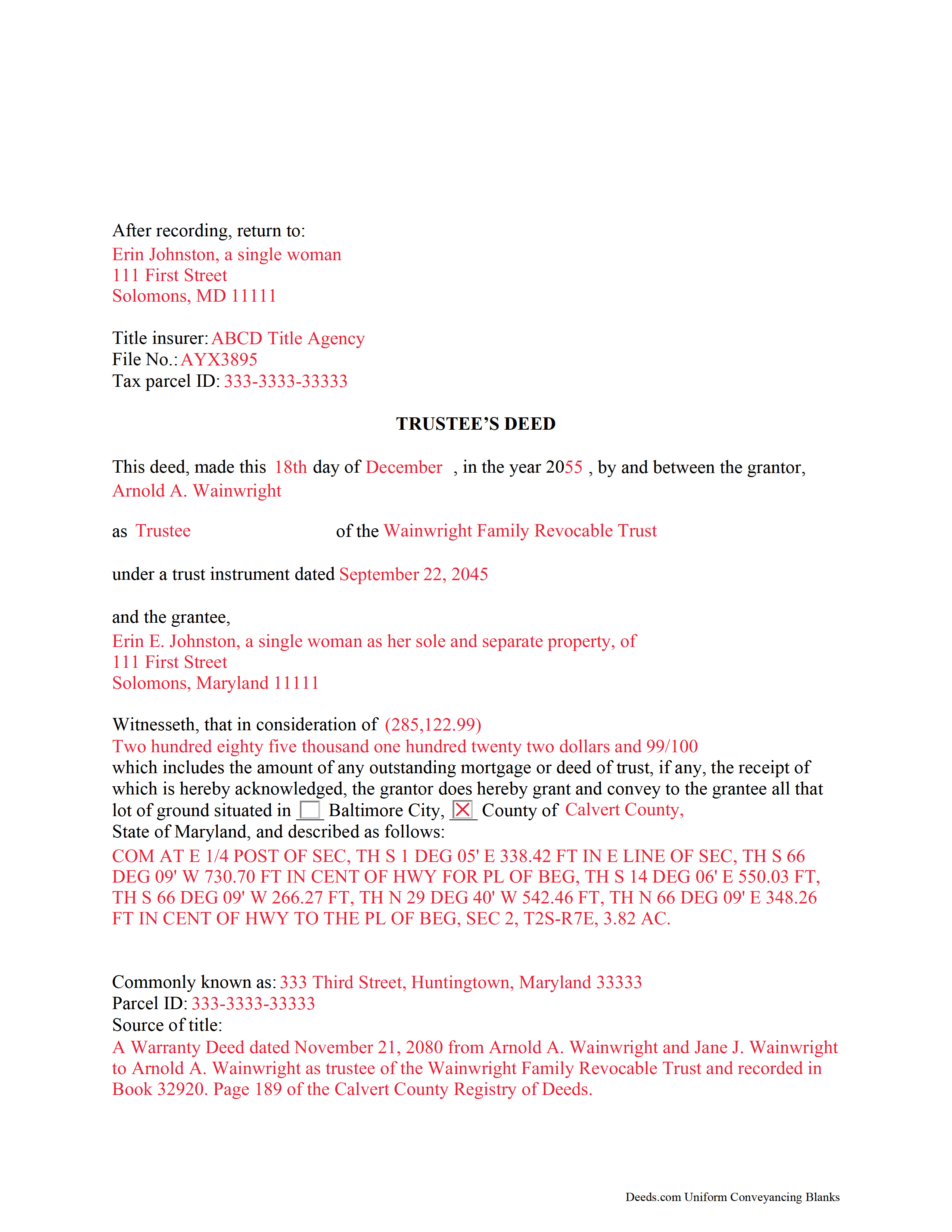

Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

Included Carroll County compliant document last validated/updated 4/17/2025

The following Maryland and Carroll County supplemental forms are included as a courtesy with your order:

When using these Trustee Deed forms, the subject real estate must be physically located in Carroll County. The executed documents should then be recorded in the following office:

Circuit Court Clerk's Office

Courthouse - 55 North Court St, Rm G-8, Westminster, Maryland 21157-5155

Hours: 8:30 to 4:30 M-F

Phone: 410-386-8710

Local jurisdictions located in Carroll County include:

- Finksburg

- Hampstead

- Keymar

- Lineboro

- Manchester

- Marriottsville

- New Windsor

- Sykesville

- Taneytown

- Union Bridge

- Westminster

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Carroll County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Carroll County using our eRecording service.

Are these forms guaranteed to be recordable in Carroll County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Carroll County including margin requirements, content requirements, font and font size requirements.

Can the Trustee Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Carroll County that you need to transfer you would only need to order our forms once for all of your properties in Carroll County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Maryland or Carroll County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Carroll County Trustee Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Trusts formed in Maryland are governed by the Estates and Trusts Article of the Maryland Code. Effective since January 1, 2015, the Maryland Trust Act (MTA) under Title 14.5 is adapted from the Uniform Trust Code and supplements the prior Maryland Discretionary Trust Act codified under Title 14.

According to Black's Law Dictionary, 8th ed., a trust is "a property interest held by one person (the trustee) at the request of another (the settlor) for the benefit of a third party (the beneficiary)." The settlor executes a trust instrument establishing the terms of the trust and "contributes property to a trust" (Md. Code Ann., Estates and Trusts 14.5-103(v)(1)).

In a living trust, the trustee holds title to property at the request of the settlor, and as such, conveyances of trust property must be made through the trustee, who generally has a power of sale under the trust instrument. Transferring real property held in trust to another party requires the use of a trustee's deed.

Trustees' deeds take their name from the person conveying the property, rather than from the type of warranties of title they carry, as with warranty deeds or quitclaim deeds. In Maryland, the trustee's deed is a fee simple conveyance. The deed can contain certain covenants of title, such as special warranty language that warrants the title against claims arising under the grantor's tenure.

The trustee conveys title to real property held by the trust as the grantor of the trustee's deed. The deed names each acting trustee and the name and date of the trust on behalf of which they are acting in addition to vesting title in the name of the grantee. As with all documents affecting real property, the trustee' deed requires a legal description of the property conveyed, as well as a reference to the prior instrument under which the trustee as grantor received title.

In Maryland, consideration statements must include the actual amount of money paid for the transfer, including the amount of a mortgage or deed of trust assumed by the grantee. State transfer tax is calculated from the consideration, with an increased rate for the first-time Maryland homebuyers purchasing a principal place of residence.

Pursuant to Md. Code Ann., Real Prop. 3-104(f)(1), deeds require a signed statement that the document has been prepared by or under the supervision of a Maryland attorney, or a party listed on the instrument. The deed must be signed by each acting trustee in the presence of a notary public before submitted for recording. In addition to meeting state and local recording standards, trustee's deeds may also require supporting documentation, which may vary from case to case.

Contact an attorney with any questions regarding Maryland trusts and trustee's deeds.

(Maryland TD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Carroll County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Carroll County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4560 Reviews )

Pauline C.

June 29th, 2025

Everything that was stated to be included in my order was complete. Very satisfied

Thank you for your positive words! We’re thrilled to hear about your experience.

Ed H.

June 28th, 2025

I filled out the Kansas form and presented it to the Clerk of Deeds in Rawlins Co and there were no problems and no expensive attorney involved for a simple transaction.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Loretta W.

June 26th, 2025

Thank you for your excellent service

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mark E.

April 25th, 2024

This was easy to use and only contained one glaring error-where to send the completed form to finish the process. I’ve completed the form, does this mean I get the amended deed sent to me? I think not.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Anne H.

July 25th, 2024

After some initial general confusion -- (we sold a small piece of land privately and therefore do not typically prepare such documentation (!)) -- we were able to purchase and download all forms from Deeds.com and understand how to complete it/them. The help is all there, we just needed to read and study it - the "Example" helped alot. We were able to complete the Document per your online form(s) and then take it to be signed/notarized - and take the completed paper document to the Registry -- and it is now all registered and we are All Set. rn Took the morning (only). THANK YOU. A wonderful tool!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Evelyn A.

October 30th, 2021

Was easy to use. Just didnt find what i needed

Thank you for your feedback. We really appreciate it. Have a great day!

Dennis S.

November 8th, 2020

Simple quitclaim form, worked perfectly for my area.

Thank you!

Jeanne P.

May 6th, 2019

very easy to use and at an affordable price.

Thank you!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael M.

June 14th, 2022

Amazing time saver, fantastic resource if you have an idea of what you are looking for and you can read. No one is going to hold your hand so be prepared to do the research yourself... it is DIY after all.

Thanks for the kind words Michael. Have a wonderful day.

Jason B.

August 8th, 2021

Deeds.com did a great job in explaining exactly what I'd need to file a deed transfer (quitclaim deed). I didn't have to order the forms piecemeal, but was able to order the whole package at once for a reasonable price. Once downloaded, their fill-in-the-blank PDF was easy to use with detailed instructions for each line item. I'd definitely use them again.

Thank you for your feedback. We really appreciate it. Have a great day!

Nancy E.

May 4th, 2025

Took me awhile to figure out and get the information printed so I can use it later.rnThank you.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Jim J.

February 8th, 2019

The forms were easy to use and the fields are tabbed so that you can enter your information and then move quickly to the next entry. The Guide for the documents was very helpful.

Thanks Jim, we appreciate your feedback.

Matthew T.

September 9th, 2020

I am a litigator based in Lee County that rarely needs to record deeds or mortgages. However, at times, the settlement or resolution of a dispute results in the conveyance of real property. I ended up in a situation where a deed to real property in Bradford County needed to be recorded on behalf of a client. My usual e-recording vendor does not include that County. Registering with Bradford County's regular e-recording vendor would have required an expensive and unnecessary annual fee.

Deeds.com was easy to use, inexpensive and fast. I highly encourage its use, especially for lawyers that occasionally need to record instruments but do not do so regularly.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Shirley W.

August 26th, 2021

I found the form easy to file out. But everything else was confusing with very little direction and help.

Thank you!

MARY LACEY M.

April 11th, 2024

I am extremely impressed with the quality of this service. They are a pleasure to work with and I know I can rely on them.

Thank you for your feedback. We really appreciate it. Have a great day!