Isabella County Grant Deed Form

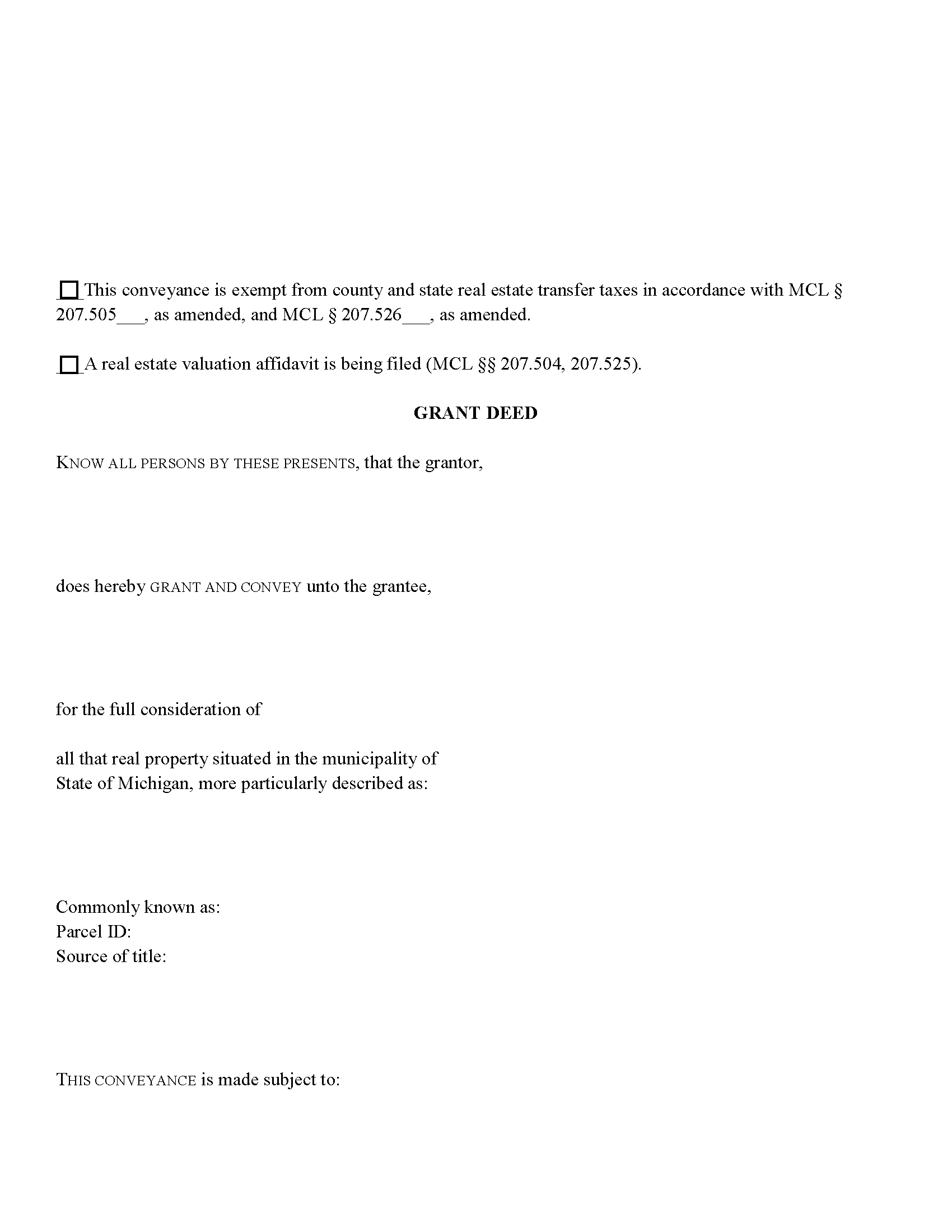

Isabella County Grant Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

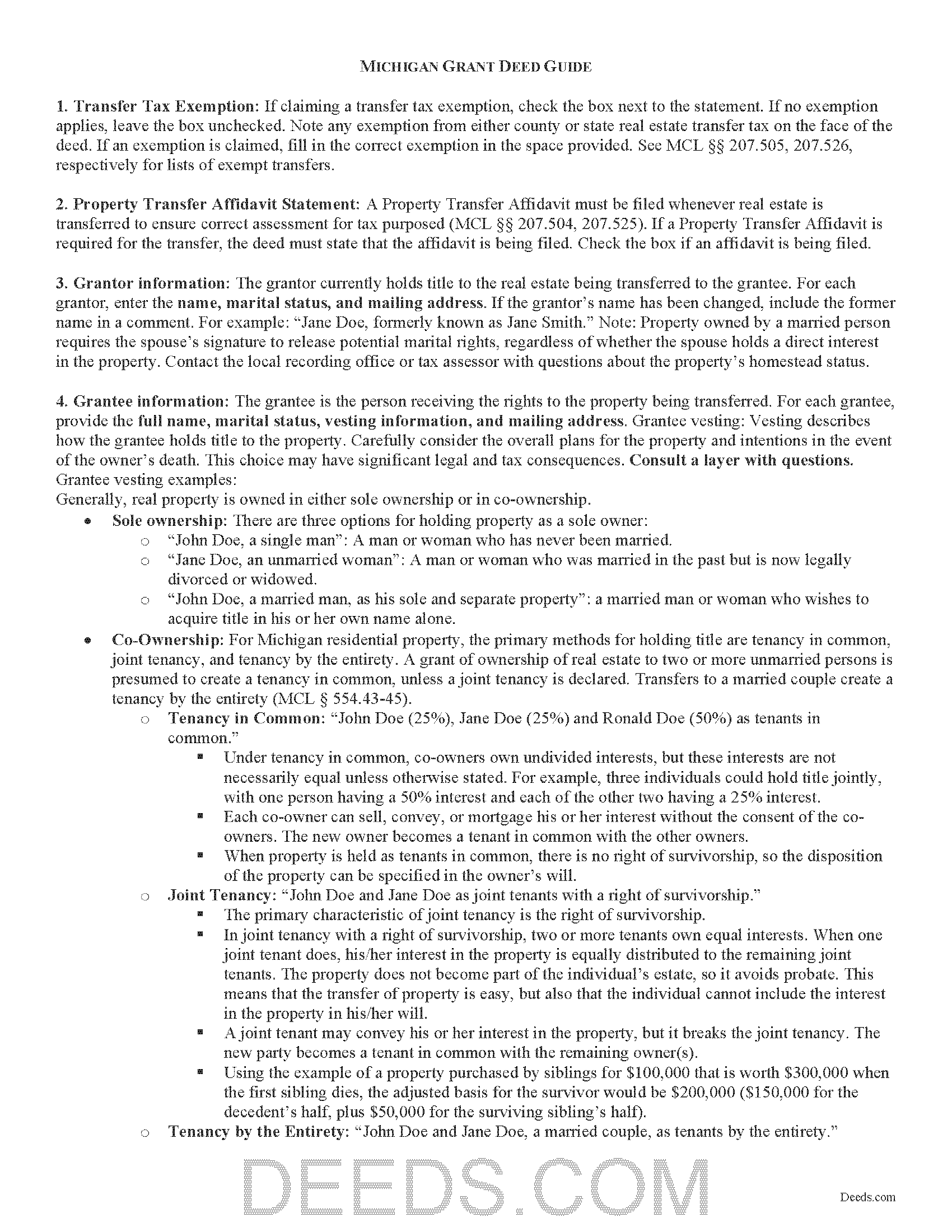

Isabella County Grant Deed Guide

Line by line guide explaining every blank on the form.

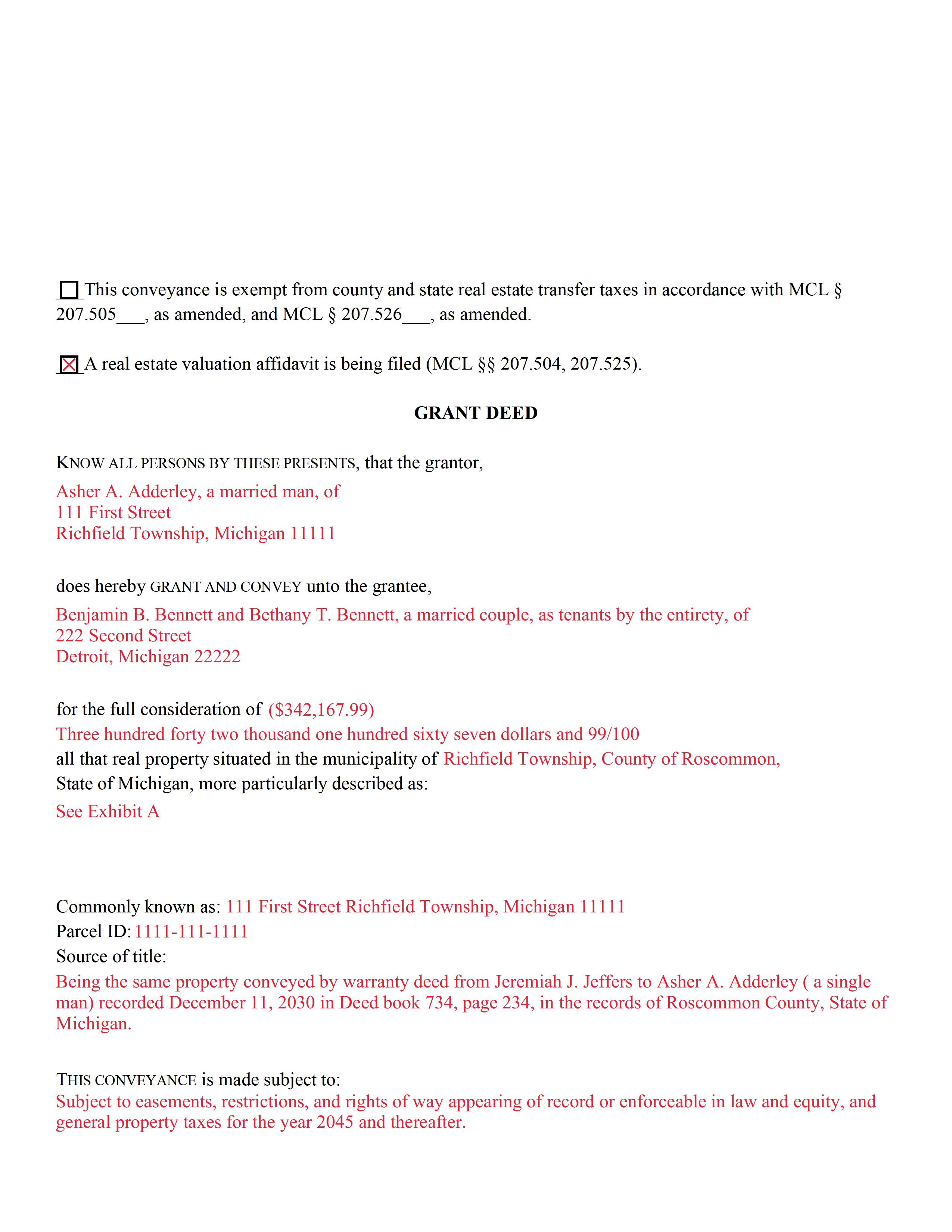

Isabella County Completed Example of the Grant Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Michigan and Isabella County documents included at no extra charge:

Where to Record Your Documents

Isabella County Register of Deeds

Mt. Pleasant, Michigan 48858

Hours: Monday - Friday 8:00 a.m. to 4:30 p.m.

Phone: (989) 317-4089

Recording Tips for Isabella County:

- Check that your notary's commission hasn't expired

- Both spouses typically need to sign if property is jointly owned

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Isabella County

Properties in any of these areas use Isabella County forms:

- Blanchard

- Mount Pleasant

- Rosebush

- Shepherd

- Weidman

- Winn

Hours, fees, requirements, and more for Isabella County

How do I get my forms?

Forms are available for immediate download after payment. The Isabella County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Isabella County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Isabella County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Isabella County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Isabella County?

Recording fees in Isabella County vary. Contact the recorder's office at (989) 317-4089 for current fees.

Questions answered? Let's get started!

Real property conveyances are governed by Chapter 565 of the Michigan Legislature, but grant deeds are not statutory forms in Michigan.

Grant deeds convey property from the grantor (generally the owner) to the grantee (generally the purchaser), with the guarantee that the grantor has not previously sold the real property interest being conveyed to the grantee, and that the property is without any liens or encumbrances, except for those specified in the deed.

Compared to a statutory warranty deed, grant deeds offer less protection to the grantee as they do not require the grantor to defend the title claims. However, they still offer more protection than a statutory quitclaim deed, guaranteeing that the owner does have a valid ownership interest in the property.

In addition to meeting all state and local standards for recorded documents, a lawful deed must include the grantor's full name and marital status, as well as the grantee's name, marital status, address, and vesting (MCL 565.201). Vesting describes how the grantee holds title to the property. For Michigan residential property, the primary methods for holding title are tenancy in common, joint tenancy, and tenancy by the entirety. A grant of ownership of real estate to two or more unmarried persons is presumed to create a tenancy in common unless a joint tenancy is declared. Transfers to a married couple create a tenancy by the entirety (MCL 554.43-45).

As with any conveyance of real estate, a grant deed requires a complete legal description of the parcel, the source of title, and a statement of the full consideration given for the transaction. If the consideration reported is nominal or not disclosed, file a Real Estate Transfer Tax Valuation Affidavit (form 2705) with the local Register of Deeds. This is important, as the value of the transfer must be known in order to calculate transfer tax (MCL 207.525).

In all cases where real estate is transferred, file a Property Transfer Affidavit (form 2766) to ensure correct assessment for tax purposes. The new owner must file in the municipality where the property is located within 45 days of transfer (MCL 207.504, 207.525).

In Michigan, a deed cannot be recorded unless it has been acknowledged (MCL 565.47). Recording preserves a clear chain of title for the property and provides public notice of the transfer. This protects both the grantor and the grantee from claims based on inaccurate information. Any deed executed within the state must be acknowledged before a judge, clerk of a court of record, or a notary public of the same state (MCL 565.8). If the deed is executed in another state, it may be acknowledged according to the laws of that state (MCL 565.9).

This article is provided for informational purposes only and is not a substitute for legal advice. Contact a lawyer with questions about grant deeds or for any other issues related to transfers of real property in Michigan.

(Michigan GD Package includes form, guidelines, and completed example)

Important: Your property must be located in Isabella County to use these forms. Documents should be recorded at the office below.

This Grant Deed meets all recording requirements specific to Isabella County.

Our Promise

The documents you receive here will meet, or exceed, the Isabella County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Isabella County Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

John R.

October 22nd, 2020

5stars for prompt and fast! Website needs work. Hard to navigate for first time users and hard to find where to pay. Emails are more clear than the "message center". Not sure what happened to my other documents, lol

Thank you for your feedback. We really appreciate it. Have a great day!

Peter K.

September 10th, 2019

Site was very easy to use. Lots of information provided...if the deed gets registered without a problem...you'll get a 10! and if it doesn't...I'll let you know!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Roger G.

October 25th, 2019

Straight to the point and easy to use site.

Thank you!

Eleanor E.

September 20th, 2019

Not knowing I could down load these forms, I first went to the local recording office thinking I could get info on the forms I needed. I was told that obviously you dont know what you are doing so find someone who does. This snippy clerk obviously didnt know the forms were accessible on line; either that or she was needing to feel her phony superiority.

Thank you for your feedback. We really appreciate it. Have a great day!

Fabio S.

May 27th, 2020

Fast, Easy and with great assistance! I will definitely use their services again!

Thank you for your feedback. We really appreciate it. Have a great day!

Victor K.

January 27th, 2023

The form I needed was correct and paginated as required. It was accepted w/o penalties. I was not happy about the information which I found way too scant. One sample form does not cover enough possibilities, more would be helpful. The instruction page is a bit better but sometimes it is not clear enough - sometimes it is not clear what the numbered items in the form correspond to. There is no guidance about the process and it would take very little to provide it. Example about "description", say where to find. There is a bunch of "free forms" attached but no guide on which are needed and when. Example: at the counter I was given a paper "conveyance" form and asked to fill it - I did not know it was needed and what it did and so I had not d

Thank you for your feedback. We really appreciate it. Have a great day!

Shonda S.

January 21st, 2023

This is the best thing I have ever done with this being my first time doing a quick claim. This has save me and my family money instead of paying a lawyer. Thanks again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Thomas D.

April 30th, 2020

The documents themselves are fine and the information provided with them is helpful. I find the actual processing of the documents, however, to be difficult particularly once the document has been saved. First, I note that the box for the date only allows entry of the last 2 digits of the year. Unfortunately, my download only allows me to enter one of the 2 digits required. When I delete it repeatedly, it eventually allows both digits to be entered but puts them in extremely small text and in superscrypt. I have not found a solution to this problem and am not sure the deed can even be recorded with this problem. Another problem is that if you try to revise the document after you have saved it the curser goes to the end of the line after each key entry. This means that there basically is no way to efficiently save the document for reworking later since you will have to delete everything you have entered in the text box unless you only need to make a single keystroke change or are willing to replace the curser after each entry. Try that with a long property description! Please note that I am using a Mac to prepare my documents and perhaps this is part of an "incompatibility problem". However, I didn't see a disclaimer regarding Mac use and so would expect the documents to perform correctly. Overall, I give the program a "2 star" rating because I am experiencing significant difficulties in entering dates in the documents even before saving them and because saving your work for later revision appears to be basically unworkable.

Thank you for your feedback Thomas, we appreciate you being specific about the issues you encountered. Adobe and Mac have a fairly long history of issues working together.

Tiffany Dawn J.

September 28th, 2019

Would be nice to have a better description on how to complete the forms if it is separated couple and one is signing the deed over to the other. I am still unsure how it should be worded. Disappointed that the guide didn't have better explanations.

Thank you for your feedback. We really appreciate it. Have a great day!

Nancy R.

June 5th, 2022

I AM NOT TOO SMART WHEN IT COMES TO COMPUTER STUFF, BUT THIS WEBSITE MADE IT SO VERY EASY & SIMPLE TO ACCOMPLISH THE TASK THAT WAS NEEDED. I FOUND MY STATE, FOUND THE TYPE OF DEED I NEEDED, FILLED IN THE BLANKS, PRINTED IT OUT & THEN GOT THE REQUIRED SIGNATURES WITNESSED & NOTARIZED -- EASY-PEASY! I WILL BE USING DEEDS.COM IN THE FUTURE & WILL CERTAINLY RECOMMEND IT TO FRIENDS & FAMILY. I REALLY APPRECIATED ALL THE OTHER FORMS OF EXPLANATION THEY GIVE YOU AS WELL AS AN EXAMPLE OF HOW YOUR COMPLETED DOCUMENT SHOULD LOOK ONCE YOU'RE FINISHED.

Thank you for your feedback. We really appreciate it. Have a great day!

Beatrice V.

August 27th, 2020

I was in despair as I needed to file two (2) very important documents with the County. Due to Covid the office was closed and my only recourse was to E-Fie with a service provider. I was fortunate enough to hear about Deeds.com. They were specific, courteous, patient and most of all productive. My documents will take awhile for the final filing but that is because the County happens to have a slow turn around time. Otherwise, I am now relieved that this part is over. Thank you Deeds.com. You are awesome.

Thank you for the kinds words Beatrice.

Sara R.

June 19th, 2019

Worked well for me to create a deed for a house I inherited. It was very thorough and easy to use. I have no experience with the law so I just googled terms I didn't understand and was fine. I also called land records a lot and ended up not needing a lot of the material included, but it was still good to have it.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jennifer H.

February 25th, 2021

Price is too expensive.

Thank you for your feedback Jennifer.

Van S.

March 25th, 2022

Easy to use...very informative...ttook care of exactly what I was looking for.

Thank you for your feedback. We really appreciate it. Have a great day!

Marilyn J.

July 18th, 2020

Just what I needed!

Thank you!