Bristol County Quitclaim Deed with Covenants Form (Massachusetts)

All Bristol County specific forms and documents listed below are included in your immediate download package:

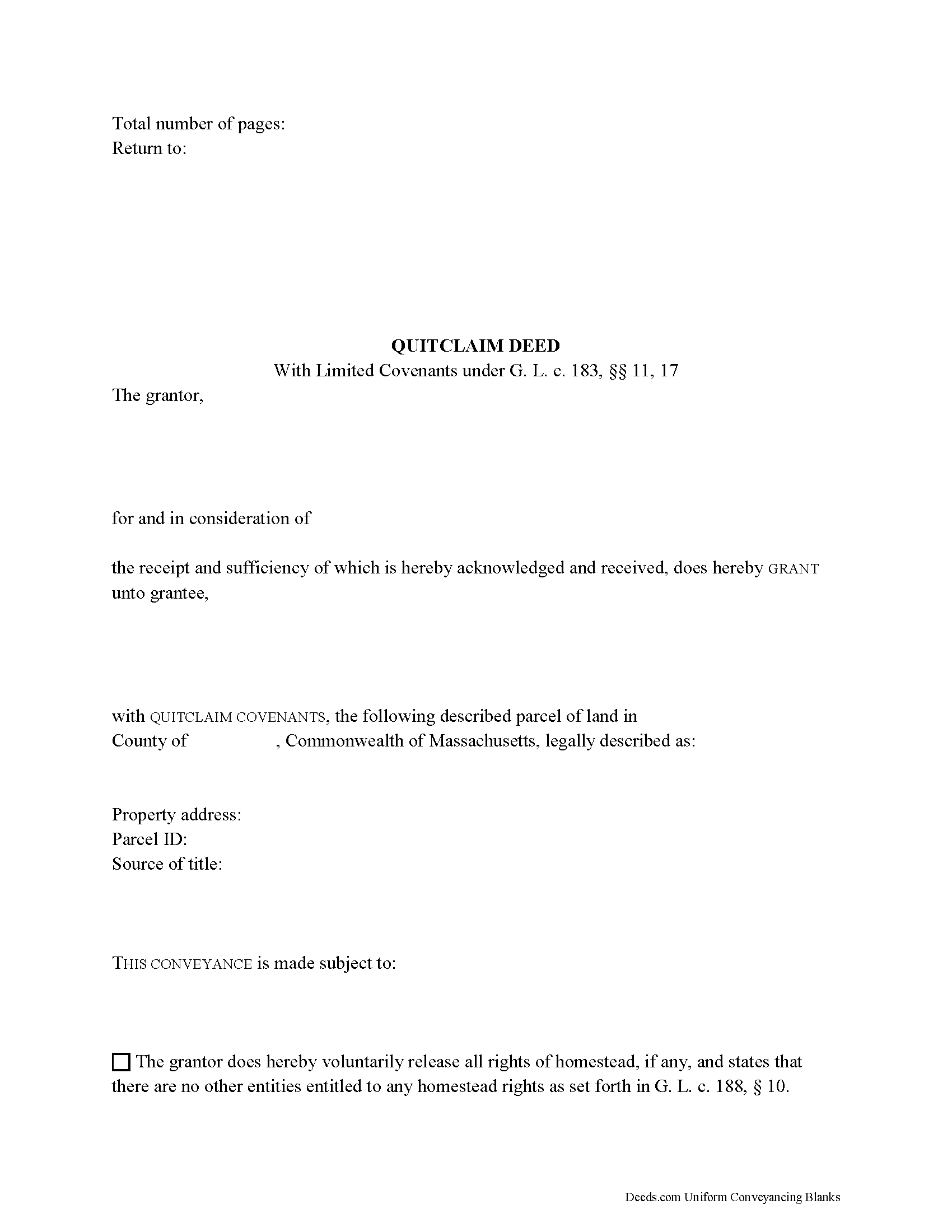

Quitclaim Deed with Covenants Form

Fill in the blank Quitclaim Deed with Covenants form formatted to comply with all Massachusetts recording and content requirements.

Included Bristol County compliant document last validated/updated 6/17/2025

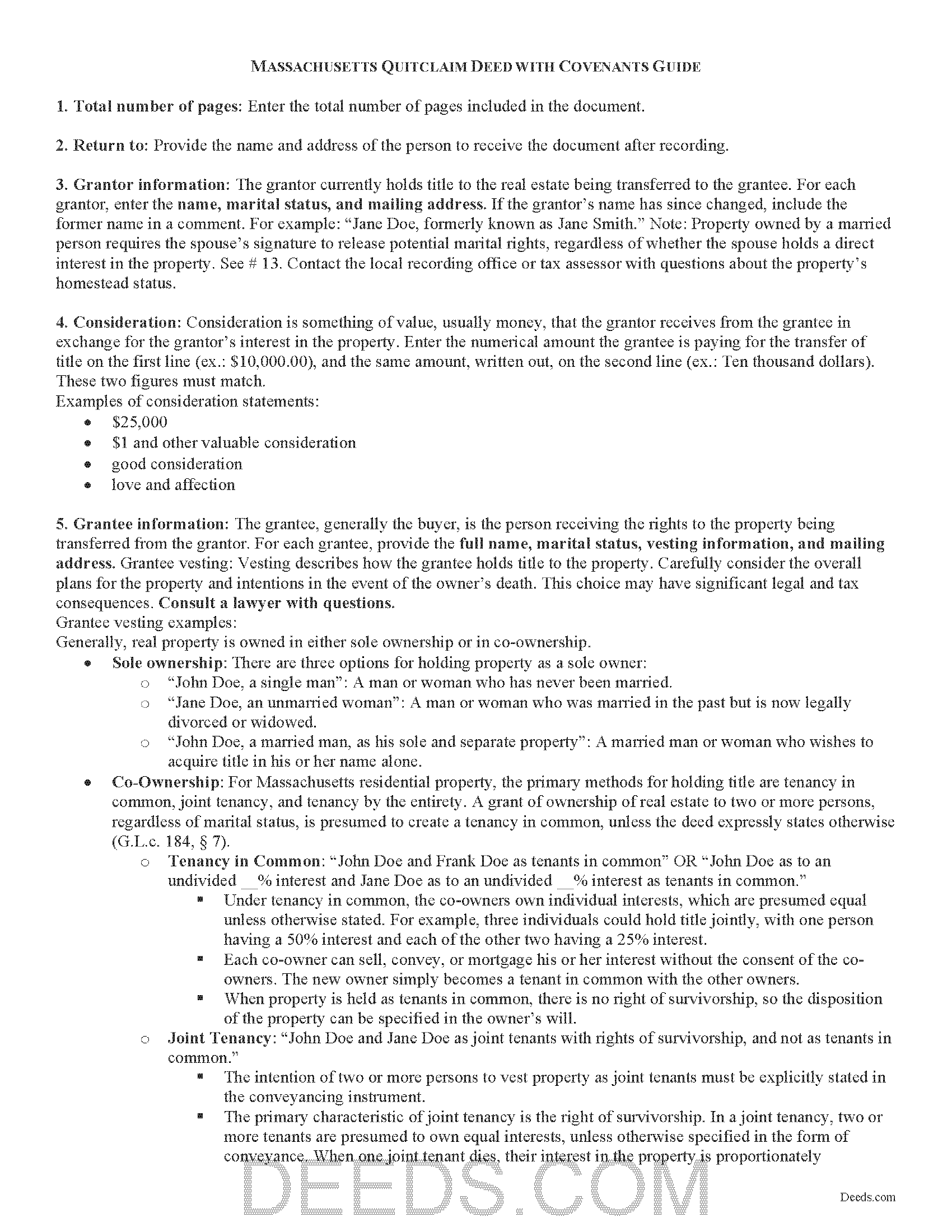

Quitclaim Deed with Covenants Guide

Line by line guide explaining every blank on the Quitclaim Deed with Covenants form.

Included Bristol County compliant document last validated/updated 3/26/2025

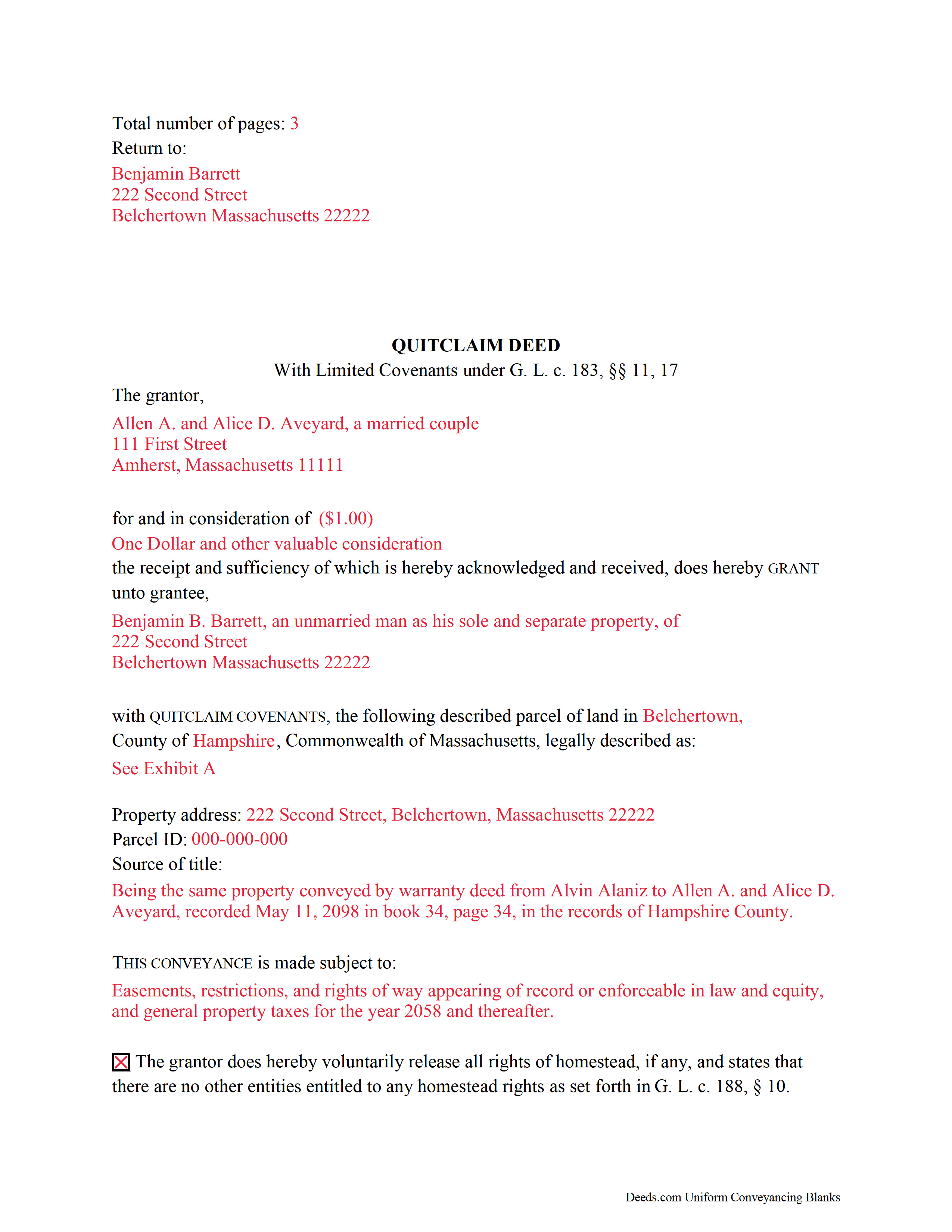

Completed Example of the Quitclaim Deed with Covenants Document

Example of a properly completed Massachusetts Quitclaim Deed with Covenants document for reference.

Included Bristol County compliant document last validated/updated 3/4/2025

The following Massachusetts and Bristol County supplemental forms are included as a courtesy with your order:

When using these Quitclaim Deed with Covenants forms, the subject real estate must be physically located in Bristol County. The executed documents should then be recorded in one of the following offices:

Bristol County Registry of Deeds, Fall River District

441 N. Main St, Fall River, Massachusetts 02722

Hours: 8:00 to 4:30 Mon-Fri / Recording until 4:00

Phone: (508) 673-2910

Bristol County Registry of Deeds, Northern District

11 Court St, Taunton, Massachusetts 02780

Hours: 8:00 to 4:30 Mon-Fri / Recording until 4:00

Phone: (508) 822-0502

Northern District - Attleboro location (no registered land)

75 Park St, Attleboro, Massachusetts 02703

Hours: 9:00 to 4:00 Mon-Fri / Recording until 3:30

Phone: (508) 455-6100

Bristol County Registry of Deeds, Southern District

25 N. 6th St, New Bedford, Massachusetts 02740

Hours: 8:00 to 4:30 Mon-Fri / Recording until 4:00

Phone: (508) 993-2603

Local jurisdictions located in Bristol County include:

- Acushnet

- Assonet

- Attleboro

- Attleboro Falls

- Berkley

- Chartley

- Dartmouth

- Dighton

- East Freetown

- East Mansfield

- East Taunton

- Easton

- Fairhaven

- Fall River

- Mansfield

- New Bedford

- North Attleboro

- North Dartmouth

- North Dighton

- North Easton

- Norton

- Raynham

- Raynham Center

- Rehoboth

- Seekonk

- Somerset

- South Dartmouth

- South Easton

- Swansea

- Taunton

- Westport

- Westport Point

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Bristol County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Bristol County using our eRecording service.

Are these forms guaranteed to be recordable in Bristol County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Bristol County including margin requirements, content requirements, font and font size requirements.

Can the Quitclaim Deed with Covenants forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Bristol County that you need to transfer you would only need to order our forms once for all of your properties in Bristol County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Massachusetts or Bristol County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Bristol County Quitclaim Deed with Covenants forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Real estate conveyances in Massachusetts are governed under Massachusetts General Laws Chapters 183 and 184.

Quitclaim deeds with limited covenants are used to transfer the rights, title, and interest in real estate, if any, from the grantor (seller) to the grantee (buyer). When using this kind of deed, the grantor "covenants that the property is free from all encumbrances," and that he will "warrant and defend the same to the grantee forever against the lawful claims and demands of all persons claiming by, through or under the grantor, but against none other" (G.L.c. 183 sec. 17). Because of these covenants, this form is valid as-is for use as a special warranty deed in Massachusetts.

In addition to meeting all state and local standards for recorded documents, a lawful deed identifies the name, address, and marital status of each grantor and grantee (G.L.c. 183 sec. 6). State law requires that all land records contain information on how the grantee will hold title (G.L.c. 184 sec. 7). For Massachusetts residential property, the primary methods for holding title are tenancy in common, joint tenancy, and tenancy by the entirety. A grant of ownership of real estate to two or more persons, regardless of marital status, is presumed to create a tenancy in common, unless the deed expressly states otherwise (G.L.c. 184 sec. 7).

As with any conveyance of real estate, a quitclaim deed with limited covenants requires a complete legal description of the parcel. The deed must state the amount of the full consideration, or the total price for the conveyance (G.L.c. 183 sec. 6). Based on the consideration paid, an excise tax (also known as a transfer tax or stamp tax) is collected from the seller (G.L.c. 64D sec. 1,2).

Record the completed deed at the local County Registry of Deeds office. Some counties (Berkshire, Bristol, Essex, Middlesex, Worcester) are split into two or more recording districts. Make sure to record the deed in the correct recording district. If the deed pertains to registered land, submit the deed to the Registry District of the Land Court. Include all relevant affidavits, forms, and fees along with the deed for recording. For guidance related to supplemental documentation, speak with the local Registry of Deeds office.

This article is provided for informational purposes only and is not a substitute for legal advice. Contact a lawyer with questions about quitclaim deeds with limited covenants or transfers of real property in Massachusetts.

(Massachusetts QCD with Covenants Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Bristol County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Bristol County Quitclaim Deed with Covenants form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4562 Reviews )

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Pauline C.

June 29th, 2025

Everything that was stated to be included in my order was complete. Very satisfied

Thank you for your positive words! We’re thrilled to hear about your experience.

Susan B.

August 8th, 2023

I guess I got what I paid for. The site said I would be able to download blank PDF forms that I could fill out on my computer. I expected fillable forms, like I download for taxes. Instead the forms I got could only be completed by using Adobe Sign and Fill tools. These are much harder to use than fillable forms.

Thank you for your feedback. We really appreciate it. Have a great day!

Derrell S.

August 26th, 2019

I like the simplicity of your site and the reasonable charge for your services but for some reason you were unable to fulfill my order. Would appreciate knowing why. Derrell Sweem

Thank you for your feedback. We really appreciate it. Have a great day!

Andrew M.

March 20th, 2021

Very easy to find the Quitclaim Deed form I needed. It was correct format and was accepted by my bank.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

George R.

July 28th, 2020

One of the most satisfactory and easy to use websites I have come across. Being able to record documents in the court records without having to pay an atty $500 per hour and accomplish the recording in about 24 hours instead of days and even weeks i

s invaluable. Worked perfectly.

Thank you!

George A. M.

August 10th, 2022

User friendly and fast to use. I was pleased with experience.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Shari N.

March 1st, 2022

Super easy to order and save a document!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Armstrong K.

March 29th, 2021

Very smooth and speedy process.

Thank you.

Thank you!

Camille L.

January 20th, 2022

very user friendly!

Thank you!

Charles S.

July 7th, 2021

Quick and easy. Highly recommend. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Judith A.

January 14th, 2022

Excellent

Thank you!

Estelle R.

May 25th, 2022

Easy to download. Hopefully easy to fill in. Just wish there was wording for a Beneficiary Deed for moving real estate property owned by a married couple to their Trust upon death of last Trustee.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mary S.

January 25th, 2019

I am so excited to find this site. Thank you

Thank you Mary. We appreciate your enthusiasm, have a great day!