Lapeer County Full Conditional Waiver of Lien Form (Michigan)

All Lapeer County specific forms and documents listed below are included in your immediate download package:

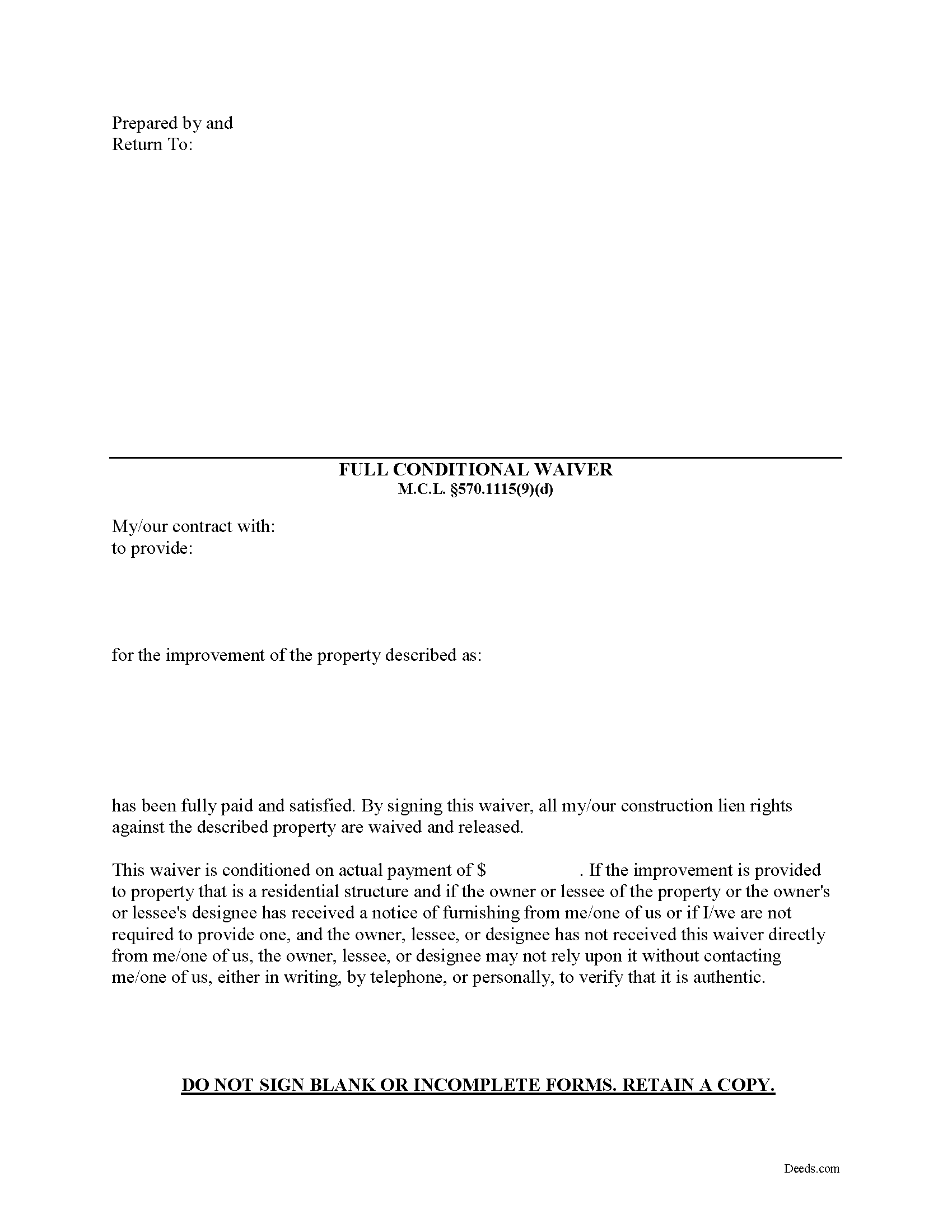

Full Conditional Waiver of Lien Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Lapeer County compliant document last validated/updated 6/5/2025

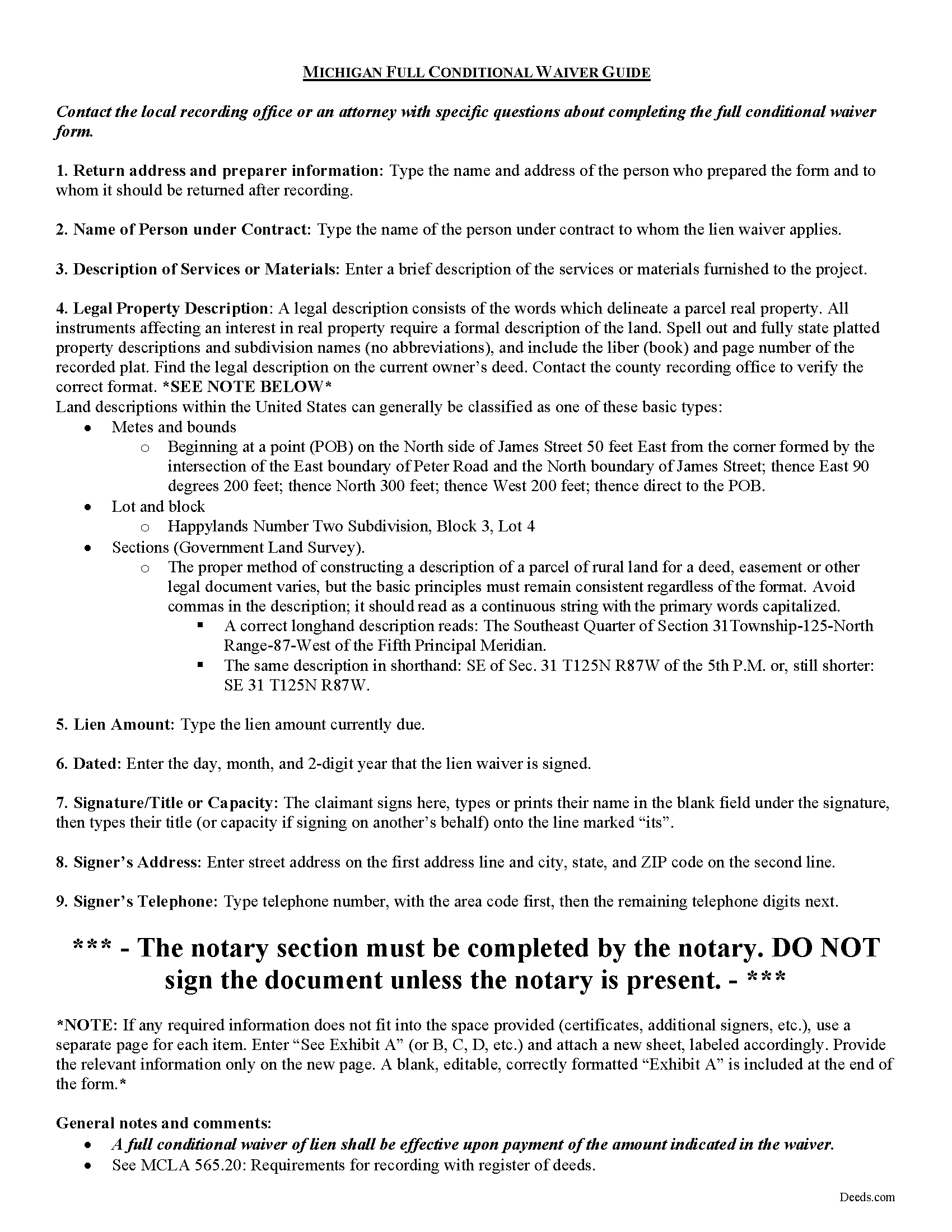

Full Conditional Waiver of Lien Guide

Line by line guide explaining every blank on the form.

Included Lapeer County compliant document last validated/updated 1/28/2025

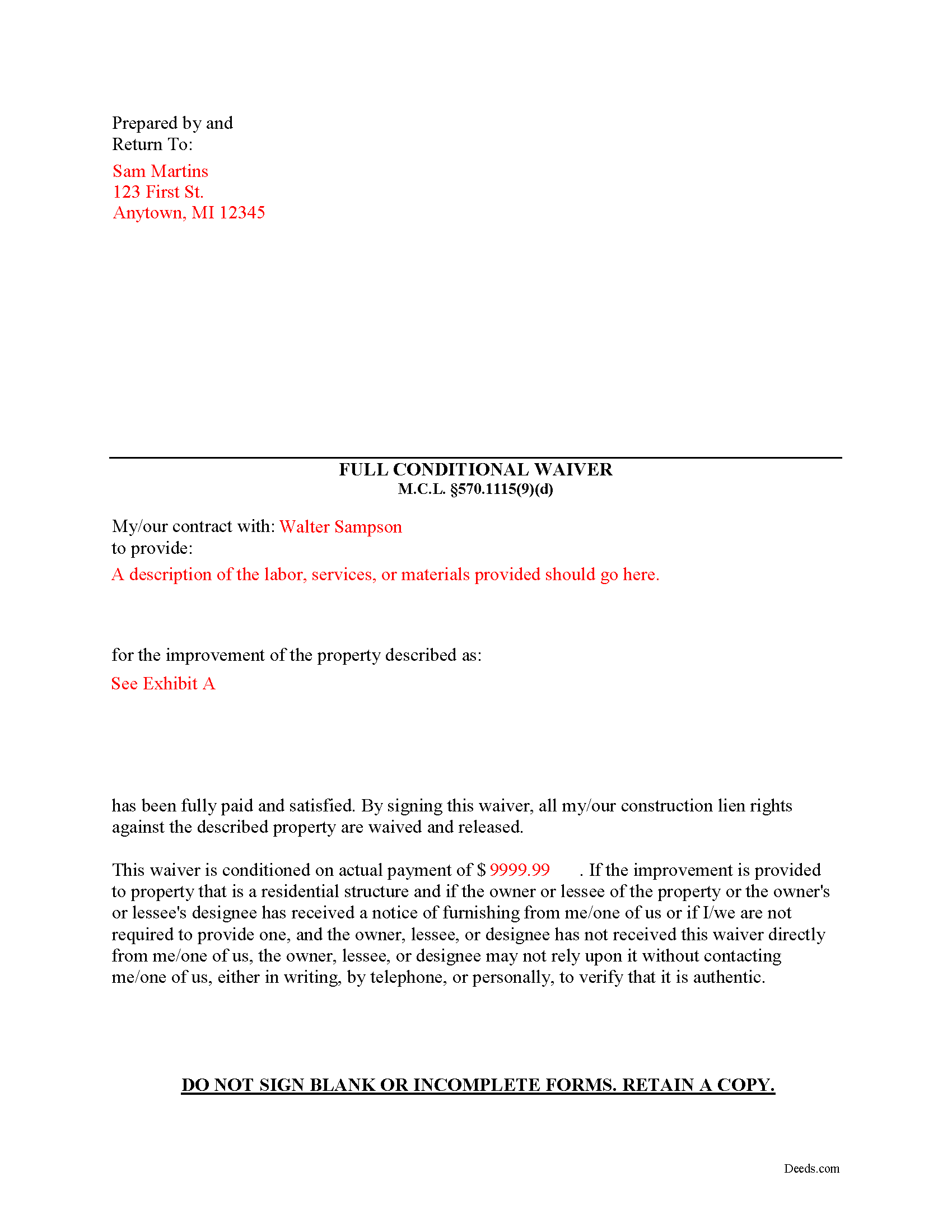

Completed Example of the Full Conditional Waiver of Lien Document

Included Lapeer County compliant document last validated/updated 6/18/2025

The following Michigan and Lapeer County supplemental forms are included as a courtesy with your order:

When using these Full Conditional Waiver of Lien forms, the subject real estate must be physically located in Lapeer County. The executed documents should then be recorded in the following office:

Lapeer County Register of Deeds

287 W Nepessing St #101, Lapeer, Michigan 48446

Hours: 8:00 to 12:30 & 1:30 to 5:00 Mon-Fri

Phone: (810) 667-0211

Local jurisdictions located in Lapeer County include:

- Almont

- Attica

- Clifford

- Columbiaville

- Dryden

- Hadley

- Imlay City

- Lapeer

- Metamora

- North Branch

- Otter Lake

- Silverwood

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Lapeer County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Lapeer County using our eRecording service.

Are these forms guaranteed to be recordable in Lapeer County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lapeer County including margin requirements, content requirements, font and font size requirements.

Can the Full Conditional Waiver of Lien forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Lapeer County that you need to transfer you would only need to order our forms once for all of your properties in Lapeer County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Michigan or Lapeer County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Lapeer County Full Conditional Waiver of Lien forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

During the construction process, a property owner (or his or her lessee) may ask the contractor for a mechanic's lien waiver in exchange for a full or partial payment.

Michigan defines four permissible types of lien waivers. These include: (1) Partial Unconditional Waiver, (2) Partial Conditional Waiver, (3), Full Unconditional Waiver, and (4) Full Conditional Waiver. M.C.L. 570.1115(9).

Use a full conditional waiver of lien when the claimant receives full payment for his or her contract from the owner, lessee, or designee. M.C.L. 570.1115(4). A waiver of a lien under this section takes effect when a person makes payment relying on the waiver, unless at the time the payment was made, the person making the payment had written notice that the payment or consideration for the waiver has failed (i.e., the check bounced at the bank). M.C.L. 570.1115(6).

Lien waiver forms must be in writing and must comply with Michigan law to be valid. Include the names of the contractor and the property owner, and identify the property and dates covered by the recorded lien.

Lien waivers can be confusing and issuing the wrong type of waiver (or issuing one too early) can result in dire consequences for mechanic's liens. Contact an attorney with questions about waivers or any other issues related to liens in Michigan.

Our Promise

The documents you receive here will meet, or exceed, the Lapeer County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lapeer County Full Conditional Waiver of Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4562 Reviews )

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Pauline C.

June 29th, 2025

Everything that was stated to be included in my order was complete. Very satisfied

Thank you for your positive words! We’re thrilled to hear about your experience.

Kelly H.

November 30th, 2020

This site was very fast and easy to use, highly recommend it.

Thank you for your feedback. We really appreciate it. Have a great day!

Teri B.

January 7th, 2019

Glad to have all of the helpful extra information, even though they don't answer all questions for all situations. So, I accessed public records and asked questions at the auditor's office. Also, on my Mac computer, filling out the actual deed form is a challenge because the screen jumps to the last page everytime I try to type a few letters or hit the return key, so I'm rollling back up to the first 2 pages after most keystrokes. A bit annoying.

Overall, happy to have these form options are available! There is really no need to wait and pay for an attorney when all the information needed is available via public records. Fill in the blanks!

Thanks so much for the feedback Teri. There are known issues between Adobe and Mac, we try to work around them as much as possible. Have a wonderful day!

Diana M.

October 18th, 2020

Awesome service. Quick and easy. Complete directions on how to complete the forms with examples for further assistance.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dawn M.

October 26th, 2020

So helpful and quick! The response time and kindness was amazing! The steps were easy to follow as well. We will definitely be using Deeds.com in the future!

Thank you for your feedback. We really appreciate it. Have a great day!

Sherilyn L.

February 14th, 2020

Easy to use & cost is great

Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cynthia G.

April 16th, 2019

Thank you for this service, very helpful

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ruthea M.

March 18th, 2025

It was easy to download, but you need to open an account before doing so. That was not clear.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

linda l.

August 10th, 2020

I was very impressed with the Mineral Deed form, especially with the instructions to fill it out AND a copy of a completed for to compare against. This definitely saved me money for an attorney.

The one thing I don't understand, though, is why I could not save the completed Deed to my hard drive. I did have to change a few things after the fact and I had to re-type the entire page to make the corrections.

If not for this, I would definitely rate the forms and instructions as a 5 star.

Thank you for your feedback. We really appreciate it. Have a great day!

Terry M.

December 2nd, 2021

Application is not well laid out. I guess it does the job but leaves a lot to be desired. Hard to follow

Thank you for your feedback. We really appreciate it. Have a great day!

Hideo K.

September 12th, 2023

Very prompt and satisfied with the service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Frank K.

July 27th, 2023

One thing I suggest is use the nomenclature Borrower / Lender / instead of Mortgatator / Mortgatee… Had to google which is which ? !

Thank you for your feedback. We really appreciate it. Have a great day!

Charles G.

June 22nd, 2022

I downloaded your Transfer on Death Deed Forms on Monday and registered the deed on Wednesday. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!