Kalkaska County Claim of Lien Form (Michigan)

All Kalkaska County specific forms and documents listed below are included in your immediate download package:

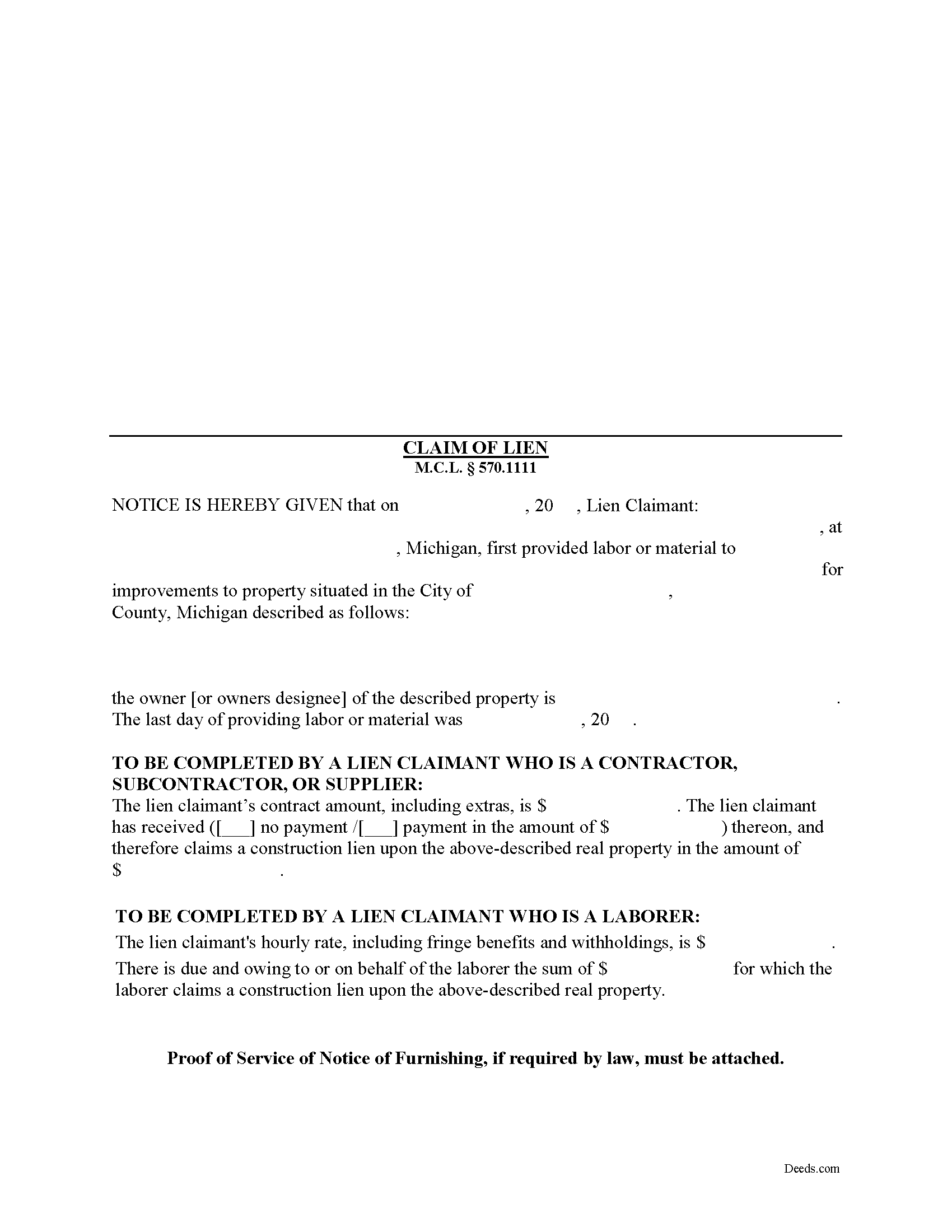

Claim of Lien Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Kalkaska County compliant document last validated/updated 6/18/2025

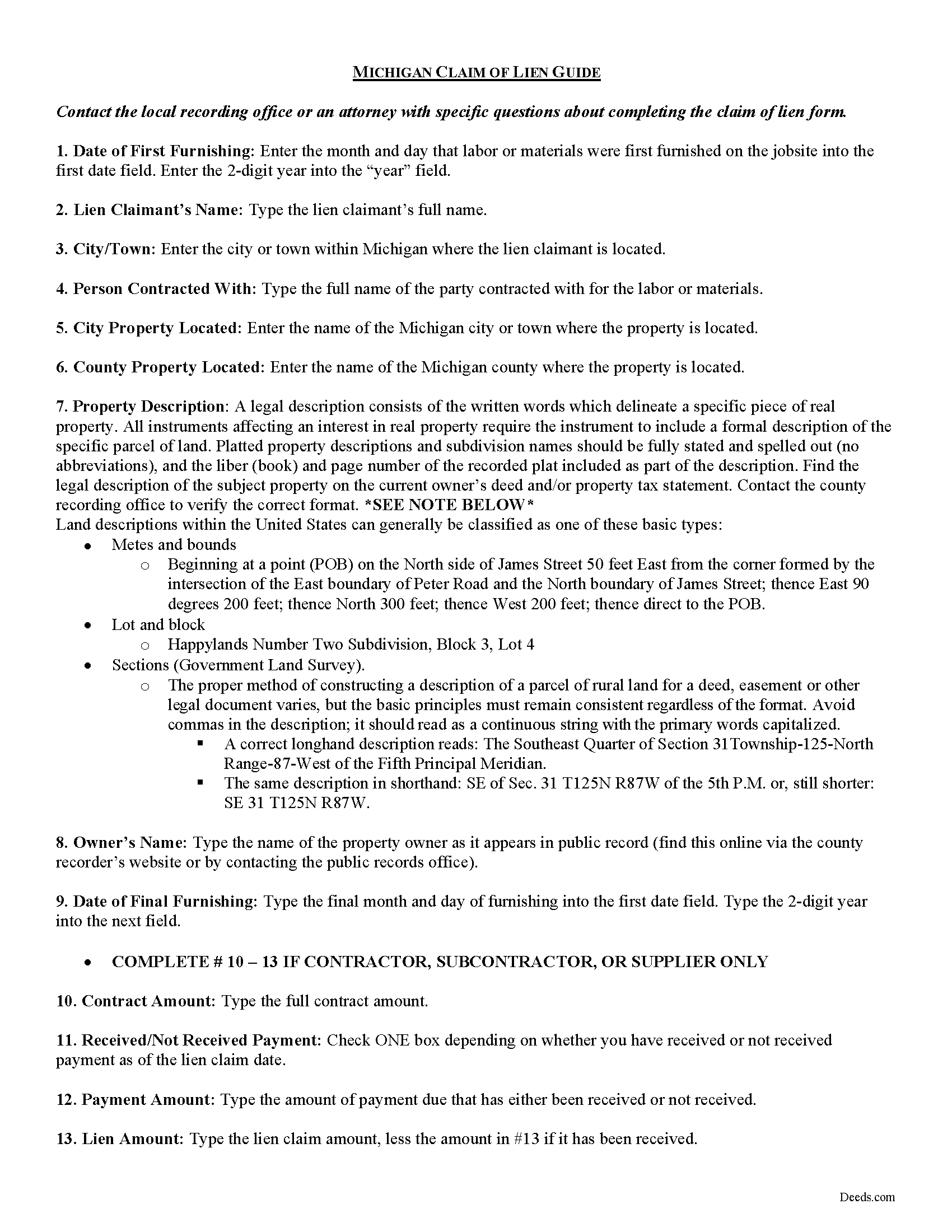

Claim of Lien Guide

Line by line guide explaining every blank on the form.

Included Kalkaska County compliant document last validated/updated 5/29/2025

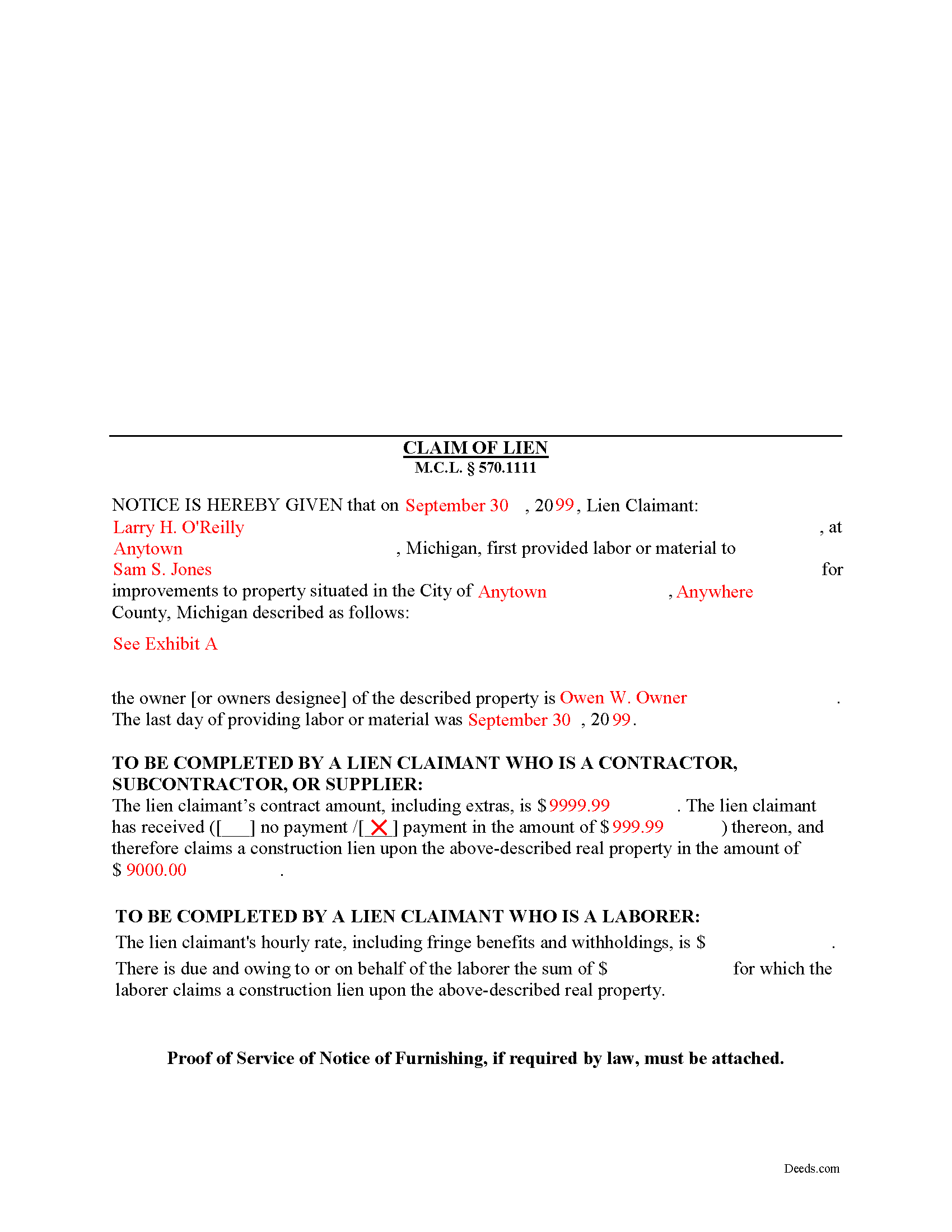

Completed Example of the Claim of Lien Document

Example of a properly completed form for reference.

Included Kalkaska County compliant document last validated/updated 5/7/2025

The following Michigan and Kalkaska County supplemental forms are included as a courtesy with your order:

When using these Claim of Lien forms, the subject real estate must be physically located in Kalkaska County. The executed documents should then be recorded in the following office:

Kalkaska County Register of Deeds

Administrative Bldg - 605 N Birch St, Kalkaska, Michigan 49646

Hours: 9:00am to 5:00pm Monday thru Friday

Phone: (231) 258-3315

Local jurisdictions located in Kalkaska County include:

- Fife Lake

- Kalkaska

- Rapid City

- South Boardman

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Kalkaska County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Kalkaska County using our eRecording service.

Are these forms guaranteed to be recordable in Kalkaska County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Kalkaska County including margin requirements, content requirements, font and font size requirements.

Can the Claim of Lien forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Kalkaska County that you need to transfer you would only need to order our forms once for all of your properties in Kalkaska County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Michigan or Kalkaska County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Kalkaska County Claim of Lien forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Claiming a Mechanic's Lien in Michigan

A mechanic's lien (sometimes called a construction or contractor's lien) is a remedy available to contractors, subcontractors, laborers, and material suppliers to help recover money due, but unpaid, for services or materials on a construction job. In many ways, a lien is a property interest like a mortgage. In Michigan, the Construction Lien Act (Act 497 of 1980) governs the procedure for obtaining this kind of lien.

In order to preserve the right of a contractor, subcontractor, laborer, or supplier to a construction lien, the contractor (or other claimant) must record a claim of lien within 90 days after the last furnishing of labor or material for the improvement, in the office of the register of deeds for each county where the real property to which the improvement was made is located. M.C.L. 570.1111(1).

A claim of lien is valid only as to the real property described in the claim of lien and located within the county where the claim of lien has been recorded. Id. It must contain the following information: (1) the date of first furnishing; (2) lien claimant's name; (3) name of person contracted with; (4) description of the subject property; (5) owner's name; (6) date of final furnishing; and (7) contract and payment amounts (if contractor) or hourly rate and sum due (if laborer). M.C.L. 570.1111(2). Attach proof of service of a Notice of Furnishing to a lien claim filed by a subcontractor, supplier, or laborer. M.C.L. 570.1111(5).

The lien claim must also be served after recording. Service refers to giving all interested parties notice of the action and an opportunity to be heard. Each contractor, subcontractor, supplier, laborer, or agent of a group of laborers who record a claim of lien must, within 15 days after the date of the recording, serve on the designee personally or by certified mail, return receipt requested, at the address shown on the notice of commencement, a copy of the claim of lien and a copy of any proof of service recorded in connection with the claim of lien. Id.

This article is provided for informational purposes only and should not be relied upon as a substitute for the advice of an attorney. If you have any questions about filing a claim of lien, or any other issues involving mechanic's liens, please consult with a Michigan-licensed attorney.

Our Promise

The documents you receive here will meet, or exceed, the Kalkaska County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Kalkaska County Claim of Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4562 Reviews )

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Pauline C.

June 29th, 2025

Everything that was stated to be included in my order was complete. Very satisfied

Thank you for your positive words! We’re thrilled to hear about your experience.

Kevin M.

May 14th, 2019

All I can say is WOW. They were so fast and professional. I received my copy of my deed that same day I requested it. There was some confusion on my part but within minutes it was explained.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dave S.

May 1st, 2019

Easy to use and get forms I needed. Corporate need for an invoice/receipt could be a bit easier - have to print screen to get any info.

Thank you for your feedback Dave, we really appreciate it.

brian o.

September 17th, 2022

I was needing some forms from another state. I am a lawyer but don't have ready access to out of state forms. I was impressed with how thorough the intake process was. Very nice that I could download the form in Word so that I could adjust a few things. Very fine service. I recommend.

Thank you!

Kristopher K.

October 22nd, 2021

Process is easy but system would not accept 3 different credit cards on first day. No phone number to call. Sent message and response was all 3 cards must have been declined. However, next day one of those cards went through with no problem.

Thank you for your feedback. Unfortunately we have no control over which payment get approved or declined.

CHERI I.

August 4th, 2021

I was so pleased with how easy this form was to download and print! Thank you and I am sure we will use you again in the future!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Carolyn L.

February 17th, 2021

Easy and quick and reasonable!

Thank you for your feedback. We really appreciate it. Have a great day!

Diane W.

January 3rd, 2020

The forms were immediately available for download, which was nice. However, I was not impressed by the lack of several features: 1) there was no way to edit set text in the form, such as where it says you should consult an attorney. That is not necessary for recording the deed and I wanted to deleted it, but could not. 2) Also, under the "Notes" section, there is a limited area to write; I tried adding a fuller explanation of something, but the form would not accept or include it when I printed the final document. The form may do the job, but it's not very sophisticated or elegant.

Thank you for your feedback. We really appreciate it. Have a great day!

Theresa M.

October 25th, 2021

This company was very thorough in having all the forms that I needed.

Thank you!

Milica K.

March 23rd, 2021

Very fast and reliable service.

Thank you for your feedback. We really appreciate it. Have a great day!

Rick H.

September 2nd, 2022

Great service... patient with me through the process.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Bill M.

September 21st, 2022

I found the path from the home page to actually ordering the document I wanted extremely convoluted and non-intuitive. I went around in circles several times before I figured out how to actually buy the document.

Thank you for your feedback. We really appreciate it. Have a great day!

Suzy I.

June 5th, 2019

I was overwhelmed with information about what forms I needed to complete the probate process, and this site was very helpful! Everything was in one place to download. Thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!