Rock County Correction Deed Form (Minnesota)

All Rock County specific forms and documents listed below are included in your immediate download package:

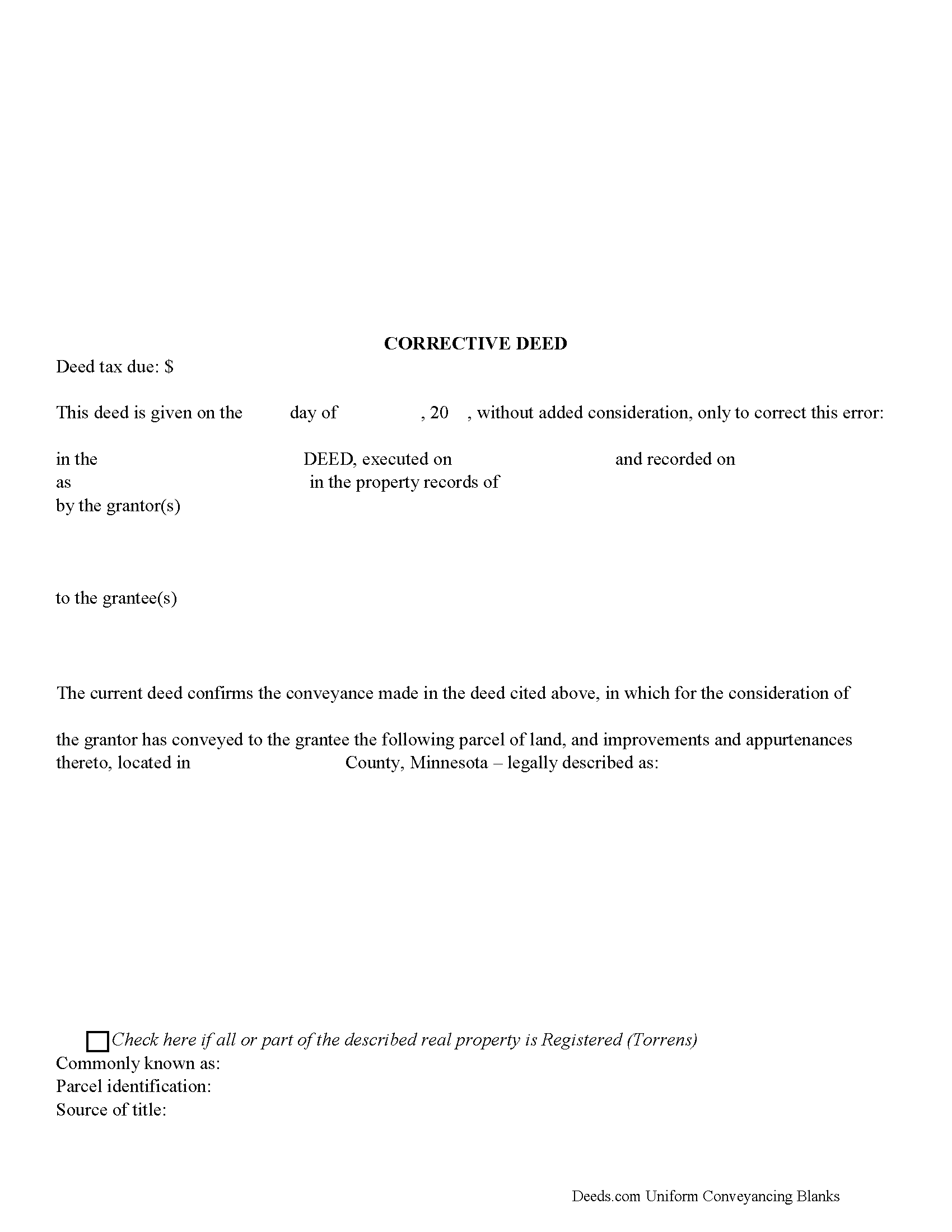

Corrective Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Rock County compliant document last validated/updated 4/15/2025

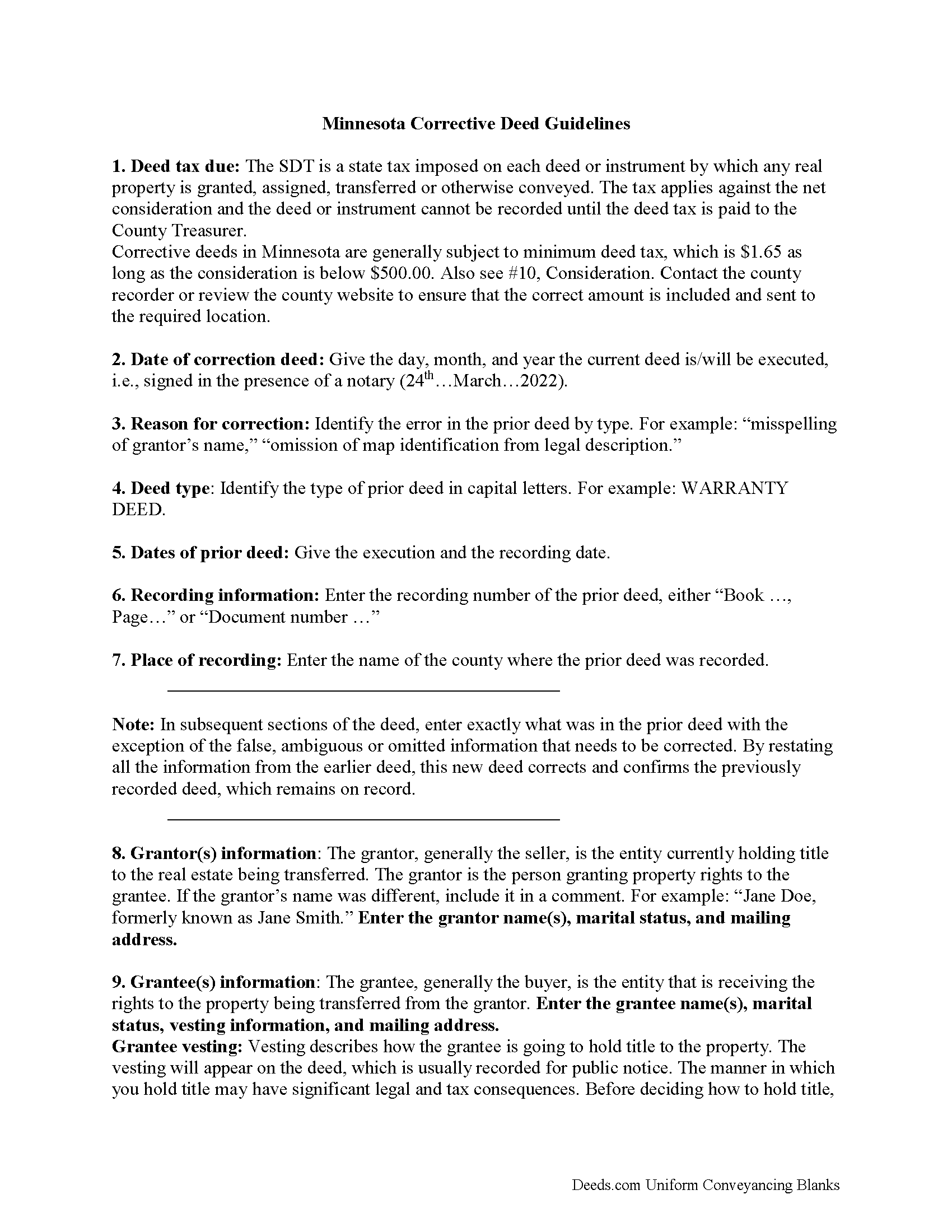

Correction Deed Guide

Line by line guide explaining every blank on the form.

Included Rock County compliant document last validated/updated 4/25/2025

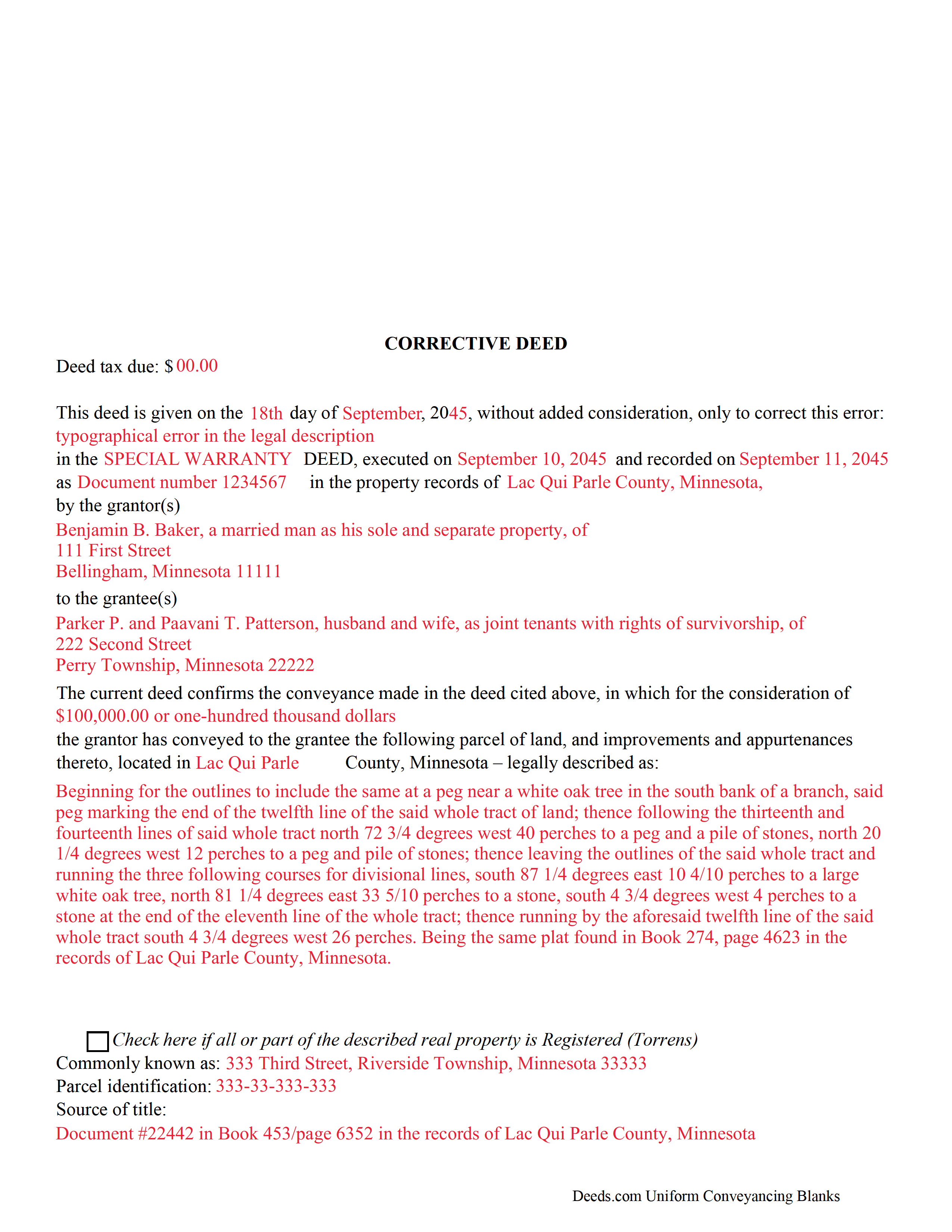

Completed Example of the Corrective Deed Document

Example of a properly completed form for reference.

Included Rock County compliant document last validated/updated 7/7/2025

The following Minnesota and Rock County supplemental forms are included as a courtesy with your order:

When using these Correction Deed forms, the subject real estate must be physically located in Rock County. The executed documents should then be recorded in the following office:

Land Records Office

Courthouse - 204 East Brown St / PO Box 509, Luverne , Minnesota 56156

Hours: 8:00am to 5:00pm M-F

Phone: (507) 283-5022

Local jurisdictions located in Rock County include:

- Beaver Creek

- Hardwick

- Hills

- Jasper

- Kenneth

- Luverne

- Magnolia

- Steen

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Rock County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Rock County using our eRecording service.

Are these forms guaranteed to be recordable in Rock County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Rock County including margin requirements, content requirements, font and font size requirements.

Can the Correction Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Rock County that you need to transfer you would only need to order our forms once for all of your properties in Rock County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Minnesota or Rock County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Rock County Correction Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Use the corrective deed to amend a previously recorded deed of conveyance with an error that could affect the title.

In Minnesota, there are two options for correcting a deed, re-recording the corrected original deed and recording a newly drafted corrective deed. When re-recording the original deed, make corrections directly on the document, but keep in mind that legal documents cannot be altered with strikeout, whiteout, line through or correction tape. Check with the county's recording office before choosing this option to verify local requirements regarding title pages, required attachments and how to handle the correcting itself.

A re-recorded document must be re-signed by the original parties and re-acknowledged and contain a correction statement that gives the reason for the re-recording and refers to the prior recording. Keep in mind that adding extra pages for the various required statements and the signatures will increase the overall page count of the re-recording, which may affect recording fees.

The easiest and cleanest option is to record a new corrective deed, which mostly restates the prior deed, but also contains the reason for the correction, reference to the prior deed by date, recording number and title, as well as the actual corrected information. By restating all the information from the earlier deed, the new deed corrects and confirms the previously recorded deed, which remains on record.

Take advantage of the statutorily defined right to have a corrective instrument inspected by the county attorney, who, "on finding that such deed is given for the purpose of correcting a defect in the title, or on account of a technical error in a prior conveyance," will certify those findings so that the deed can be recorded even if "there are unpaid taxes or assessments upon such land." (Minn. Stat. 272.15) As far as deed tax is concerned, corrective deeds in Minnesota are generally subject to minimum deed tax. Contact the county recorder or review the county website to ensure that the correct amount is included and sent to the required location.

(Minnesota CD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Rock County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Rock County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4564 Reviews )

Michael G.

July 14th, 2025

Very helpful and easy to use

Your appreciative words mean the world to us. Thank you.

JAMES D.

July 10th, 2025

Slick as can be and so convenient.rnrnWorked like a charm

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Vicky M.

September 1st, 2022

I would give Deeds.com 10 stars if I could!! The staff were super friendly and easy to work with. They kept me constantly updated during the process of uploading and forwarding my deeds for recording. And, the price was extremely reasonable. I look forward to utilizing Deeds.com every time I need to record a deed no matter what U.S. State. I wholeheartedly recommend them!

Thank you for your feedback. We really appreciate it. Have a great day!

Wanda R.

January 22nd, 2019

Very satisfied with the ease of using your database. Excellent place to get help with deeds.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

STANLEY K.

February 3rd, 2022

I AM DELIGHTED TO BE PARTY TO DEEDS.COM. THE PROCESS IS DOWN-TO-EARTH AND VERY USER FRIENDLY. I MUST SAY THAT JUST THE SAVINGS IN TRAVEL TIME AND MONEY IS IN ITSELF VERY REFRESHING. THIS ON LINE PROCESS IS SO CONVENIENT FOR MY OVERALL EFFORT AND OF COURSE FOR OUR CLIENTS AS WELL. I GOT BACKED UP IN RECORDING WHEN THE VIRUS BEGAN RAGING AND PERSONAL VISITS TO LAND RECORDS BECAME A THING OF THE PAST.I FOUND THE SITE WITH A SUGGESTION FROM DC LAND RECORDS' ASSISTANT BY PHONE. I ONLY WISH I'D KNOWN ABOUT THIS AWESOME SERVICE BEFORE 2020. HATS OFF TO DEEDS.COM!

Thank you for your feedback. We really appreciate it. Have a great day!

Norma G.

May 9th, 2019

Thank you! This is very helpful

Thank you!

Ashley D.

March 4th, 2021

Was able to print my documents immediately. Documents included deed form, a guide, a sample document, etc. Very helpful!

Thank you for your feedback. We really appreciate it. Have a great day!

Dreama R.

May 7th, 2019

Awesome! I had to correct a quit claim deed and the form on your site made it very easy.

Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Carlos T.

September 15th, 2021

Site was easy to use and forms were exactly what I needed. Will use this in the future for other needed forms. A+

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sylvia H.

July 21st, 2022

Thank you so much for making it easy and professionally trustworthy.

You are the best!!!

Thank you!

William S.

September 25th, 2020

Love the ability to e-record a single document as a private citizen. Other companies only want to do business with large volume filers like title companies and attorneys. e-recording was super easy and so efficient. Got confirmation of recording from county clerk less than one hour after submission.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Roger G.

October 25th, 2019

Straight to the point and easy to use site.

Thank you!

James B.

July 31st, 2019

Your website is very easy to use. No problem downloading the forms.

Thank you!

Gerald G.

September 16th, 2020

I am researching forms required to change deed from joint owners to individual. Subsequently, forms required when/after a trust is established for real property.

Thank you!