Grand Traverse County Certificate of Trust MCL 700.7913 Form

Grand Traverse County Michigan Certificate of Trust MCL 700.7913 Form

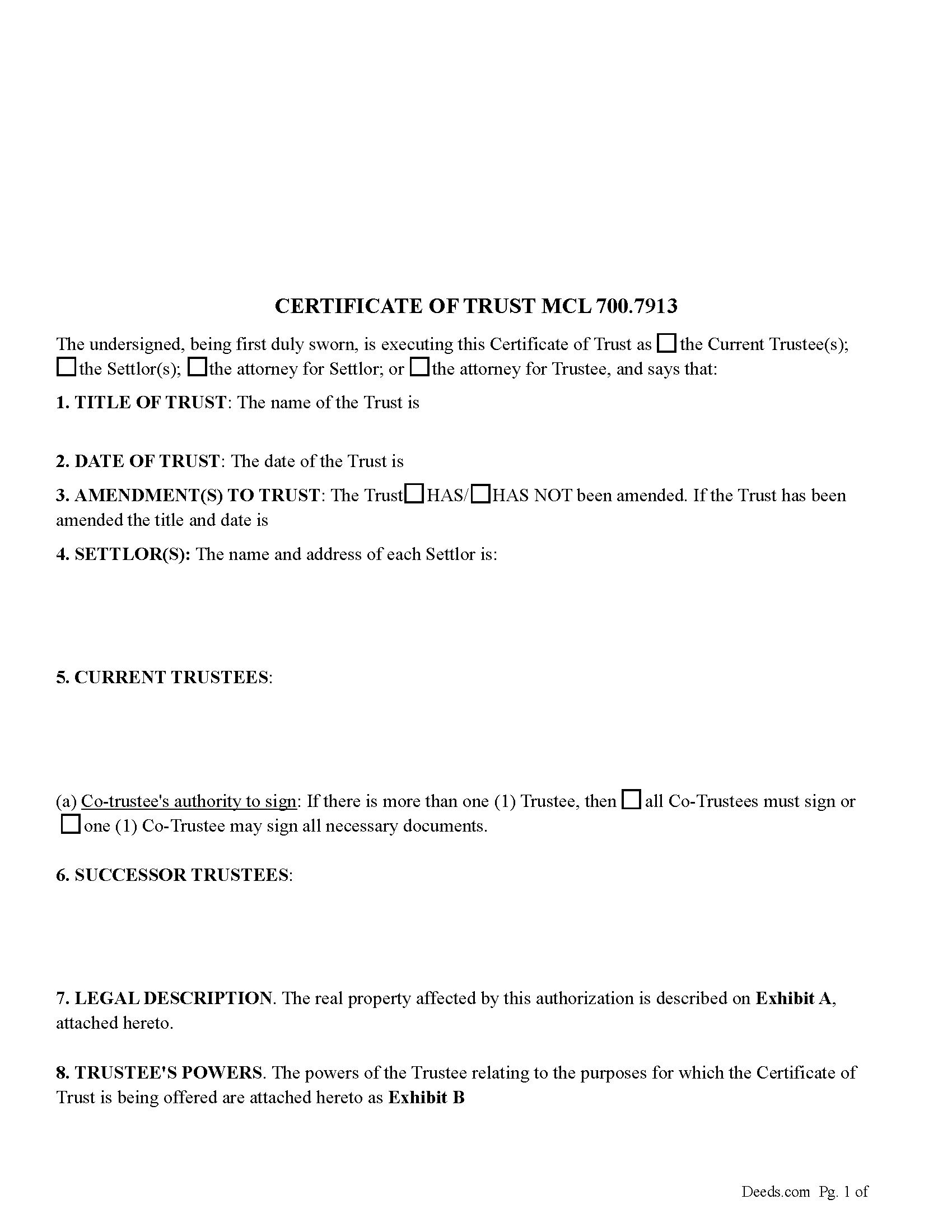

Fill in the blank form formatted to comply with all recording and content requirements.

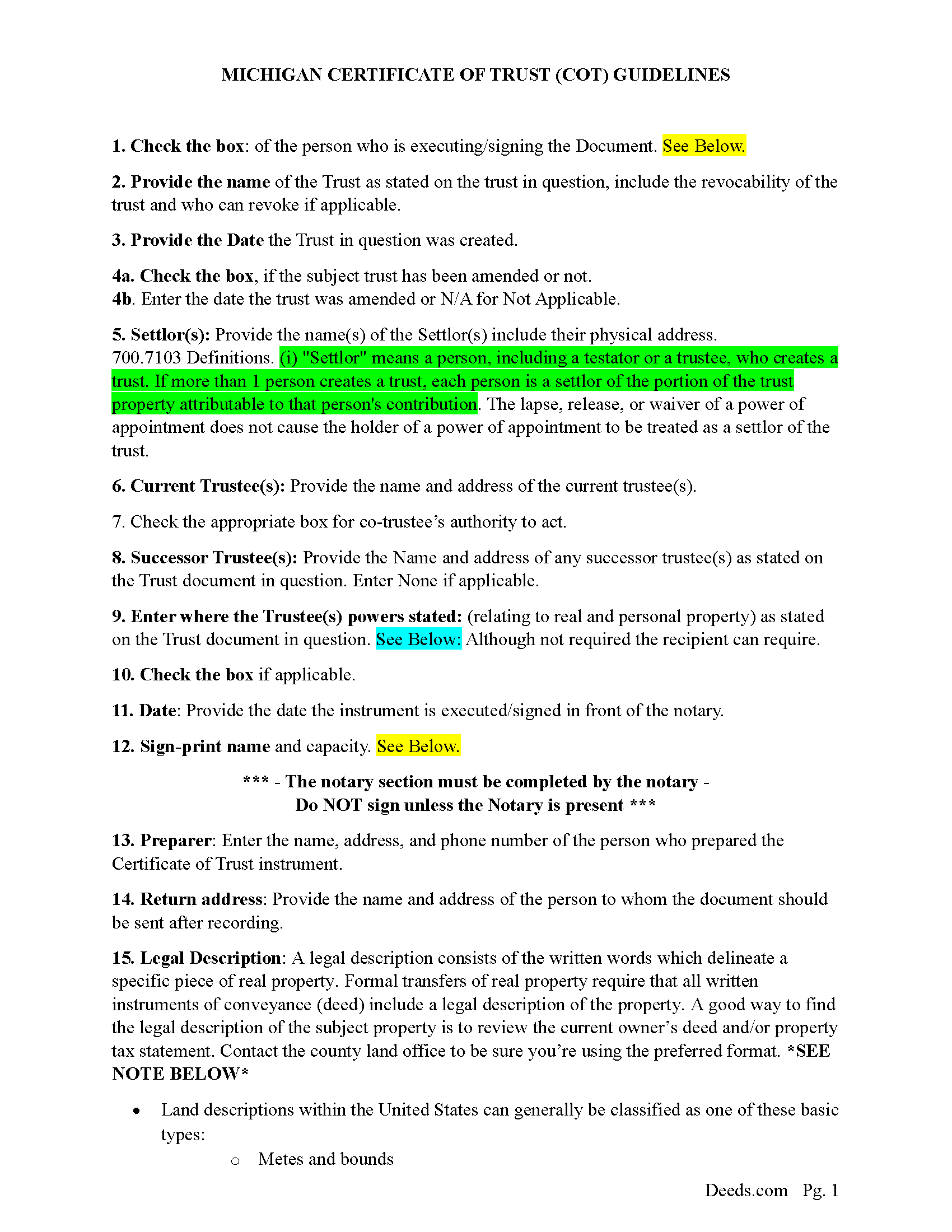

Grand Traverse County Certificate of Trust Guidelines

Line by line guide explaining every blank on the form.

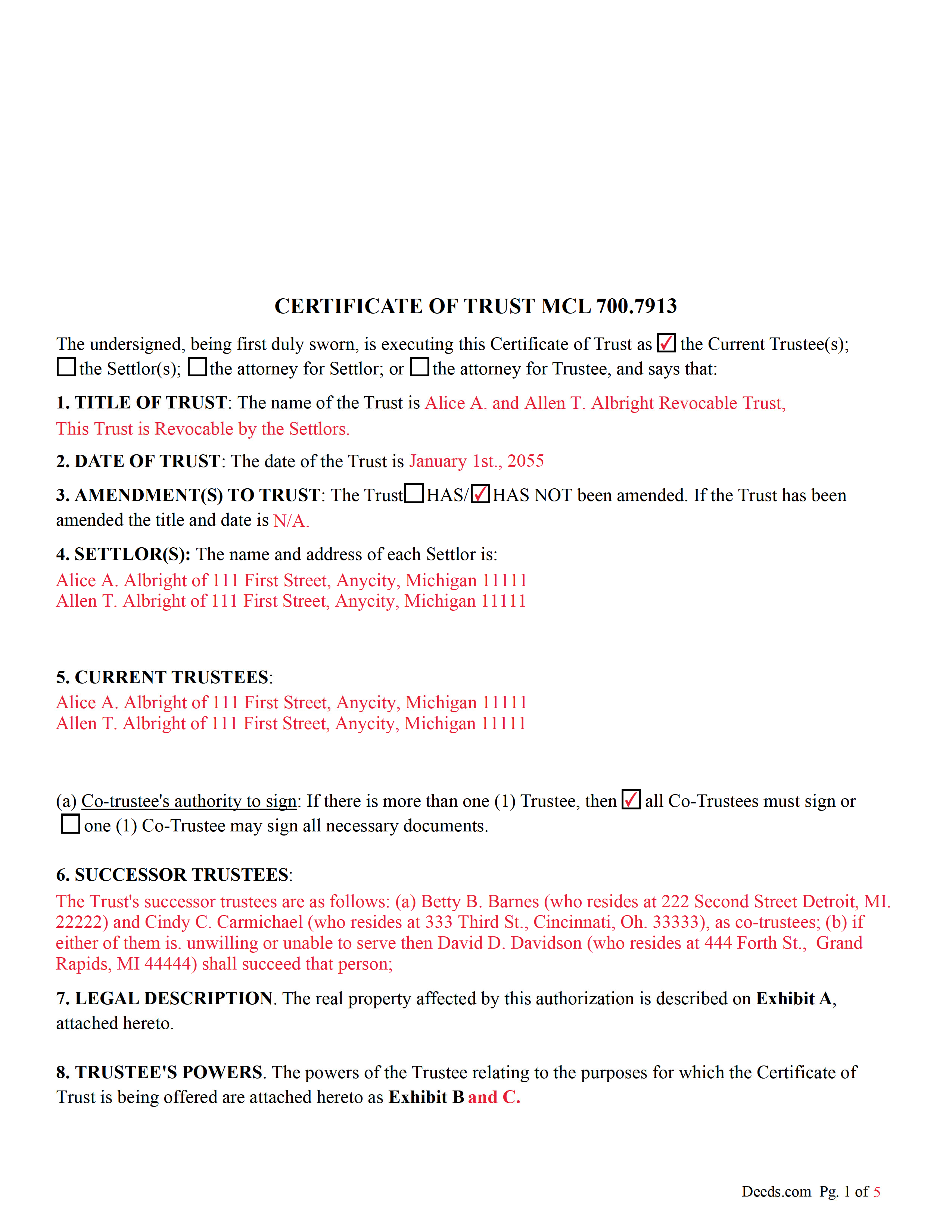

Grand Traverse County Completed Example of the Certificate of Trust Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Michigan and Grand Traverse County documents included at no extra charge:

Where to Record Your Documents

County Register of Deeds

Traverse City, Michigan 49684

Hours: 8:00 am to 5:00 pm Mon - Fri

Phone: (231) 922-4753

Recording Tips for Grand Traverse County:

- Check that your notary's commission hasn't expired

- Check margin requirements - usually 1-2 inches at top

- If mailing documents, use certified mail with return receipt

Cities and Jurisdictions in Grand Traverse County

Properties in any of these areas use Grand Traverse County forms:

- Acme

- Grawn

- Interlochen

- Kingsley

- Mayfield

- Old Mission

- Traverse City

- Williamsburg

Hours, fees, requirements, and more for Grand Traverse County

How do I get my forms?

Forms are available for immediate download after payment. The Grand Traverse County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Grand Traverse County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Grand Traverse County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Grand Traverse County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Grand Traverse County?

Recording fees in Grand Traverse County vary. Contact the recorder's office at (231) 922-4753 for current fees.

Questions answered? Let's get started!

New legislation was signed into law in 2018 that, in essence, consolidated the two types of certificates of trust into one, a (Certificate of Trust) and a (Certificate of Trust Existence and Authority). This Certificate of Trust allows those with an interest in real property the necessary information regarding the Trust to help either fund the Trust or allow real property to be transferred with a clear title. A COT provides pertinent/relevant information needed to satisfy title companies and/or banks. When a Trustee wants to sell real property that is part of a trust, a COT will be required at or before the closing.

Pursuant to the current law, a certificate of trust must include:

The name of the trust, the date of the trust, and the date of each operative trust instrument.

The name and address of each current trustee.

The powers of the trustee relating to the purposes for which the certificate of trust is offered.

The revocability or irrevocability of the trust and the identity of any person holding the power to revoke the trust.

The authority of co-trustees to sign on behalf of the trust or otherwise authenticate on behalf of the trust and whether all or less than all co-trustees are required to exercise the trustee powers.

A statement that the trust has not been revoked, modified or amended in any manner that would cause the representations included in the certificate of trust to be incorrect.

The certificate of trust may be signed or otherwise authenticated by the settlor, any trustee (including a successor trustee), or an attorney for the settlor or the trustee.

700.7913 Certificate of trust.

Sec. 7913.

(1) Instead of furnishing a copy of the trust instrument to a person other than a trust beneficiary, the trustee may furnish to the person a certificate of trust that must include all of the following information:

(a) The name of the trust, the date of the trust, and the date of each operative trust instrument.

(b) The name and address of each current trustee.

(c) The powers of the trustee relating to the purposes for which the certificate of trust is being offered.

(d) The revocability or irrevocability of the trust and the identity of any person holding a power to revoke the trust.

(e) The authority of cotrustees to sign on behalf of the trust or otherwise authenticate on behalf of the trust and whether all or less than all of the cotrustees are required to exercise powers of the trustee.

(2) A certificate of trust may be signed or otherwise authenticated by the settlor, any trustee, or an attorney for the settlor or trustee. The certificate must be in the form of an affidavit.

(3) A certificate of trust must state that the trust has not been revoked, modified, or amended in any manner that would cause the representations included in the certificate of trust to be incorrect.

(4) A certificate of trust need not include the dispositive terms of the trust instrument.

(5) A recipient of a certificate of trust may require the trustee to furnish copies of those excerpts from each trust instrument that designate the trustee and confer on the trustee the power to act in the pending transaction.

(6) A person that acts in reliance on a certificate of trust without knowledge that the representations included in the certificate of trust are incorrect is not liable to any person for so acting and may assume without inquiry the existence of the trust and other facts included in the certificate of trust.

(7) A person that in good faith enters into a transaction in reliance on a certificate of trust may enforce the transaction against the trust property as if the representations included in the certificate of trust were correct.

(8) A person that makes a demand for the trust instrument in addition to a certificate of trust or excerpts of the trust instrument is liable for damages, costs, expenses, and legal fees if the court determines that the person that made the demand did not act pursuant to a legal requirement to demand the trust instrument.

(9) This section does not limit the right of a person to obtain a copy of the trust instrument in a judicial proceeding that concerns the trust.

(Michigan COT Package includes form, guidelines, and completed example) For use in Michigan only.

Important: Your property must be located in Grand Traverse County to use these forms. Documents should be recorded at the office below.

This Certificate of Trust MCL 700.7913 meets all recording requirements specific to Grand Traverse County.

Our Promise

The documents you receive here will meet, or exceed, the Grand Traverse County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Grand Traverse County Certificate of Trust MCL 700.7913 form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Ralph L.

April 19th, 2022

Thank you.Very good.

Thank you for your feedback. We really appreciate it. Have a great day!

Virginia P.

December 10th, 2019

Not user friendly despite additional guide. There are other products out there that are superior. A waste of $20.

Sorry to hear that Virginia. Your order and payment has been canceled. We do hope that you find something more suitable to your needs elsewhere. Have a wonderful day.

John v.

April 7th, 2020

Process is well laid out, clear and concise. Check out is easy. Recommendations: * Assign names to the downloadable files that are meaningful, such as: WARRANTY DEED instead of the useless and cryptic 1420490866F11417.pdf. * Provide a ONE BUTTON DOWNLOAD for all forms ordered. It's aggravating to have to click on each of the 20 documents and download them individually.

Thank you for your feedback. We really appreciate it. Have a great day!

Sara D.

September 25th, 2019

Would have been beneficial to have more information about the previous sale history of the property. The report was received in a very timely manner.

Thank you for your feedback. We really appreciate it. Have a great day!

Judith O.

January 13th, 2019

Unfortunately, it wasn't the information I needed. I wanted something that could remove my husbands name on our deed, because he passed away last month.

Sorry to hear about your situation Judith. The document you selected is one that would need to be used during the grantor's lifetime. Under the circumstances, we have canceled your order and refunded your payment.

Delsina T.

October 9th, 2020

So helpful. Thank you so much for making this a smooth process.

Thank you!

William O.

June 13th, 2025

form worked great but was over priced for such a simple form , should be around $10 and most people could easily create this themselves.

Hi William, thank you for your review. We’re glad the form worked well for you. We understand it may seem simple on the surface, but Transfer on Death Deeds—especially in New York—require precise language and adherence to both state and county-level rules. Our forms are attorney-prepared, regularly reviewed for legal compliance, and include helpful instructions to reduce the risk of costly filing errors. We appreciate your feedback and hope the document serves its purpose smoothly.

Teresa T.

October 6th, 2022

amazingly fast! Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

mary c.

May 24th, 2022

Really good product, included guide to filling out forms. Totally pleased with that part. Customer service however was terrible. Did not hear back after I sent two emails. The site signed me up but after I was accepted they would not allow me to download a form, with the notation my account was closed. Had to use another email. Had problems with that. Finally got off of site and went to a login site that allowed me to download the forms. If you can get past setting up your account, it is fantastic site. Nice price compared to alternatives. Also I recieved two validation codes. Have no idea why they were sent.

Thank you!

Viola J.

August 2nd, 2021

You made this so easy to process the Executor Deed. THANK YOU a thousand times. Appreciate that all forms are in one place and I did not have to search all over the internet to get what I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Aron H.

September 17th, 2020

Impressed with how quick the process was to e-record our documents. Will recommend this service to anyone needing to record a document.

Thank you!

Patricia G.

January 19th, 2021

Oh my goodness! Y'all are an answer to prayers! You provided all the forms necessary in one convenient packet, and at a VERY reasonable price! I can't thank y'all enough for helping my family & myself with what could've been a difficult and expensive situation! God bless you for your time and talent!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Roger M.

January 22nd, 2021

EASY. WORKED WITH PROBLEMS.

Thank you!

Danny H.

May 15th, 2020

You should list the address of where to mail the forms, so we don't have to look it up. It would make things a little easier.Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

CEDRIC D.

December 2nd, 2021

need more instructions for each form

Thank you for your feedback. We really appreciate it. Have a great day!