Emmet County Correction Deed Form

Emmet County Correction Deed Form

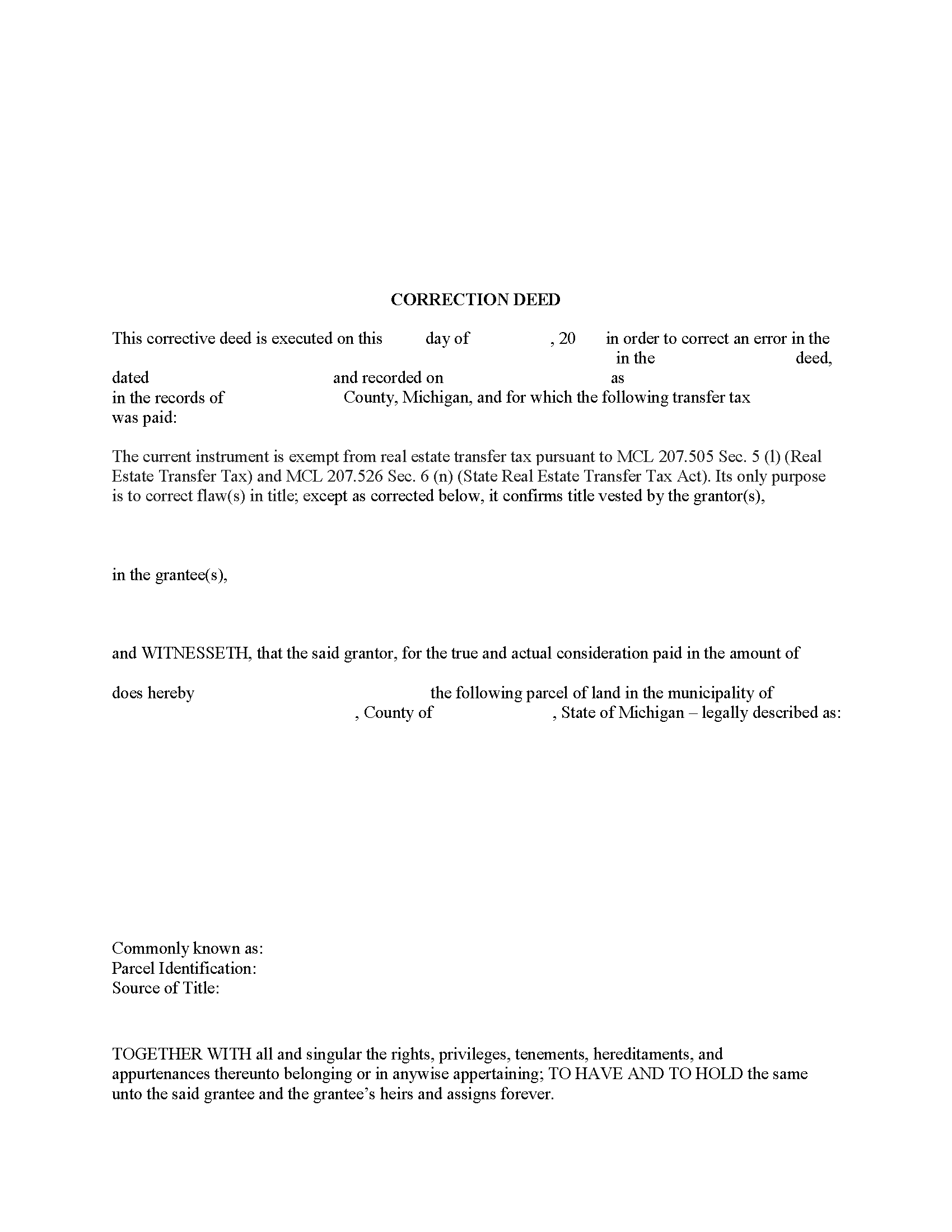

Fill in the blank form formatted to comply with all recording and content requirements.

Emmet County Correction Deed Guide

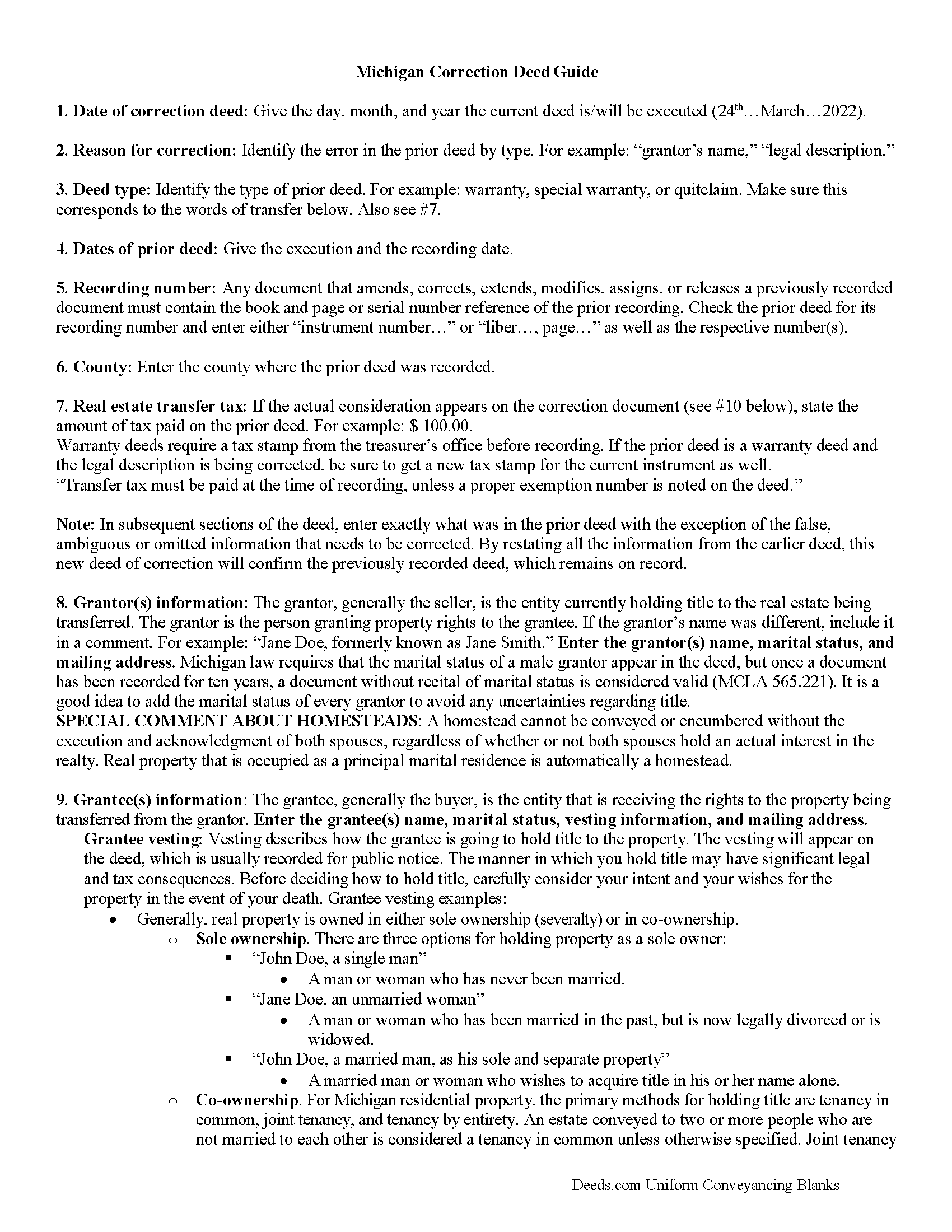

Line by line guide explaining every blank on the form.

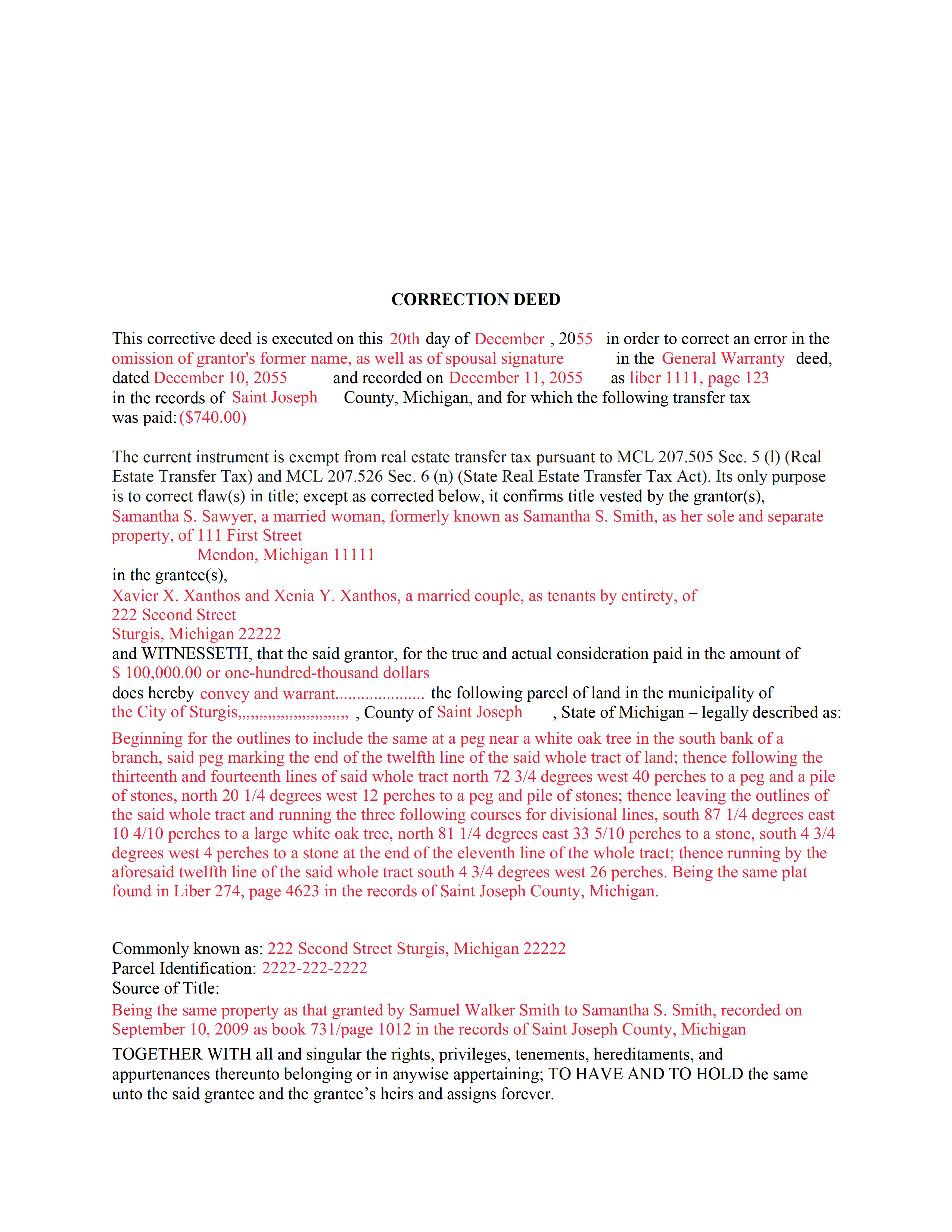

Emmet County Completed Example of the Correction Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Michigan and Emmet County documents included at no extra charge:

Where to Record Your Documents

Emmet County Register of Deeds

Petoskey, Michigan 49770

Hours: 8:00 to 5:00 M-F

Phone: (231) 348-1761

Recording Tips for Emmet County:

- Ensure all signatures are in blue or black ink

- Documents must be on 8.5 x 11 inch white paper

- Check margin requirements - usually 1-2 inches at top

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Emmet County

Properties in any of these areas use Emmet County forms:

- Alanson

- Brutus

- Carp Lake

- Conway

- Cross Village

- Good Hart

- Harbor Springs

- Levering

- Oden

- Pellston

- Petoskey

Hours, fees, requirements, and more for Emmet County

How do I get my forms?

Forms are available for immediate download after payment. The Emmet County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Emmet County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Emmet County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Emmet County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Emmet County?

Recording fees in Emmet County vary. Contact the recorder's office at (231) 348-1761 for current fees.

Questions answered? Let's get started!

Use this correction deed to correct an error in a previously executed and recorded deed.

Correction deeds are used to adjust the earlier deed when that document contains minor errors of omission or typographical errors, sometimes called scrivener's mistakes. For example, a misspelled name, an omitted or wrong middle initial, a minor error in the property description, or an omitted execution date. Do not us the correction deed for more substantial changes, such as the removal of a name from a deed. Such alterations are better handled through a quit claim deed.

The correction deed, also called corrective deed, must state that its sole purpose is to correct a specific error, which is usually identified by type. For example: an error in the grantor's name, or an error in the grantor's marital status. It also must clearly reference the type of document it is correcting and state the execution and recording date of that prior document, as well as the number under which it was recorded, either referred to as instrument number or liber (book) and page number.

In subsequent sections, the correction deed repeats the information that was in the prior deed with the exception of the false, ambiguous or omitted information that needs to be corrected. By restating all the information from the earlier deed, this new deed of correction will confirm the previously recorded deed, which remains on record as is.

Warranty deeds require a tax stamp from the treasurer's office before recording. If the prior deed is a warranty deed and the legal description is being corrected, be sure to get a new tax stamp for the current instrument as well. In some counties, any deed that contains the word "warrant" must be checked by the treasurer's office first regardless of the type of correction.

(Michigan CD Package includes form, guidelines, and completed example)

Important: Your property must be located in Emmet County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Emmet County.

Our Promise

The documents you receive here will meet, or exceed, the Emmet County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Emmet County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Daniel V.

April 11th, 2023

Awesome service Recorded a deed within 24hrs and saved my self a 14hr+ journey

Thank you for your feedback. We really appreciate it. Have a great day!

Corey G.

May 24th, 2023

Very informative and helpful Thank you so much

Thank you for the kinds words Corey, glad we could help.

Daniel S.

February 11th, 2019

It was easy to find the forms I was looking for and the guided steps and examples of how to use the form were beneficial.

Thank you for your feedback. We really appreciate it. Have a great day!

Tim G.

April 23rd, 2020

Pretty good all in all. I do wish I could download forms to a word doc instead of a .pdf. Word is more 'accessable'.

Thank you!

Christine K.

March 26th, 2021

This site was fast and easy to use. I would highly recommend using them. Thank you Deeds.com!!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Laverne C.

September 2nd, 2020

Great service. The issue I had was uploading the file of several pages. Once I learned, everything became clear and easier. The support group have been extremely prompt and helpful, I would surely use the service again and recommend the serivce.

Thank you!

James A.

June 18th, 2024

Very easy to navigate and start your process.

Thank you for your positive words! We’re thrilled to hear about your experience.

Sophia G.

February 11th, 2022

Hassle free service , and don't have to wait in line

Thank you for your feedback. We really appreciate it. Have a great day!

Colleen P.

May 4th, 2020

It was frustrating to get the scans done but that might have been due to a learning curve. After 4 tries they were accepted. I couldn't figure out how to delete or close the failed attempts. Waiting to see if Recorder office has changed the title.

Thank you for your feedback. We really appreciate it. Have a great day!

Samantha B.

December 9th, 2020

Awesome service! This took care of my needs 10x faster than I thought possible. I even bought an extra service that wasn't needed to accomplish my end goal and they refunded me without me even asking. Highly recommend!

Thank you for your feedback. We really appreciate it. Have a great day!

Jessi S.

March 4th, 2020

Delivery of documents was instantaneous once payment is received. Thank you for that. For future clarification to potential users, Deeds.com may want to categorize the type of easement documents that are available. I was needing a 'utility easement' form and received an 'ingress/egress' form. Had I known it was an ingress/egress document, I would not have made the purchase. Outside of this issue, this site is very helpful for the average layperson to hold guardianship over personal interests.

Thank you for your feedback. We really appreciate it. Have a great day!

John F.

January 28th, 2021

The document I purchased was perfect for what I needed done. Very easy to obtain the document. Website very easy to navigate. Would use again and would recommend to anyone who needs the documents.

Thank you for your feedback. We really appreciate it. Have a great day!

William H.

July 18th, 2023

It was quick and easy to download the forms I need to modify a property deed. No problems n the least.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Debby R.

July 6th, 2021

Very easy to use

Thank you!

OLGA R.

October 30th, 2020

Excellent Service for E-Recording. They work with you and guide you on every aspect.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!