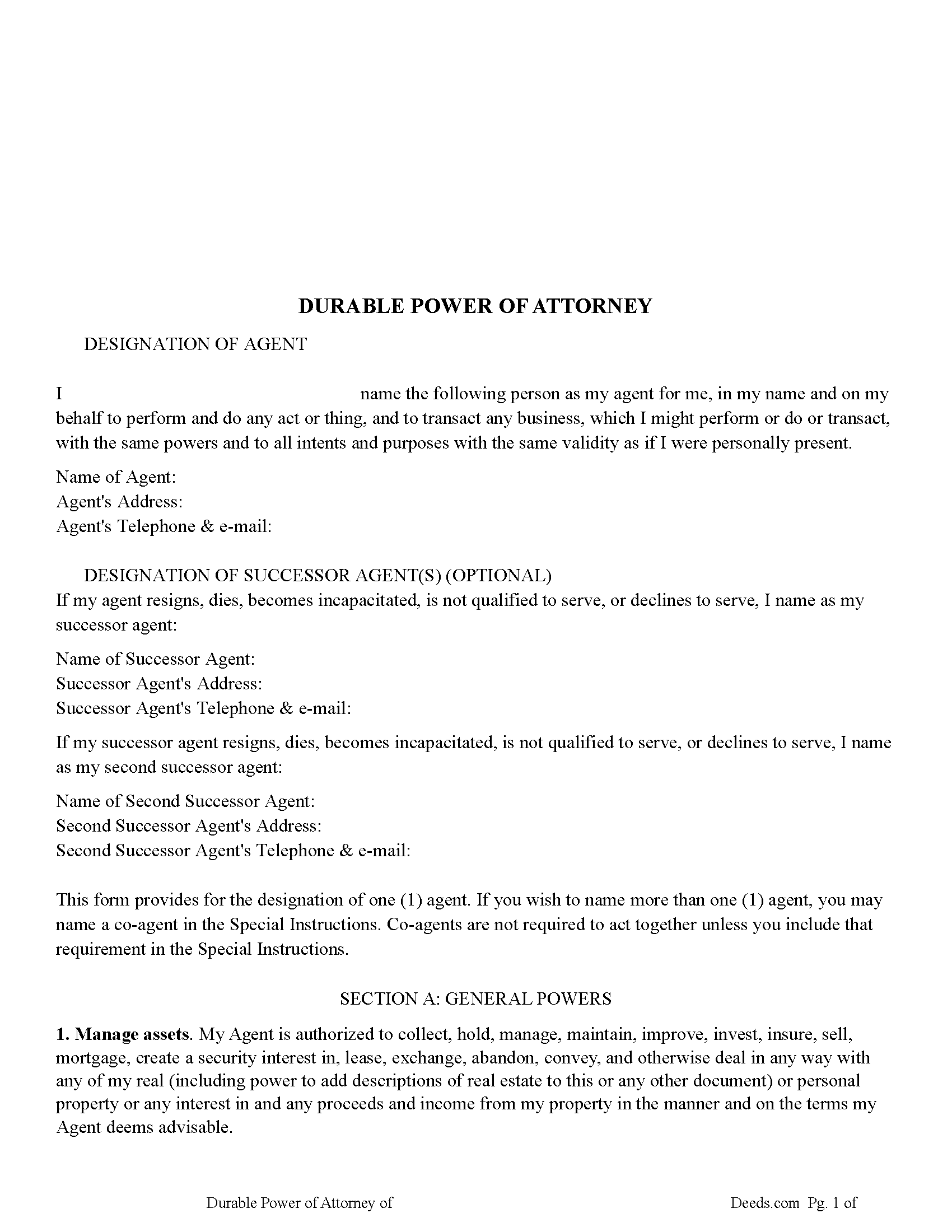

Isabella County Durable Power of Attorney Form

Isabella County Durable Power of Attorney Form

Fill in the blank form formatted to comply with all recording and content requirements.

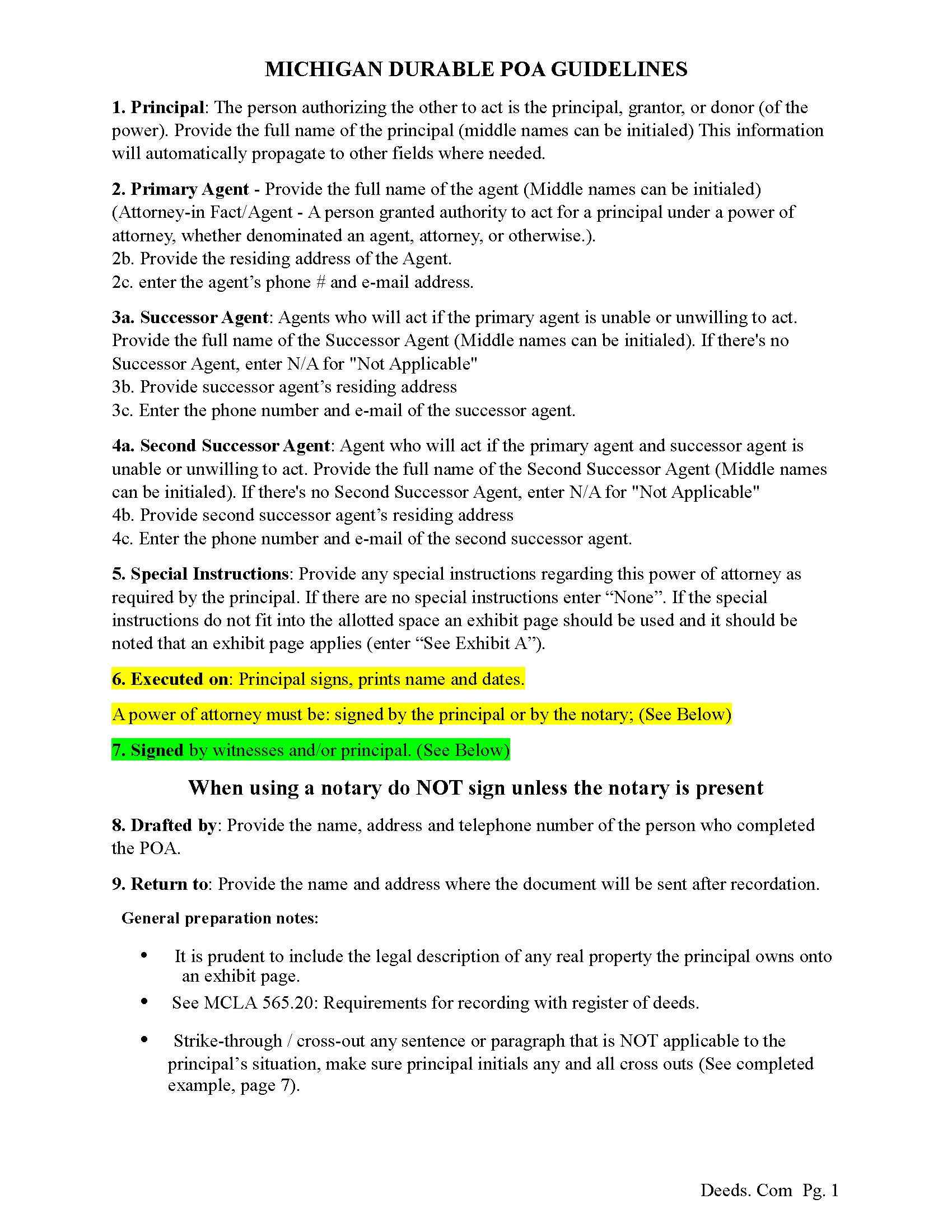

Isabella County Guidelines Durable Power of Attorney

Line by line guide explaining every blank on the form.

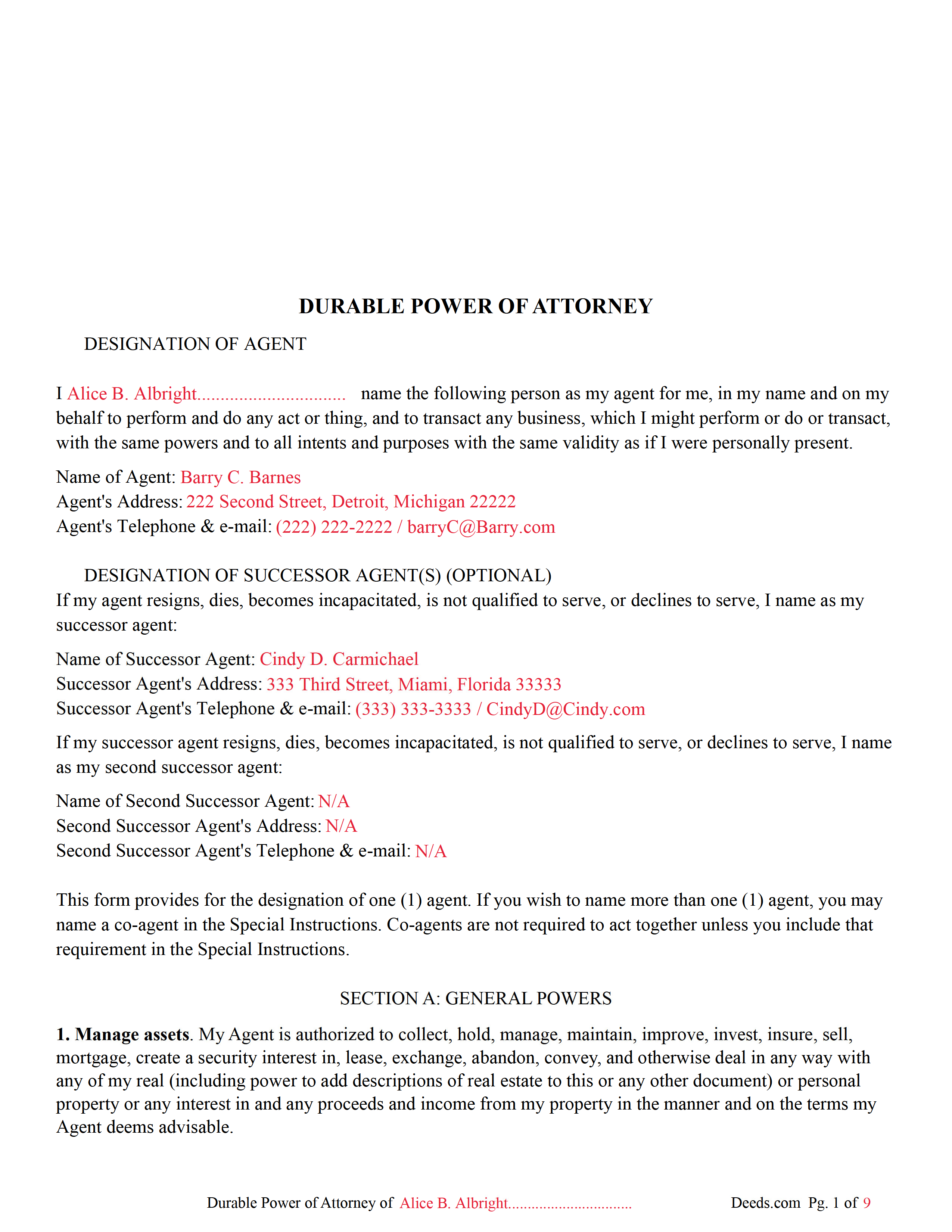

Isabella County Completed Example of the Durable Power of Attorney Document

Example of a properly completed form for reference.

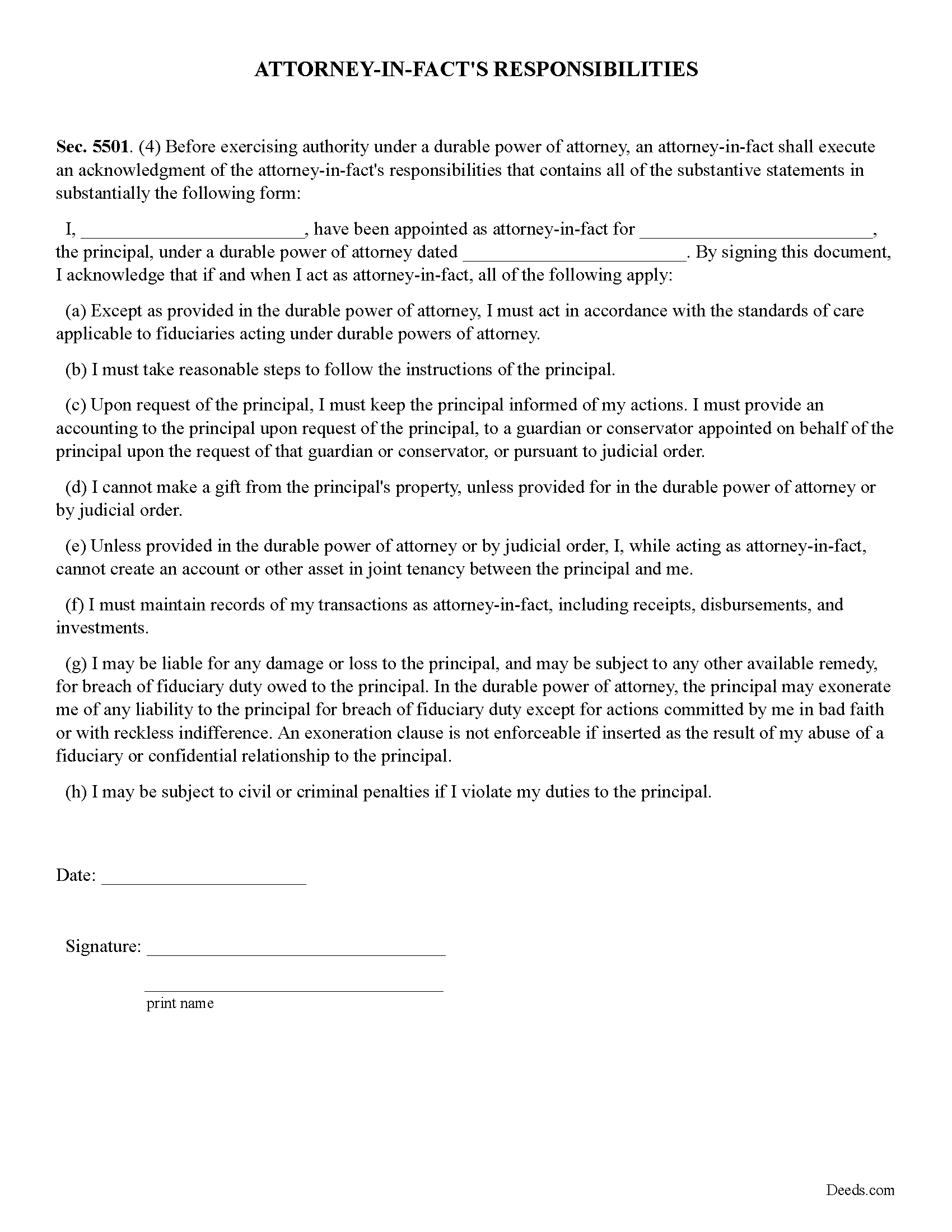

Isabella County Attorney in Facts Responsibilities Form

Statutory Form, often required by third parties.

All 4 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Michigan and Isabella County documents included at no extra charge:

Where to Record Your Documents

Isabella County Register of Deeds

Mt. Pleasant, Michigan 48858

Hours: Monday - Friday 8:00 a.m. to 4:30 p.m.

Phone: (989) 317-4089

Recording Tips for Isabella County:

- Ensure all signatures are in blue or black ink

- Both spouses typically need to sign if property is jointly owned

- Make copies of your documents before recording - keep originals safe

Cities and Jurisdictions in Isabella County

Properties in any of these areas use Isabella County forms:

- Blanchard

- Mount Pleasant

- Rosebush

- Shepherd

- Weidman

- Winn

Hours, fees, requirements, and more for Isabella County

How do I get my forms?

Forms are available for immediate download after payment. The Isabella County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Isabella County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Isabella County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Isabella County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Isabella County?

Recording fees in Isabella County vary. Contact the recorder's office at (989) 317-4089 for current fees.

Questions answered? Let's get started!

The Principal designates an attorney in fact and contains the words ("This power of attorney is not affected by the principal's subsequent disability or incapacity, or by the lapse of time", or "This power of attorney is effective upon the disability or incapacity of the principal" or similar words showing the principal's intent that the authority conferred is exercisable notwithstanding the principal's subsequent disability or incapacity and, unless the power states a termination time, notwithstanding the lapse of time since the execution of the instrument) (sec.5501.(a))

Sec 5501. (3) An attorney-in-fact designated and acting under a durable power of attorney has the authority, rights, responsibilities, and limitations as provided by law with respect to a durable power of attorney, including, but not limited to, all of the following:

(a) Except as provided in the durable power of attorney, the attorney-in-fact shall act in accordance with the standards of care applicable to fiduciaries exercising powers under a durable power of attorney.

(b) The attorney-in-fact shall take reasonable steps to follow the instructions of the principal.

(c) Upon request of the principal, the attorney-in-fact shall keep the principal informed of the attorney-in-fact's actions. The attorney-in-fact shall provide an accounting to the principal upon request of the principal, to a conservator or guardian appointed on behalf of the principal upon request of the guardian or conservator, or pursuant to judicial order.

(d) The attorney-in-fact shall not make a gift of all or any part of the principal's assets, unless provided for in the durable power of attorney or by judicial order.

(e) Unless provided in the durable power of attorney or by judicial order, the attorney-in-fact, while acting as attorney-in-fact, shall not create an account or other asset in joint tenancy between the principal and the attorney-in-fact.

(f) The attorney-in-fact shall maintain records of the attorney-in-fact's actions on behalf of the principal, including transactions, receipts, disbursements, and investments.

(g) The attorney-in-fact may be liable for any damage or loss to the principal, and may be subject to any other available remedy, for breach of fiduciary duty owed to the principal. In the durable power of attorney, the principal may exonerate the attorney-in-fact of any liability to the principal for breach of fiduciary duty except for actions committed by the attorney-in-fact in bad faith or with reckless indifference. An exoneration clause is not enforceable if inserted as the result of an abuse by the attorney-in-fact of a fiduciary or confidential relationship to the principal.

(h) The attorney-in-fact may receive reasonable compensation for the attorney-in-fact's services if provided for in the durable power of attorney

MICHIGAN DURABLE POA

SECTION A: GENERAL POWERS

1. Manage assets.

2. Debts and expenses.

3. Bank Accounts.

4. Deposits and withdrawals.

5. Checks.

6. Borrowing.

7. Collection powers.

8. Safe deposit box.

9. Securities and investments.

10. Litigation

11. Insurance, annuities, and benefit plans.

12. College savings accounts

13. Taxes

14. Services.

15. Support.

16. Government benefits.

17. Medicaid Qualification

18. Access to Digital Assets (Including Content).

SECTION B: EXTRAORDINARY POWERS AND LIMITATIONS

1. Gifts

2. Gifts from trust

3. Creating Joint Tenancy.

4. Create trusts

5. Amend, revoke, restate, reform, and terminate trusts

6. Transfer assets to trusts

7. Withdraw income and principal from trusts

8. Disclaimer.

9. Intent of Principal with regard to paying for my care and needs

10. Limitation on Agent liability for investments

11. Limitation on Agent liability for preservation of the estate plan

12. Amend/Revoke Funeral Representative Designation

SECTION C: POWERS RELATED TO MY PERSONAL CARE

l. Establish residency.

2. Care contracts

3. Medical and personal records

4. Privacy rights

SECTION D: OTHER PROVISIONS

l. Incidental authority

2. Nomination of Agent as conservator

3. Compensation of Agent

4. Use of copies

5. Durability.

6. Third-party reliance

7. Special Instructions

(Michigan DPOA Package includes form, guidelines, and completed example) For use in Michigan only.

Important: Your property must be located in Isabella County to use these forms. Documents should be recorded at the office below.

This Durable Power of Attorney meets all recording requirements specific to Isabella County.

Our Promise

The documents you receive here will meet, or exceed, the Isabella County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Isabella County Durable Power of Attorney form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

DOUGLAS H.

December 16th, 2020

Just as promised My quitclaim deed went through the county recorders office with no problem.

Thank you for your feedback. We really appreciate it. Have a great day!

Rodney S.

October 7th, 2021

Good service; thank you.

Thank you!

Charles B.

December 14th, 2019

Excellent andeasy to navigate website for non-lawyers. Needed some forms for a specific county in a specific state, and Deeds.com took me right there, where I downloaded the forms and a guide on how to fill them out.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Earnestine C.

September 4th, 2019

Informative and instruction clear and concise, which made it easy for a person without real estate knowledge to acquire needed information. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Kirk G.

October 23rd, 2021

Excellent! I will be back!

Thank you!

RAUL G.

October 14th, 2019

Very pleased with the service, easy to download and print

Thank you for your feedback. We really appreciate it. Have a great day!

Kelly W.

March 26th, 2020

Great resource! Wish you could expand to more than just deeds, but then you would have to rename it. :) Thanks! Kelly

Thank you!

William A.

May 12th, 2020

great service and very accommodating generally, and especially during these times.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kevin & Kim S.

August 20th, 2020

So very easy to use and we're so glad we could do everything from our home office.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kimberly S.

April 21st, 2022

I wasted a lot of my time because I didn't do any research to know what I needed. Nobody fault but mine.

Thank you!

Charles K.

December 23rd, 2021

So far it has been a good experience. I am working on getting a beneficiary deed.

Thank you for your feedback. We really appreciate it. Have a great day!

Kathryn P.

February 9th, 2022

Somewhat easy to traverse.

Thank you!

Tressa P.

November 17th, 2020

This online service was very easy to use. I highly recommend Deeds.com. The quick response from the representative upon submitting your document is quick. If something needed to be adjusted they will send you message and you can in turn respond right away with a message. The pricing of this service is very reasonable.

Thank you!

Ron D.

January 14th, 2019

No choice since the county does not seem to provide info you supplied.

Thank Ron, have a great day!

Maria D.

May 22nd, 2020

Deeds.com has done a great job. I really recommend to everyone who needs this service, fast & reliable. Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!