Calhoun County Lis Pendens Release Form (Michigan)

All Calhoun County specific forms and documents listed below are included in your immediate download package:

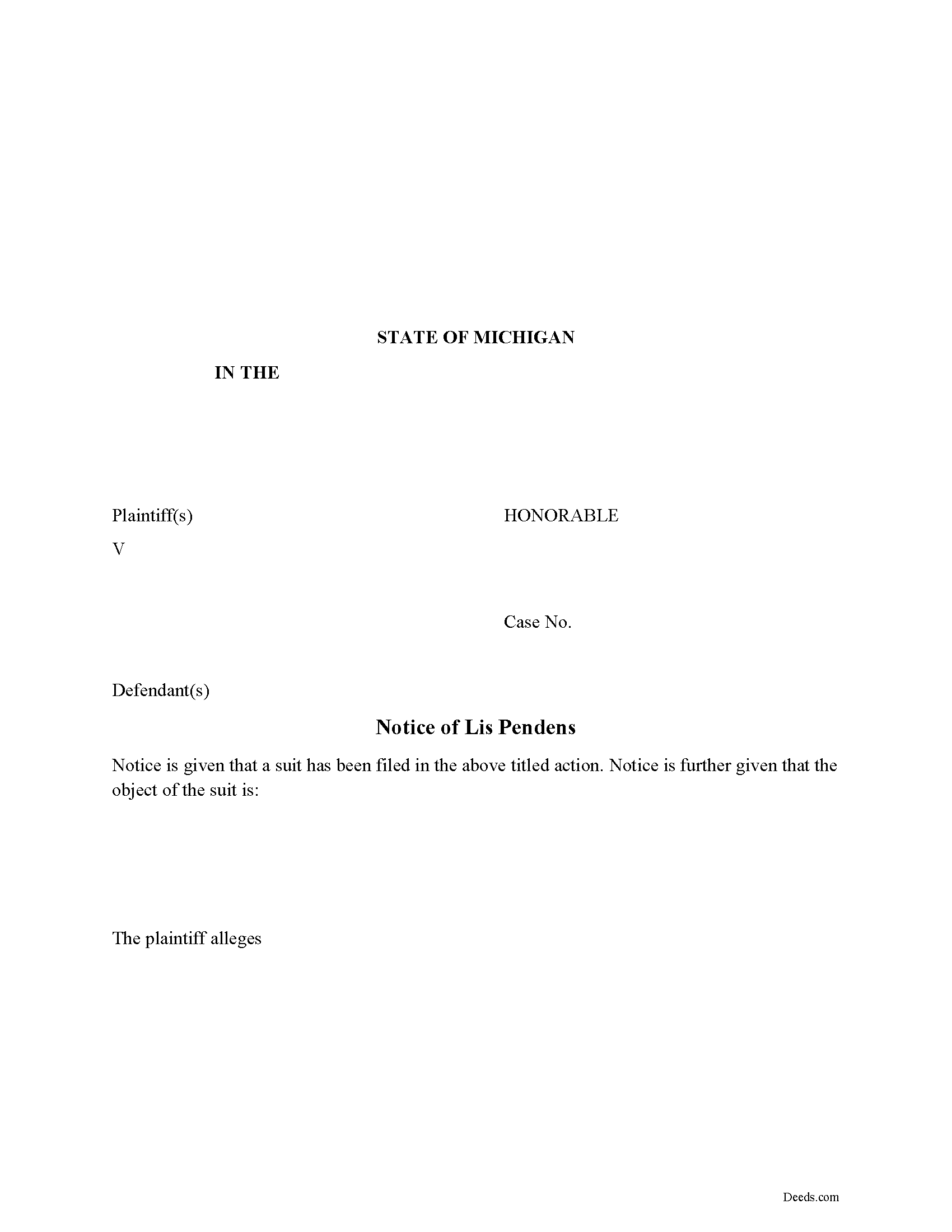

Lis Pendens Release Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Calhoun County compliant document last validated/updated 5/13/2025

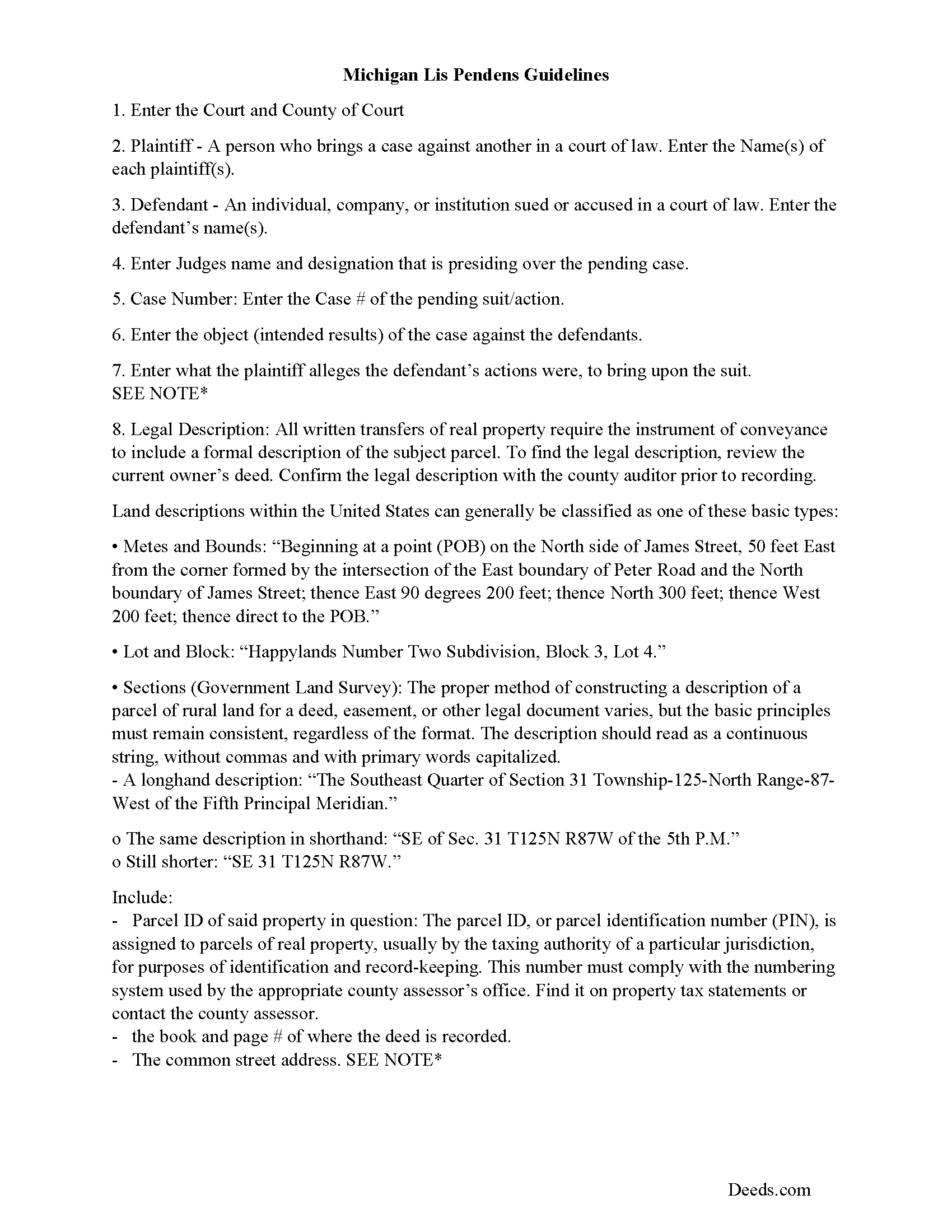

Lis Pendens Release Guide

Line by line guide explaining every blank on the form.

Included Calhoun County compliant document last validated/updated 7/11/2025

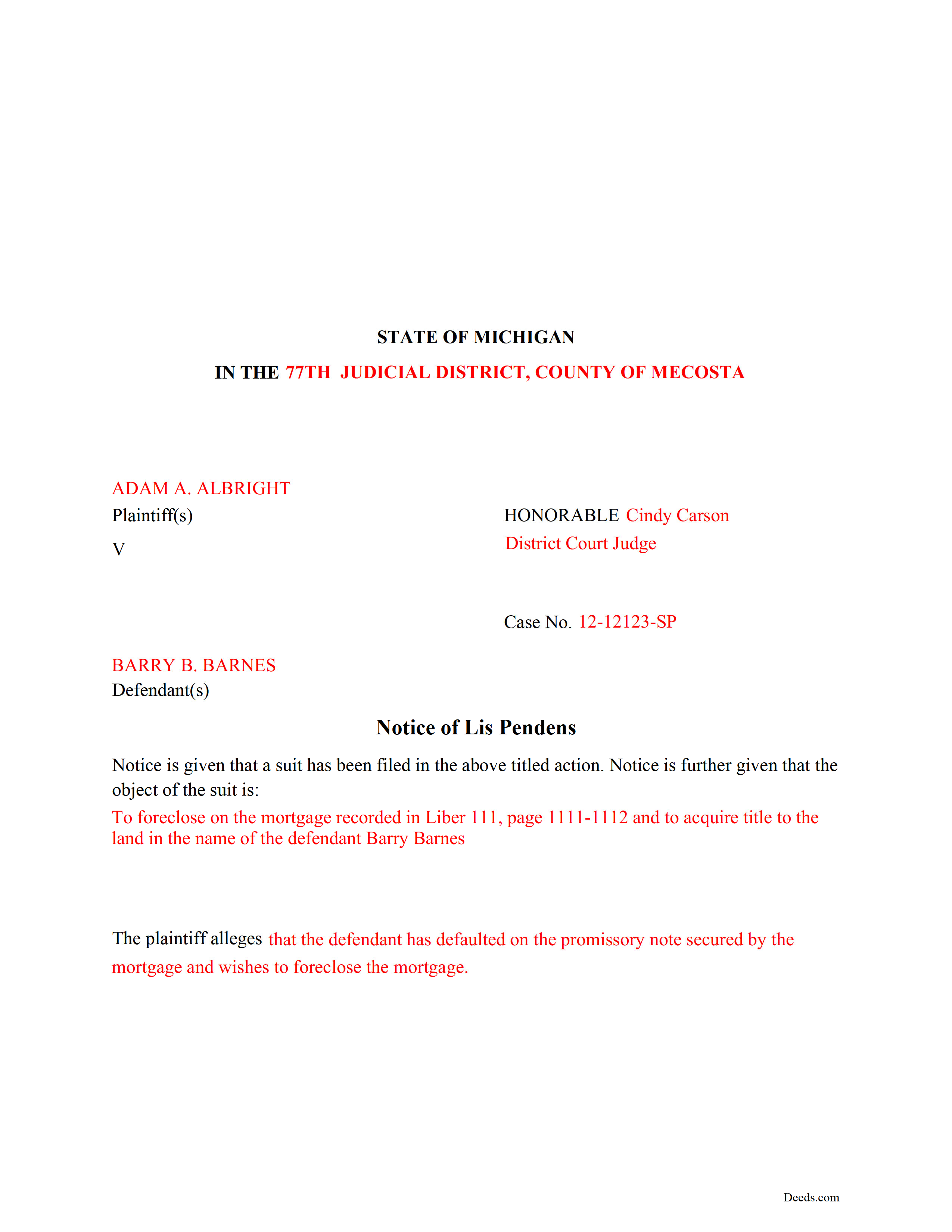

Completed Example of the Lis Pendens Release Document

Example of a properly completed form for reference.

Included Calhoun County compliant document last validated/updated 4/3/2025

The following Michigan and Calhoun County supplemental forms are included as a courtesy with your order:

When using these Lis Pendens Release forms, the subject real estate must be physically located in Calhoun County. The executed documents should then be recorded in one of the following offices:

Calhoun County Register of Deeds

County Bldg - 315 W Green St, Marshall, Michigan 49068

Hours: 8:00am-5:00pm M-F

Phone: (269) 781-0718

Battle Creek Office

Justice Center - 161 E Michigan Ave, Battle Creek, Michigan 49017

Hours: 8:00am-5:00pm M-F

Phone: 269-969-6908

Local jurisdictions located in Calhoun County include:

- Albion

- Athens

- Battle Creek

- Bedford

- Burlington

- Ceresco

- East Leroy

- Homer

- Marshall

- Tekonsha

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Calhoun County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Calhoun County using our eRecording service.

Are these forms guaranteed to be recordable in Calhoun County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Calhoun County including margin requirements, content requirements, font and font size requirements.

Can the Lis Pendens Release forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Calhoun County that you need to transfer you would only need to order our forms once for all of your properties in Calhoun County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Michigan or Calhoun County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Calhoun County Lis Pendens Release forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

When the case is settled or abandoned it is prudent to release the lis pendens document. A property could be passed over by a buyer because of the existing notice. Damages could then be realized by the seller.

600.2725 Notice lis pendens; cancellation; costs.

(1) If a plaintiff filing the notice before the service of the summons fails to serve the same within the time prescribed in this chapter, or after the action is settled, discontinued or abated, or final judgment is rendered therein against the party filing the notice, and the time to appeal therefrom has expired, the court, upon the application of any person aggrieved and upon such notice as may be directed or approved by it, shall direct that a notice of the pendency of an action be canceled of record by a particular register of deeds, or by all the registers of deeds, with whom it is filed.

(2) If a plaintiff filing the notice unreasonably neglects to proceed in the action, or does not commence or prosecute the action in good faith, the court, in its discretion, upon the application of any person aggrieved and upon such notice as may be directed or approved by it, may direct that a notice of the pendency of an action be canceled of record by a particular register of deeds, or by all the registers of deeds, with whom it is filed.

(3) The cancellation shall be made by a note to that effect, on the margin of the record, referring to the order. A certified copy of the order shall be filed for record with the register of deeds before the notice is canceled.

(4) The court, in its discretion, upon directing cancellation of the notice upon termination of the action, or during the pendency thereof if satisfied that the plaintiff who filed the notice unreasonably neglected to proceed in the action or did not commence or prosecute the same in good faith, may direct the plaintiff to pay all or any of the costs and expenses occasioned by filing the notice and the cancellation of the record, aside from the costs of the action itself.

(Michigan LP Release Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Calhoun County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Calhoun County Lis Pendens Release form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4563 Reviews )

JAMES D.

July 10th, 2025

Slick as can be and so convenient.rnrnWorked like a charm

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Robson A.

June 15th, 2021

Very easy & efficient to use! I would have had to drive an hour to the county office. So glad this worked instead!

You should advertise more....if I hadn't done research I would never have known about your service.

Thank you!

randall a.

July 16th, 2019

As advertised. good value.

Thank you for your feedback. We really appreciate it. Have a great day!

Soledad T.

August 30th, 2021

It's Great!!!

Thank you!

scott m.

February 21st, 2021

thanks- easy as pie.

Thank you!

David N.

January 9th, 2025

Thank you fine Deeds Company. I hope all goes well for you and all your team!

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Melody P.

January 29th, 2021

Thanks again for such expedient and excellent service!

Thank you!

Susan S.

July 28th, 2020

The actual transfer of deed form seems to be the only one not fillable in Adobe. Seems odd.

Thank you!

Michael P.

June 17th, 2020

excellent and timely service.

Thank you!

Connie E.

December 25th, 2018

Great service! Easy to download and view. Florida should have the Revocable Transfer on Death (TOD)deed, that many other States have. That's the one I really wanted. This one will do in the meantime.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joe F.

January 11th, 2021

TOOK ME SEVERAL DAYS TO FIND A SITE THAT DIDNT CHARGE $100 JUST TO USE ONE FORM. THANKS

Thank you for your feedback. We really appreciate it. Have a great day!

Bernique C.

May 18th, 2022

Was very pleased to be referred by another user for needed documents. Add me to "satisfied customers"

Thank you for your feedback. We really appreciate it. Have a great day!

Erik G.

January 12th, 2022

Great...

Thank you!