Sibley County Disclaimer of Interest Form

Sibley County Disclaimer of Interest Form

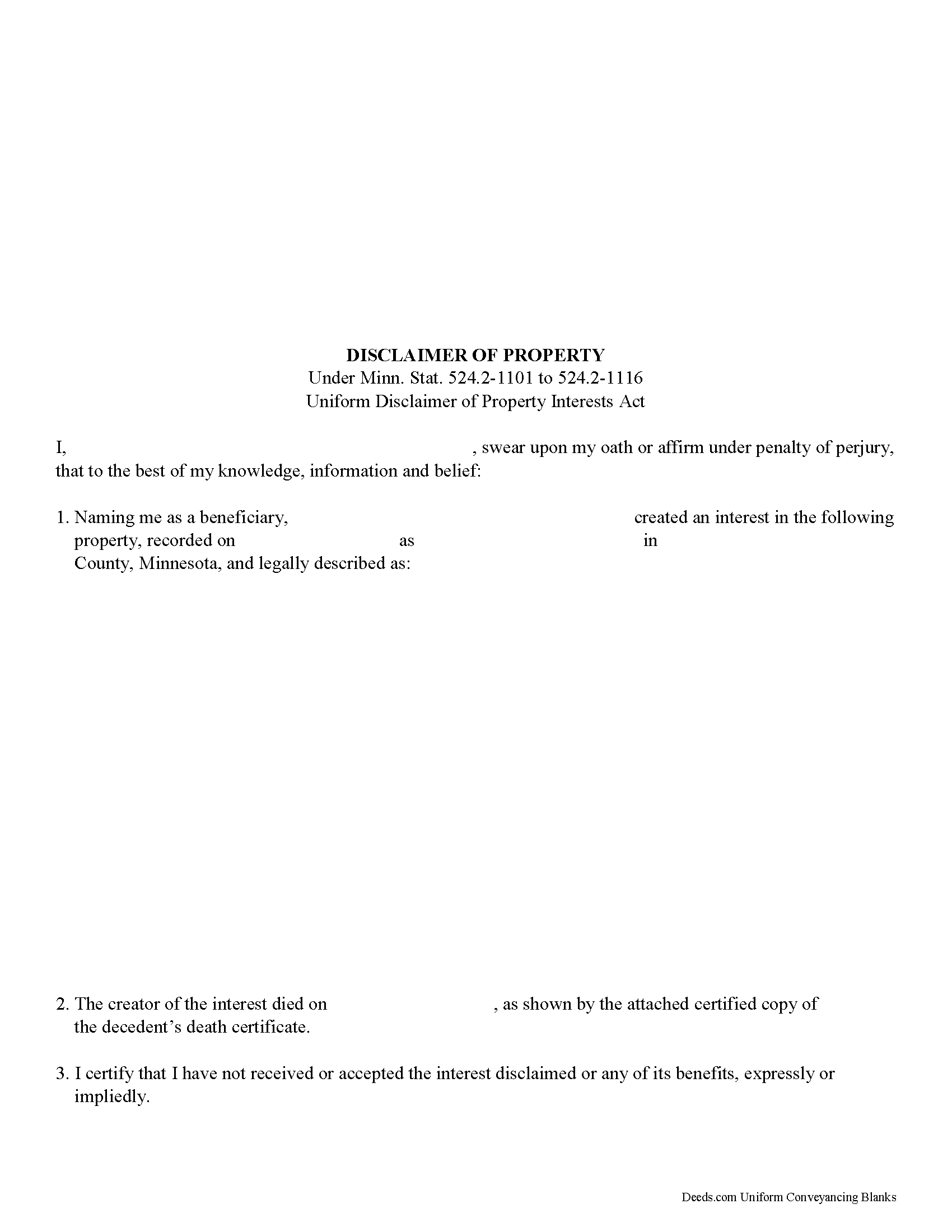

Fill in the blank form formatted to comply with all recording and content requirements.

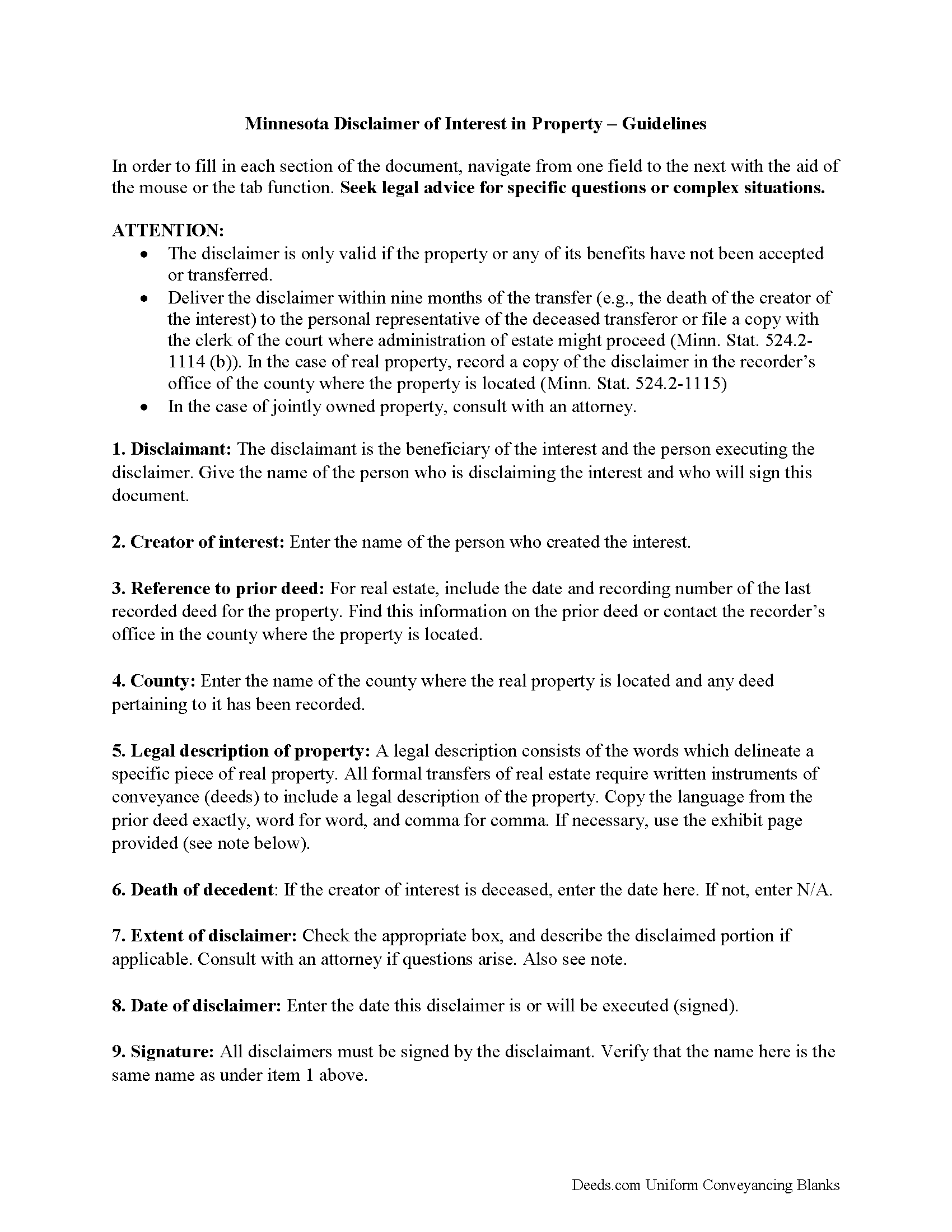

Sibley County Disclaimer of Interest Guide

Line by line guide explaining every blank on the form.

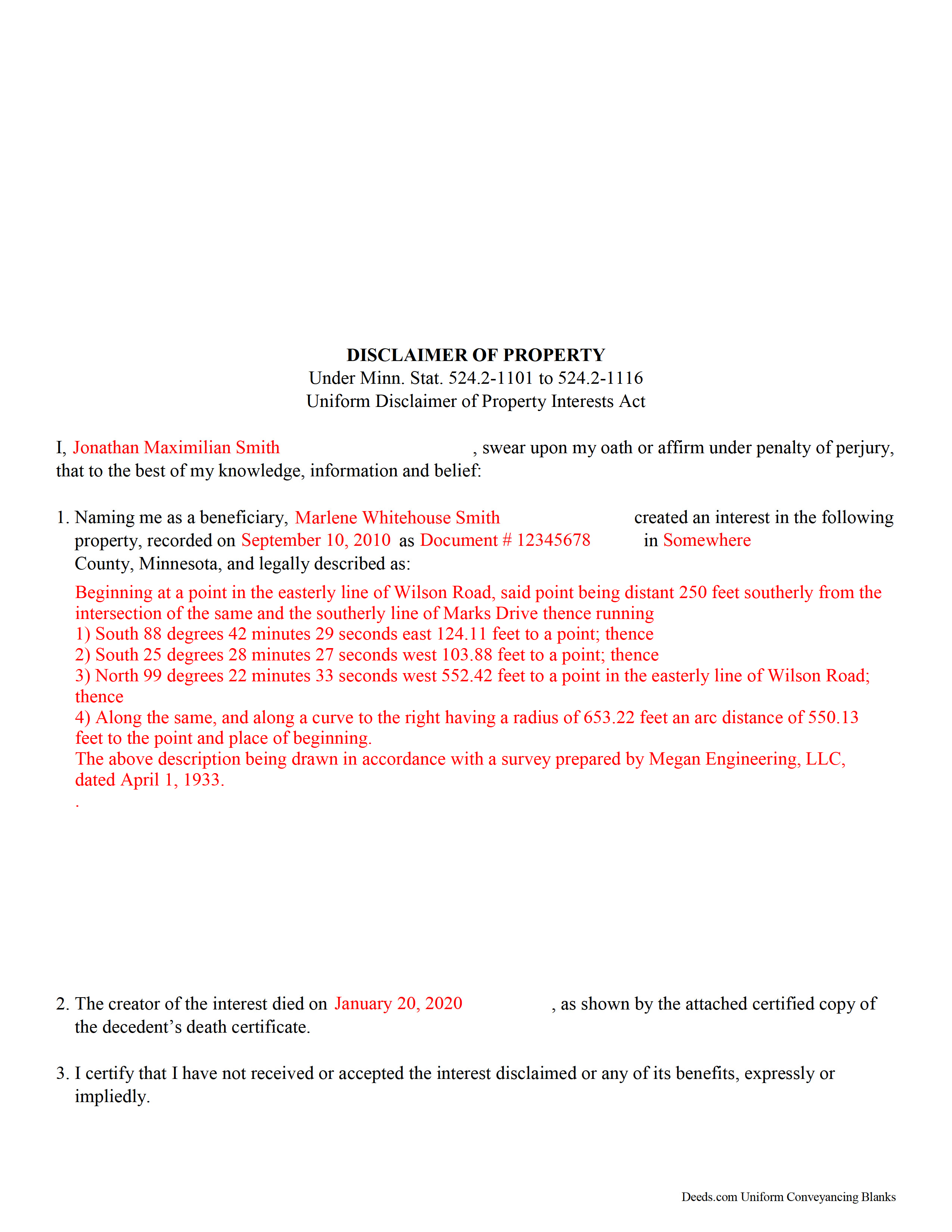

Sibley County Completed Example of the Disclaimer of Interest Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Minnesota and Sibley County documents included at no extra charge:

Where to Record Your Documents

Sibley County Recorder

Gaylord, Minnesota 55334

Hours: 8:00am to 4:30pm M-F

Phone: (507) 237-4080

Recording Tips for Sibley County:

- Recorded documents become public record - avoid including SSNs

- Request a receipt showing your recording numbers

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Sibley County

Properties in any of these areas use Sibley County forms:

- Arlington

- Gaylord

- Gibbon

- Green Isle

- Henderson

- New Auburn

- Winthrop

Hours, fees, requirements, and more for Sibley County

How do I get my forms?

Forms are available for immediate download after payment. The Sibley County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Sibley County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Sibley County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Sibley County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Sibley County?

Recording fees in Sibley County vary. Contact the recorder's office at (507) 237-4080 for current fees.

Questions answered? Let's get started!

Under the Minnesota statutes, the beneficiary of an interest in property may renounce the gift, either in part or in full (Minn. Stat. 524.2-1101 to 524.2-1116 Uniform Disclaimer of Property Interests Act). Note that the option to disclaim is only available to beneficiaries who have not acted in any way to indicate acceptance or ownership of the interest.

The disclaimer must be in writing and include a description of the interest, a declaration of intent to disclaim all or a defined portion of the interest, and be signed by the disclaimant (Minn. Stat. 524.2-1107 (c)).

Deliver the disclaimer within nine months of the transfer (e.g., the death of the creator of the interest) to the personal representative of the decedent's estate, or file it with the clerk of the court in any county where administration of estate might proceed (524.2-1114 (b)). In the case of real property, record a copy of the disclaimer in the office of the county recorder or the registrar of titles in the county or counties where the real estate is located (524.2-1115).

A disclaimer is irrevocable and binding for the disclaiming party and his or her creditors, so be sure to consult an attorney when in doubt about the drawbacks and benefits of disclaiming inherited property. If the disclaimed interest arises out of jointly-owned property, seek legal advice as well.

(Minnesota DOI Package includes form, guidelines, and completed example)

Important: Your property must be located in Sibley County to use these forms. Documents should be recorded at the office below.

This Disclaimer of Interest meets all recording requirements specific to Sibley County.

Our Promise

The documents you receive here will meet, or exceed, the Sibley County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Sibley County Disclaimer of Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Sandra G.

January 3rd, 2019

We were referred to the site by banking friend. It does take time to read through and figure out what a person needs, form-wise, to accomplish the goal. Once that was decided, check out and the download was very easy. What a great savings in cost and time.

Thank you Sandra, glad we could help. Also, please thank your friend for us. Have a wonderful day.

Heidi G.

July 20th, 2019

I have not yet actually completed the entire process. However, the preliminary documents, ability to try them and ease of filling them out is pretty nice, so far.

Thank you!

Thomas D.

July 10th, 2019

The site is fine with one exception. About half the pdf files I downloaded were corrupted. I could not open them or view their contents. Fortunately, the link continued to work, so after I discovered this, I downloaded the corrupted files again, and they now seem fine. I do not know if my computer or the website caused this odd problem.

Thank you for your feedback. We really appreciate it. Have a great day!

Patricia G.

July 10th, 2019

Very easy to order and download all the promised forms and instructions

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Susan H.

November 10th, 2024

I used the quitclaim deed form, it was easy to fill out, had notarized and was accepted by the county's recorders office. Having a example form made it so much easier to fill out.

Thank you for your positive words! We’re thrilled to hear about your experience.

Jane H.

February 5th, 2019

So far, so good!

Thank you Jane. Have a great day!

sharon s.

October 22nd, 2020

great site for downloading forms

Thank you!

Patricia C.

July 11th, 2019

The website works fine. The process of changing my Mineral Deed is sure more expensive in Texas. But I appreciate the convenience of the website and the pages of directions.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lloyd T.

September 13th, 2023

Example deed given did not apply to married couples as joint owners with both being grantors. The example and directions also did not show how to write more than one grantee as equal grantees. Both would have been helpful when husband and wife are granting their property to their children equally. Also when attaching the exhibit A with the property description the example did not say "see exhibit A"in the property description area, so I didn't write that. Luckily the recorder of deeds allowed me to write it in. I think directions and examples for multiple scenarios would be helpful.

Thank you for your feedback. We really appreciate it. Have a great day!

Dexter Lamar H.

August 4th, 2023

Quick service!

Thank you!

Brett T.

July 22nd, 2022

Where have you been my whole life. I will join if I can afford it. Do you have a form for a Private Family Trust Company ....Irrevocable Trust ...Revocable Trust.....send me an email so I will have contact info.

Thank you!

Alan E.

August 11th, 2021

I couldn't be happier with this service. They're helpful, quick and thorough. They make filing government documents very easy.

Thank you for your feedback. We really appreciate it. Have a great day!

Johnnie G.

July 6th, 2020

We had hoped, as this was direct through our State recorder's office, State-specific data would be pre-filled in. Also there is no help when transferring the home title from a Revocable Trust to the living Trustee and new spouse (no example given, no help for which code to use). And the example doesn't match the prior deed revision format submitted by our attorney. So, not the best experience. We may have to get an attorney involved...what we were hoping to avoid

Thank you for your feedback. We really appreciate it. Have a great day!

Abdel M.

August 8th, 2023

Easy to use and they are very responsive.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jayne S.

August 24th, 2023

Very prompt and excellent service!

Thank you for your feedback. We really appreciate it. Have a great day!