Todd County Mortgage Secured by Promissory Note Form

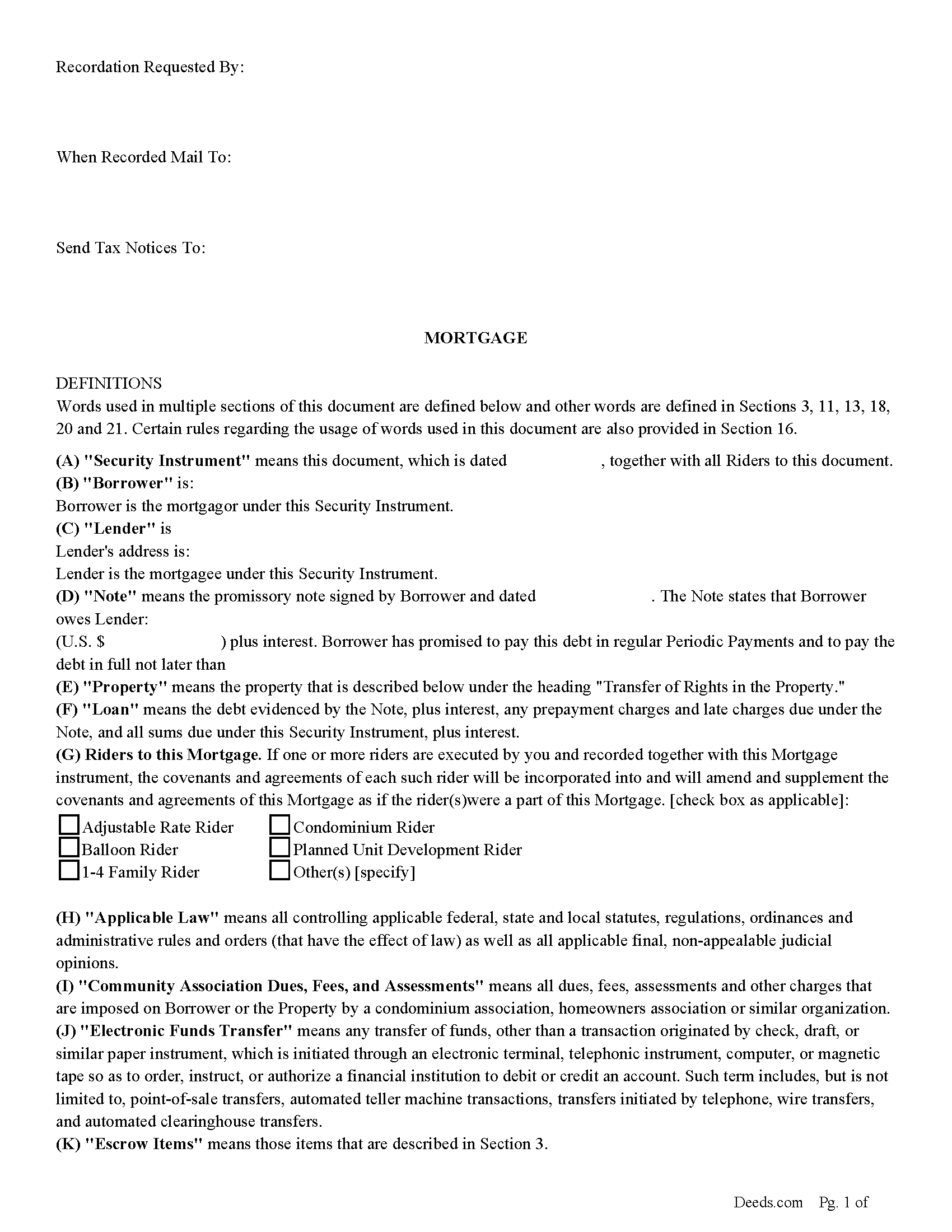

Todd County Mortgage Form

Fill in the blank form formatted to comply with all recording and content requirements.

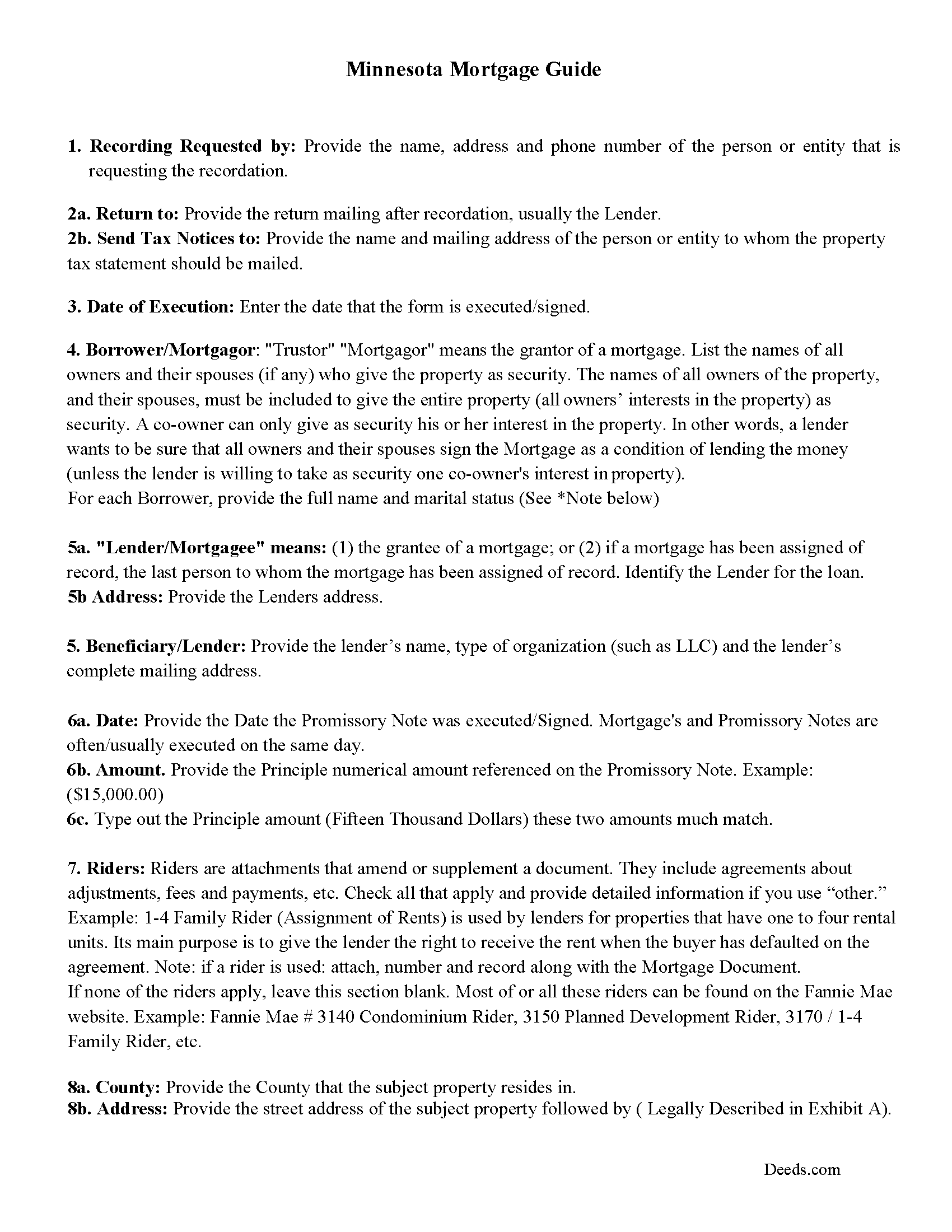

Todd County Mortgage Guide

Line by line guide explaining every blank on the form.

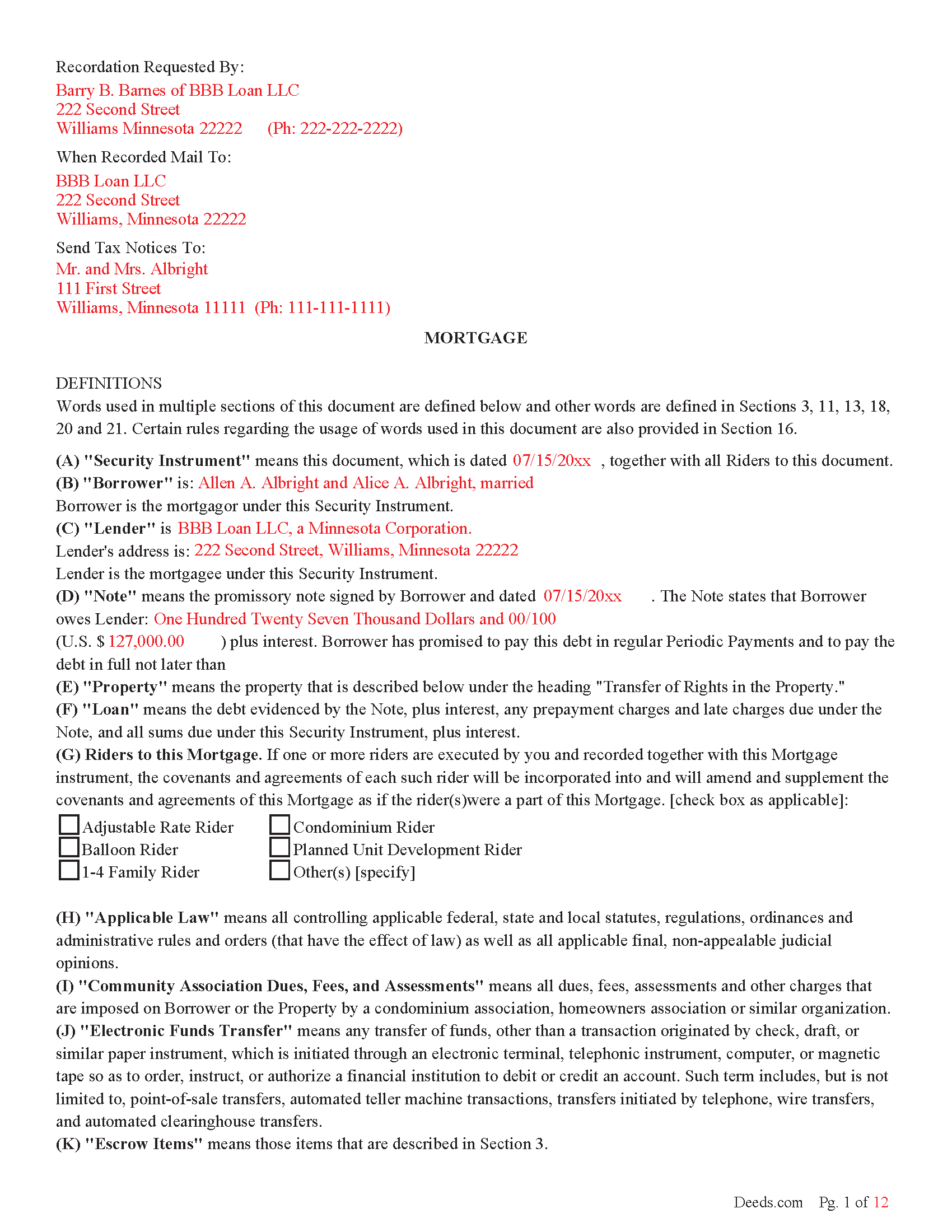

Todd County Completed Example of the Mortgage Document

Example of a properly completed form for reference.

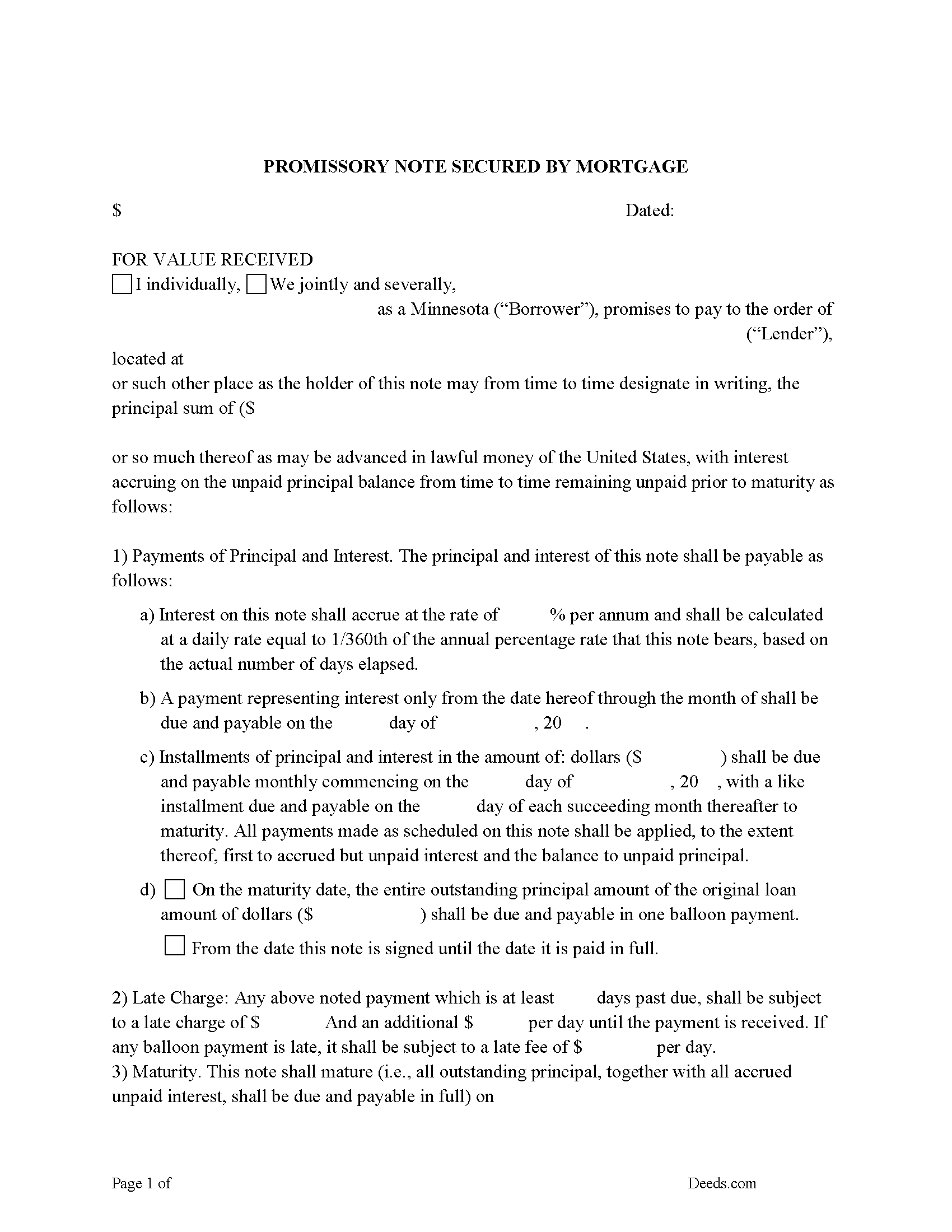

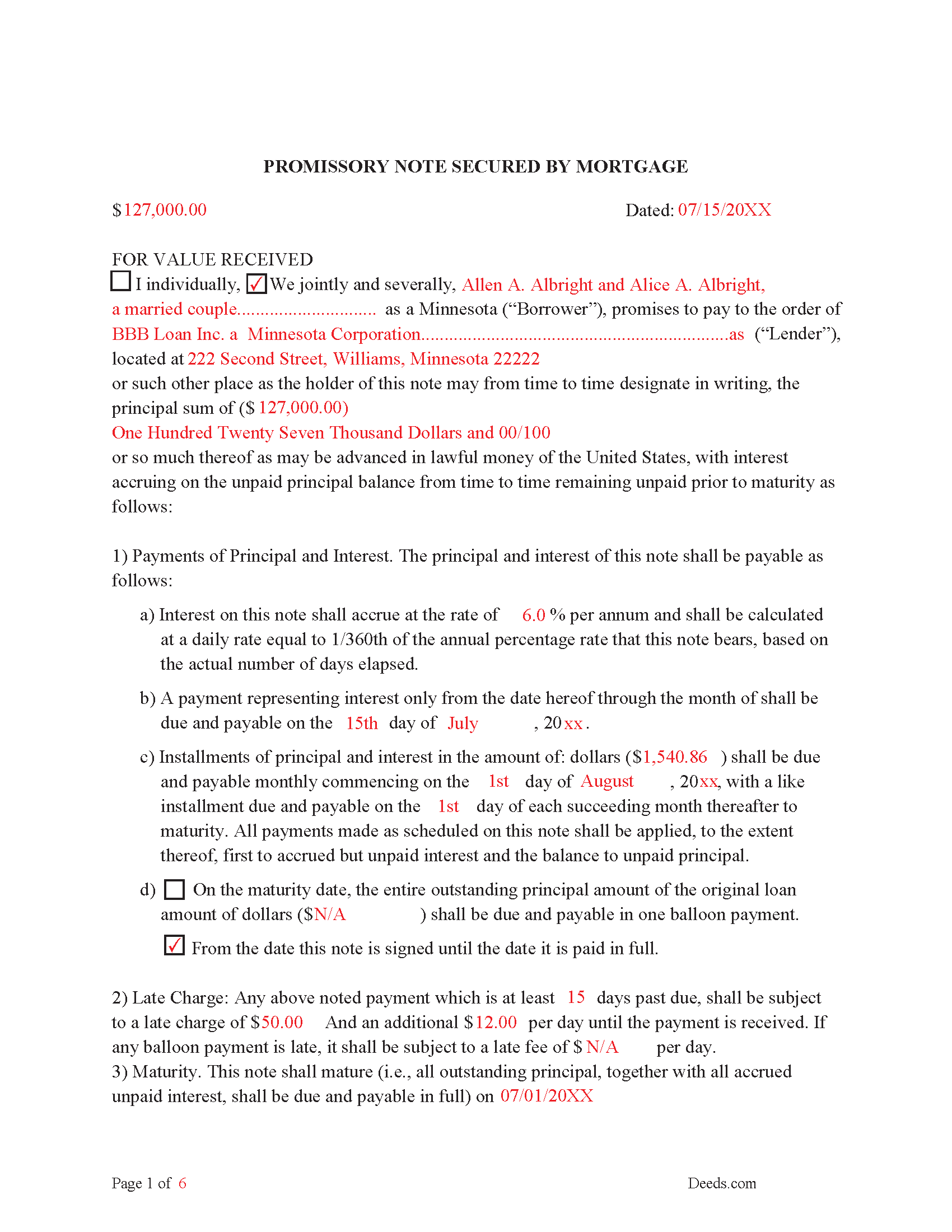

Todd County Promissory Note Form

Note that is secured by the Mortgage. Can be used for traditional installments or balloon payment.

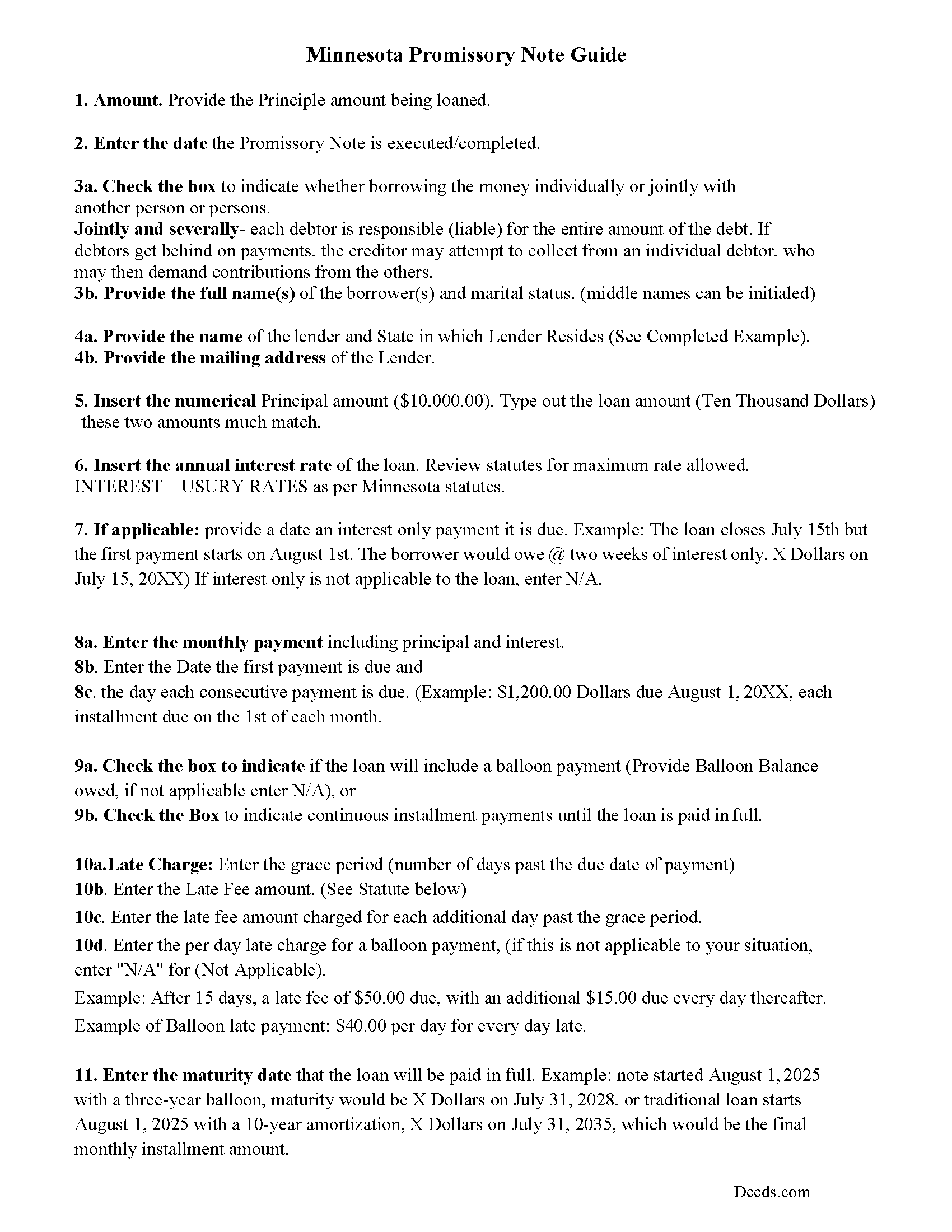

Todd County Promissory Note Guidelines

Line by line guide explaining every blank on the form.

Todd County Completed Example of the Promissory Note Document

This Minnesota Promissory Note is filled in and highlighted, showing how the guideline information, can be interpreted into the document.

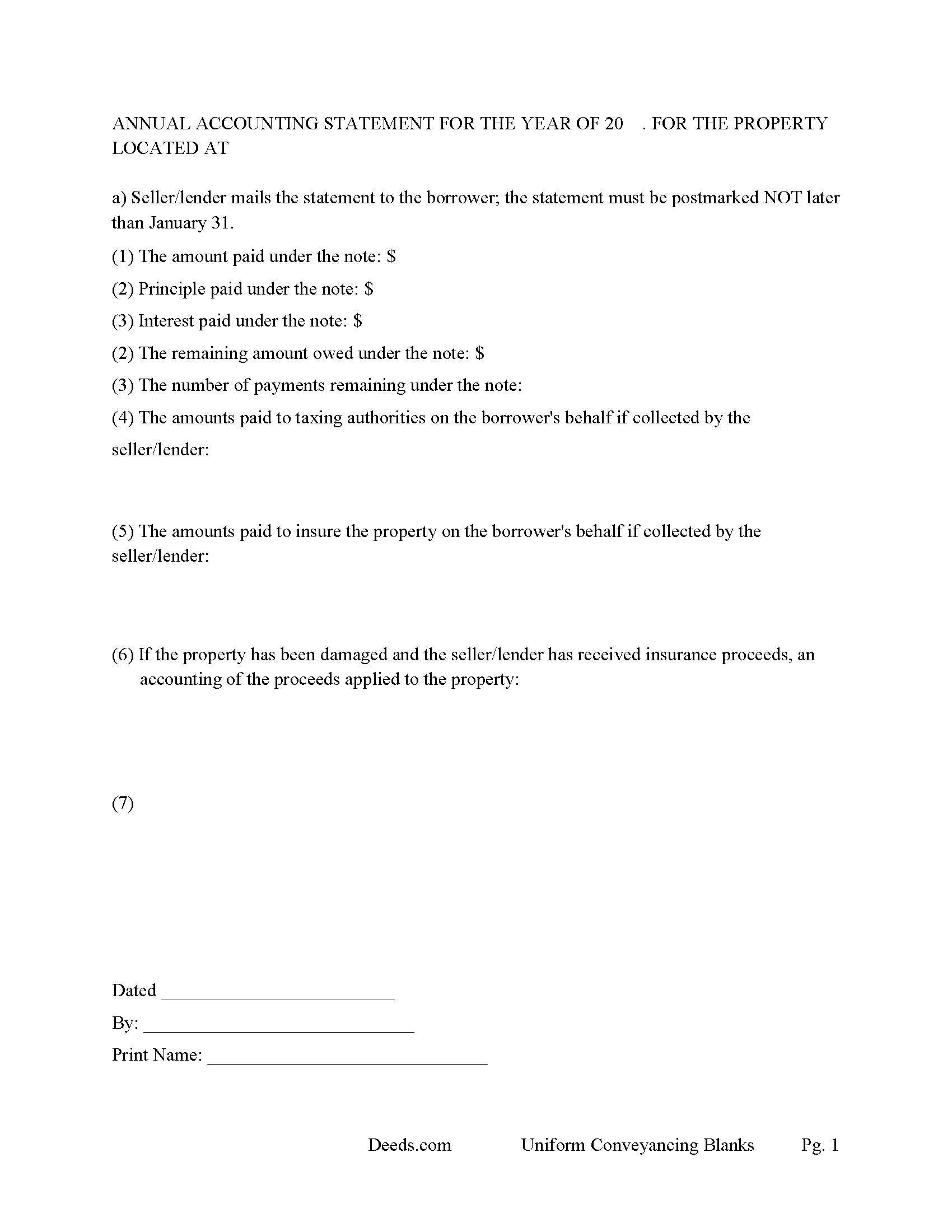

Todd County Annual Accounting Statement Form

Mail to borrower for fiscal year reporting.

All 7 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Minnesota and Todd County documents included at no extra charge:

Where to Record Your Documents

Todd County Recorder & Registrar

Long Prairie, Minnesota 56347

Hours: 8:00am to 4:30pm M-F

Phone: (320) 732-4428

Recording Tips for Todd County:

- Ensure all signatures are in blue or black ink

- Ask if they accept credit cards - many offices are cash/check only

- Verify all names are spelled correctly before recording

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Todd County

Properties in any of these areas use Todd County forms:

- Bertha

- Browerville

- Burtrum

- Clarissa

- Eagle Bend

- Grey Eagle

- Hewitt

- Long Prairie

- Staples

- West Union

Hours, fees, requirements, and more for Todd County

How do I get my forms?

Forms are available for immediate download after payment. The Todd County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Todd County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Todd County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Todd County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Todd County?

Recording fees in Todd County vary. Contact the recorder's office at (320) 732-4428 for current fees.

Questions answered? Let's get started!

This is a recordable document, when (properly recorded shall be taken and deemed notice to parties.) (507.32 Record, When Notice to Parties; Assignment of Mortgage.)

No instrument by which the title to real estate or any interest therein or lien thereon, is conveyed, created, encumbered, assigned or otherwise disposed of, shall be recorded by the county recorder or registered by the registrar of titles until the name and address of the person who or corporation which drafted the instrument is printed, typewritten, stamped or written on it in a legible manner.

(507.091 Conveyance to Include Name and Address of Drafter)

(No contract for deed or deed conveying fee title to real estate or affidavit of survivorship shall be recorded by the county recorder or registered by the registrar of titles until the name and address of the person to whom future tax statements should be sent, is printed, typewritten, stamped or written on it in a legible manner.) 507.092 Conveyance to Include Name and Address of Person to Receive Tax Statements.

Use this comprehensive 12 page Mortgage Form for vacant land, residential property, rental property (up to 4 units), small commercial property, condominiums, and planned unit developments. A mortgage secured by a promissory note that includes stringent default terms can be beneficial to a lender.

(Minnesota Mortgage Package includes forms, guidelines, and completed examples) For use in Minnesota only.

Important: Your property must be located in Todd County to use these forms. Documents should be recorded at the office below.

This Mortgage Secured by Promissory Note meets all recording requirements specific to Todd County.

Our Promise

The documents you receive here will meet, or exceed, the Todd County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Todd County Mortgage Secured by Promissory Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

HELENA M.

March 19th, 2021

Quick, super easy and very reasonable charge!!

Thank you for your feedback. We really appreciate it. Have a great day!

Marion B.

September 2nd, 2023

As far as I know all is in order as far as my transfer on death instrument for Illinois. Thank you so much!

Thank you for your feedback. We really appreciate it. Have a great day!

Noah B.

May 14th, 2020

Website is basic, but get's the job done. Communication was prompt and efficient. Would use again. Thank You!

Thank you!

Robert G.

July 2nd, 2020

Excellent. I needed a NOC recorded immediately and you guys made it happen when all other avenues looked like they were not going to be possible. Thank you very much.

Thank you for your feedback. We really appreciate it. Have a great day!

Mary P.

February 11th, 2019

Excellent easy to follow instructions.

Great to hear Mary, Have a wonderful day!

Ed C.

June 16th, 2025

I purchased the DIY quitclaim deed forms for Florida and couldn’t be happier. The forms were clear, professional, and easy to follow. I had everything filled out and recorded without a single issue. Worth every penny — the site is great, and the forms are exactly what I needed. Highly recommend!

Thanks so much, Ed! We’re thrilled to hear that the Florida quitclaim deed forms worked perfectly for you and that the recording process went smoothly. We appreciate your trust and recommendation!

Ajinder M.

June 18th, 2020

wonderful. saved my time and energy. Absolutely love this service. All the best AJ

Thank you!

Cheryl B.

November 20th, 2021

Seems easy enough, may have downloaded forms I don't need, however I'm hoping that these are the only I'll need. Did a lot of research and Deeds.com looks to be the best for anything you need. I am very happy at finally being able to find the forms I was looking for so easily. Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dawna M.

June 15th, 2021

Easy to use website and immediate documents appropriate for my area. My only complaint is that the forms had an alignment problem where the fields that were filled in by me did not line up with the template text. I tried to correct it to no avail so I ended up having to retype the entire document. I purchased two templates and both had the same issue.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jessica S.

December 21st, 2018

Paid the money, but never received any information; not even an email saying they couldn't find anything.

Thank you for your feedback. Reviewing your account, looks like the property detail report you ordered was completed on December 14, 2018 at 10:56am. The report has been available for you to download in your account ever since.

Mary G.

March 7th, 2021

Deeds.com was a fast and easy site to use the staff answered my questions online efficiently

Thank you!

Susan K.

February 16th, 2019

Very helpful; information included on the form explanations about Colorado laws in regards to beneficiary deeds helped us understand the issues involved.

Thank you for your feedback. We really appreciate it. Have a great day!

Roy B.

January 31st, 2021

Great way to get forms needed and fill them out then we only need to record them!

Thank you!

CEDRIC D.

December 2nd, 2021

need more instructions for each form

Thank you for your feedback. We really appreciate it. Have a great day!

David C.

January 17th, 2020

Very fast service

Thank you!