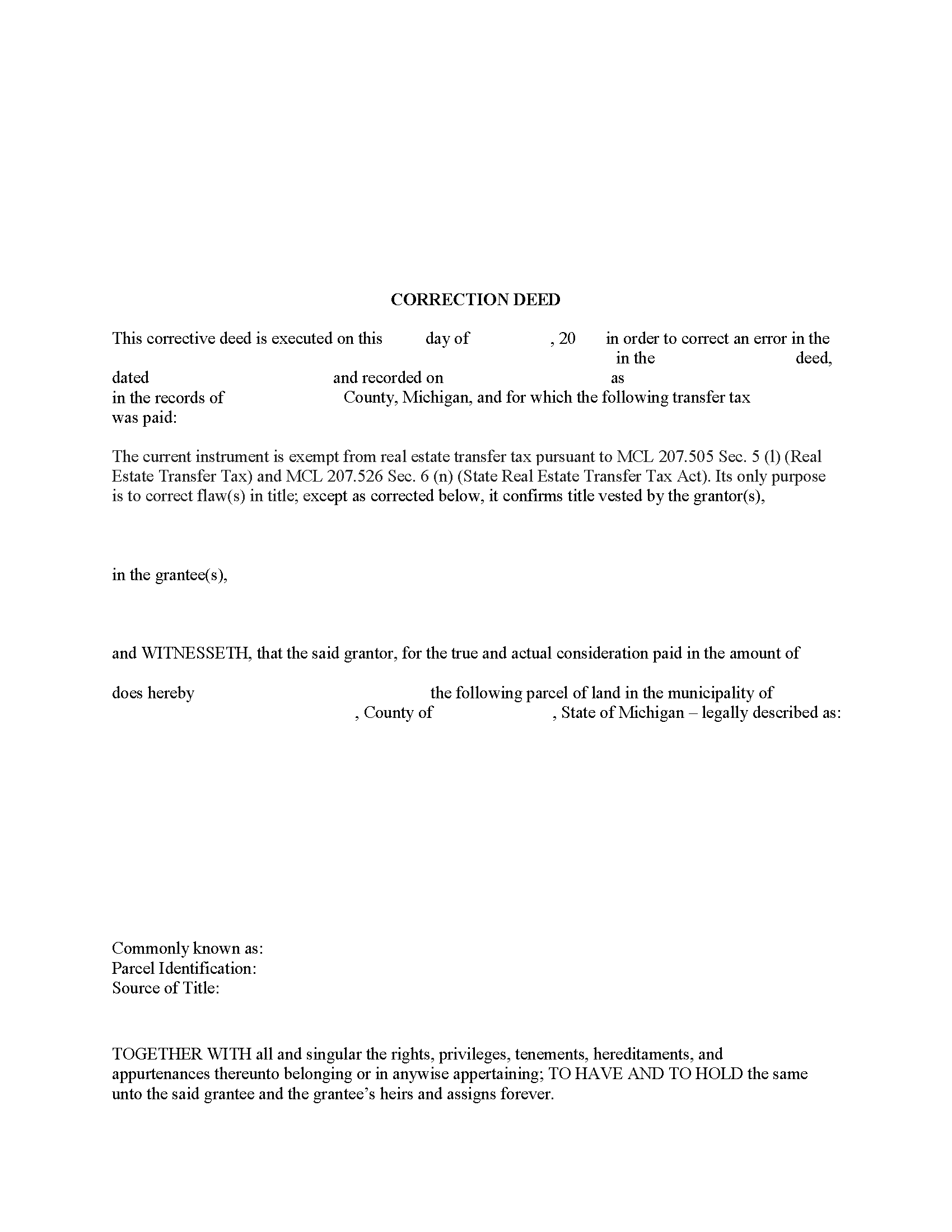

Clinton County Correction Deed Form

Clinton County Correction Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

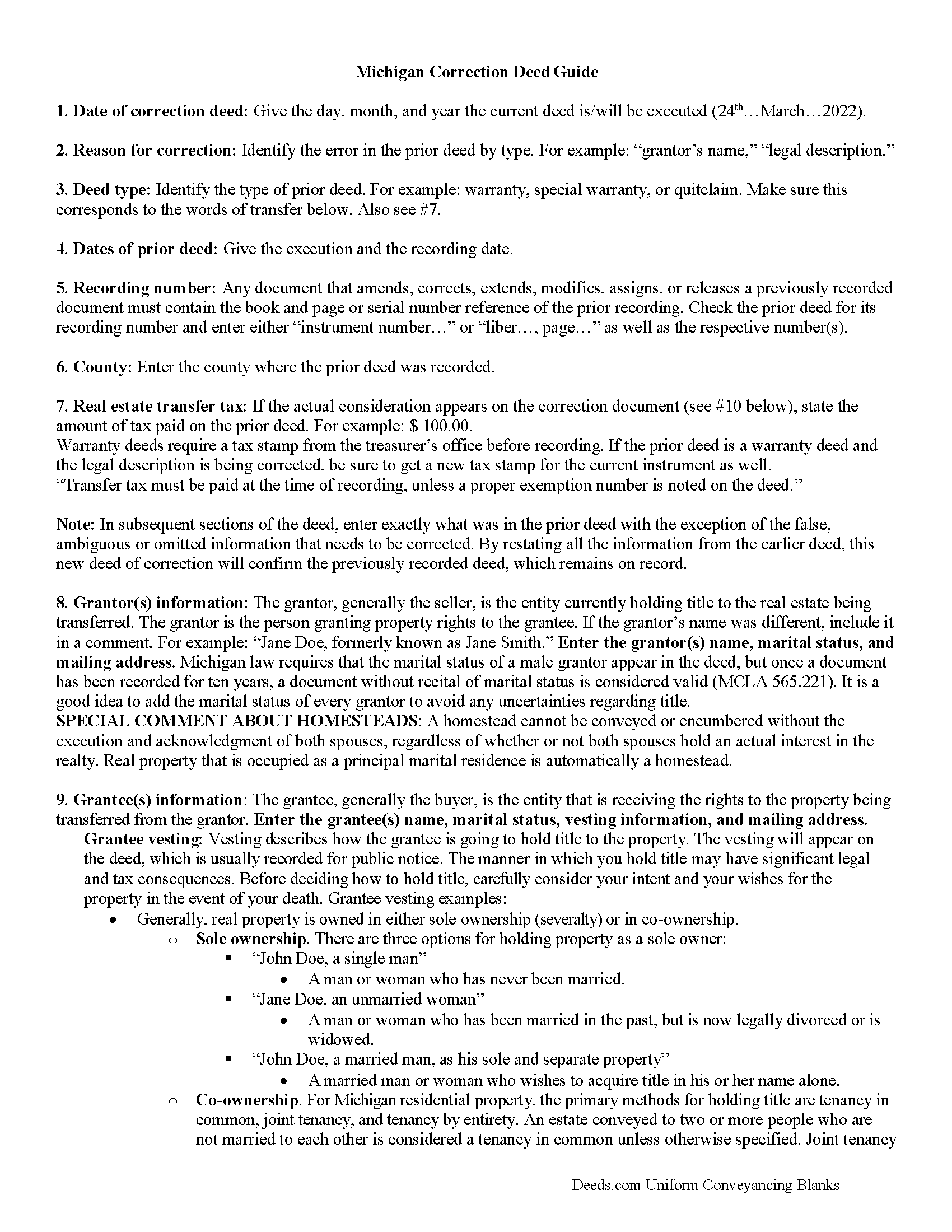

Clinton County Correction Deed Guide

Line by line guide explaining every blank on the form.

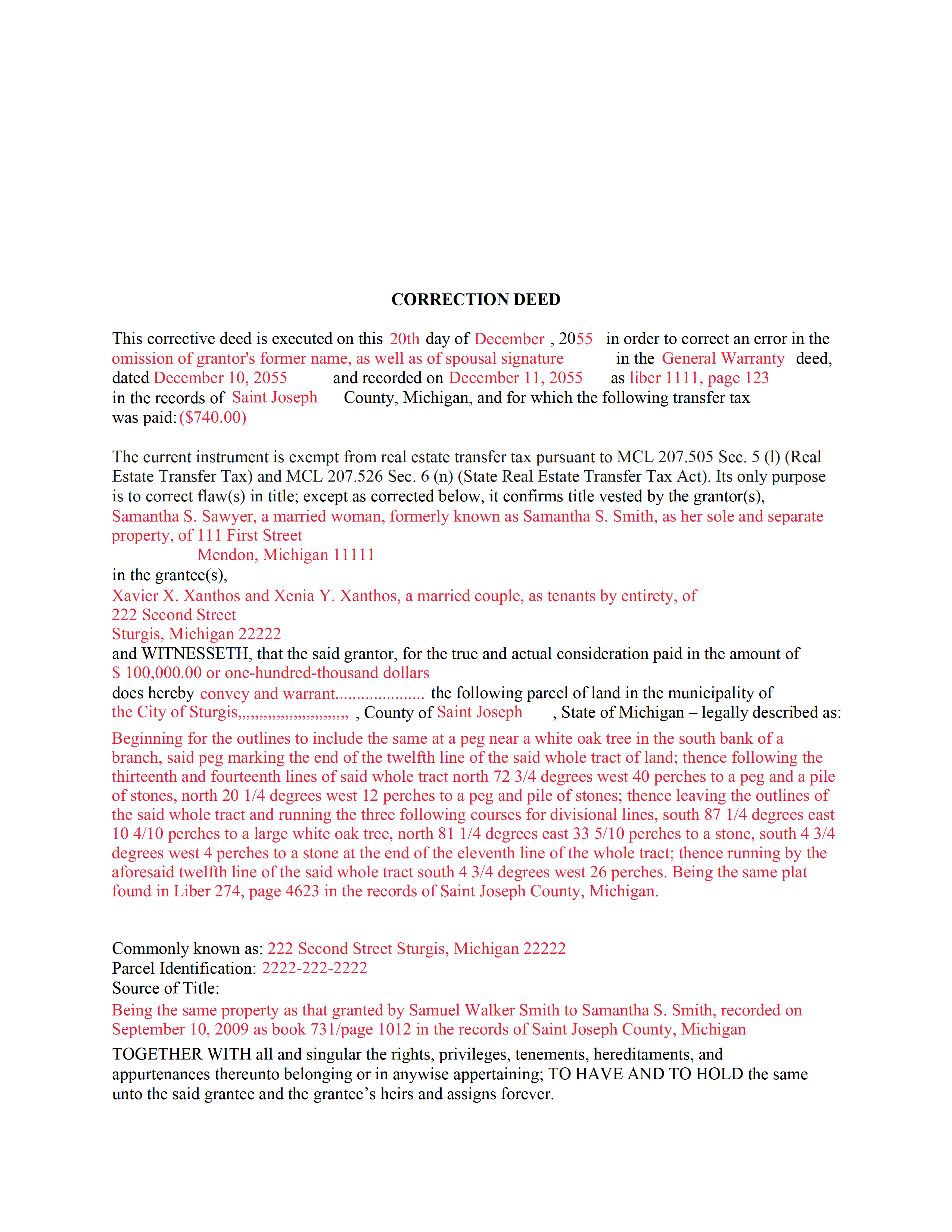

Clinton County Completed Example of the Correction Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Michigan and Clinton County documents included at no extra charge:

Where to Record Your Documents

Clinton County Register of Deeds

St. Johns, Michigan 48879

Hours: 8:00 to 12:00 & 1:00 to 5:00 M-F

Phone: (989) 224-5270

Recording Tips for Clinton County:

- Bring your driver's license or state-issued photo ID

- Recorded documents become public record - avoid including SSNs

- Both spouses typically need to sign if property is jointly owned

- Request a receipt showing your recording numbers

- Ask for certified copies if you need them for other transactions

Cities and Jurisdictions in Clinton County

Properties in any of these areas use Clinton County forms:

- Bath

- Dewitt

- Eagle

- Elsie

- Eureka

- Fowler

- Lansing

- Maple Rapids

- Ovid

- Saint Johns

- Westphalia

Hours, fees, requirements, and more for Clinton County

How do I get my forms?

Forms are available for immediate download after payment. The Clinton County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Clinton County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Clinton County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Clinton County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Clinton County?

Recording fees in Clinton County vary. Contact the recorder's office at (989) 224-5270 for current fees.

Questions answered? Let's get started!

Use this correction deed to correct an error in a previously executed and recorded deed.

Correction deeds are used to adjust the earlier deed when that document contains minor errors of omission or typographical errors, sometimes called scrivener's mistakes. For example, a misspelled name, an omitted or wrong middle initial, a minor error in the property description, or an omitted execution date. Do not us the correction deed for more substantial changes, such as the removal of a name from a deed. Such alterations are better handled through a quit claim deed.

The correction deed, also called corrective deed, must state that its sole purpose is to correct a specific error, which is usually identified by type. For example: an error in the grantor's name, or an error in the grantor's marital status. It also must clearly reference the type of document it is correcting and state the execution and recording date of that prior document, as well as the number under which it was recorded, either referred to as instrument number or liber (book) and page number.

In subsequent sections, the correction deed repeats the information that was in the prior deed with the exception of the false, ambiguous or omitted information that needs to be corrected. By restating all the information from the earlier deed, this new deed of correction will confirm the previously recorded deed, which remains on record as is.

Warranty deeds require a tax stamp from the treasurer's office before recording. If the prior deed is a warranty deed and the legal description is being corrected, be sure to get a new tax stamp for the current instrument as well. In some counties, any deed that contains the word "warrant" must be checked by the treasurer's office first regardless of the type of correction.

(Michigan CD Package includes form, guidelines, and completed example)

Important: Your property must be located in Clinton County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Clinton County.

Our Promise

The documents you receive here will meet, or exceed, the Clinton County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Clinton County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Charles S.

July 2nd, 2021

Easy to set up and fast service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gene K.

April 24th, 2019

I am still in the trial stage. I am an older lawyer. Any help I can get is worth it. Once you get used to the format and data fill in the deed thing is excellent. Very professional if not a little slow. I have only done three deeds in one state so I will have to see how it goes. I like the product and their attitude towards pleasing the customer. We'll see when I try the recording part.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Pamela B.

May 29th, 2021

The process was not difficult but I don't think that it suited my needs. There were several fields that were not applicable to me but I had to enter something to proceed. I also filled out the other form and mailed it in with some documentation that the electronic service did not ask for. Questions of my attempt are still unanswered. I hope I didn't waste time with this process. We shall see. Thank you.

Thank you!

Charles C.

January 30th, 2019

Using an I pad and cannot type on form that was downloaded. I do not have a computer Charles

Thank you for your feedback Charles. You might want to make sure you have the Adobe app on your Ipad: https://itunes.apple.com/us/app/adobe-fill-sign/id950099951?mt=8

Maggie C.

April 29th, 2020

Easy to use fantastic website. Immediately found the Sheriff's Deed I needed.

Thank you!

Michael G.

July 14th, 2025

Very helpful and easy to use

Your appreciative words mean the world to us. Thank you.

Debra M.

May 29th, 2020

Since the recorder's office is closed, due to Covid, this worked well to submit my Quit Claim Deed. I was a bit confused with the direction and download. But, I think I got her done! We'll see if I get recorded and confirmation is received. I may be back

Thank you for your feedback. We really appreciate it. Have a great day!

Scott A.

July 8th, 2020

Good site. Saved me a trip to one or two courthouses.

Thank you for your feedback. We really appreciate it. Have a great day!

Cindy N.

August 2nd, 2024

Our home was in only my husband’s name and as we are getting older, it was time to add my name to the Deed to avoid potential issues in the future. Our experience with Deeds.com was wonderful. The website is user friendly, instructions written in layman’s terms, straightforward and easy to follow. Very reasonably priced. I highly recommend using Deeds.com.

Thank you for the kind words Cindy. We appreciate you. Have an amazing day!

anthony r.

November 19th, 2020

Fast and easy

Thank you!

Jean B.

February 28th, 2023

Thank you for this service. Saved a lot of my time and money. The guide and sample was very helpful. Jean

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kolette S.

February 7th, 2020

The forms are nice; however, they do not display the "th" after the day or the second digit of the year. You can type them in, but they will not print out. I just left them blank and will handwrite.

Thank you for your feedback. We really appreciate it. Have a great day!

Lillian F.

May 2nd, 2019

I LOVE THE EASE OF GETTING THE INFORMATION I REQUESTED. YOUR SERVICE IS MORE THAN WHAT I EXPECTED.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ajinder M.

June 18th, 2020

wonderful. saved my time and energy. Absolutely love this service. All the best AJ

Thank you!

ERHAN S.

February 3rd, 2023

amazing time and cost saving service for me. Thank you.

Thank you!